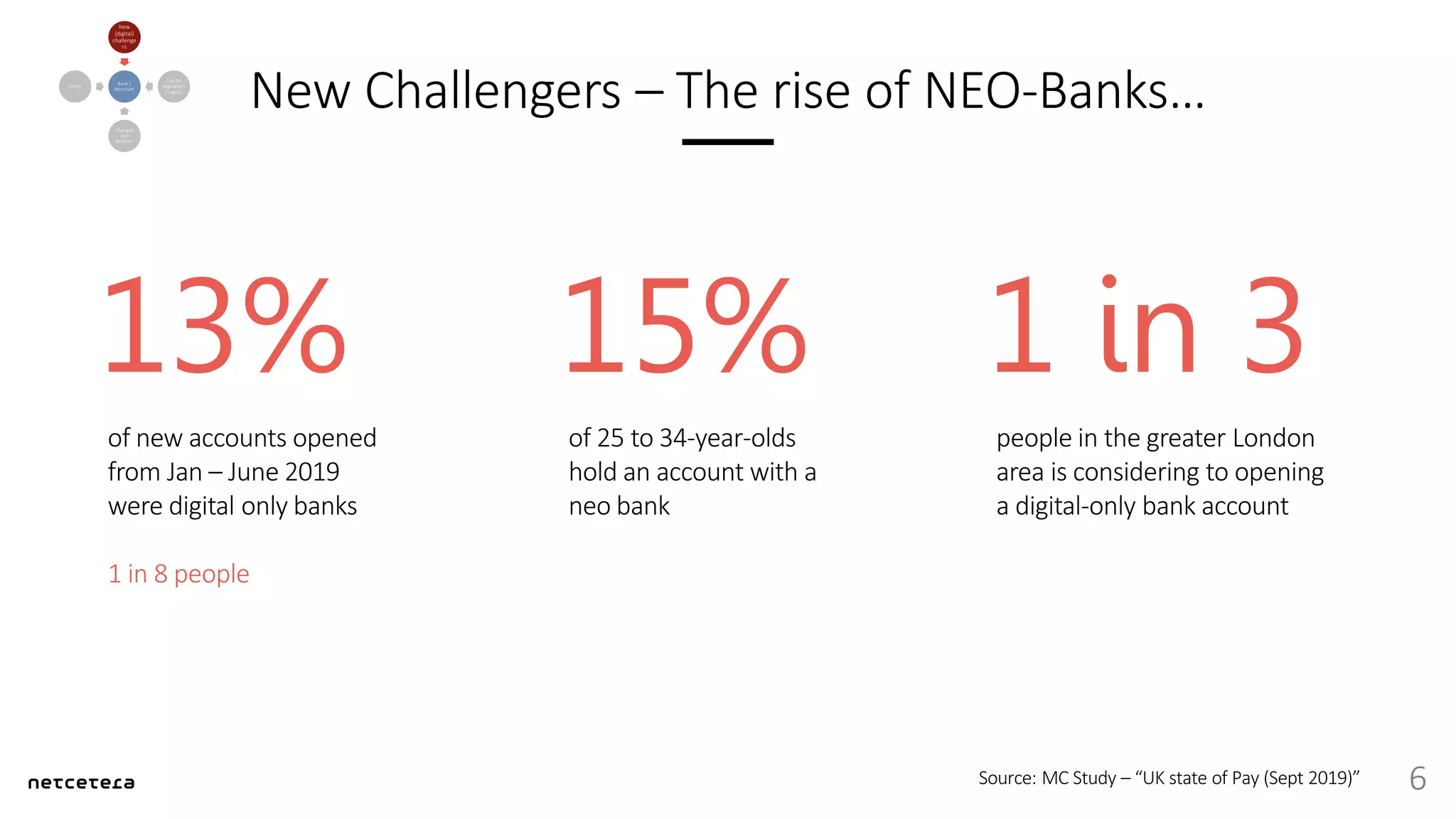

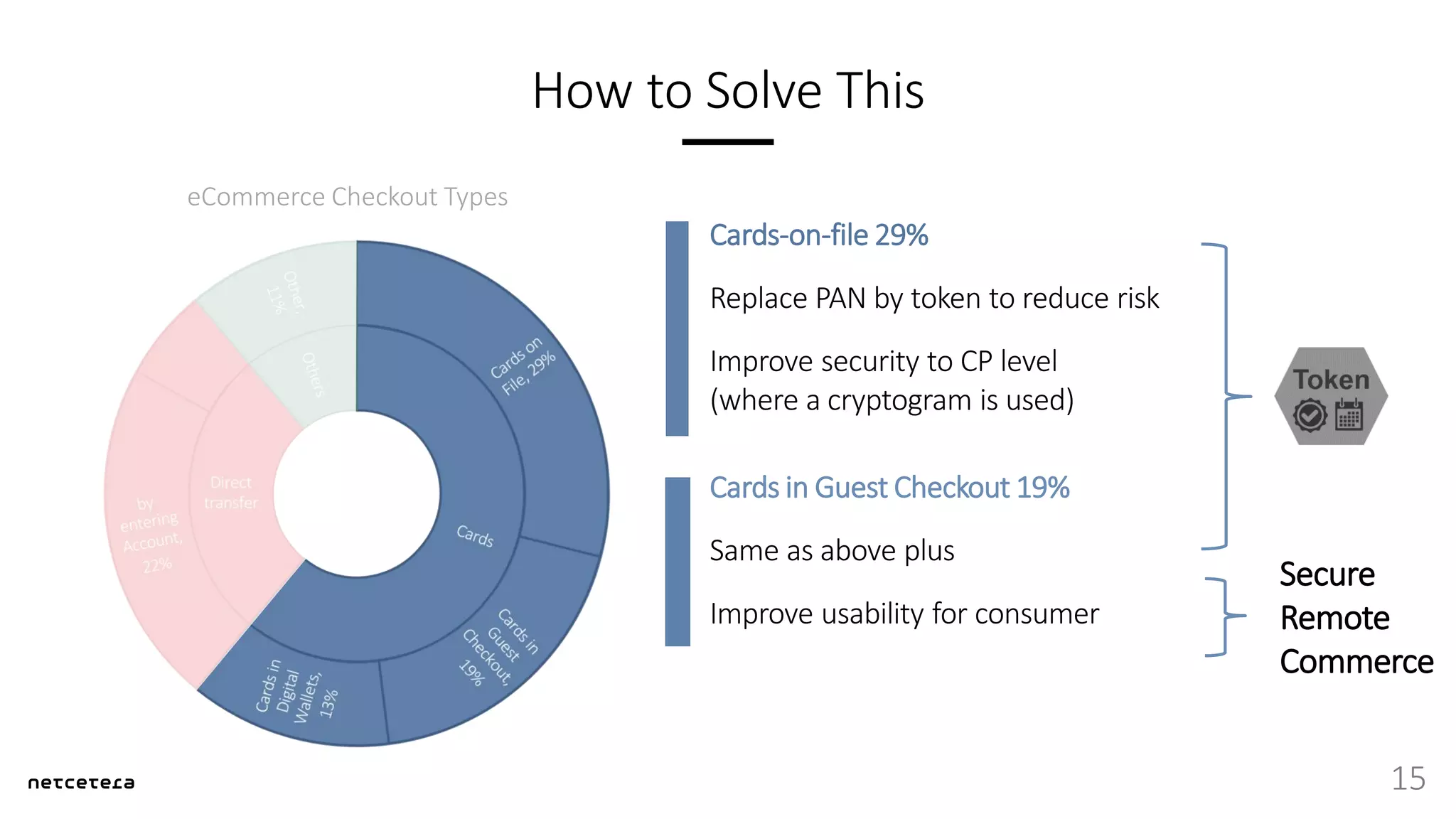

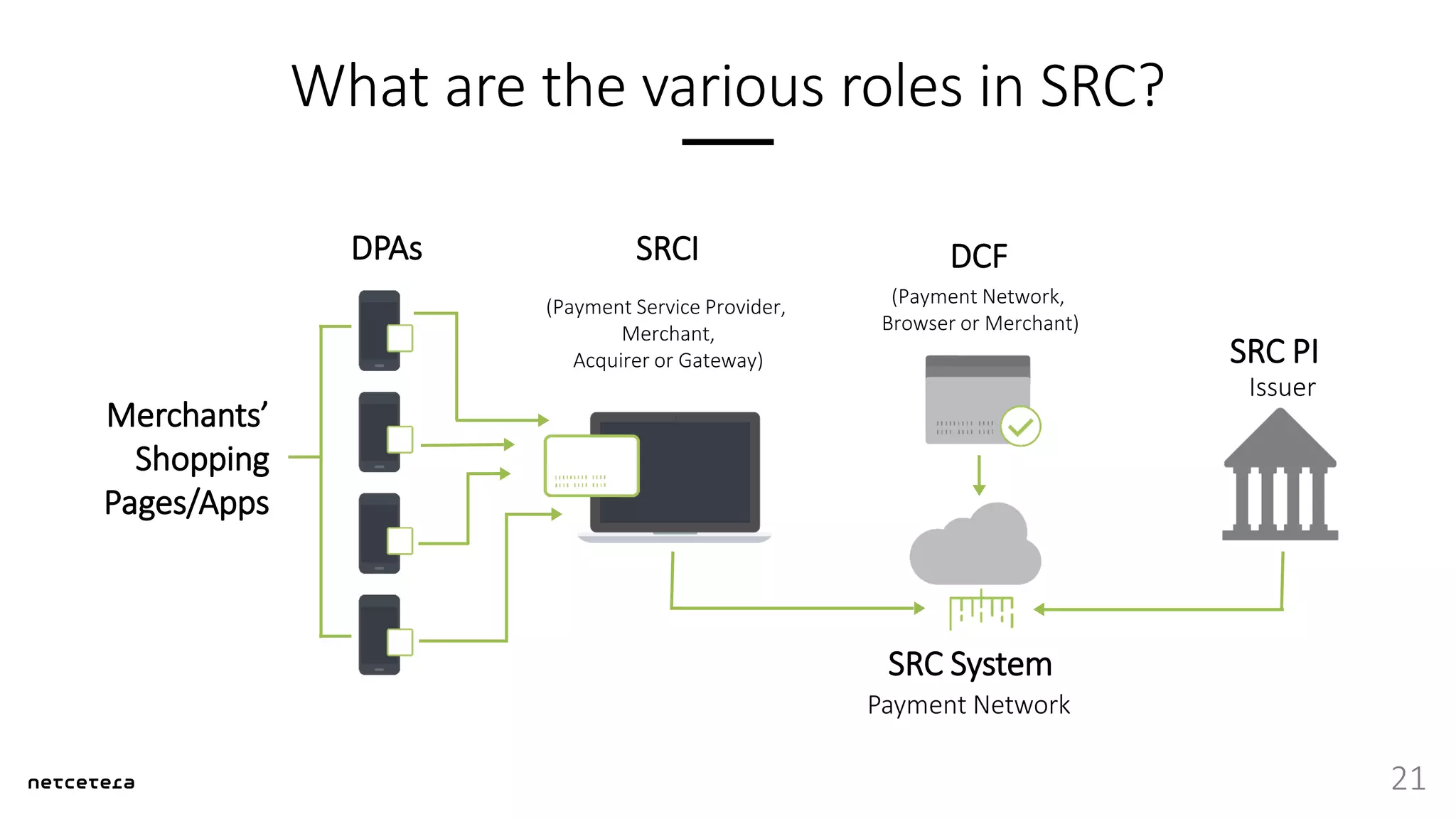

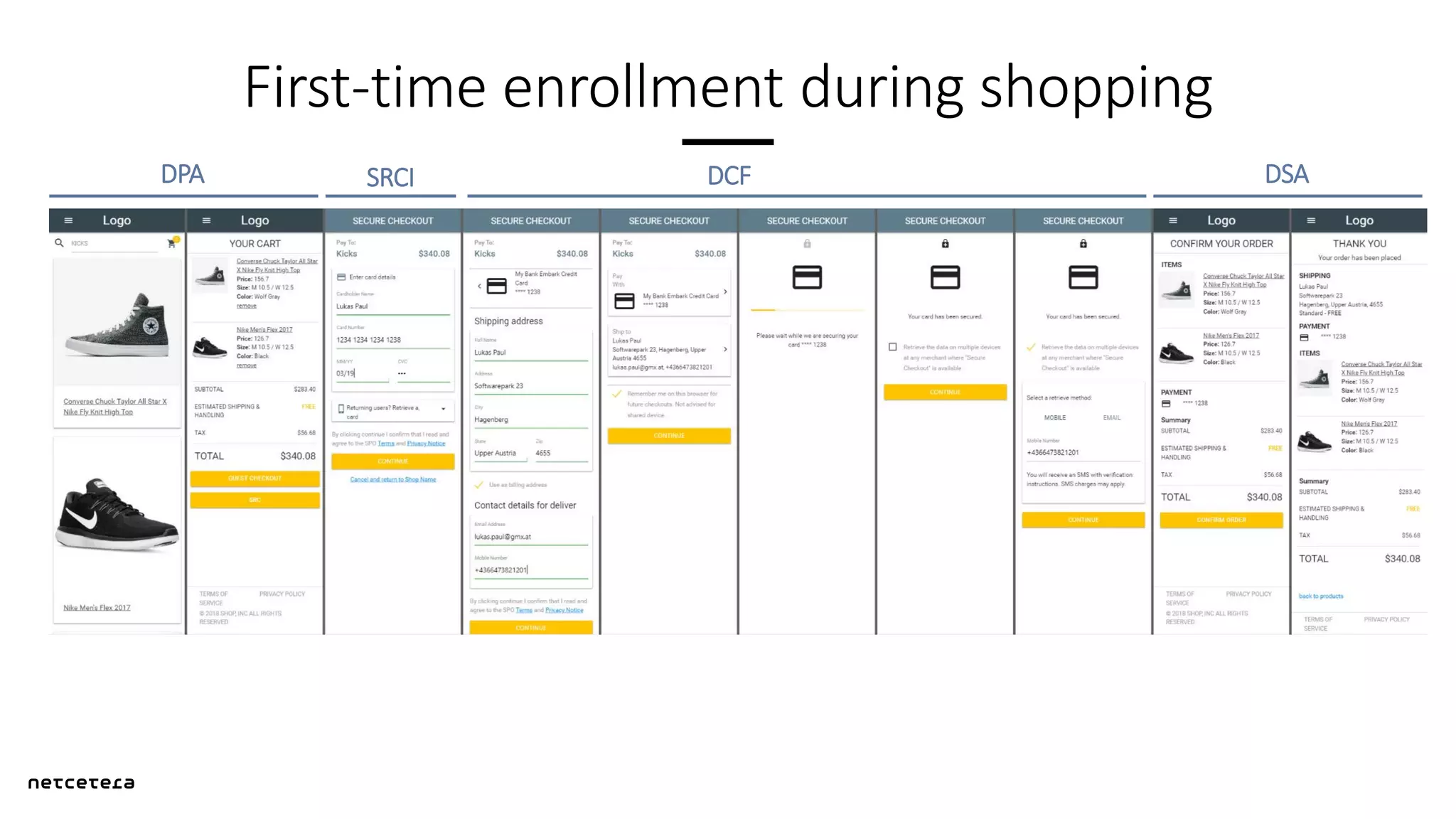

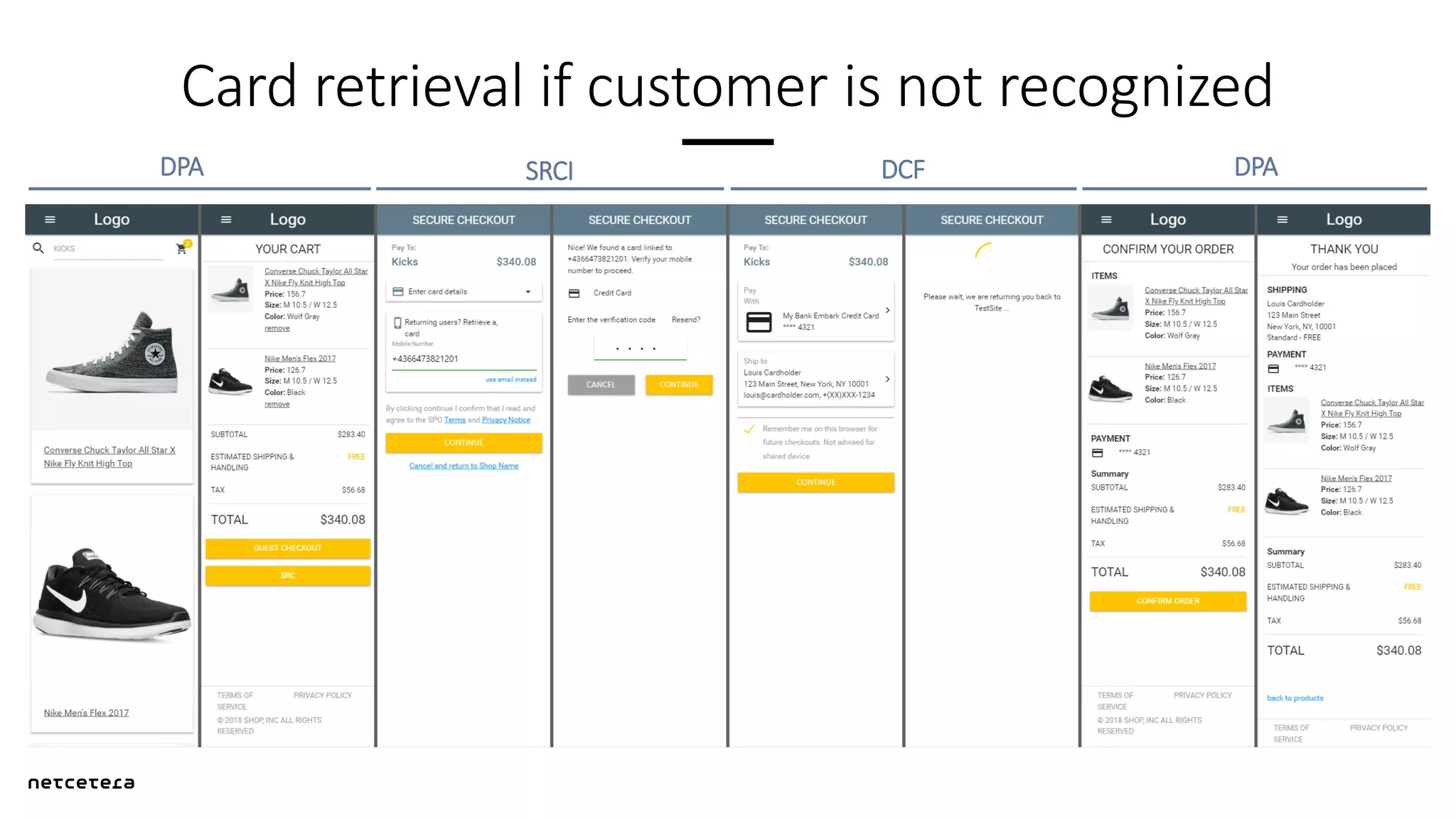

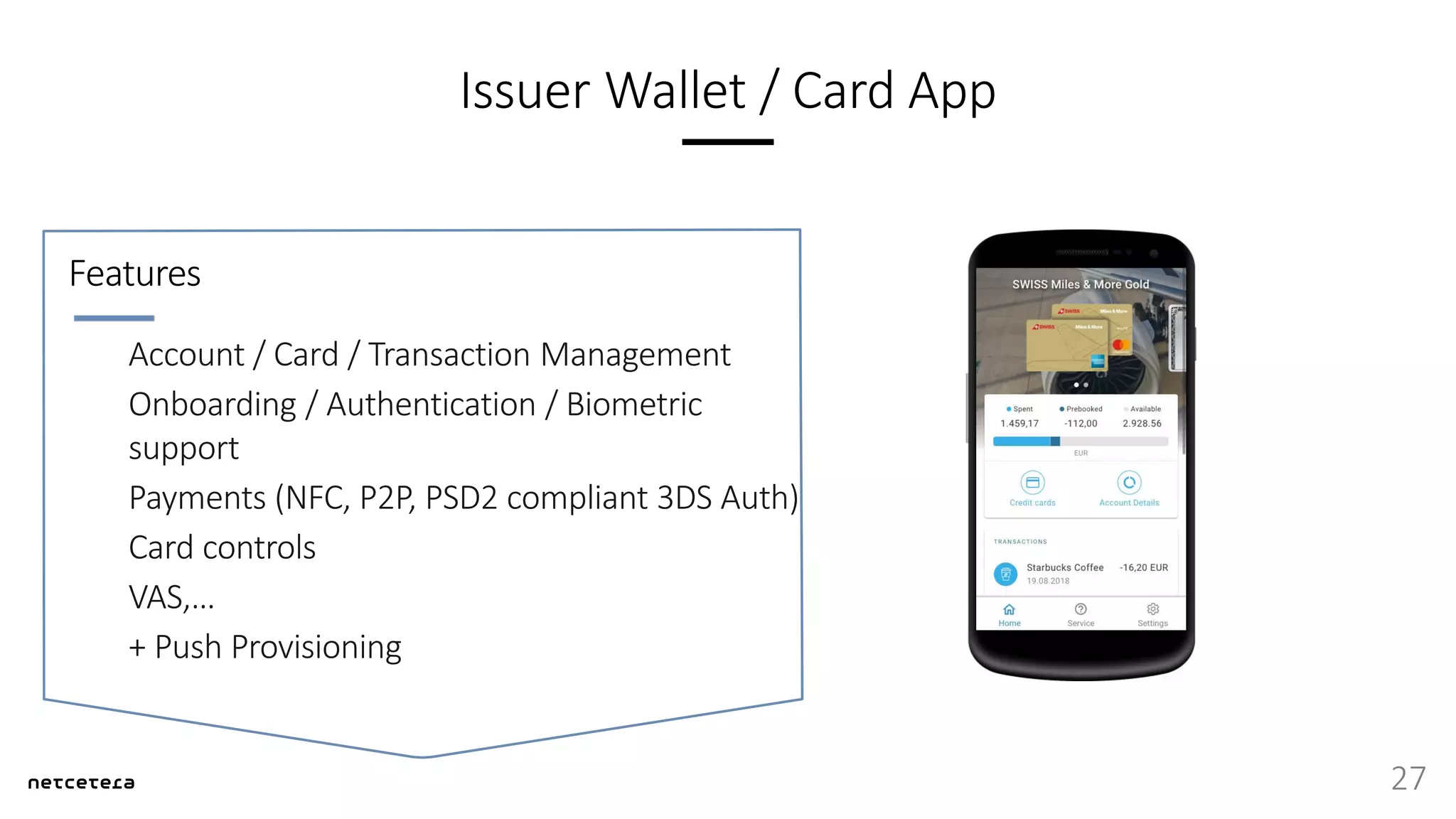

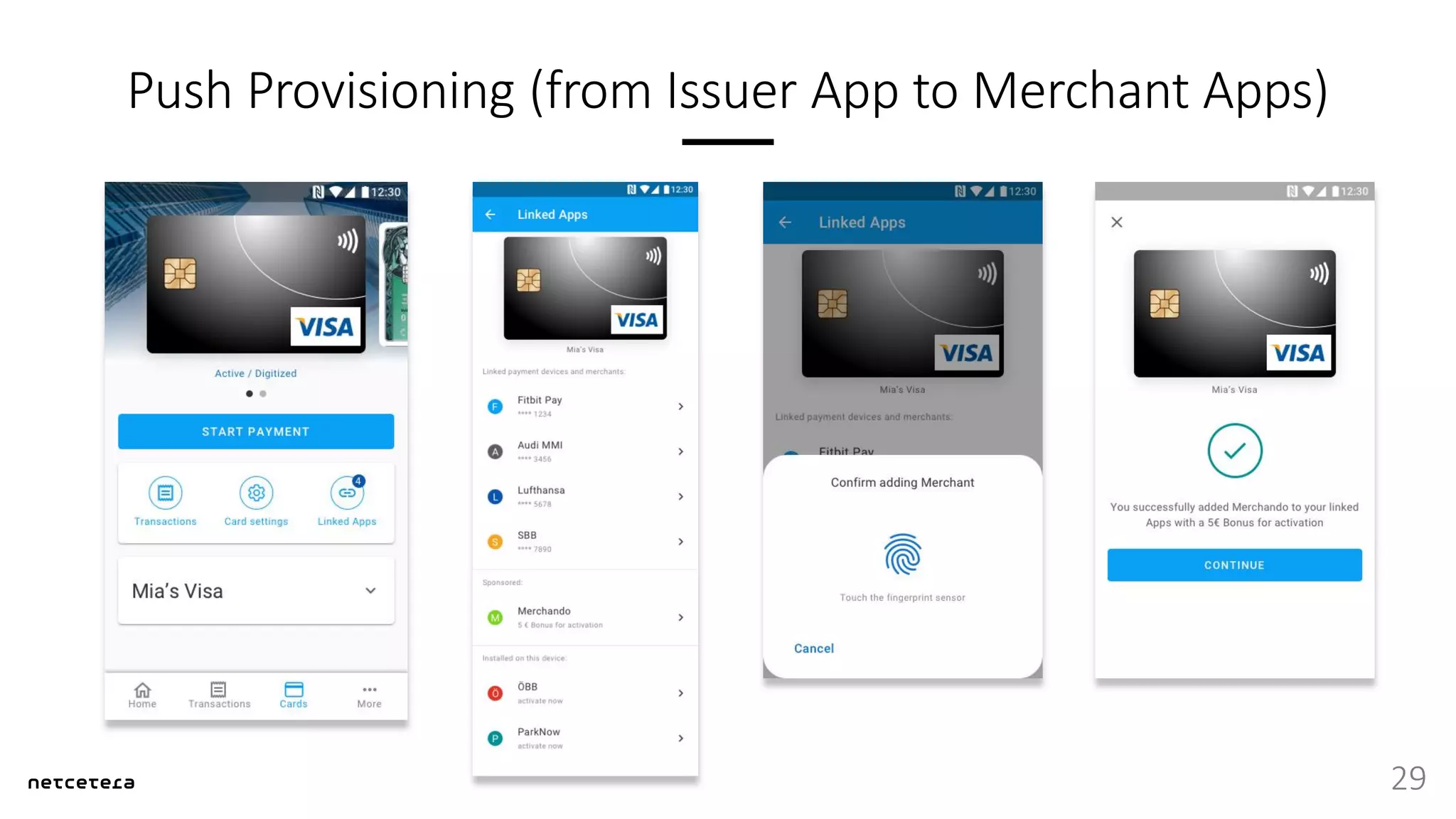

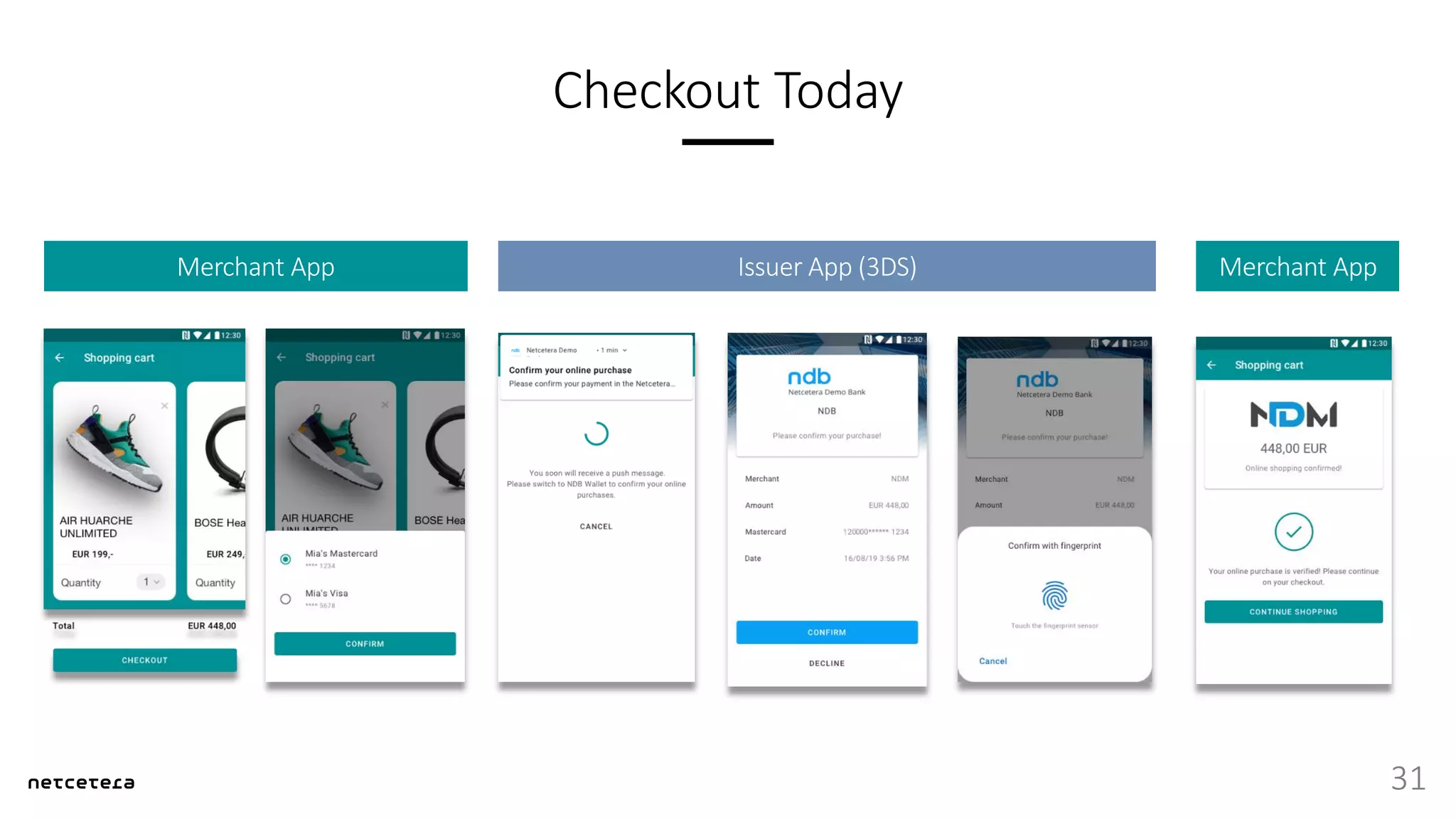

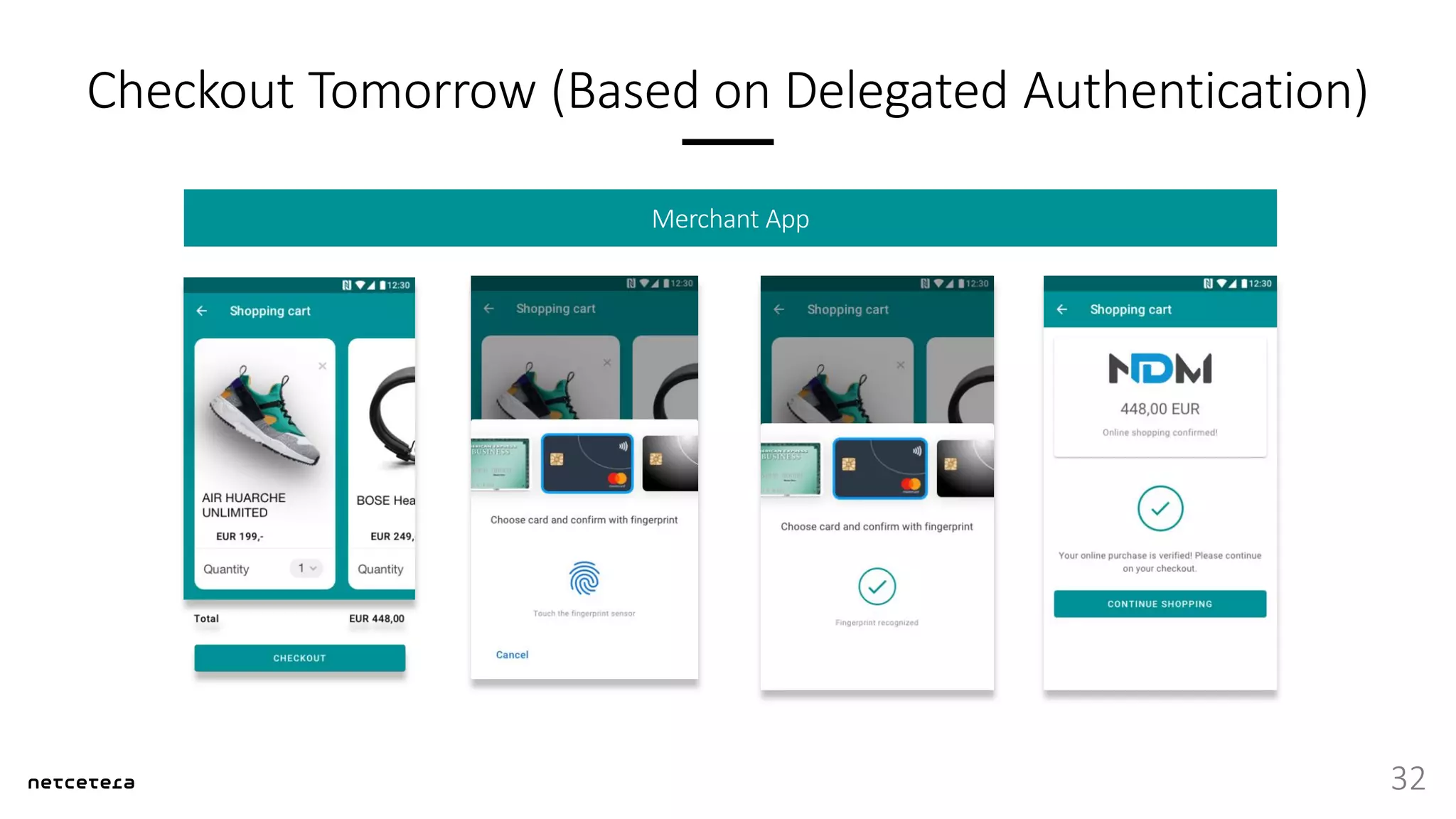

The document summarizes the key topics discussed at the Swiss Payment Forum 2019 including the challenges facing digital payments such as new fintech competitors, changing regulations, and shifting user behaviors. It also covers new developments in e-commerce payments including merchant tokenization and Secure Remote Commerce (SRC). The document discusses how solutions like tokenization, delegated authentication, push provisioning, and SRC can help drive adoption by improving the user experience and security of digital payments.