The webinar discusses the benefits and challenges of 3D Secure and highlights new features in version 2.2 that aim to improve the user experience. Key points include:

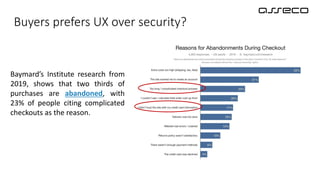

- 3D Secure provides benefits like liability shift but can create friction for cardholders during online transactions.

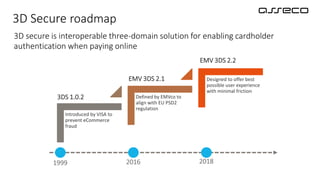

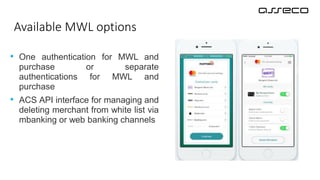

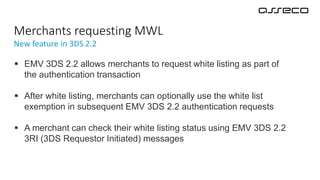

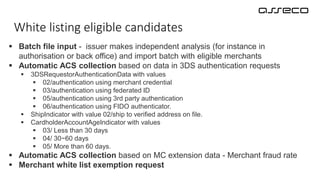

- Version 2.2 focuses on minimizing user actions and authentication through tools like merchant white listing, risk-based exemptions, and decoupled authentication.

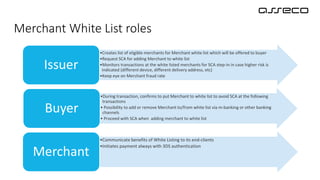

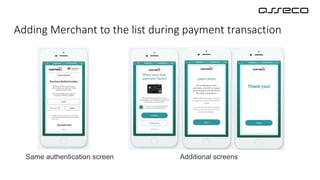

- Merchant white listing allows cardholders to add trusted merchants to their own list and skip authentication for future purchases from those merchants.

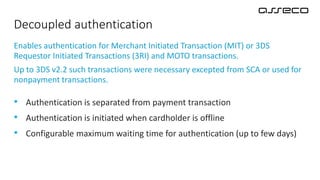

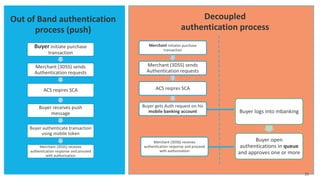

- Decoupled authentication separates authentication from payment, allowing it to occur offline through mobile notifications within a configurable time window.