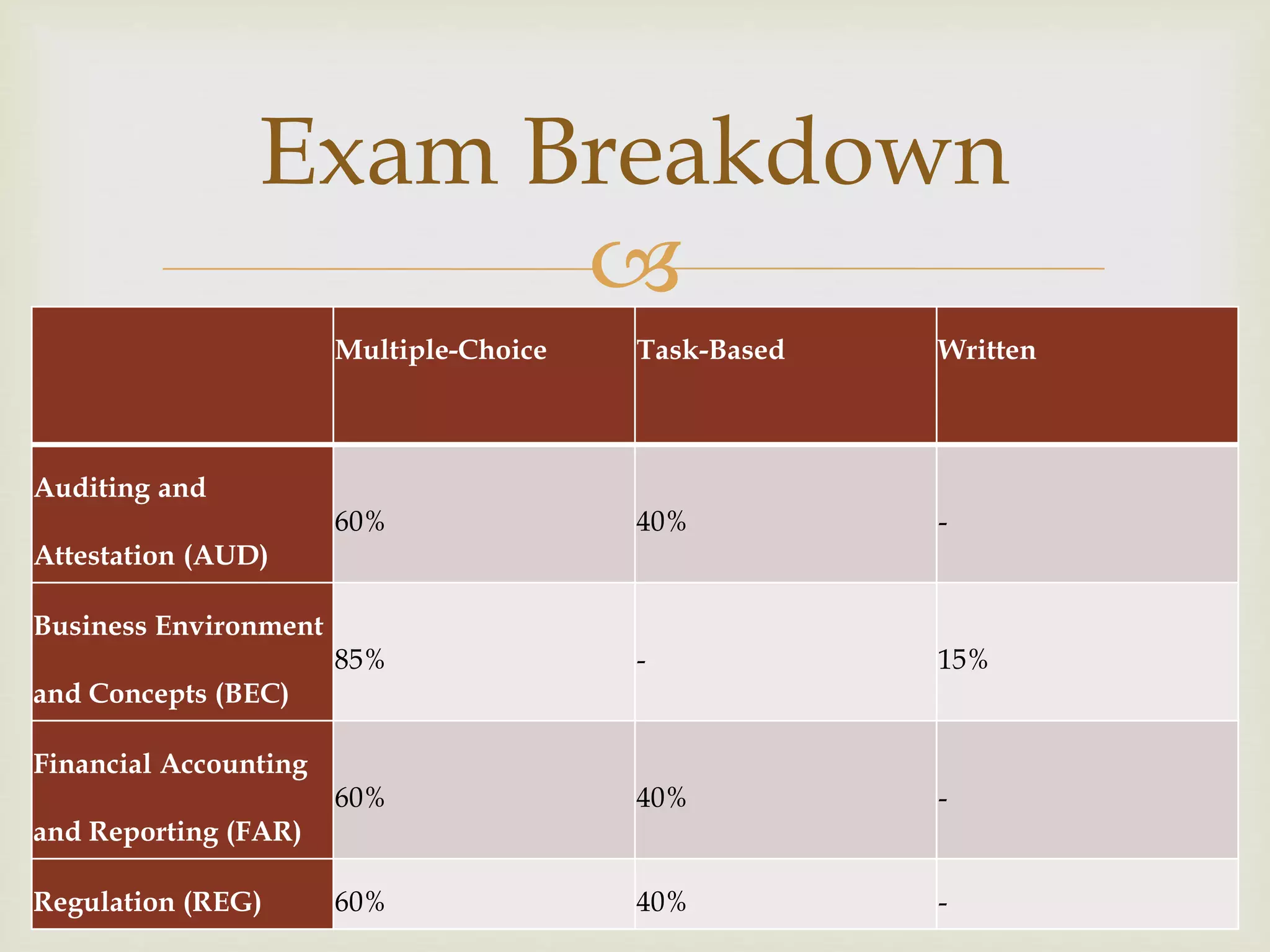

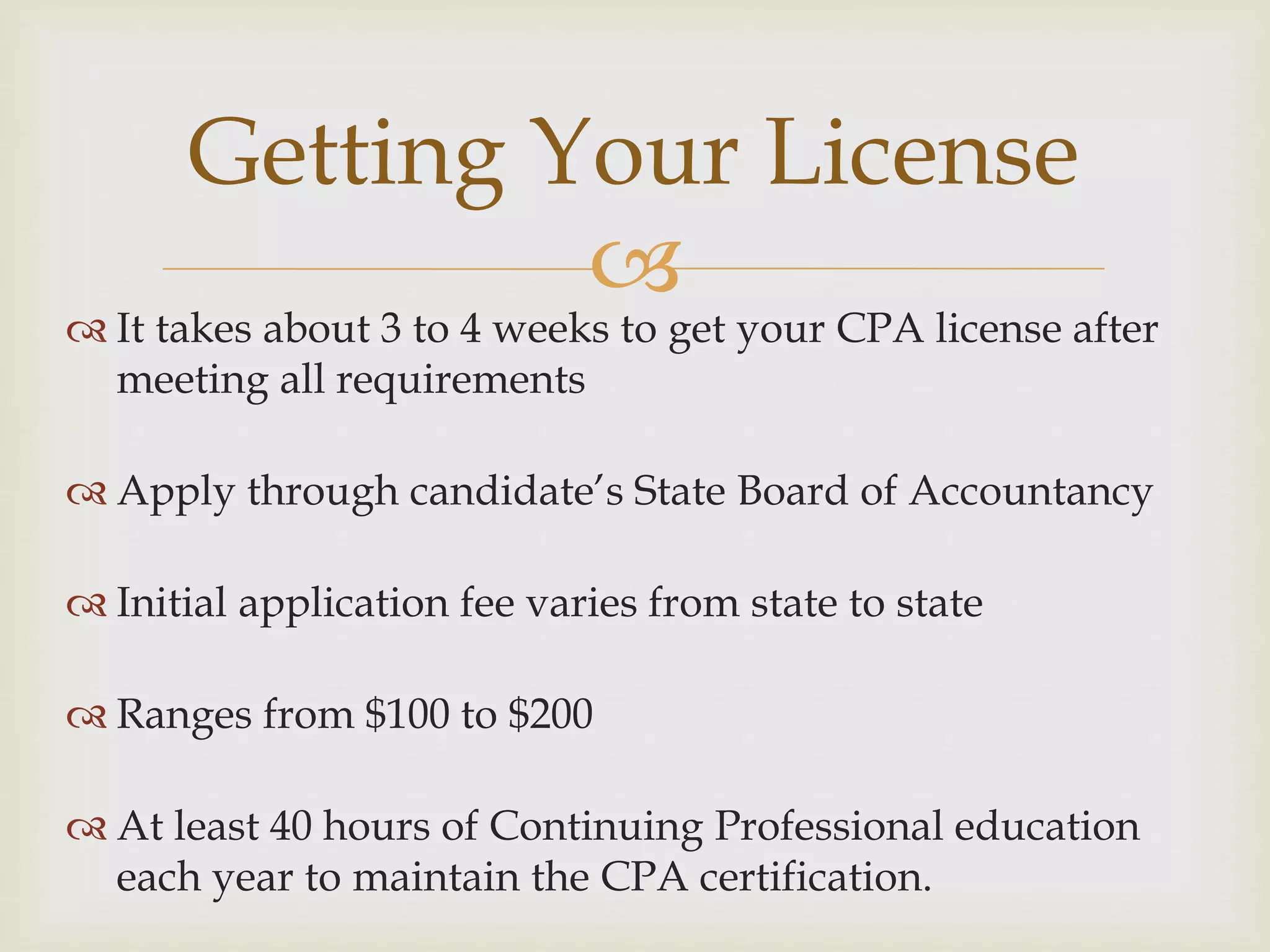

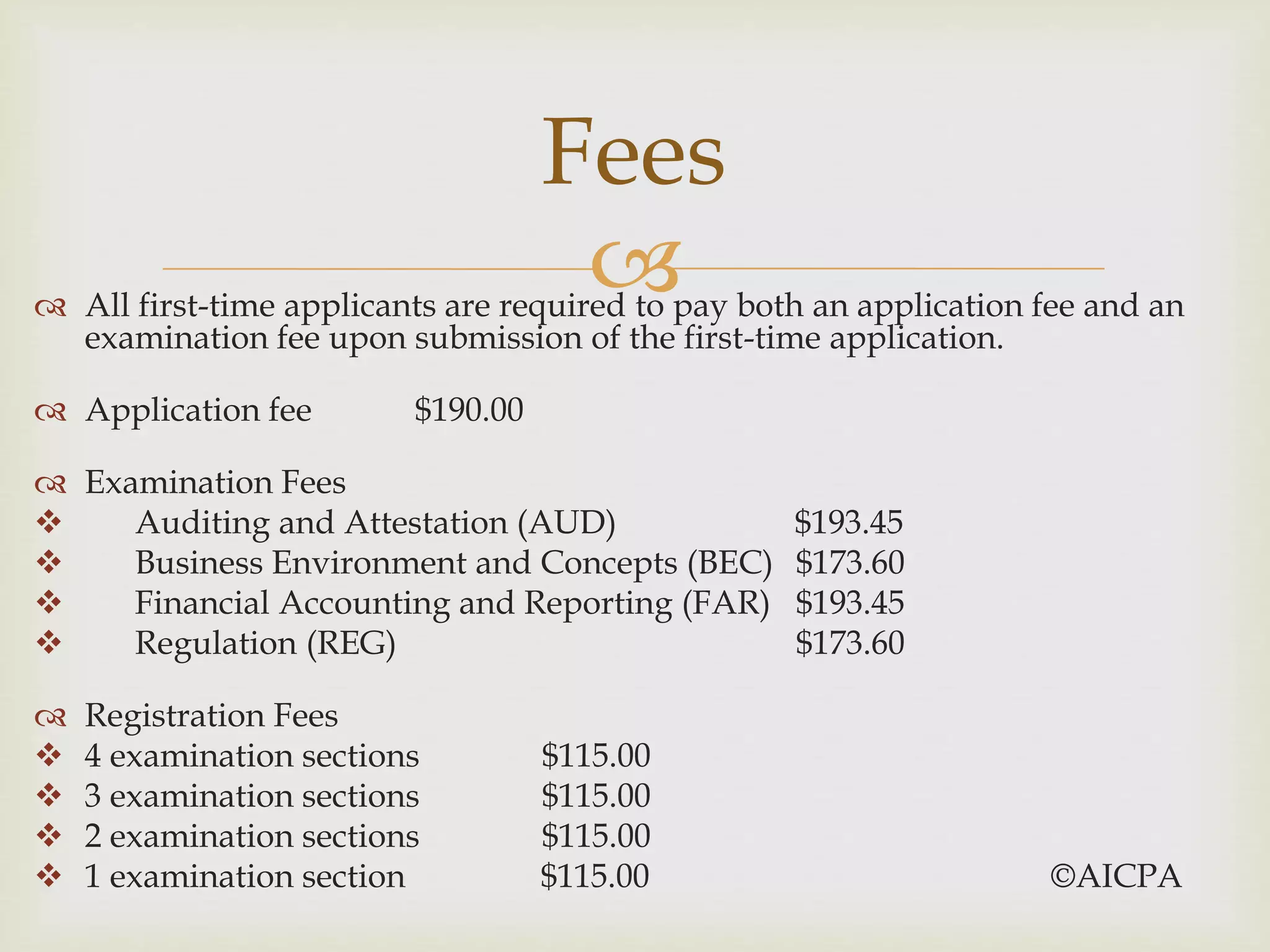

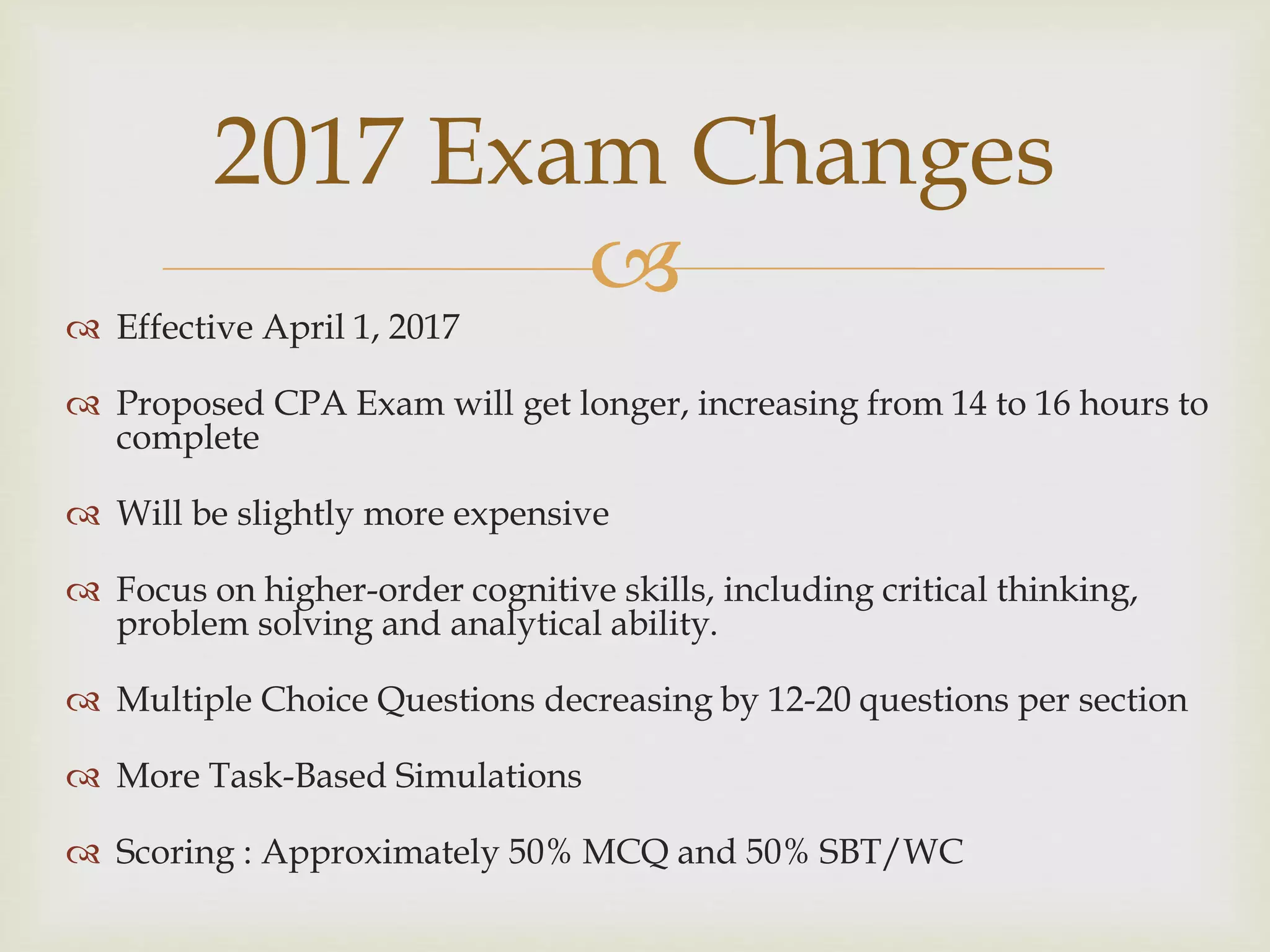

The document discusses the requirements and process for becoming a Certified Public Accountant (CPA) in the United States. It outlines the 3 E's that are required - Education, Exam, and Experience. For education, most states require 150 credit hours of accounting coursework. The CPA exam consists of 4 computer-based sections that must be passed within 18 months. Candidates also need 1-2 years of experience under a CPA before becoming licensed. Maintaining the license requires ongoing continuing education. The process prepares accountants for prestigious and well-compensated work in various fields like auditing, tax preparation, and financial planning.