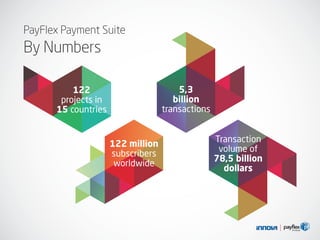

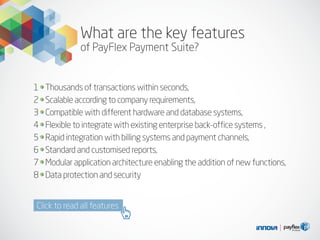

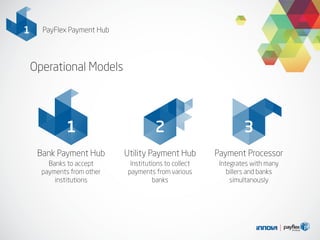

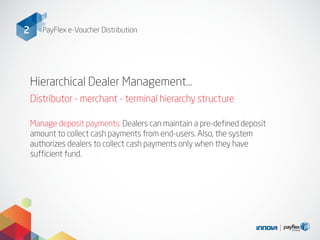

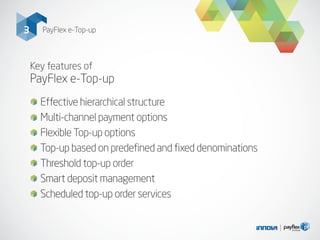

The document discusses Payflex Payment Suite, a cutting-edge financial transaction processing system that offers a range of payment and collection services with high security and efficiency, while minimizing costs for various institutions like telecom operators and banks. It highlights the benefits of the Payflex Payment Hub, e-voucher distribution, and e-top-up solutions, emphasizing their ability to facilitate transactions quickly and securely. Overall, the suite aims to streamline financial exchanges in the cloud, enhancing operational efficiency and customer satisfaction.