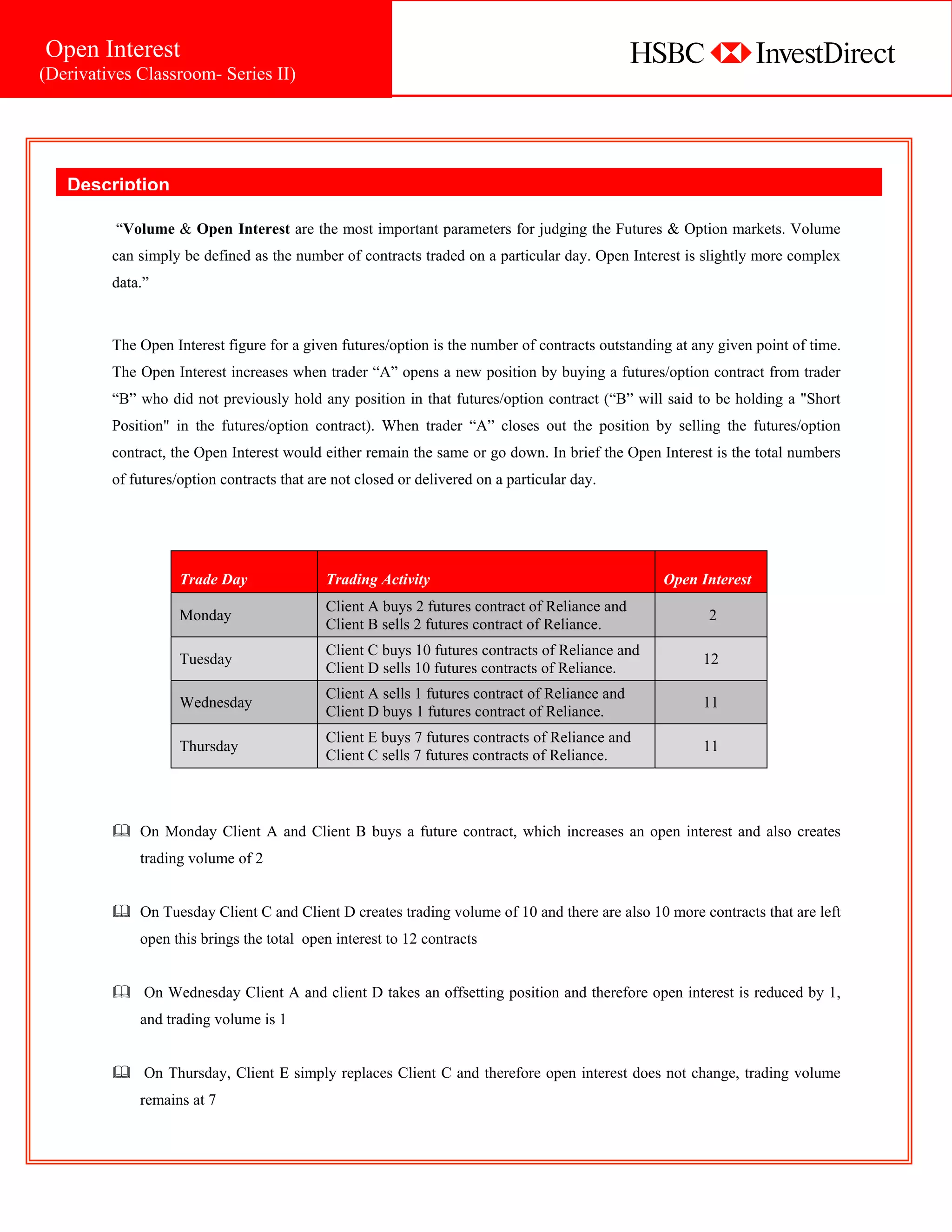

The document discusses open interest in derivatives markets. It defines open interest as the total number of futures or options contracts that have not been closed or delivered on a given day. The document explains that open interest increases when a new long position is opened and decreases when a position is closed. It provides examples of how open interest changes with different trading activities. The document also discusses inferences that can be drawn from changing open interest levels and trends in the underlying price.