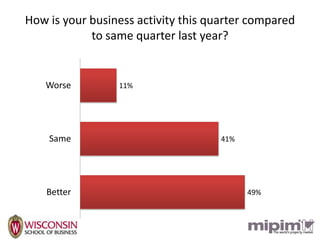

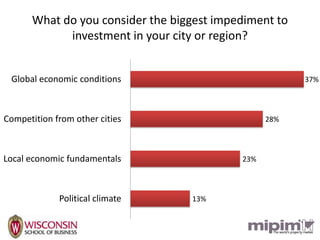

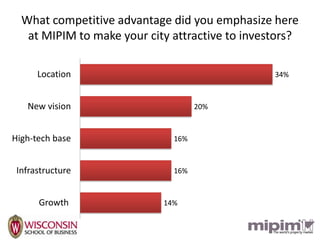

The MIPIM 2012 insights indicate mixed sentiment on business activity, with 49% reporting improvement compared to the previous year. Participants highlighted challenges such as global economic conditions and competition from other cities, while emphasizing location and infrastructure as key advantages in attracting investment. Overall, there is cautious optimism among real estate professionals regarding future market conditions and hiring plans.