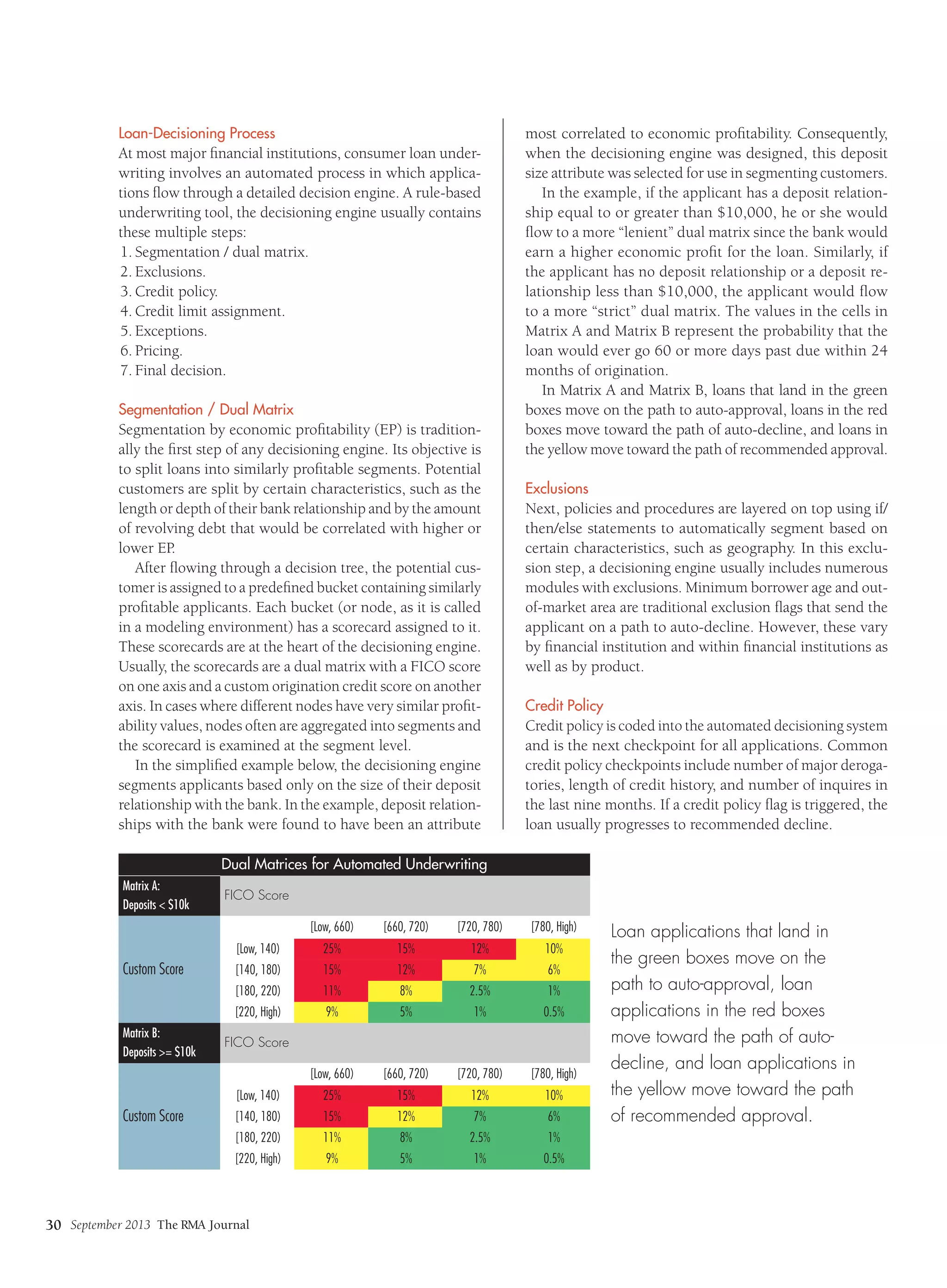

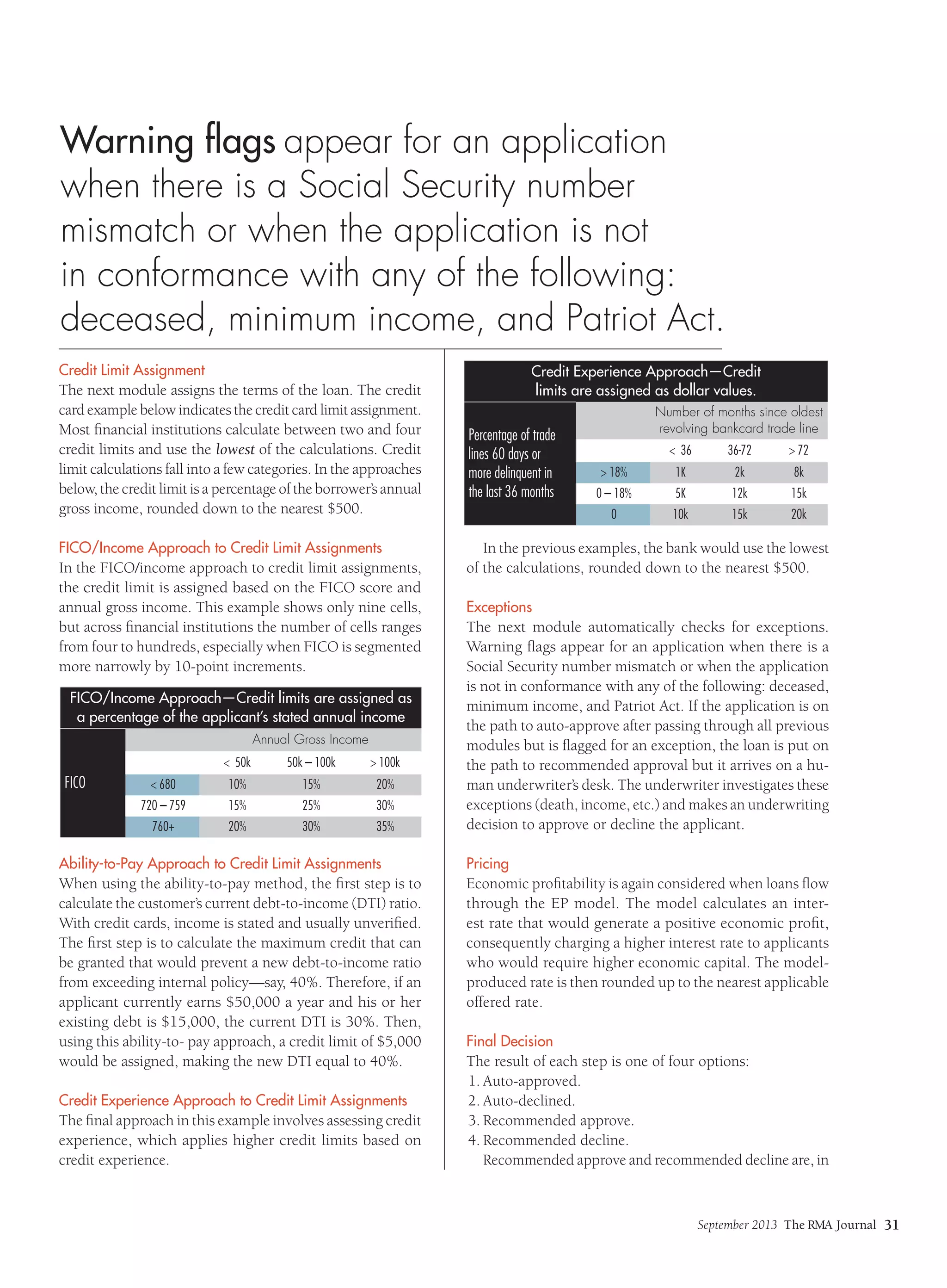

The document discusses the role of credit review in enhancing the underwriting process through data analytics and automated decision-making in consumer lending. It outlines how automated underwriting processes are structured and the various modules involved in decision-making, including segmentation, credit policies, and exception handling. Additionally, it contrasts credit review's responsibilities with model risk management, emphasizing the need for comprehensive examinations of underwriting practices and policies.