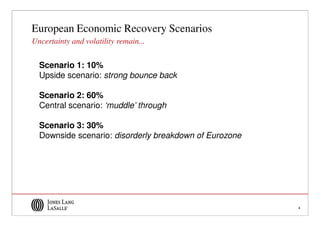

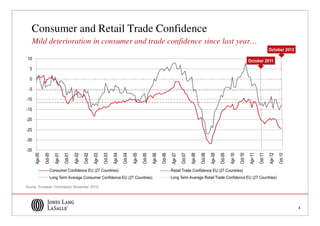

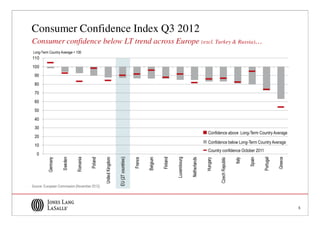

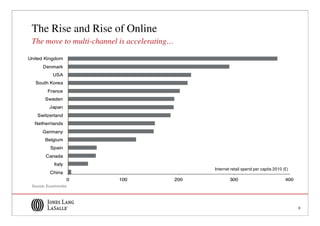

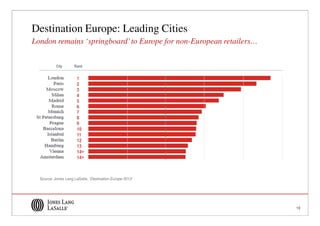

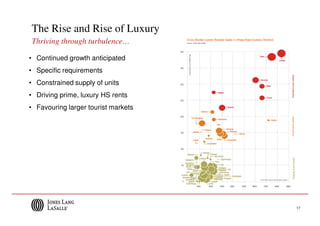

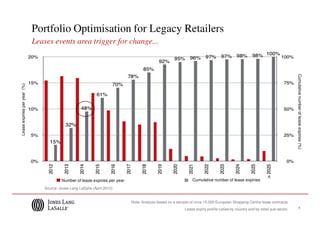

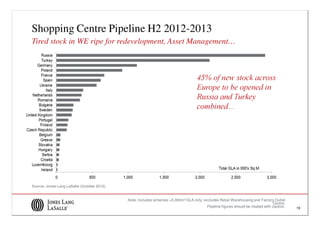

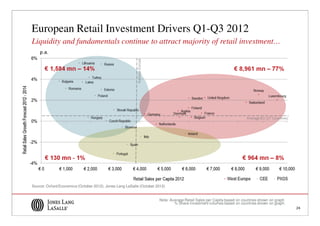

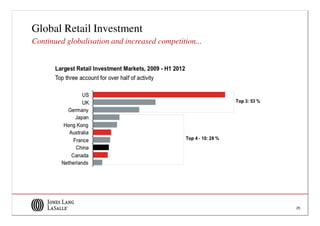

The document discusses the current state of the European retail economy, highlighting uncertainty and subdued growth post-MAPIC 2011 while noting pockets of strong growth in certain regions. It emphasizes the rise of online retail and multi-channel strategies, the changing landscape for retail requirements, and the importance of international markets. Key takeaways for 2013 include ongoing adaptation to digital trends, targeted expansion, and a bifurcated retail investment market focusing on prime assets due to a lack of debt.