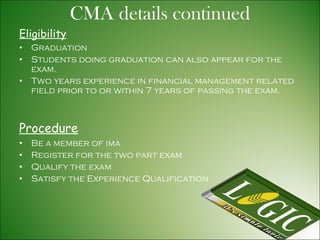

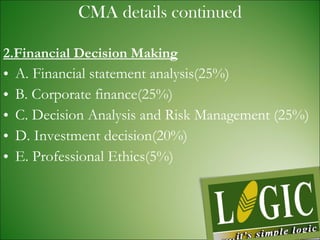

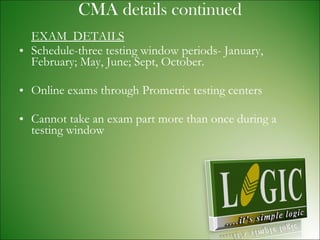

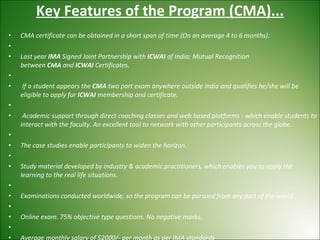

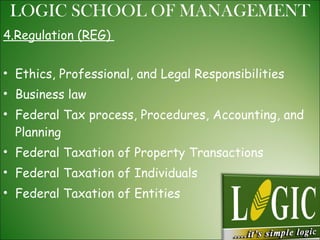

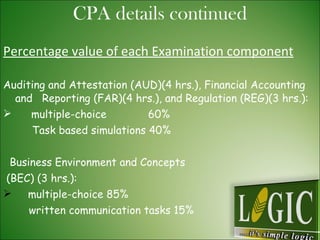

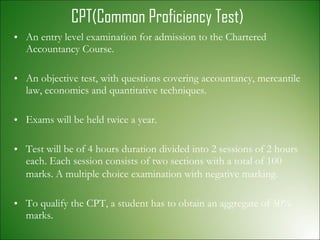

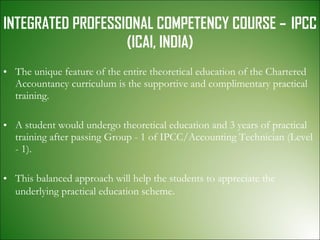

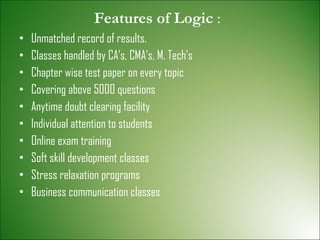

Logic School of Management is a leading institution in Kerala aimed at developing global finance/business professionals, and it has expanded to Bangalore since 2010. The school offers a range of professional courses, including CMA, CPA, and integrated professional competency courses, supported by experienced faculty and comprehensive study resources. With a focus on practical training and strong academic support, participants can prepare for certification exams that significantly enhance their career prospects in the finance sector.