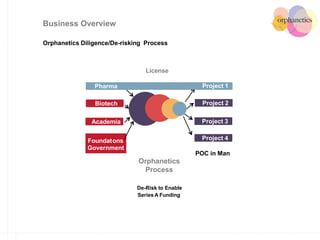

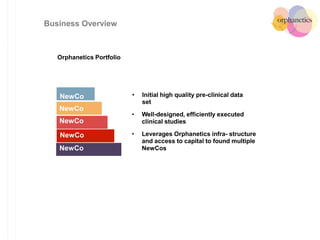

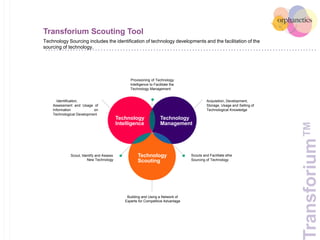

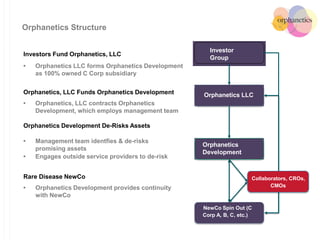

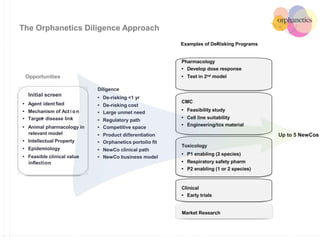

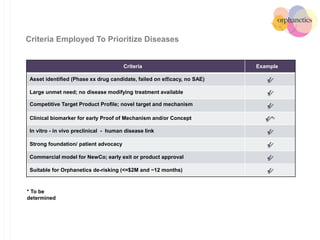

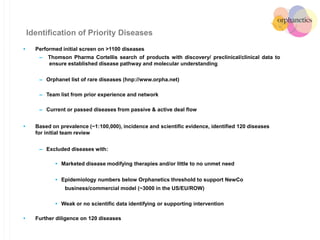

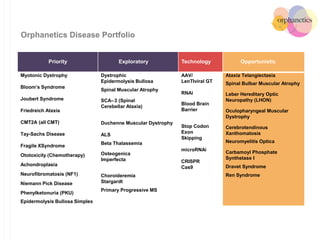

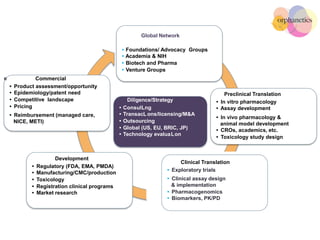

Orphanetics aims to create new biotechnology companies focused on rare and ultra-rare diseases by evaluating therapeutic opportunities, conducting de-risking experiments, and seeking candidates compatible with forming new ventures; it utilizes a collaborative model working with various organizations to identify assets, de-risk programs, and accelerate the formation of new companies developing therapeutics for diseases with unmet medical needs.