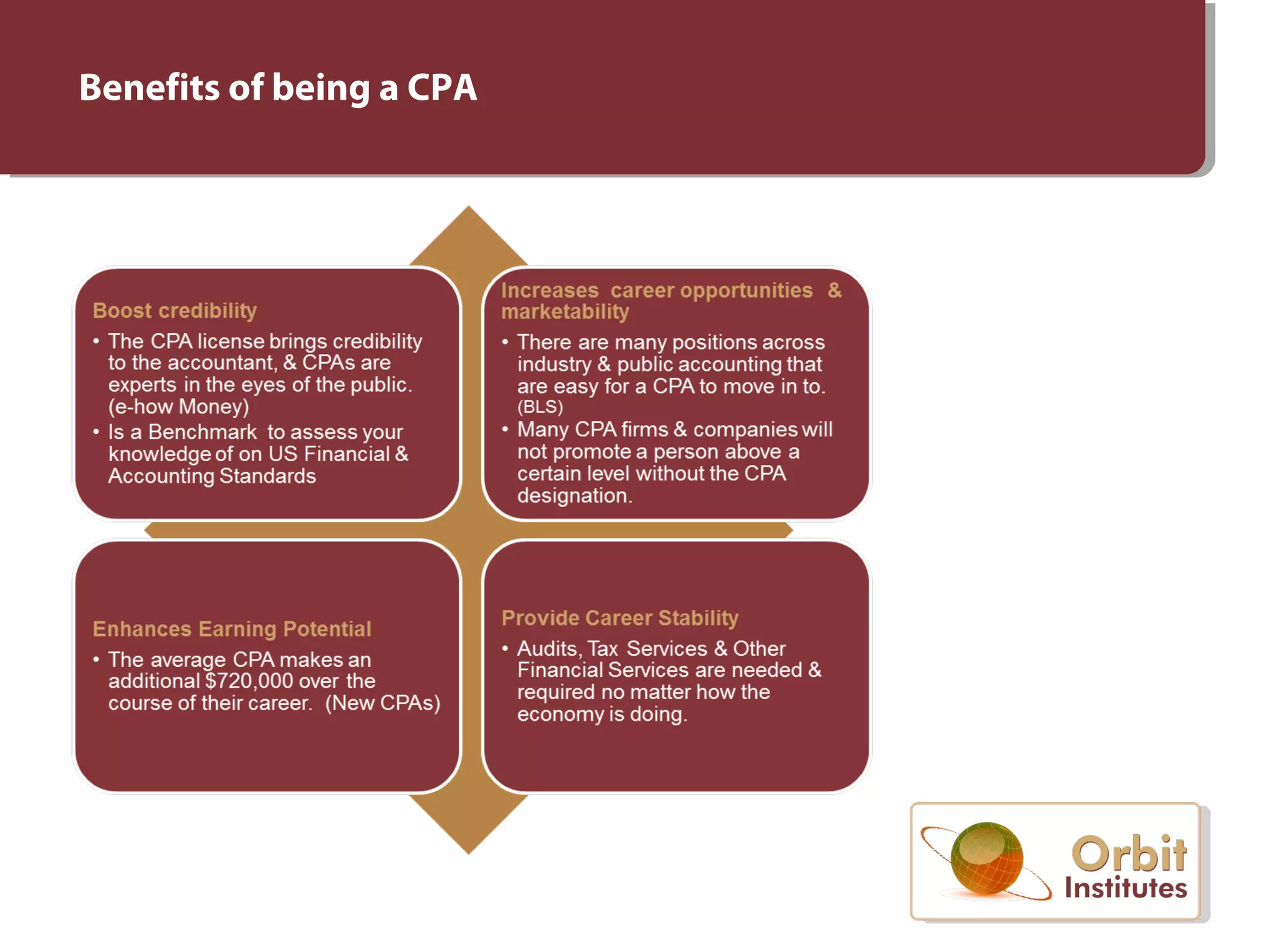

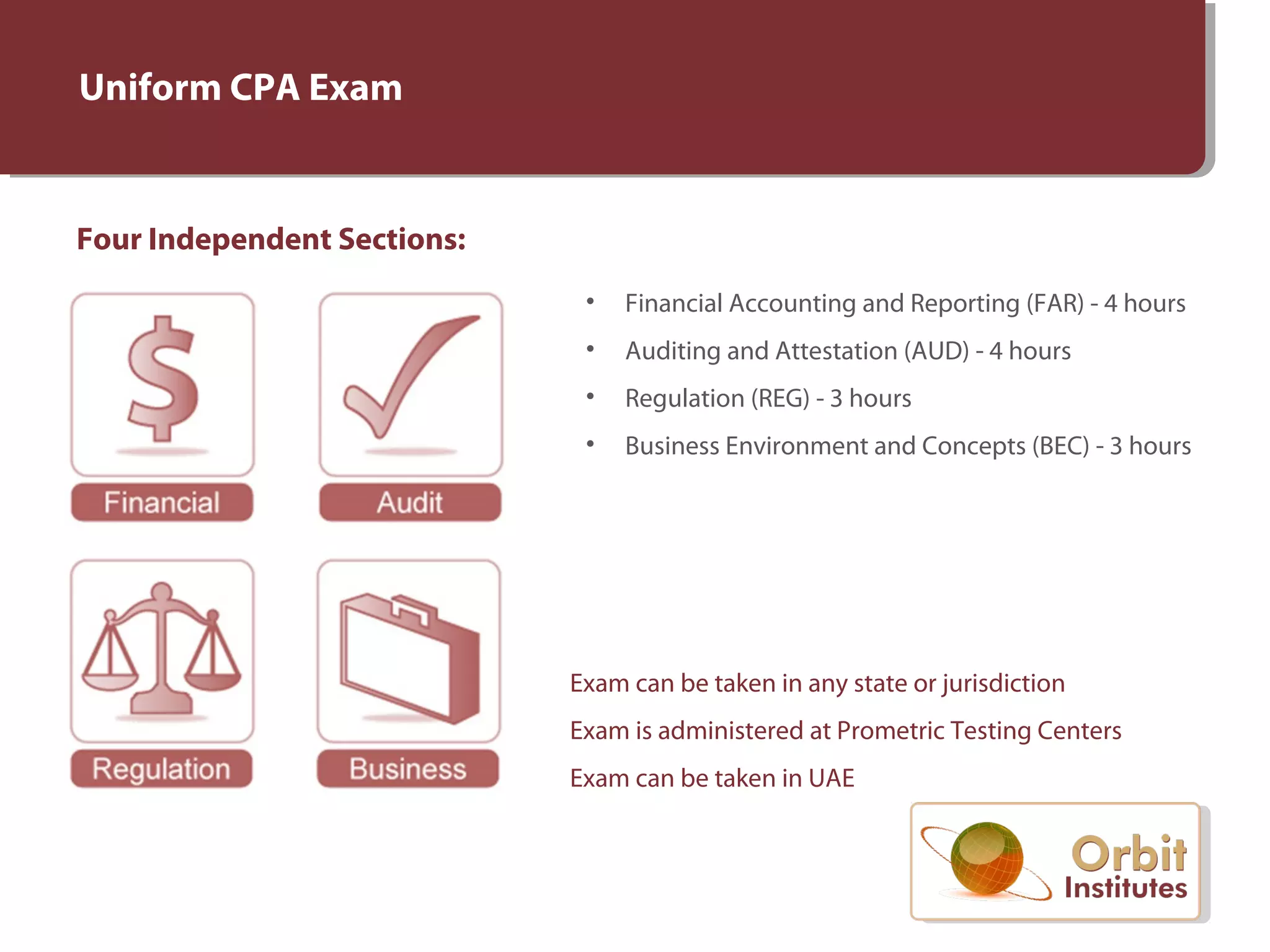

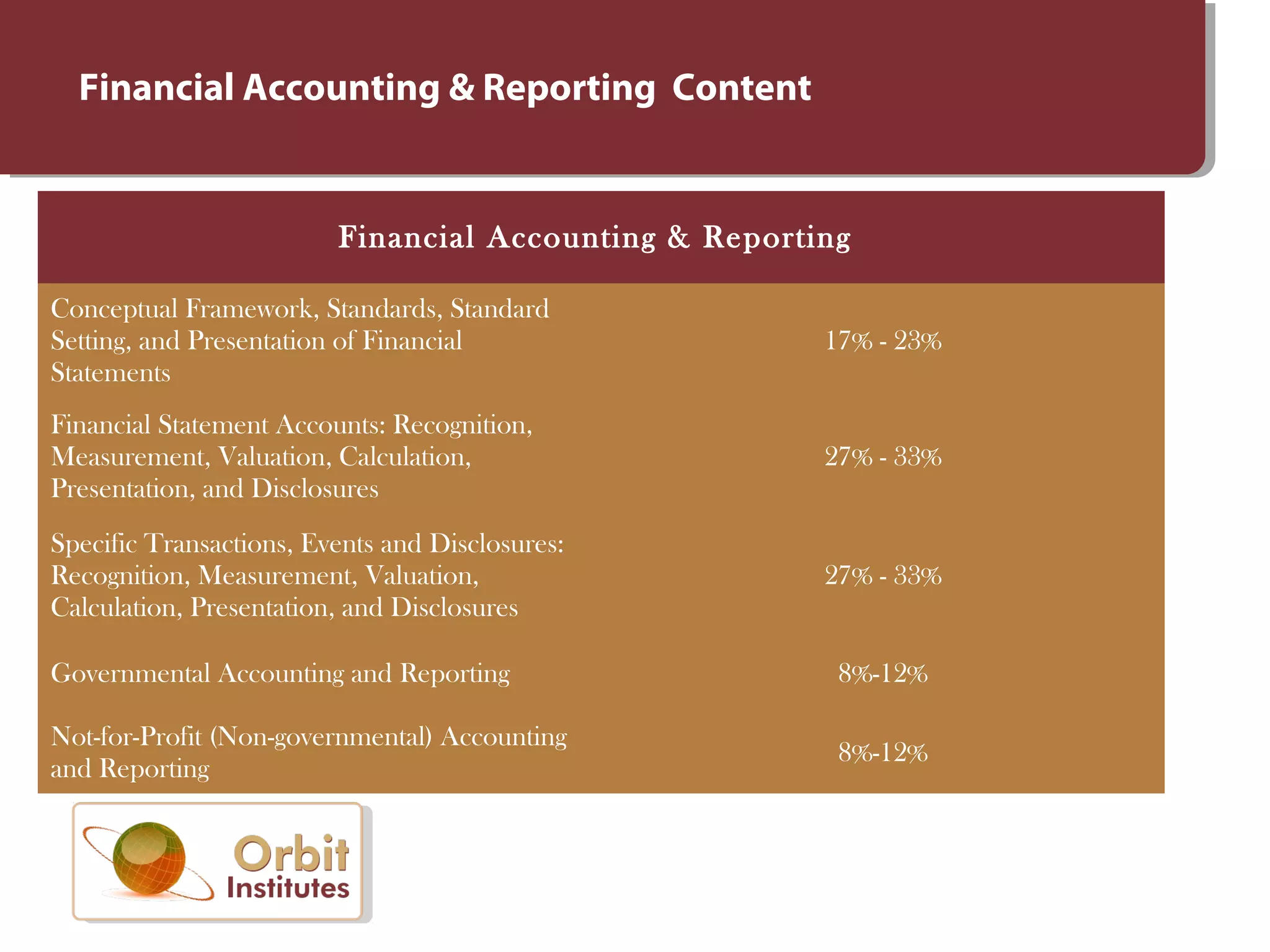

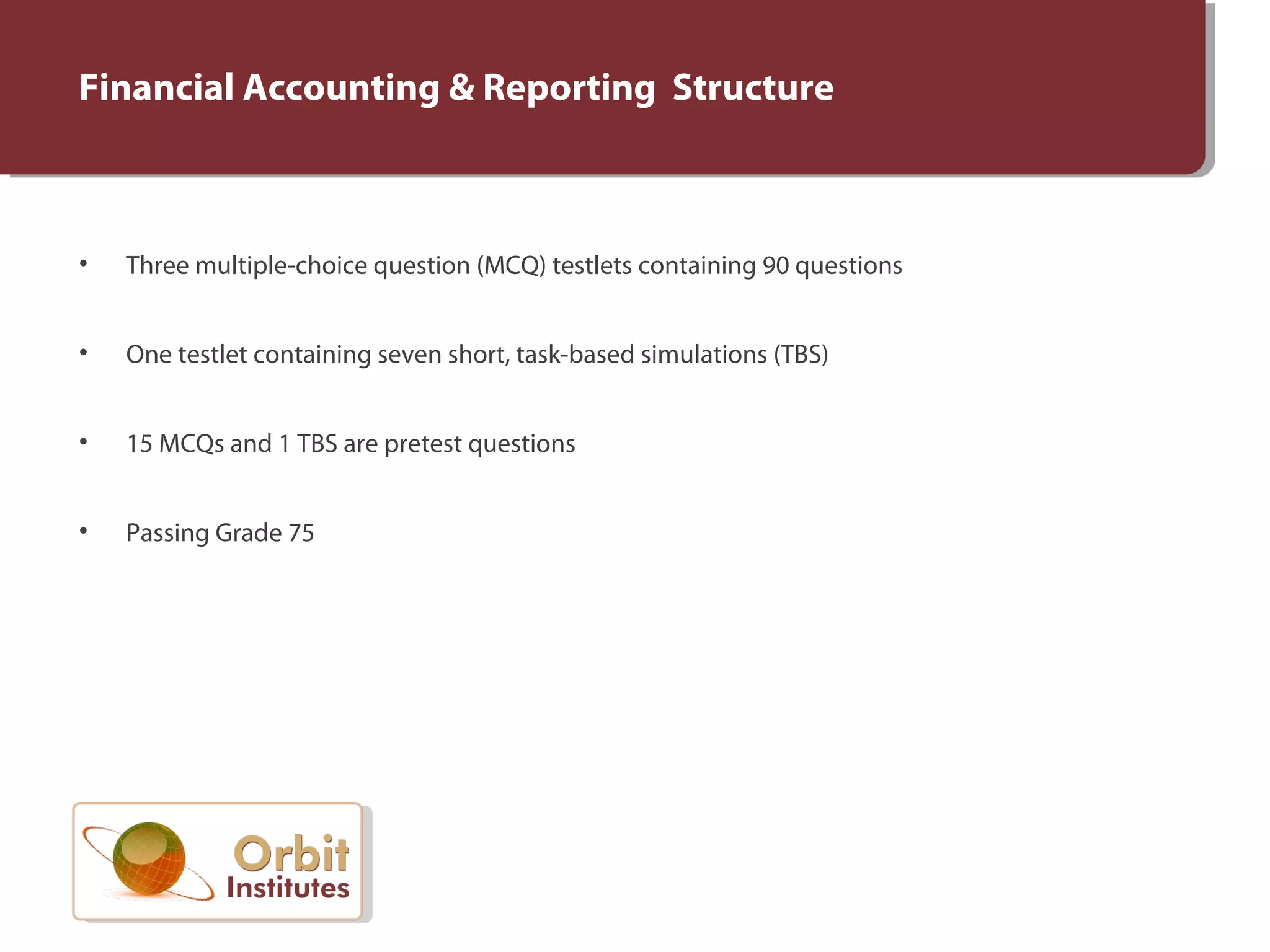

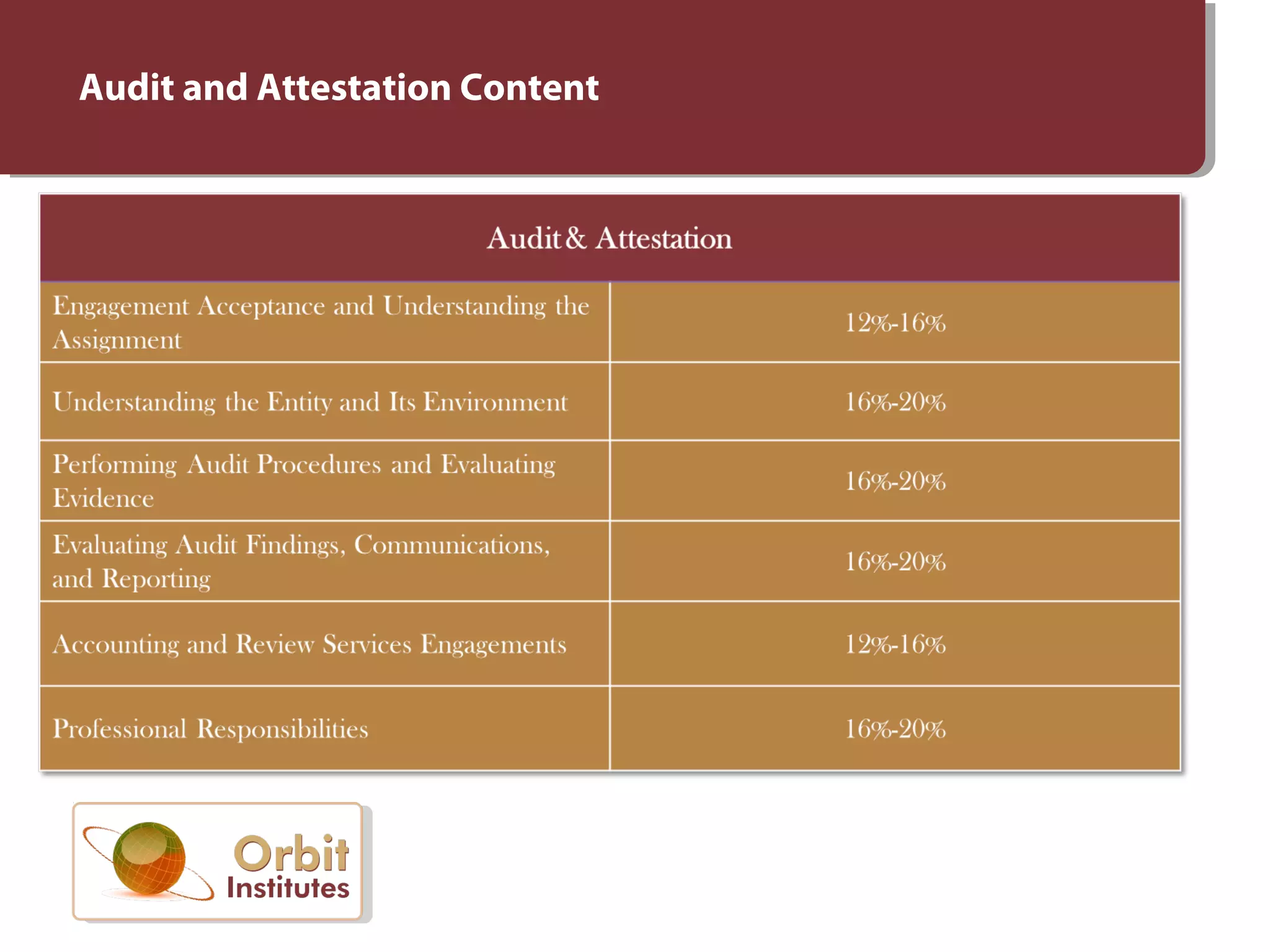

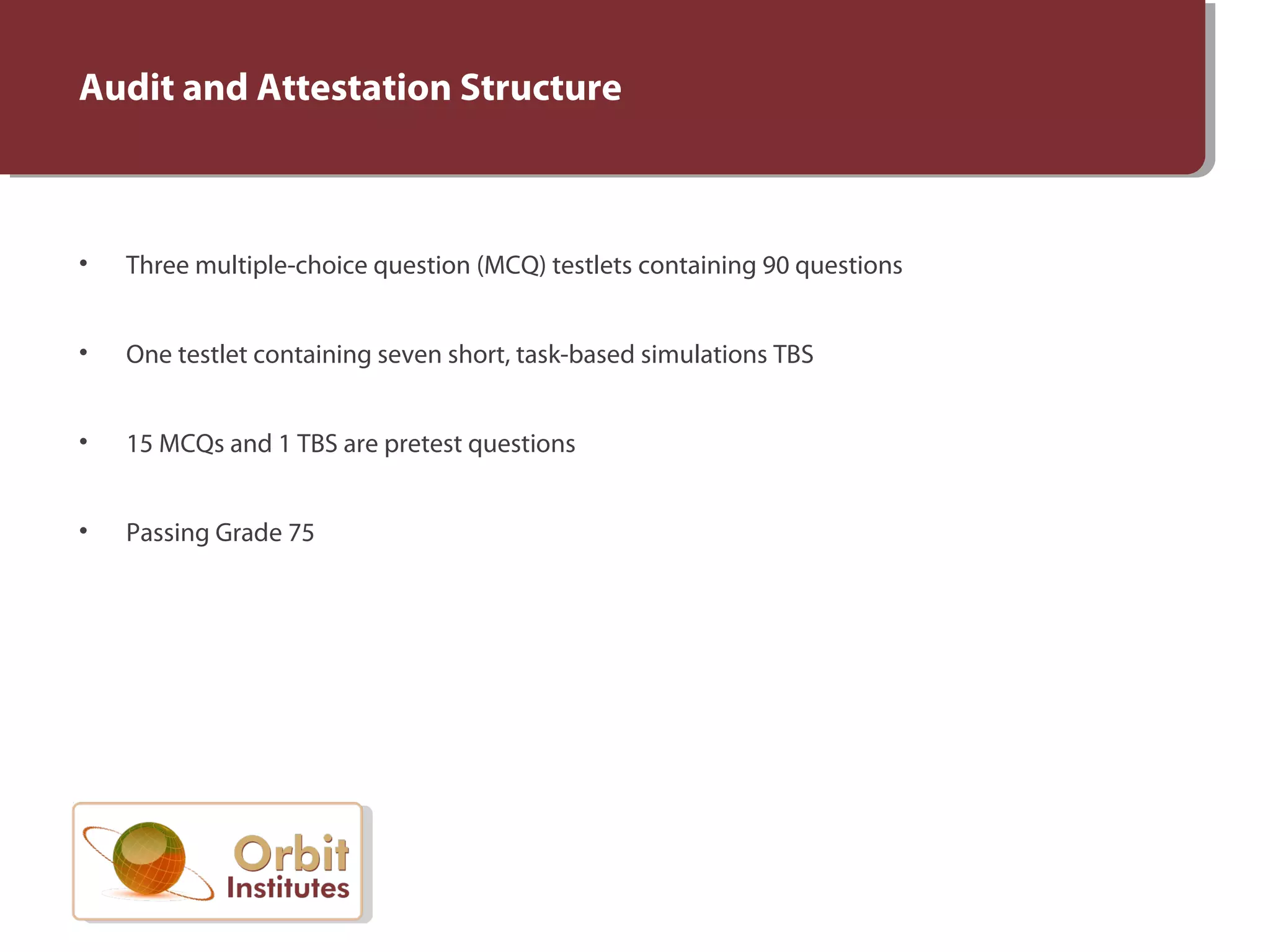

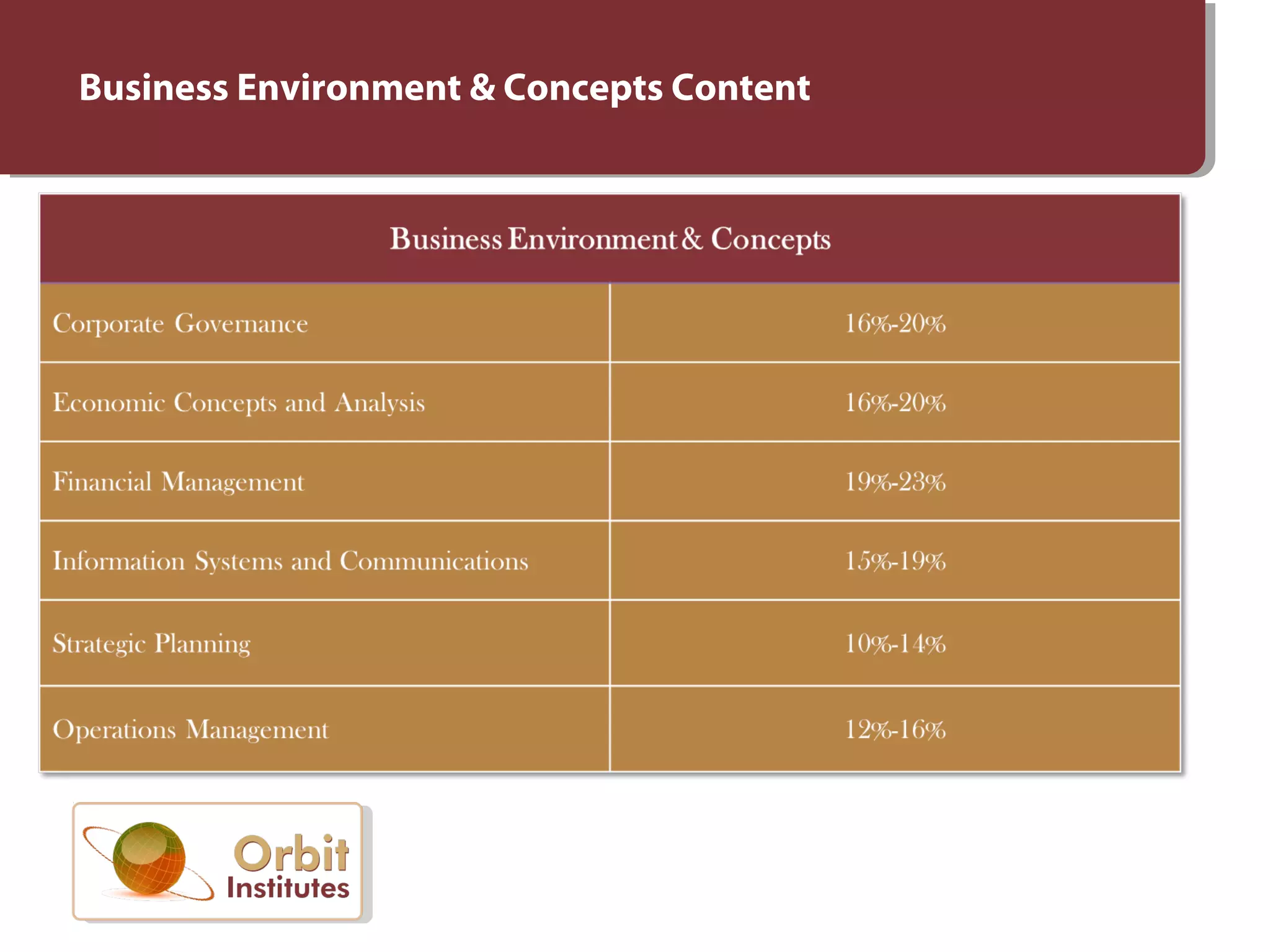

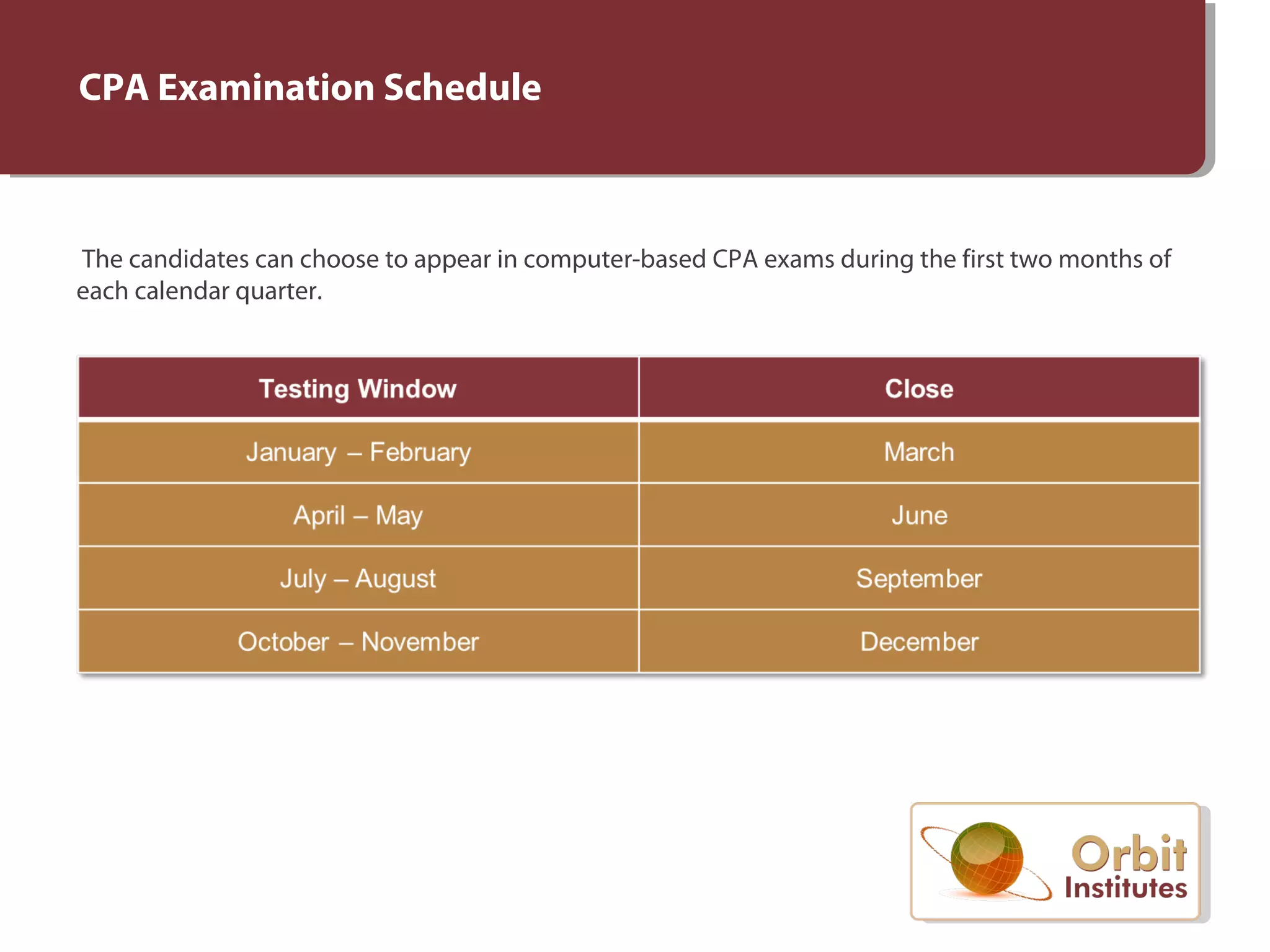

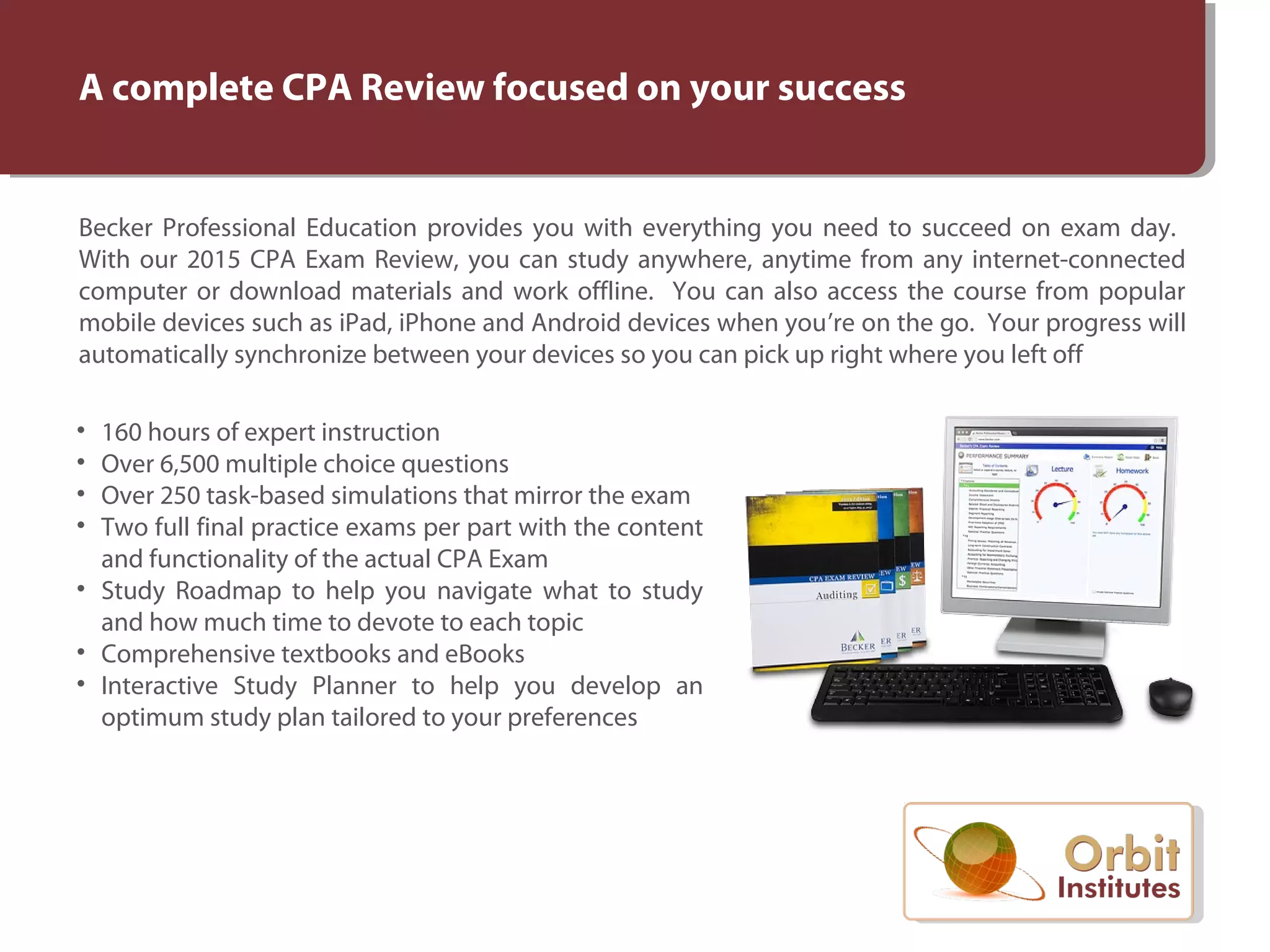

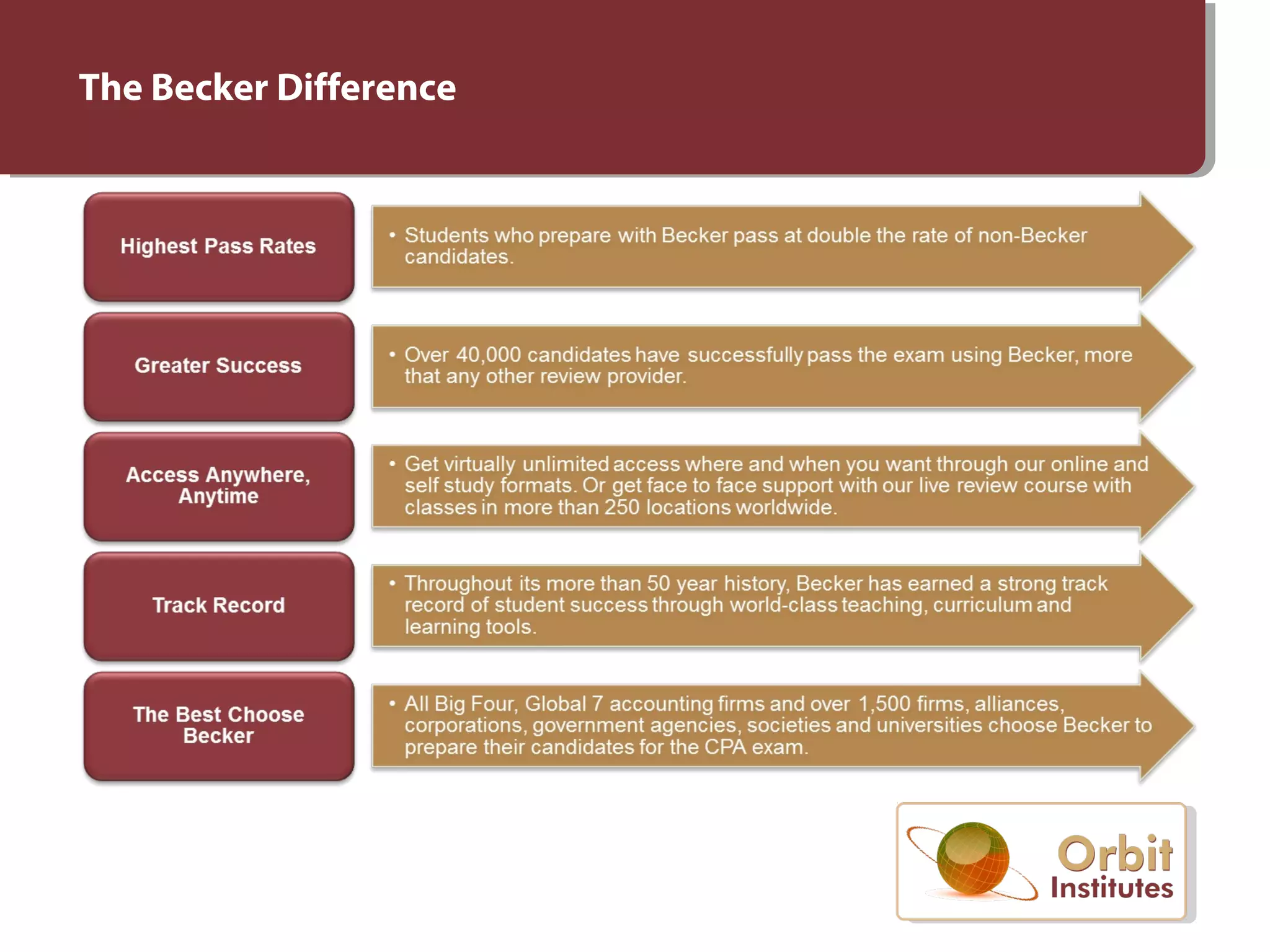

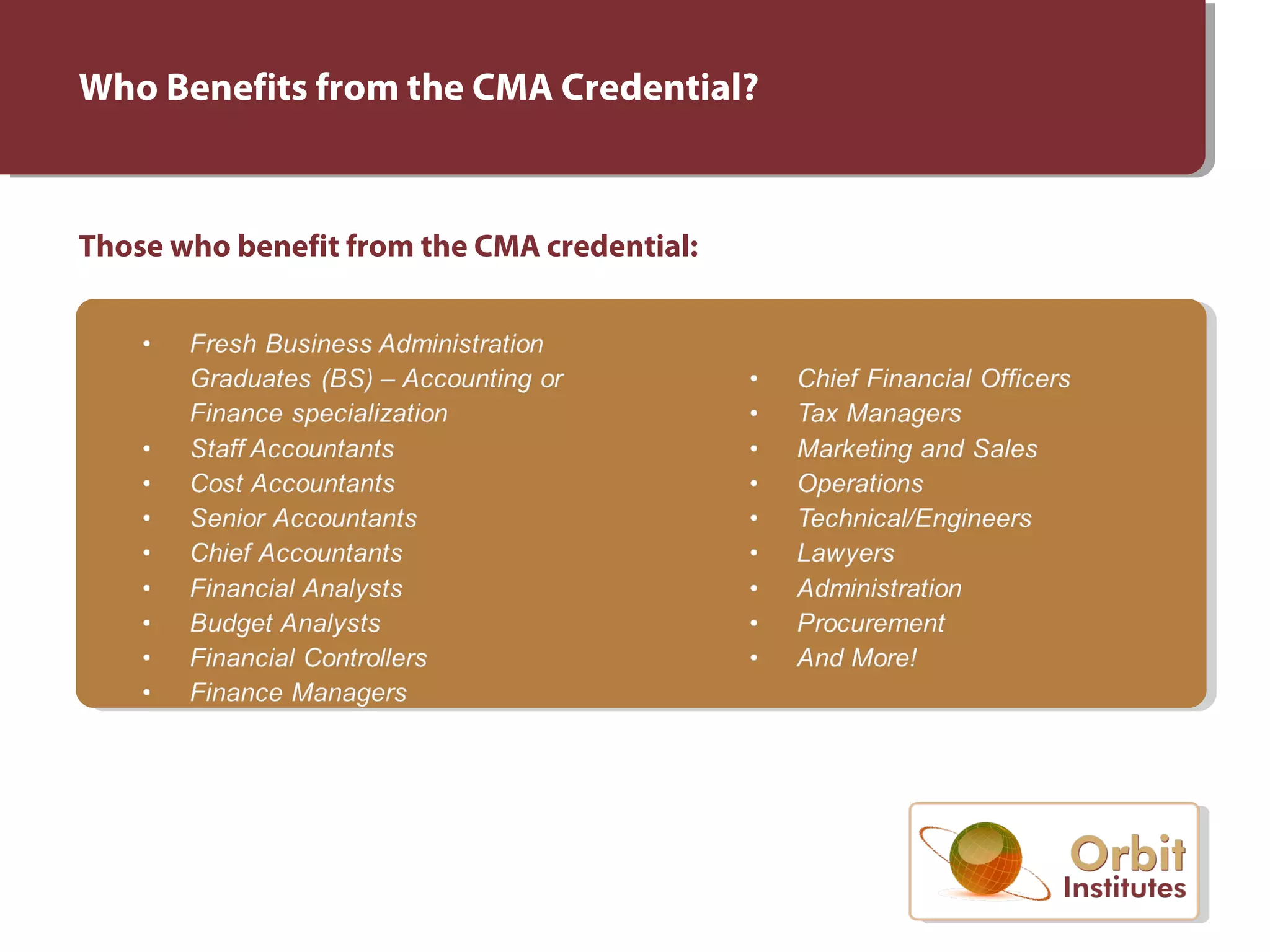

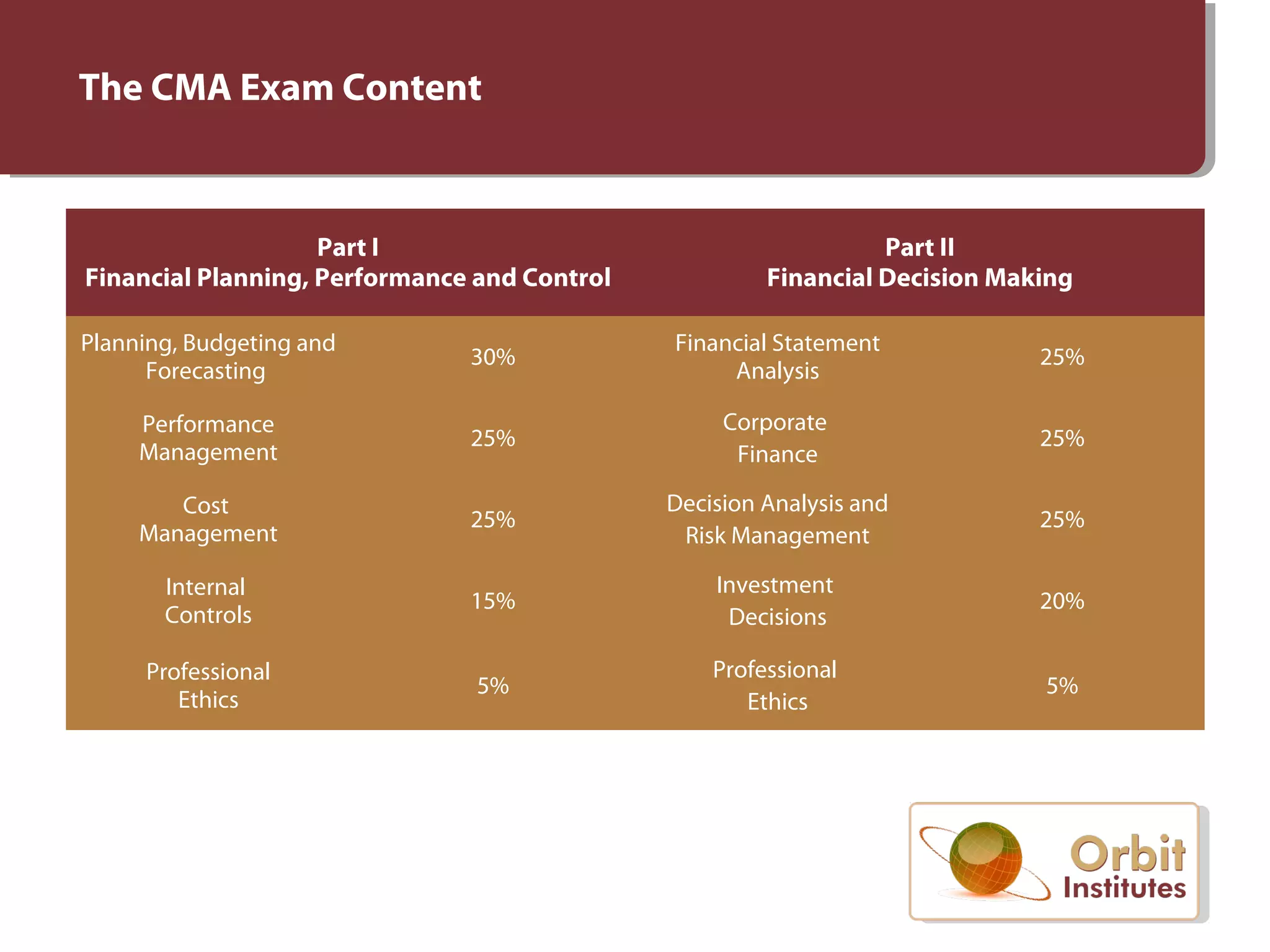

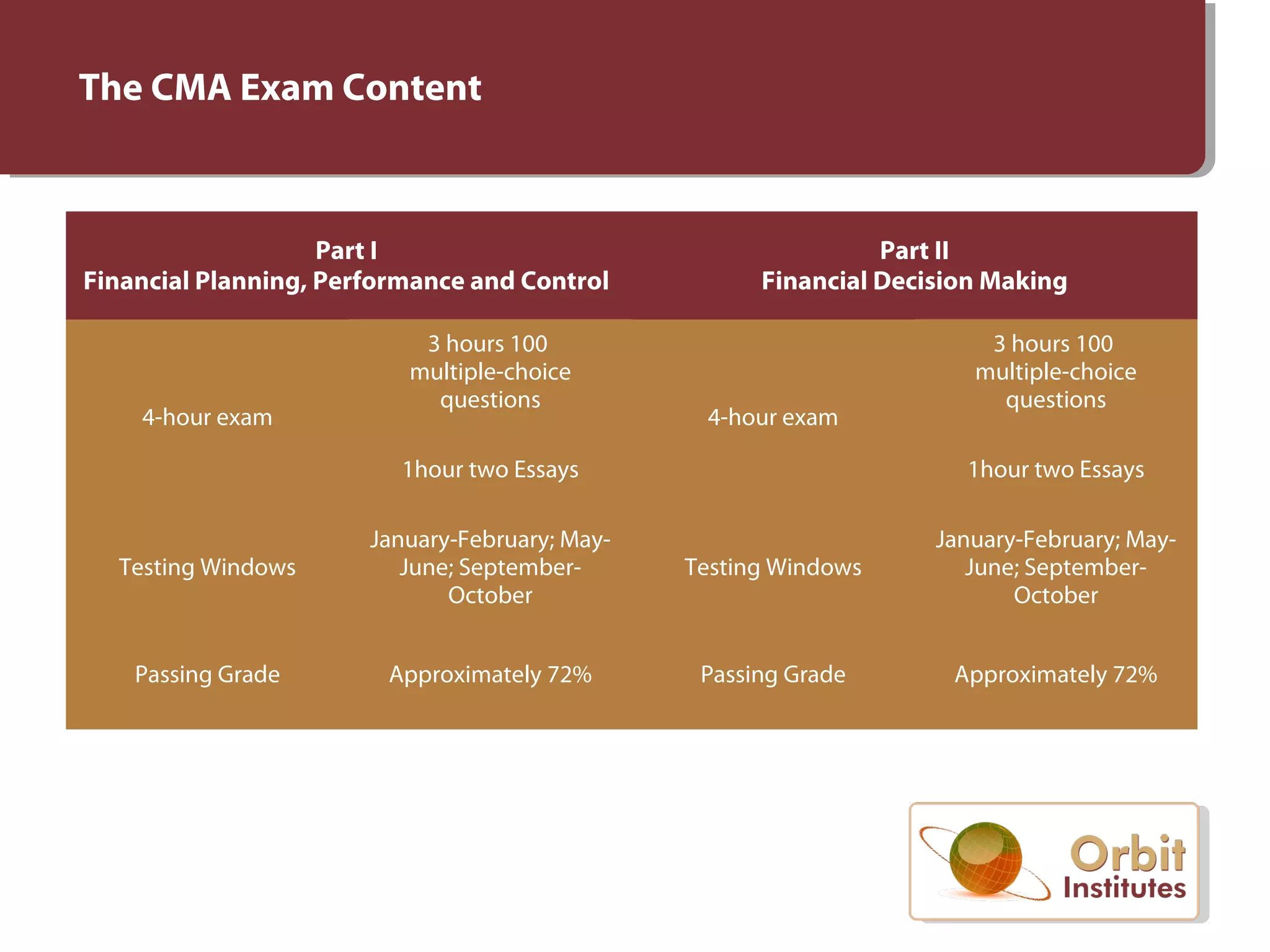

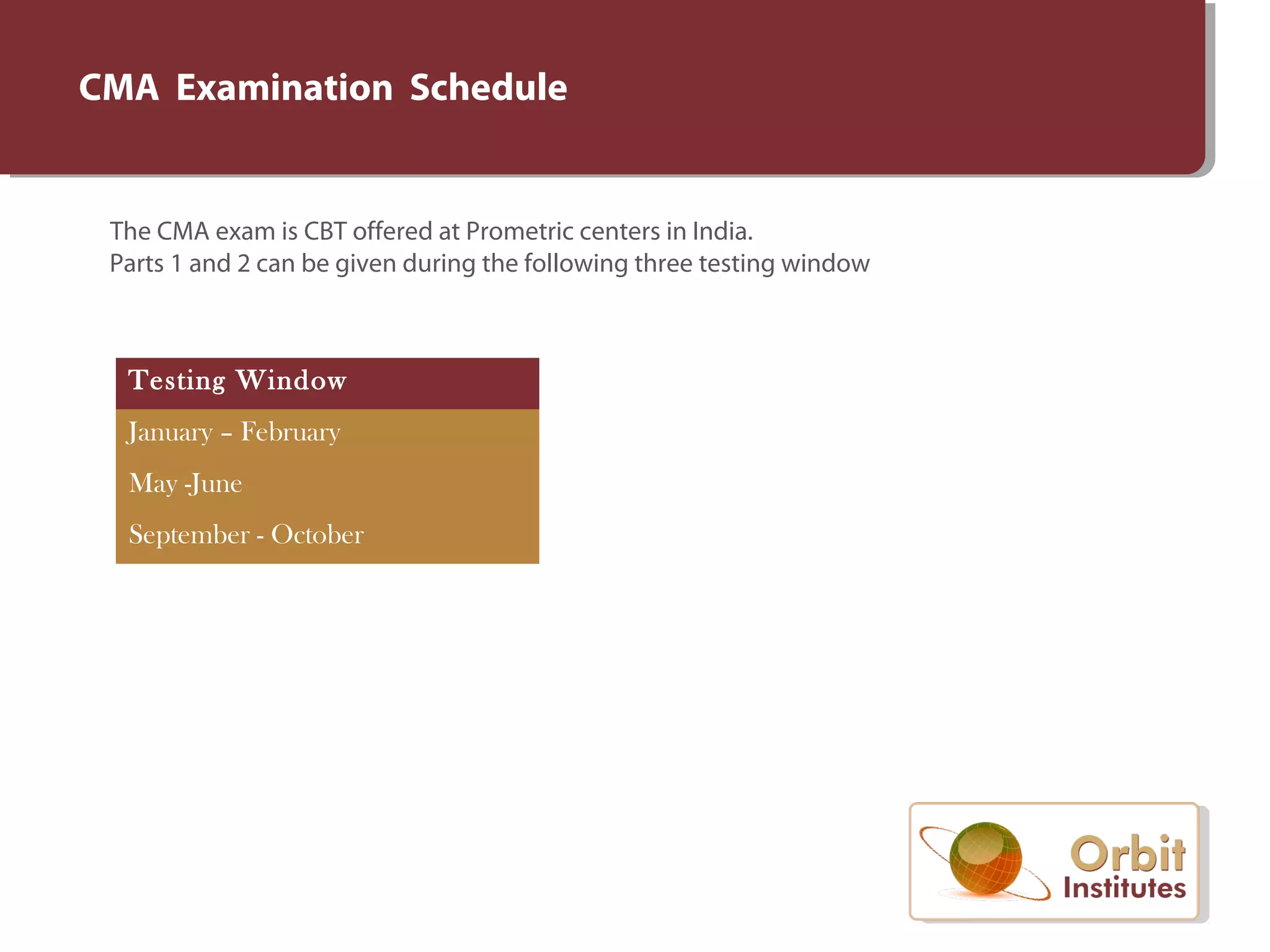

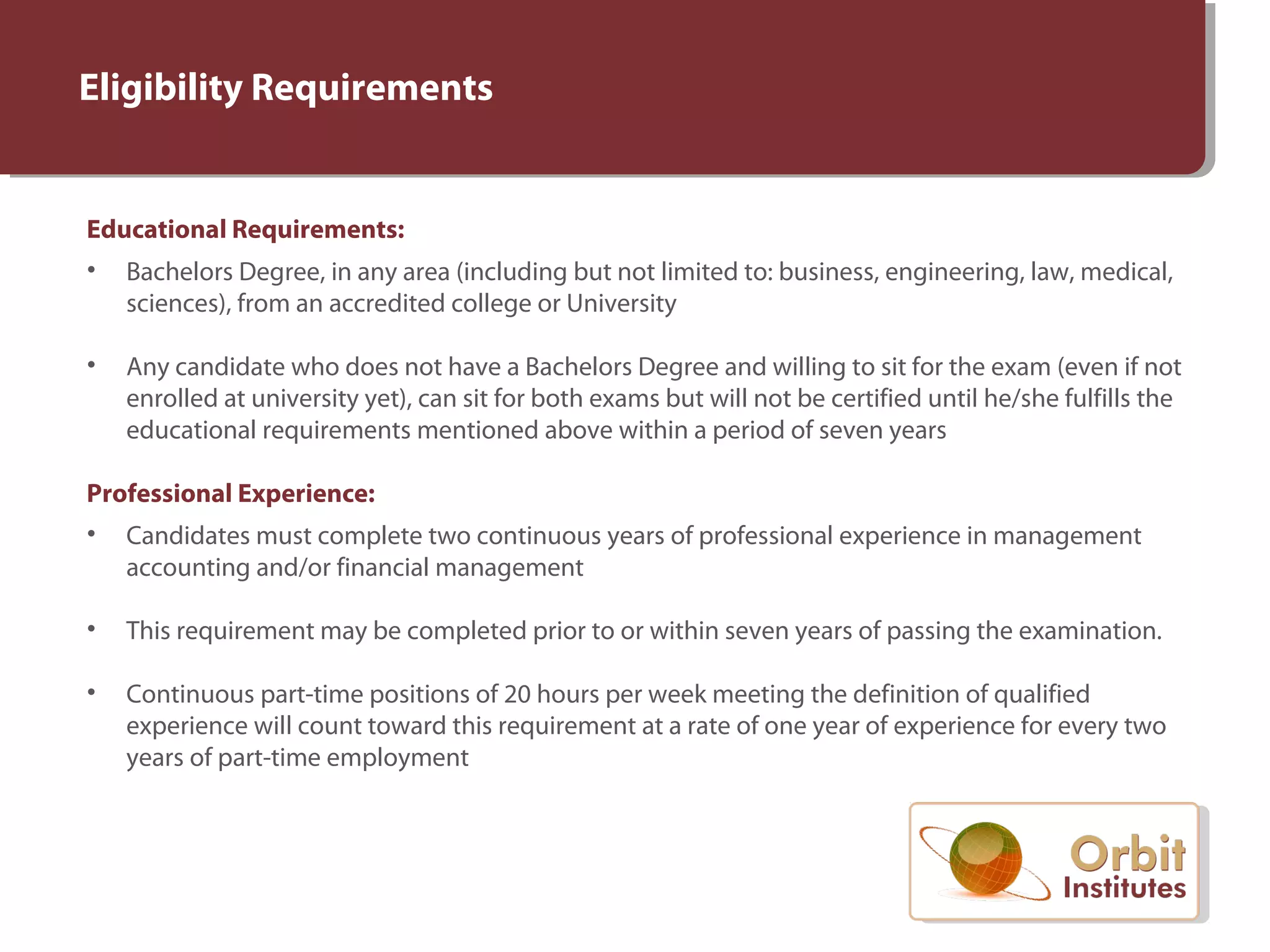

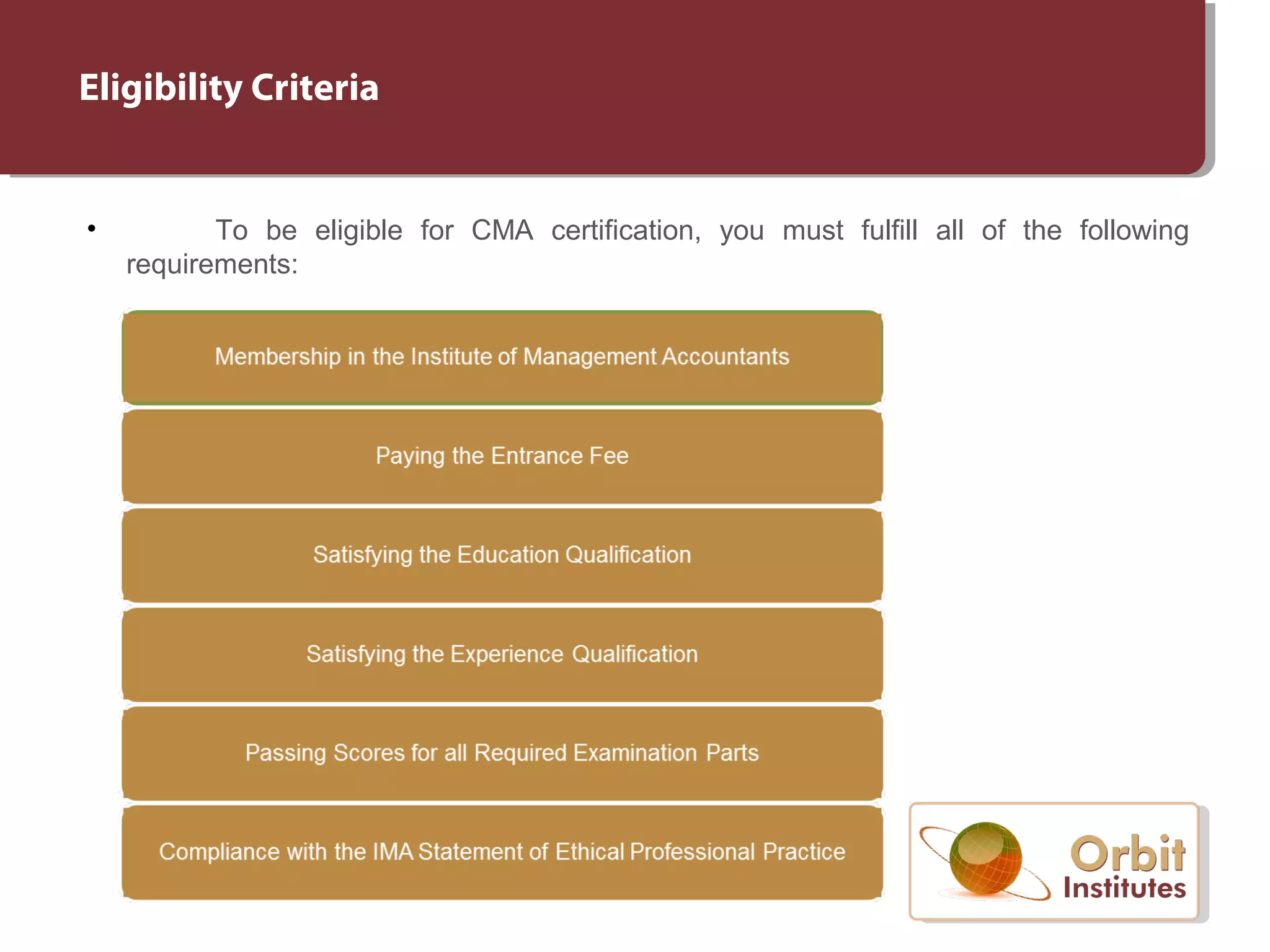

The document discusses the importance and benefits of getting certified in accounting and finance. It notes that there is a skills shortage and that CFOs need employees with competencies beyond what traditional education provides. There is also a growing demand for certification due to increasing complexity, a focus on ethics, and globalization. Certification provides benefits like competitive advantage, commitment to excellence, personal satisfaction, professional recognition, and career positioning. It then discusses popular certification programs like the CPA, CMA, and DipIFR and provides an overview of the eligibility requirements, exam structure, and review courses available to prepare for each.