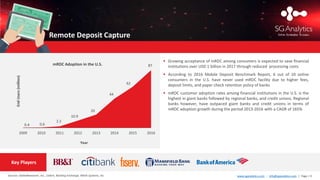

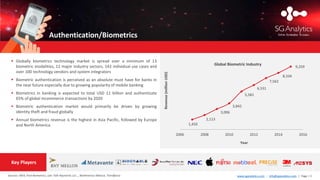

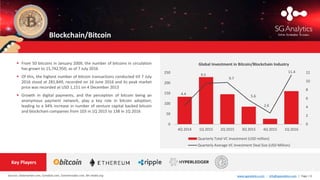

This document summarizes the key trends and developments in next-generation payment processing technologies over the next decade. It highlights 9 important technologies: EMV chip cards, remote deposit capture, authentication/biometrics, contactless payments, real-time/faster payments, blockchain/bitcoin, e-commerce/m-commerce, mobile point of sale (mPOS), and mobile wallets. For each technology, it provides data on adoption rates, expected growth and revenues, as well as some of the major players in each field. The overall document indicates that payments are evolving rapidly due to innovation and that the pace of change will continue to accelerate in the coming years.