This document provides information about becoming a certified public accountant (CPA) including the requirements, career opportunities, and exam process. Some key points:

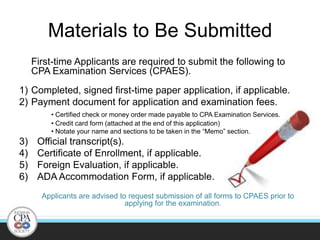

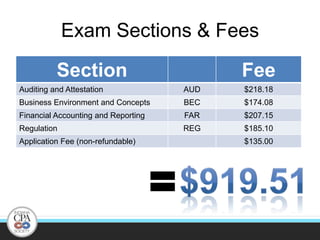

- CPAs must have 150 credit hours of education, including 24 hours of accounting courses and 24 hours of business courses. They must pass the 4 section CPA exam.

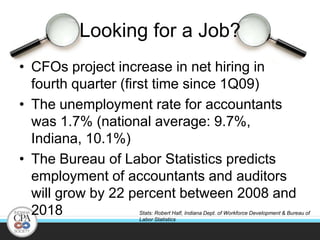

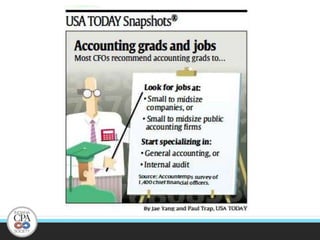

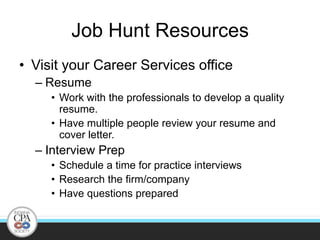

- There is flexibility and diverse career opportunities as a CPA such as working in any field like accounting, finance, consulting, or government. The unemployment rate for accountants is very low.

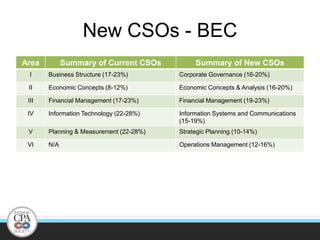

- The CPA exam is changing with new computer-based testing, more task-based simulations, and inclusion of both US GAAP and IFRS questions. Exam sections are also