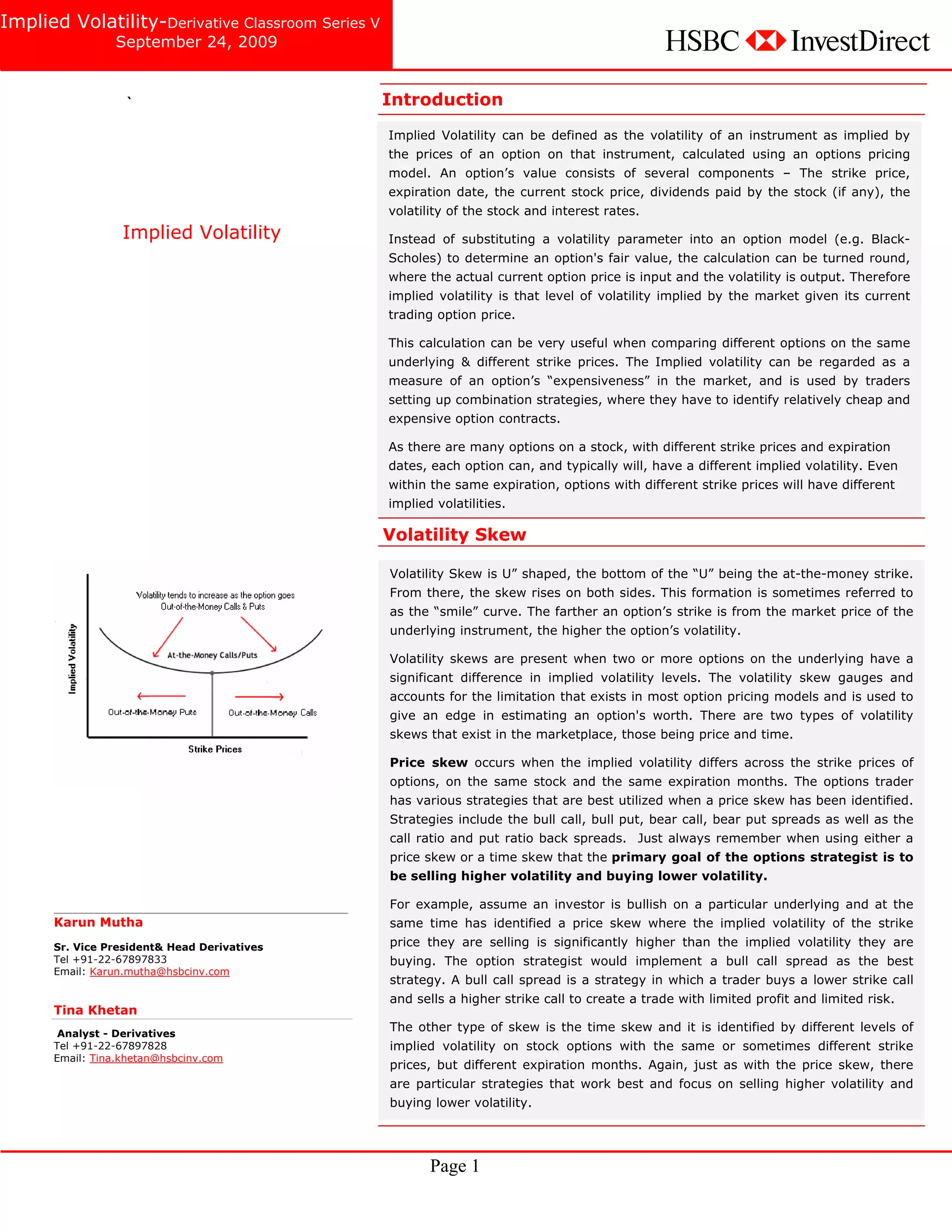

Implied volatility is a measure of the volatility of an instrument as implied by option prices on that instrument using an options pricing model. Implied volatility differs from historical volatility and can provide useful information to traders. Changes in implied volatility impact option prices, and the relationship between implied and historical volatility over time can indicate whether the market expects higher or lower future volatility. Volatility skews exist when options with different strike prices have different implied volatilities, and various options strategies aim to take advantage of these differences.