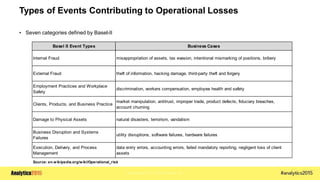

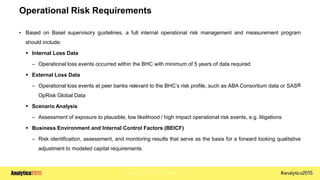

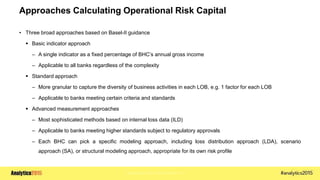

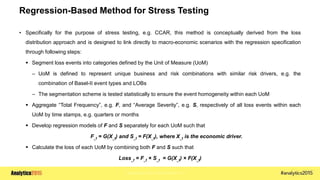

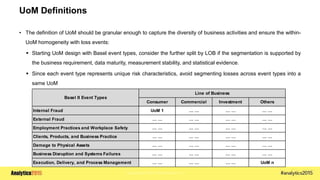

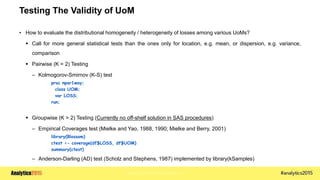

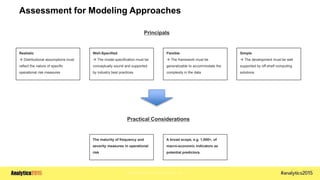

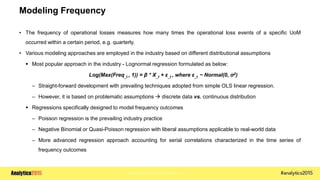

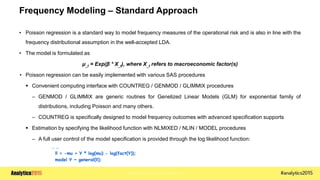

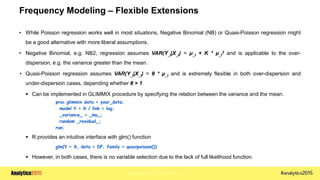

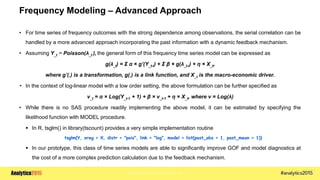

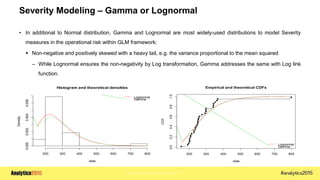

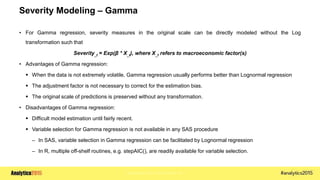

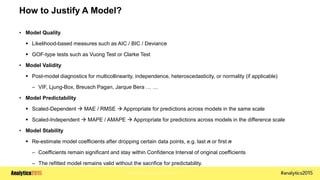

This document discusses modeling approaches for operational loss forecasts in stress testing. It describes the seven categories of operational loss events defined by Basel-II, and requirements for operational risk management programs including internal loss data, external loss data, scenario analysis, and business environment factors. It then covers three approaches to calculating operational risk capital and describes a regression-based method used for stress testing that links losses to macroeconomic scenarios. The document discusses defining units of measure, testing unit homogeneity, modeling frequency and severity, and considers Poisson, negative binomial, and time series regressions.