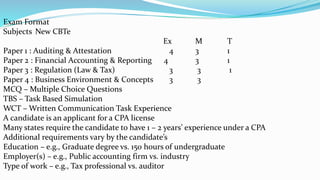

A Certified Public Accountant (CPA) is a qualified accountant who has passed the Uniform Certified Public Accountant Examination and met state-specific education and experience requirements. The CPA designation was established in 1896 in New York, and most states now require candidates to complete 150 semester hours of education, which often involves a combined bachelor's and master's program. There are various requirements for licensure, including education, examination, and relevant experience under a CPA.

![CPA exam

In order to become a CPA in the United States,

the candidate must sit for and pass the Uniform

Certified Public Accountant

Examination (Uniform CPA Exam), which is set

by theAmerican Institute of Certified Public

Accountants (AICPA) and administered by

the National Association of State Boards of

Accountancy (NASBA). The CPA designation

was first established in law in New York State

on April 17, 1896.[2]

Eligibility to sit for the Uniform CPA Exam is

determined by individual state boards of

accountancy. All states have adopted what is

known as the "150 hour rule" (150 college

semester units or the equivalent), which usually

requires an additional year of education past a

regular 4 year college degree, or a master's

degree. (As such, universities offer commonly

offer combined 5-year bachelor's/master's

degree programs, allowing a student to earn

both degrees while receiving the 150 hours

needed for exam eligibility.)](https://image.slidesharecdn.com/ppt-160401043637/85/CPA-Training-3-320.jpg)