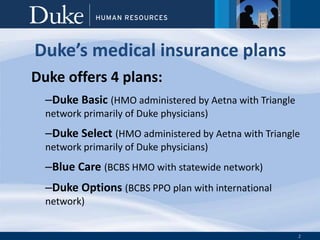

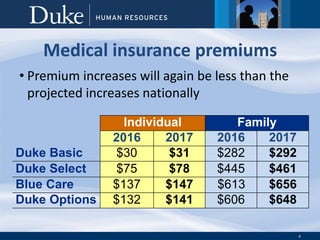

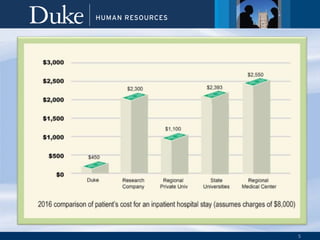

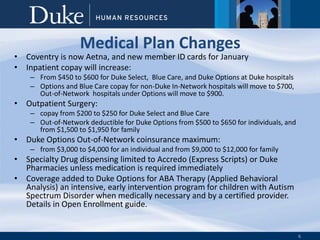

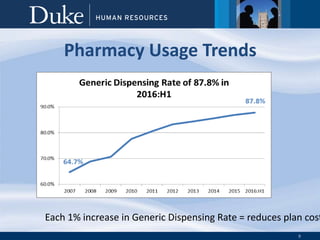

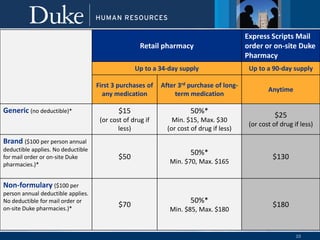

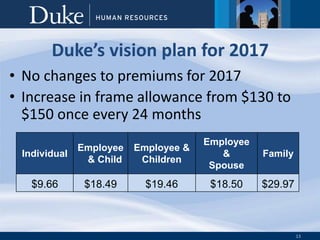

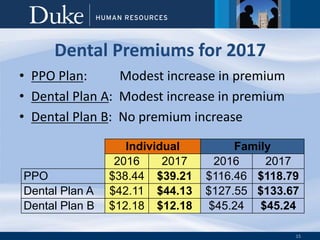

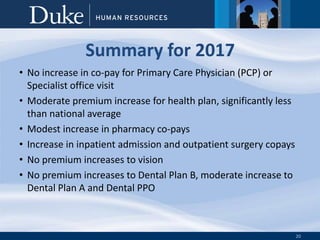

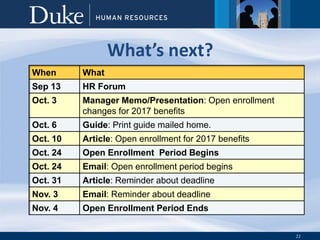

Duke University & Health System's open enrollment for 2017 benefits runs from October 24 to November 4, 2016, offering several medical insurance plans with various coverage options and premium increases that are lower than national averages. Key changes include increased copays for hospitalization and outpatient surgery, updated pharmacy co-pays, and a new coverage for ABA therapy for children with autism. Additional details include tobacco surcharges and the elimination of the dollar maximum for transgender surgery under the Duke Options plan.