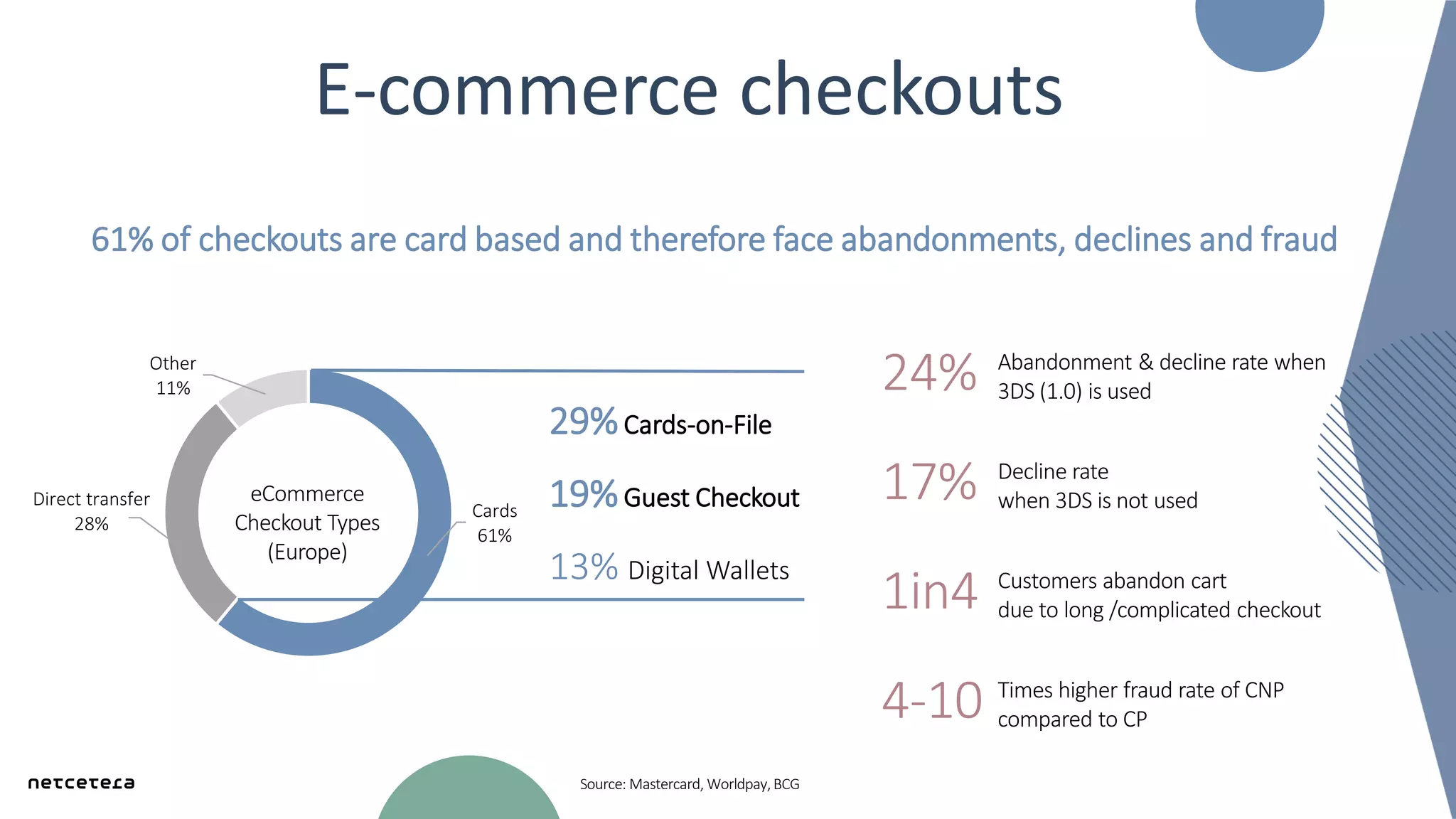

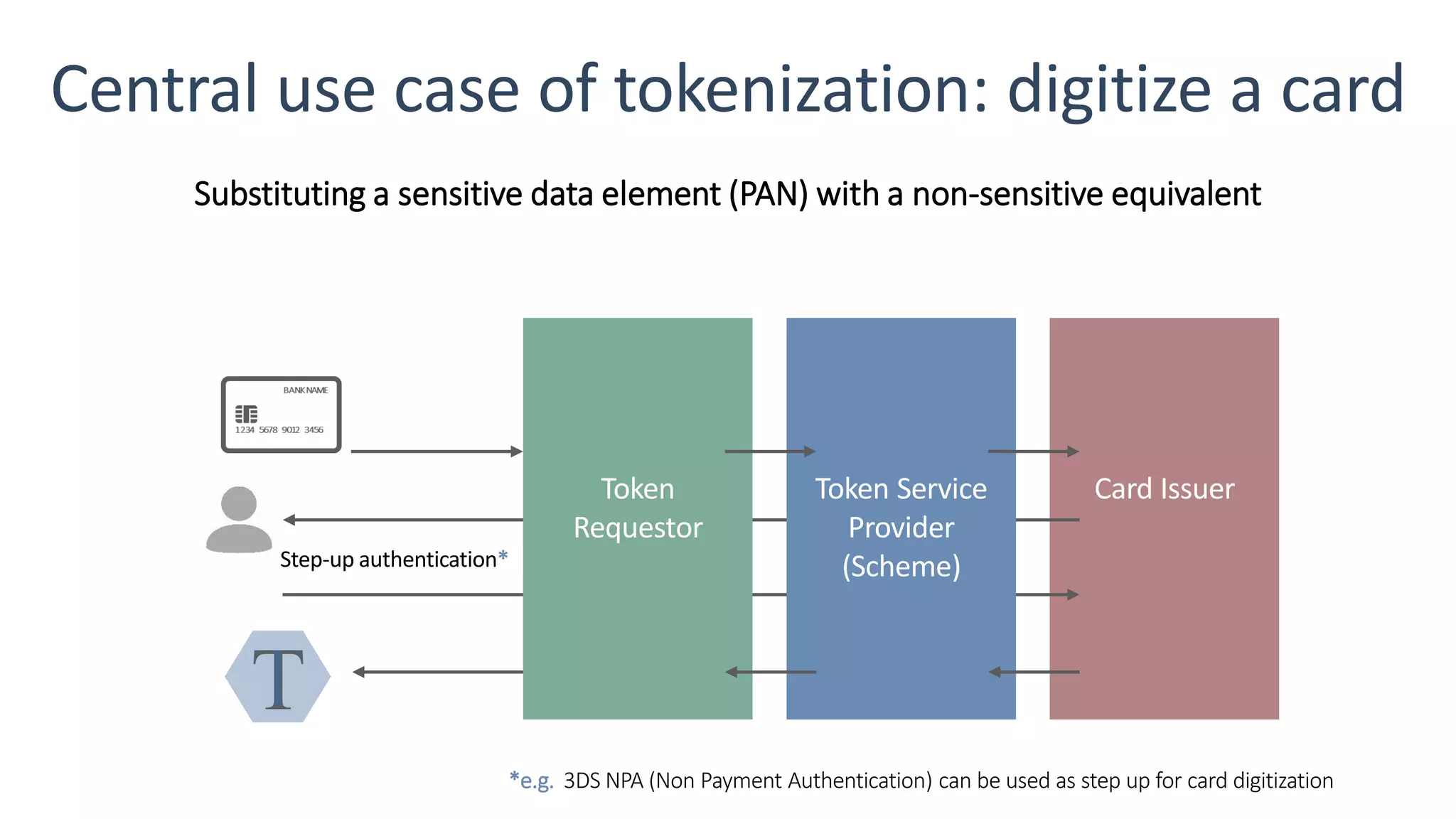

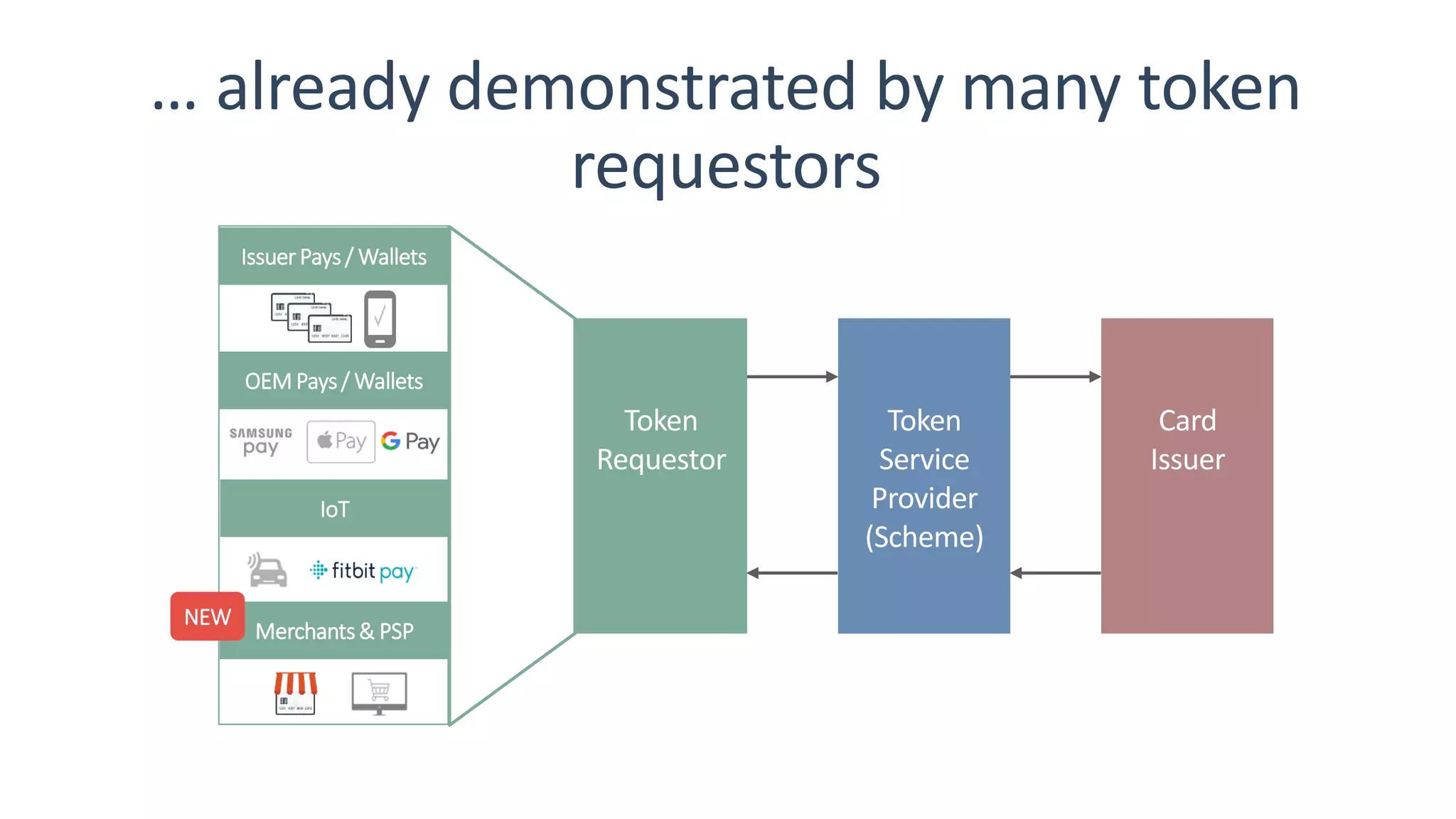

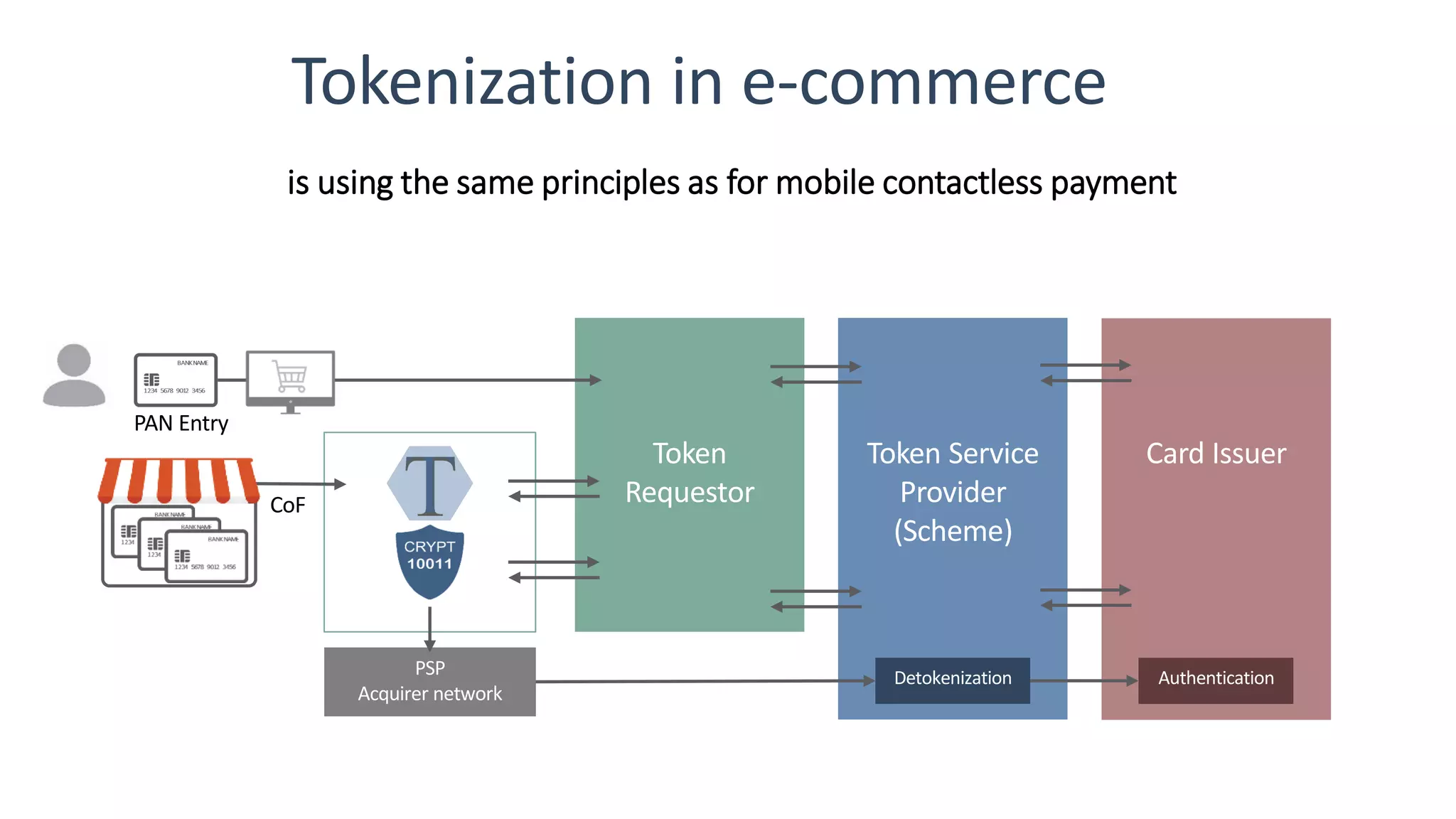

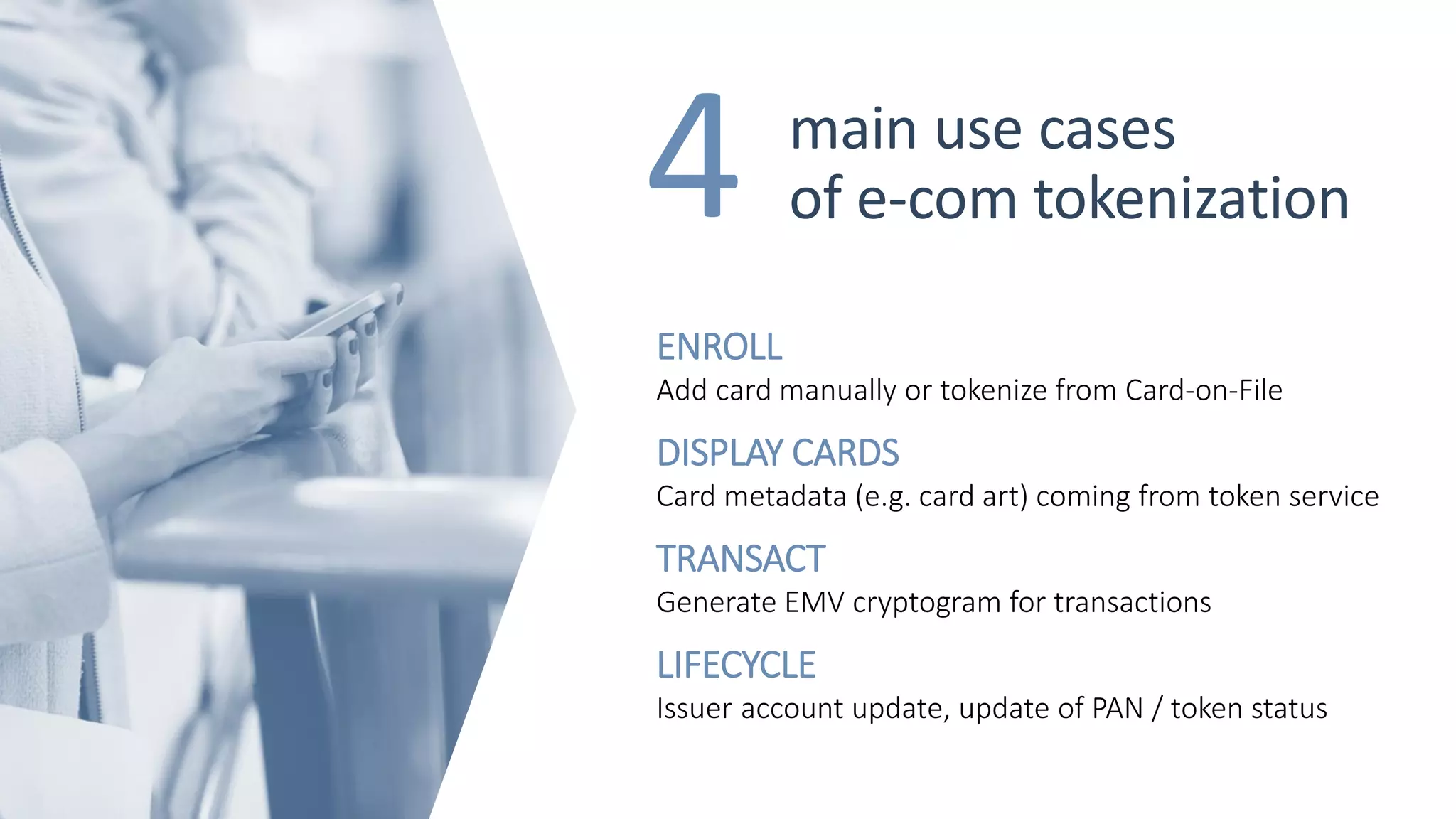

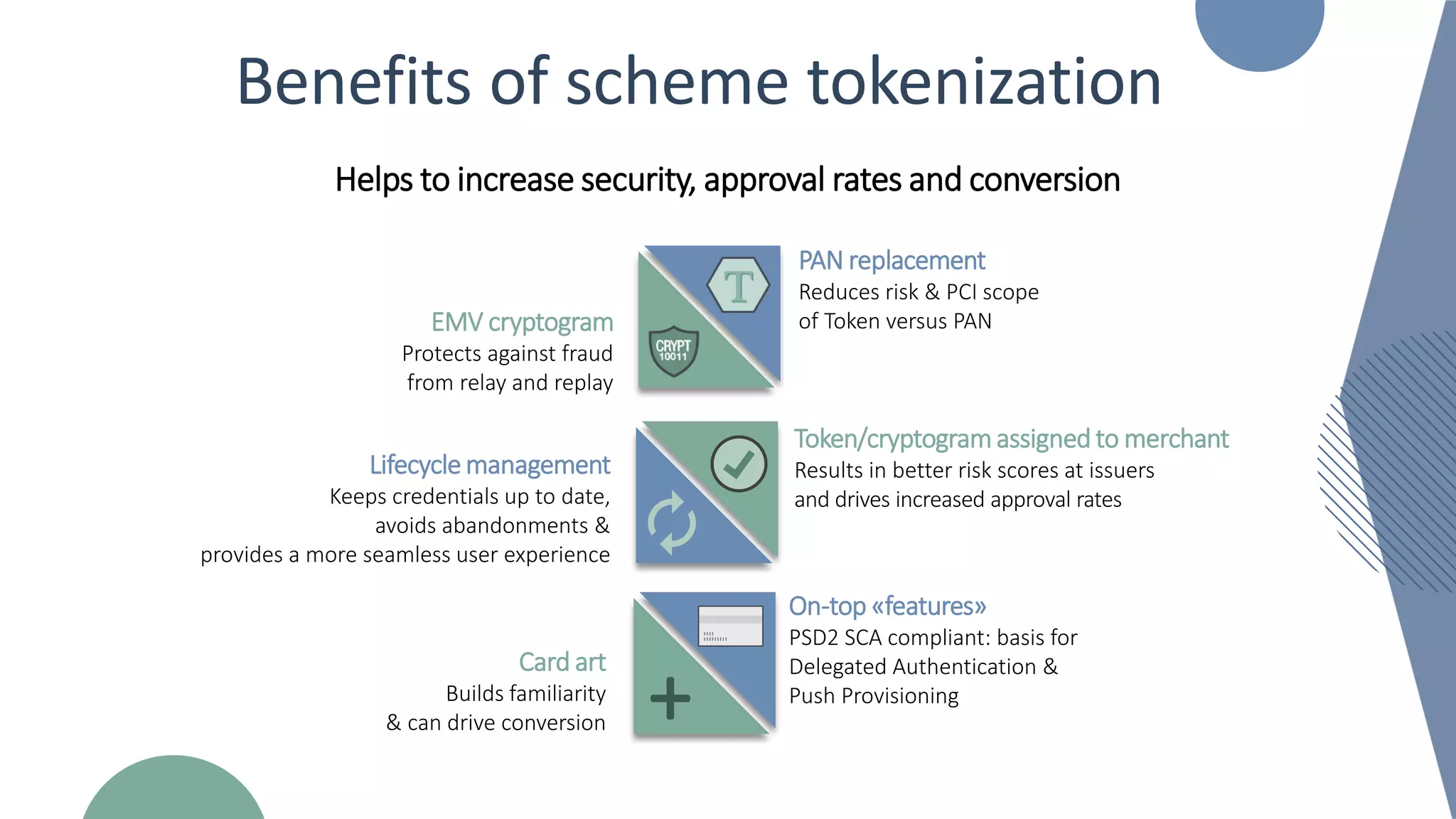

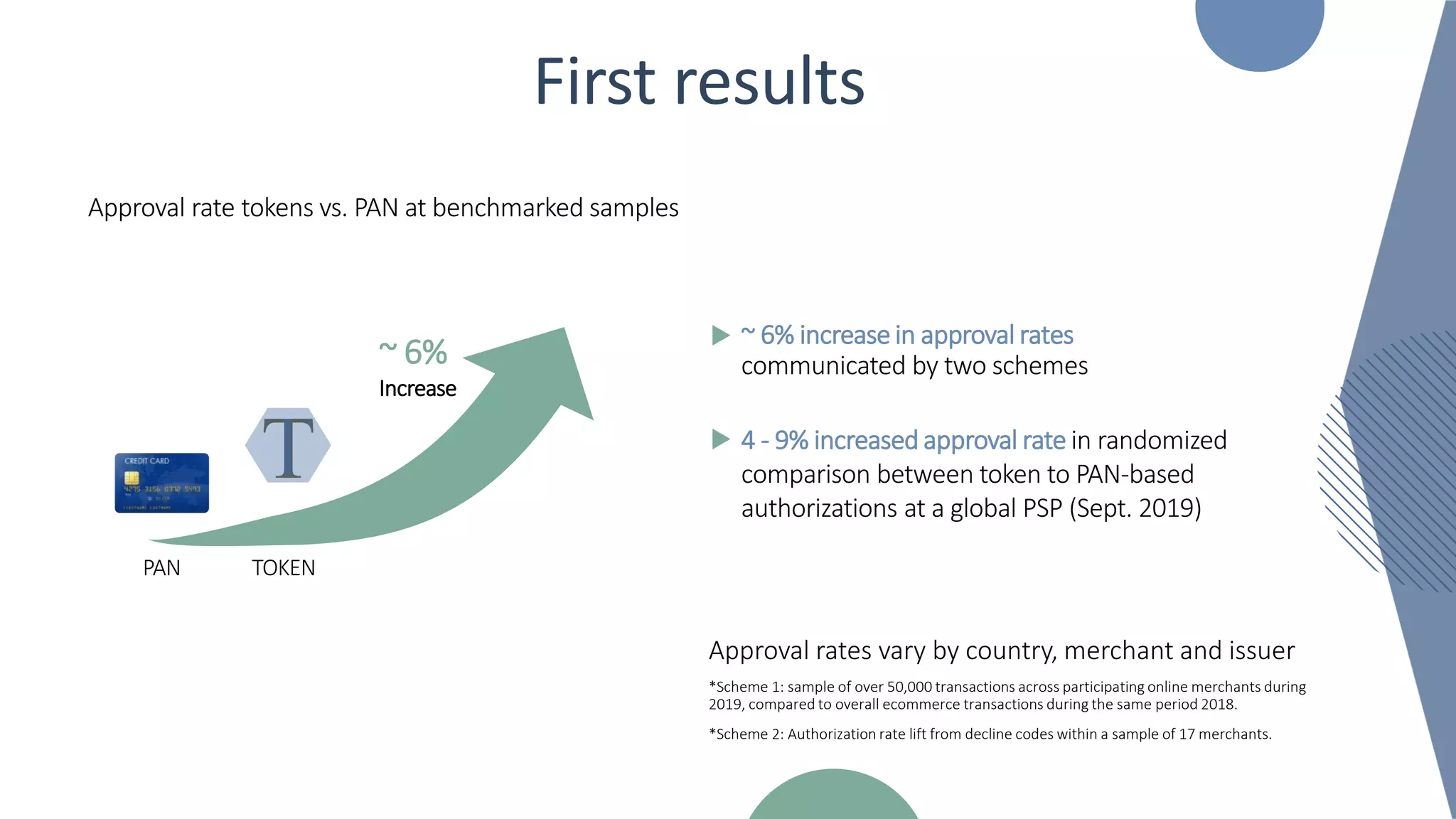

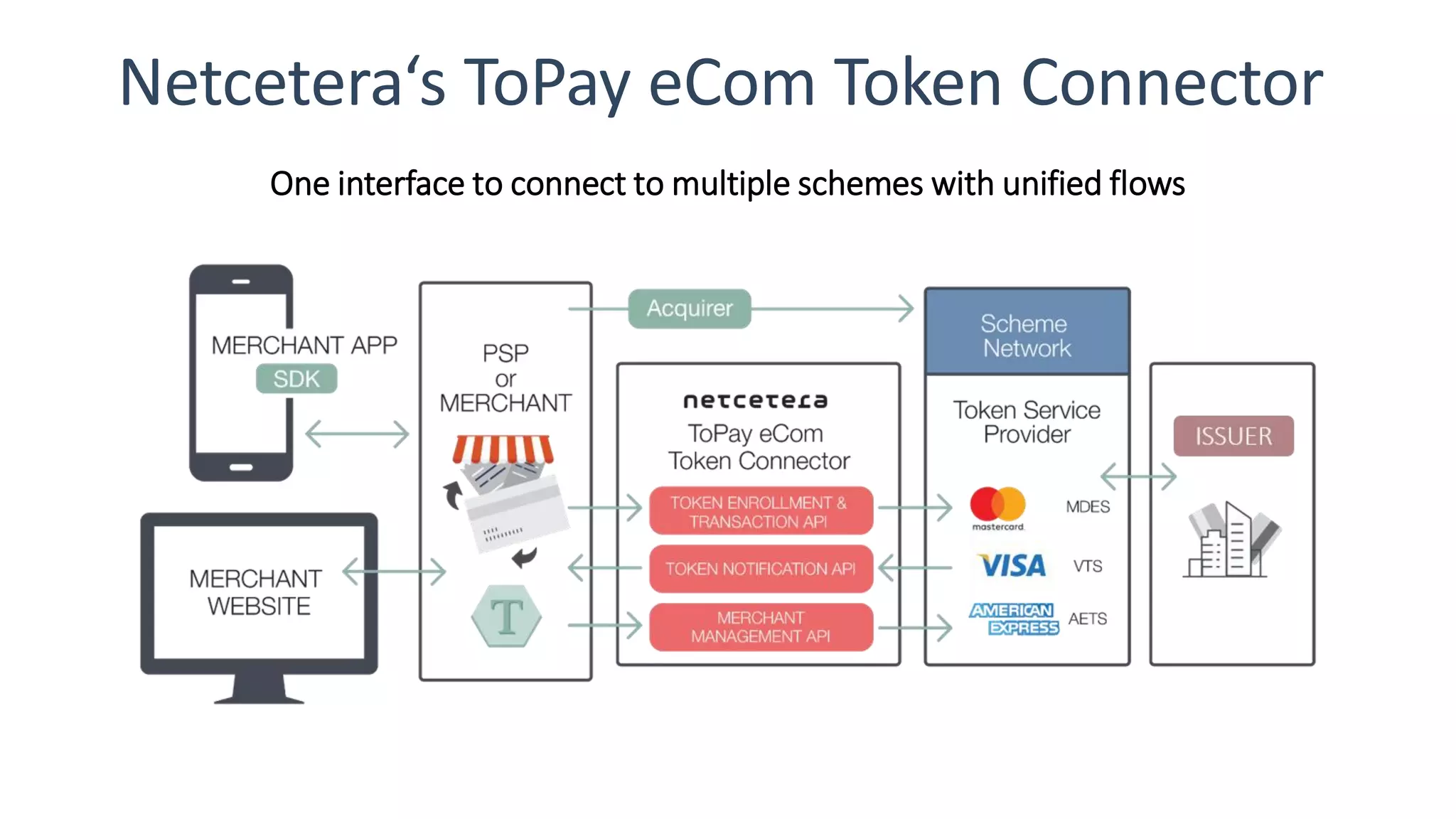

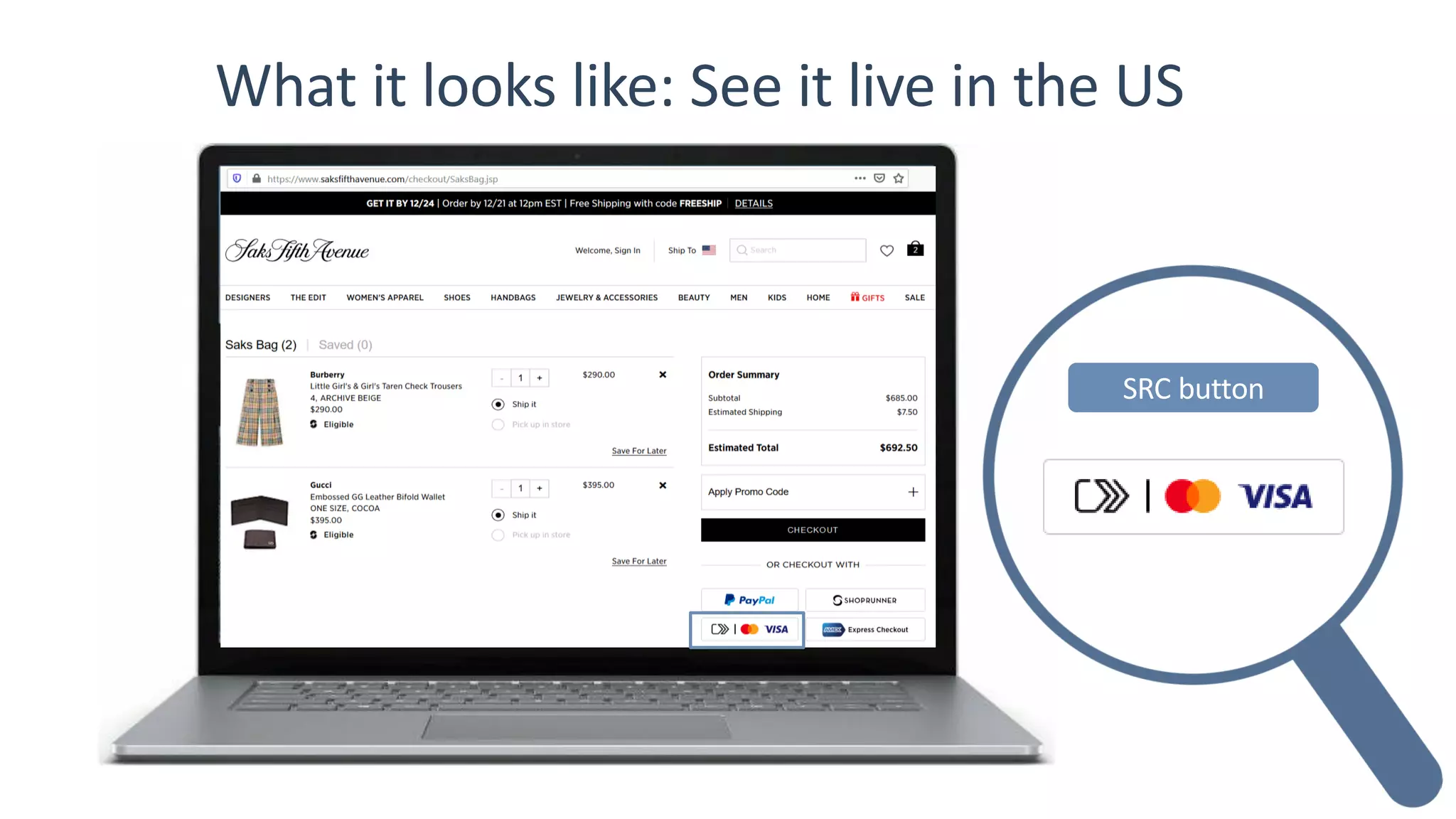

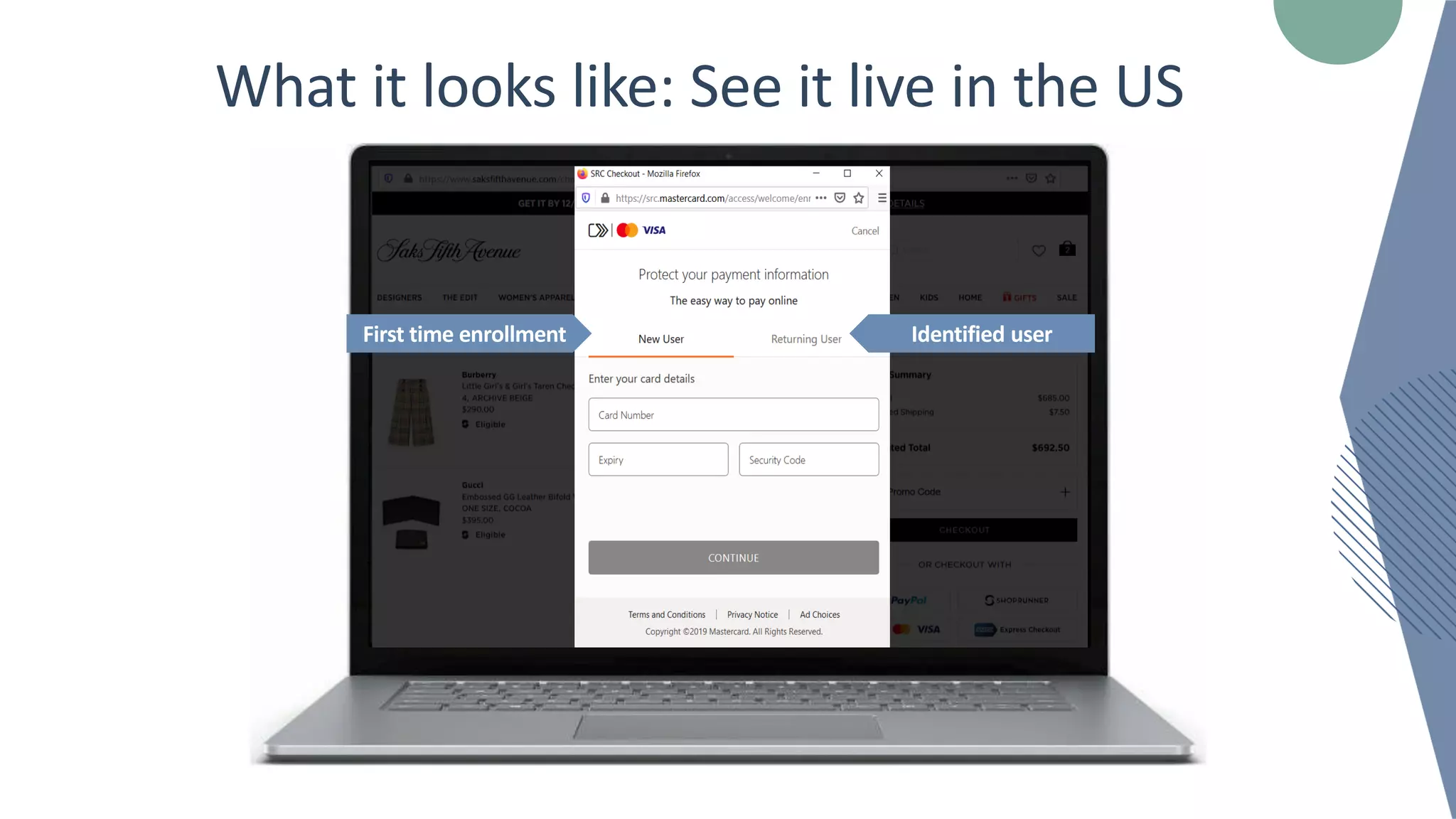

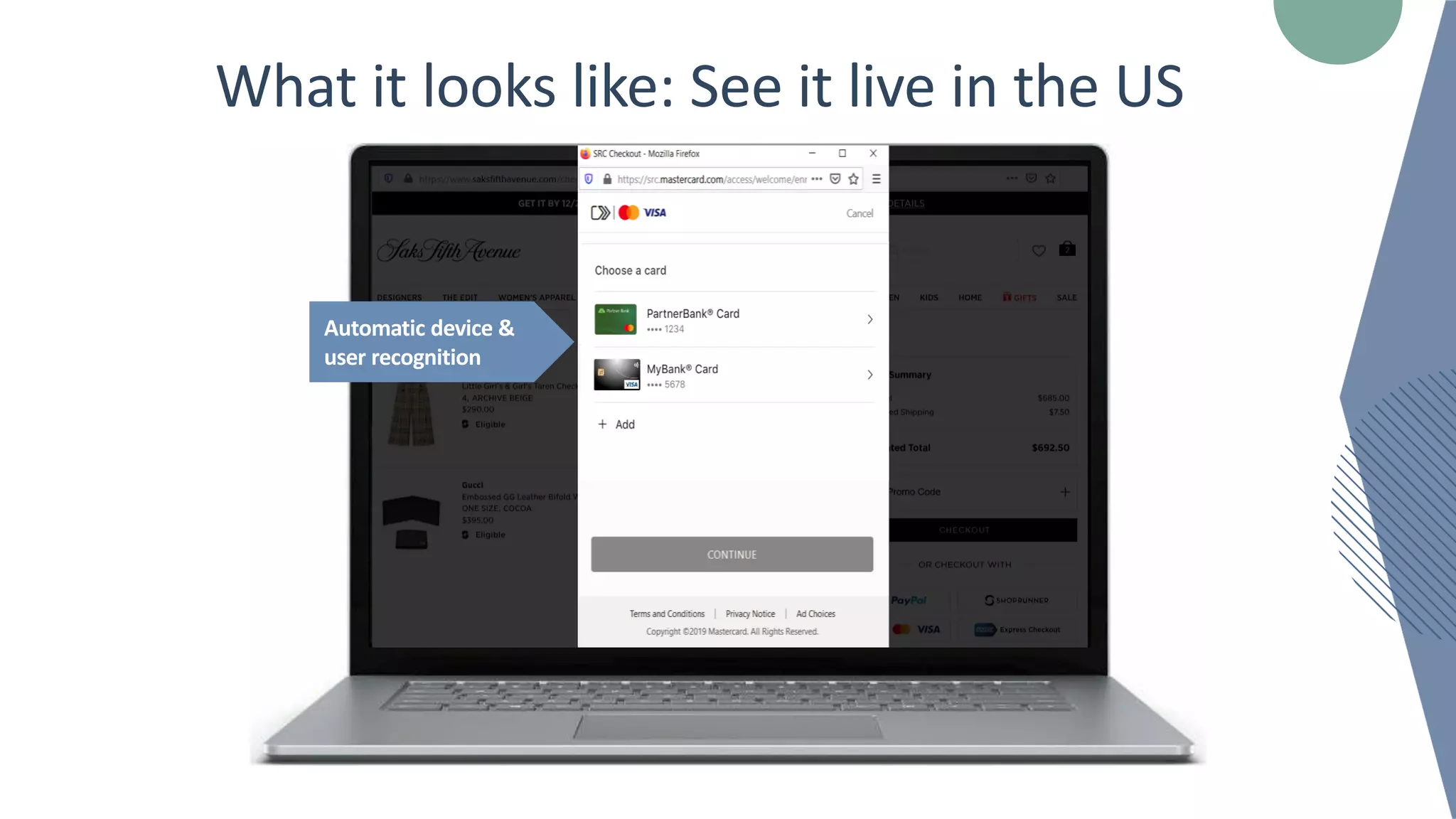

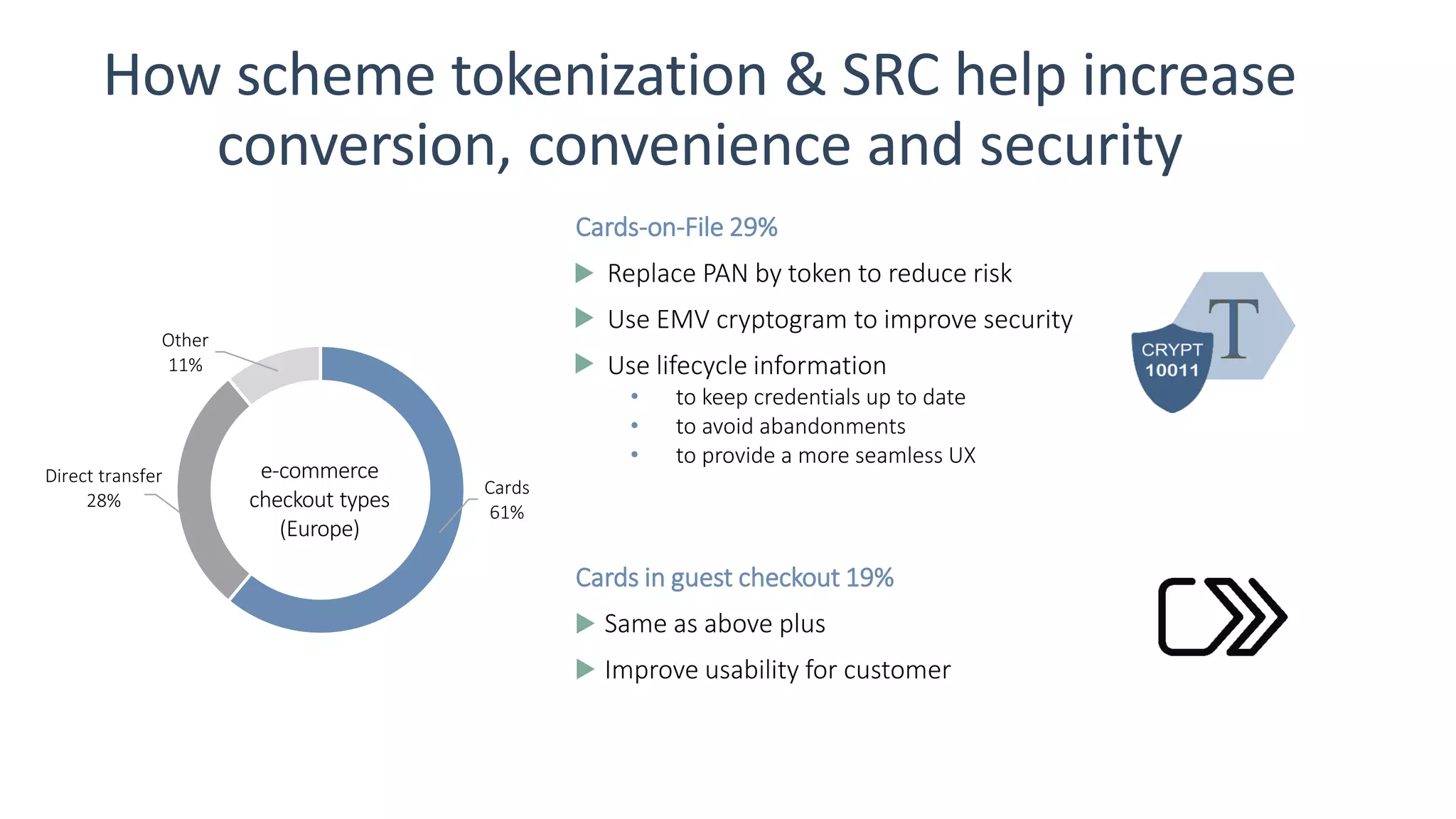

This document discusses trends, challenges, and technologies related to e-commerce checkouts. It notes that 61% of checkouts are card-based, which face issues like abandonment, declines, and fraud. Tokenization and Secure Remote Commerce (SRC) are presented as key technologies to address these problems by digitizing cards, improving security with cryptograms, and providing a more seamless user experience through features like automatic user and device recognition. SRC in particular is described as a future standard that could create a consistent checkout experience across payment schemes. Examples are given of how tokenization and SRC could increase approval rates by 6%, conversion rates, and overall convenience and security for online transactions.