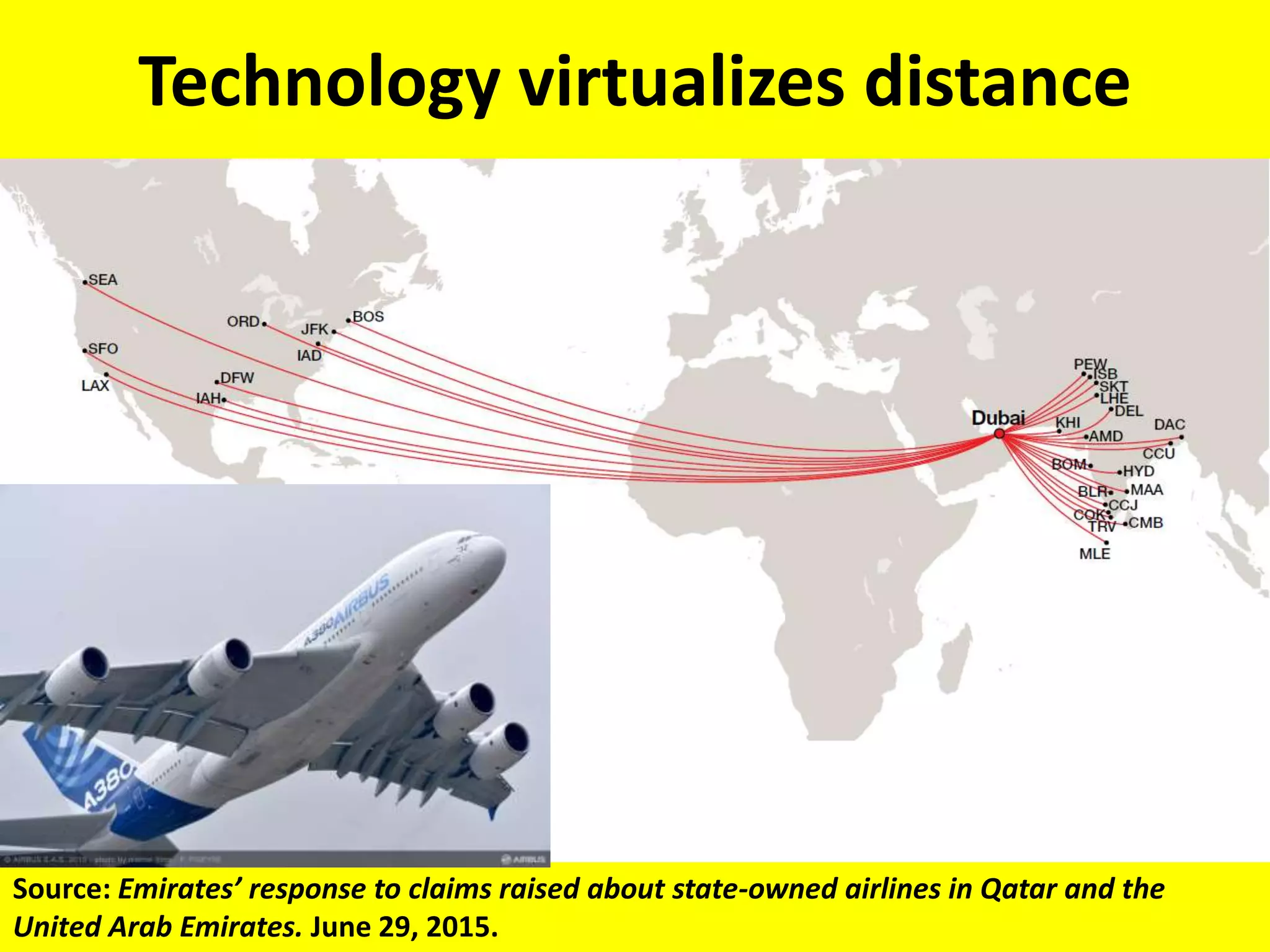

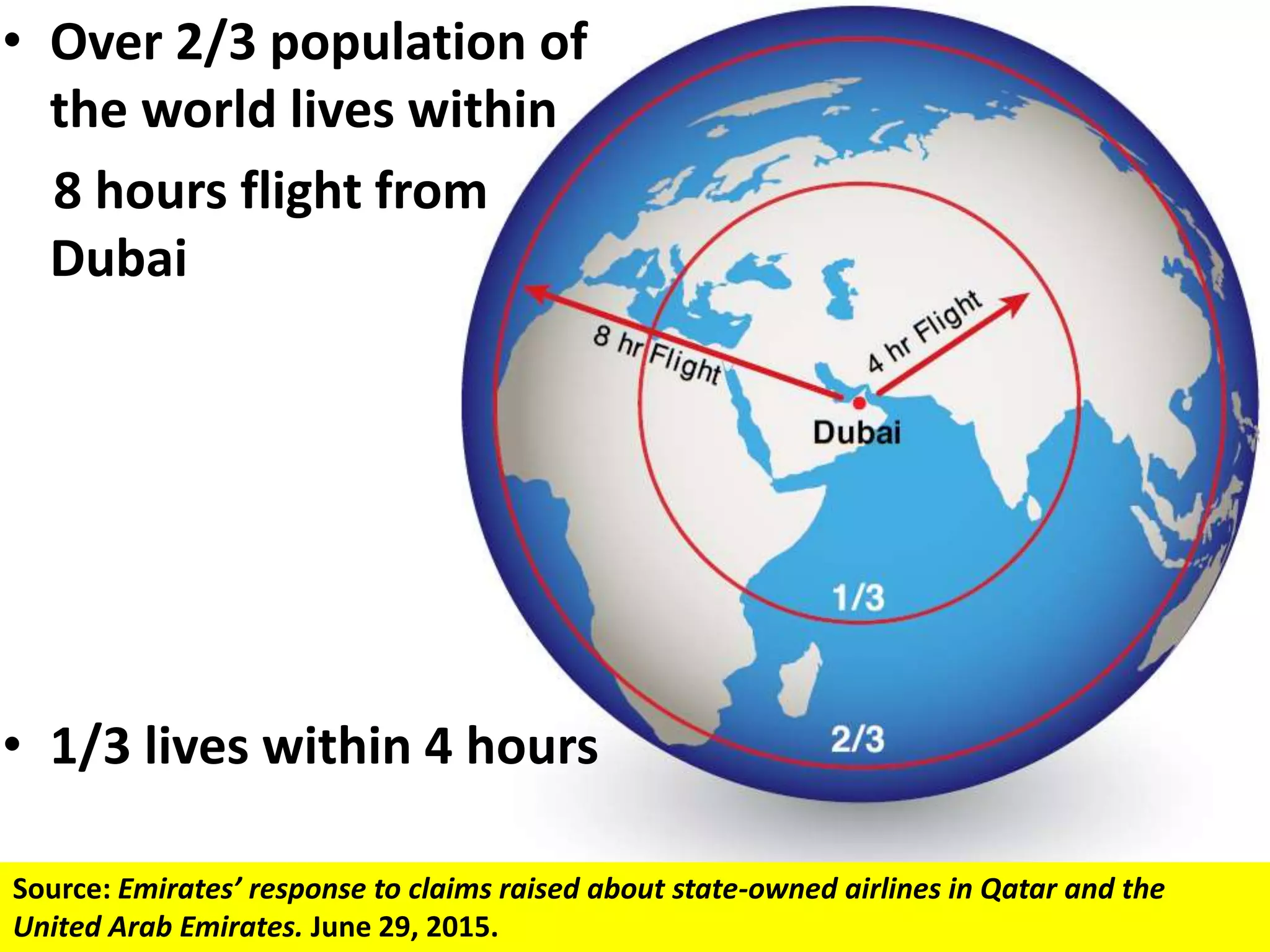

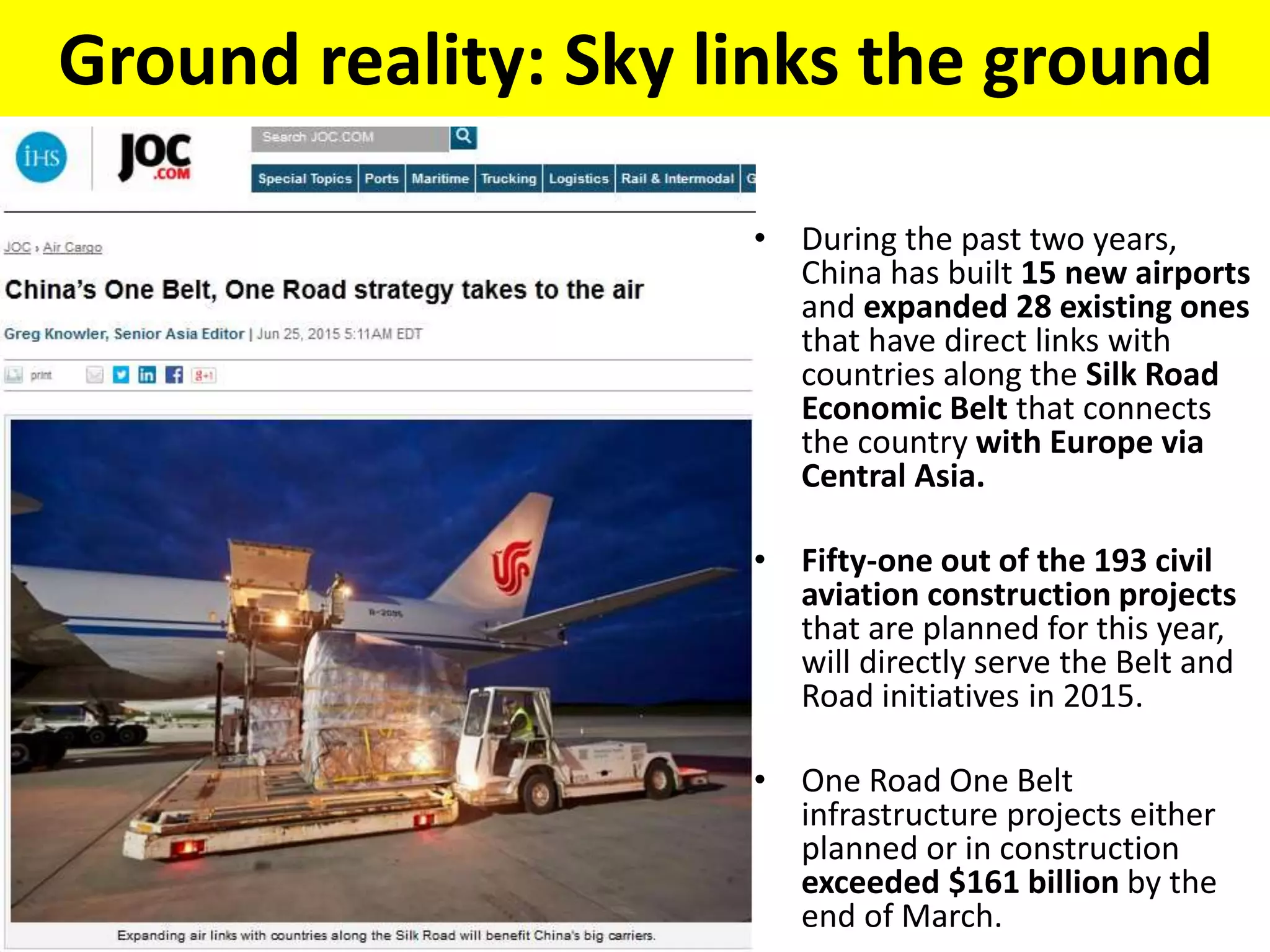

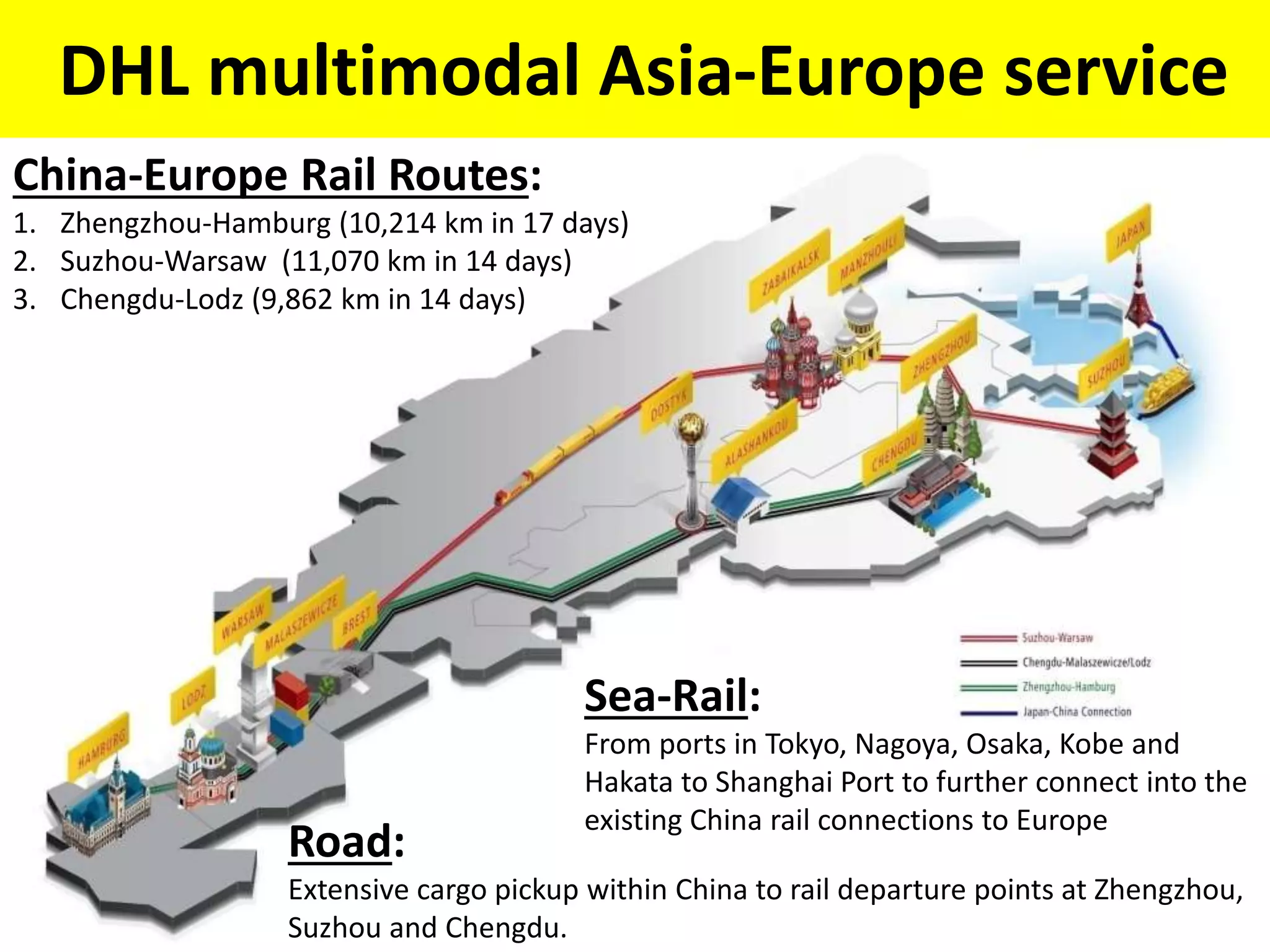

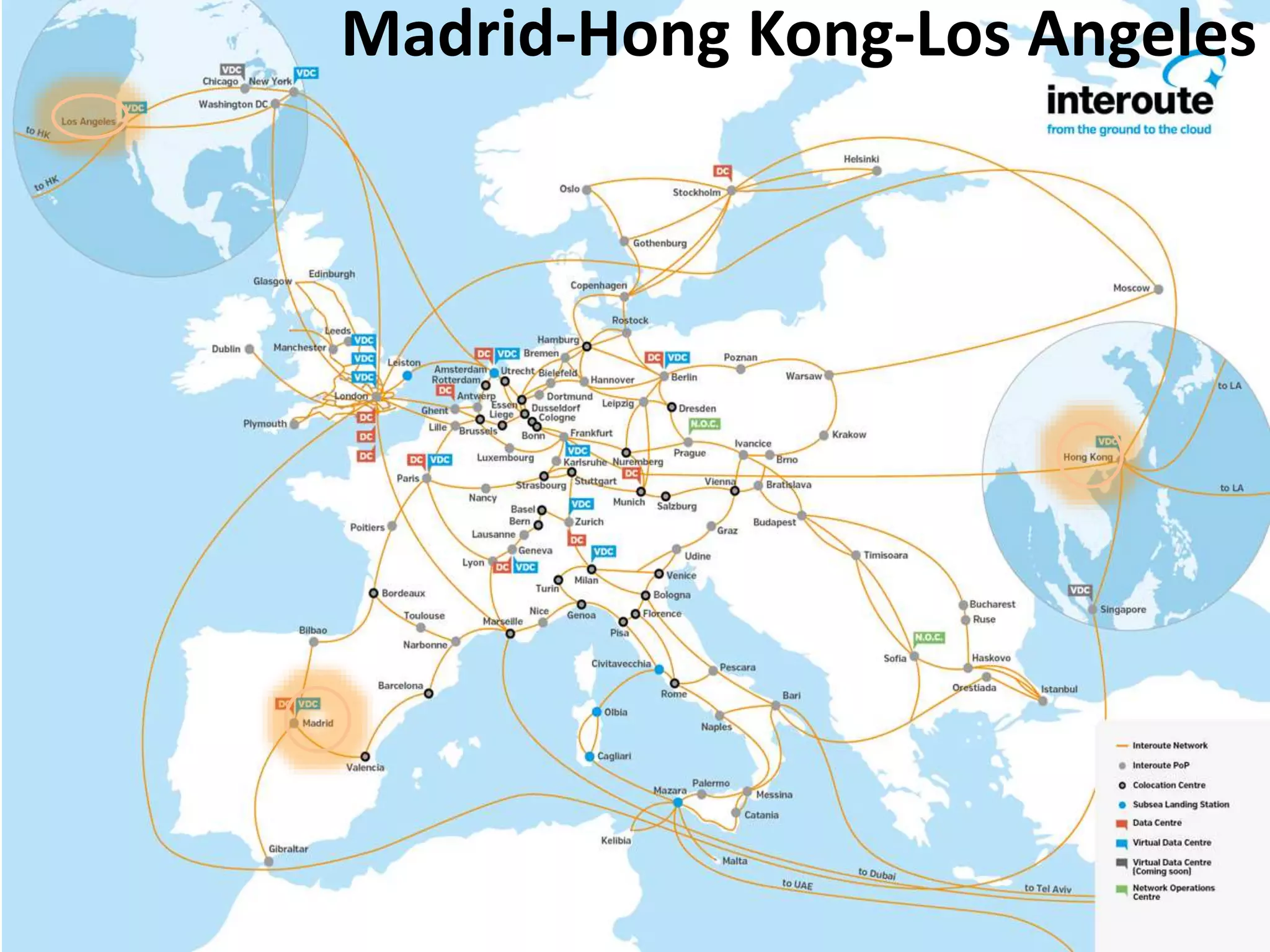

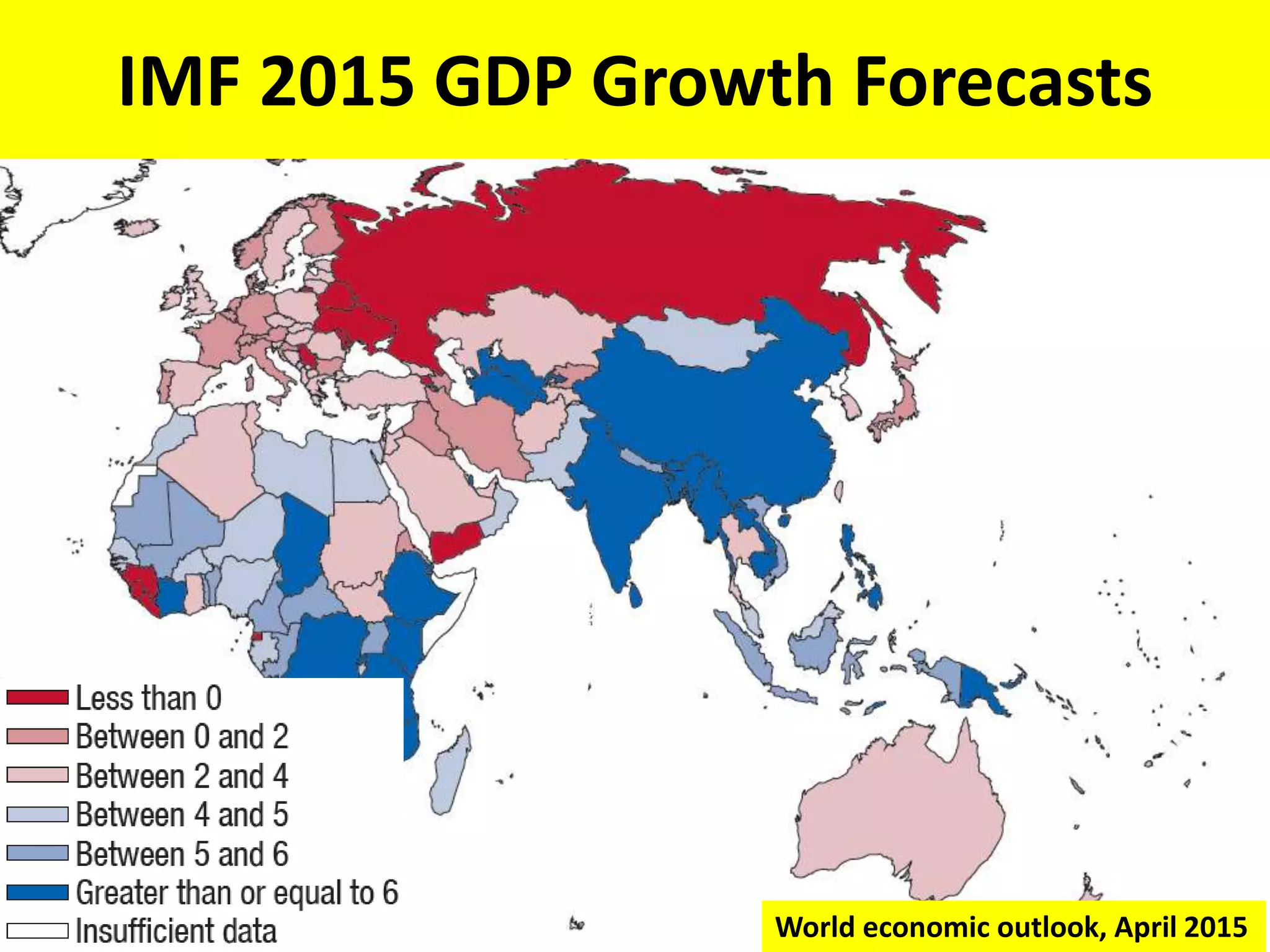

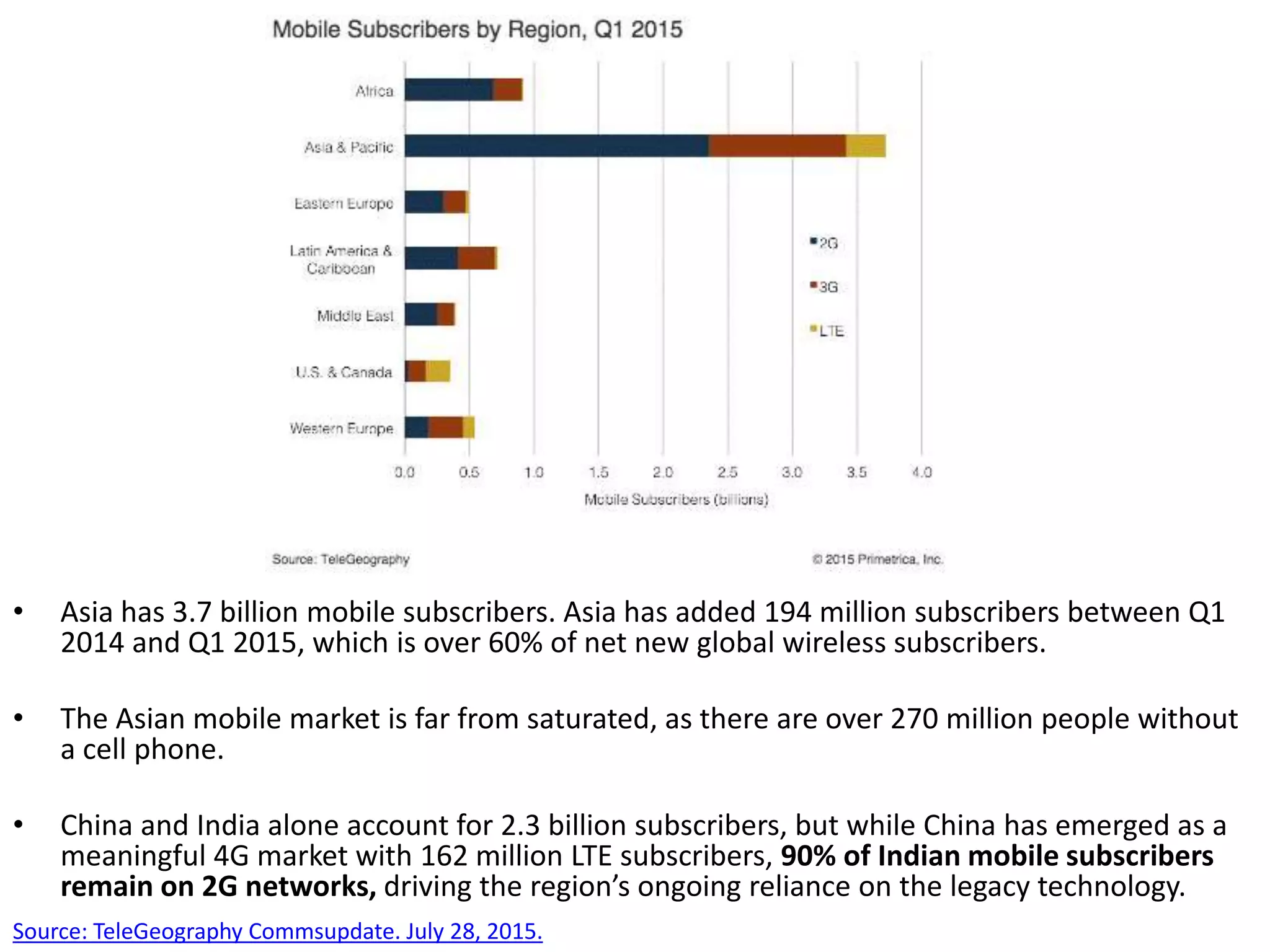

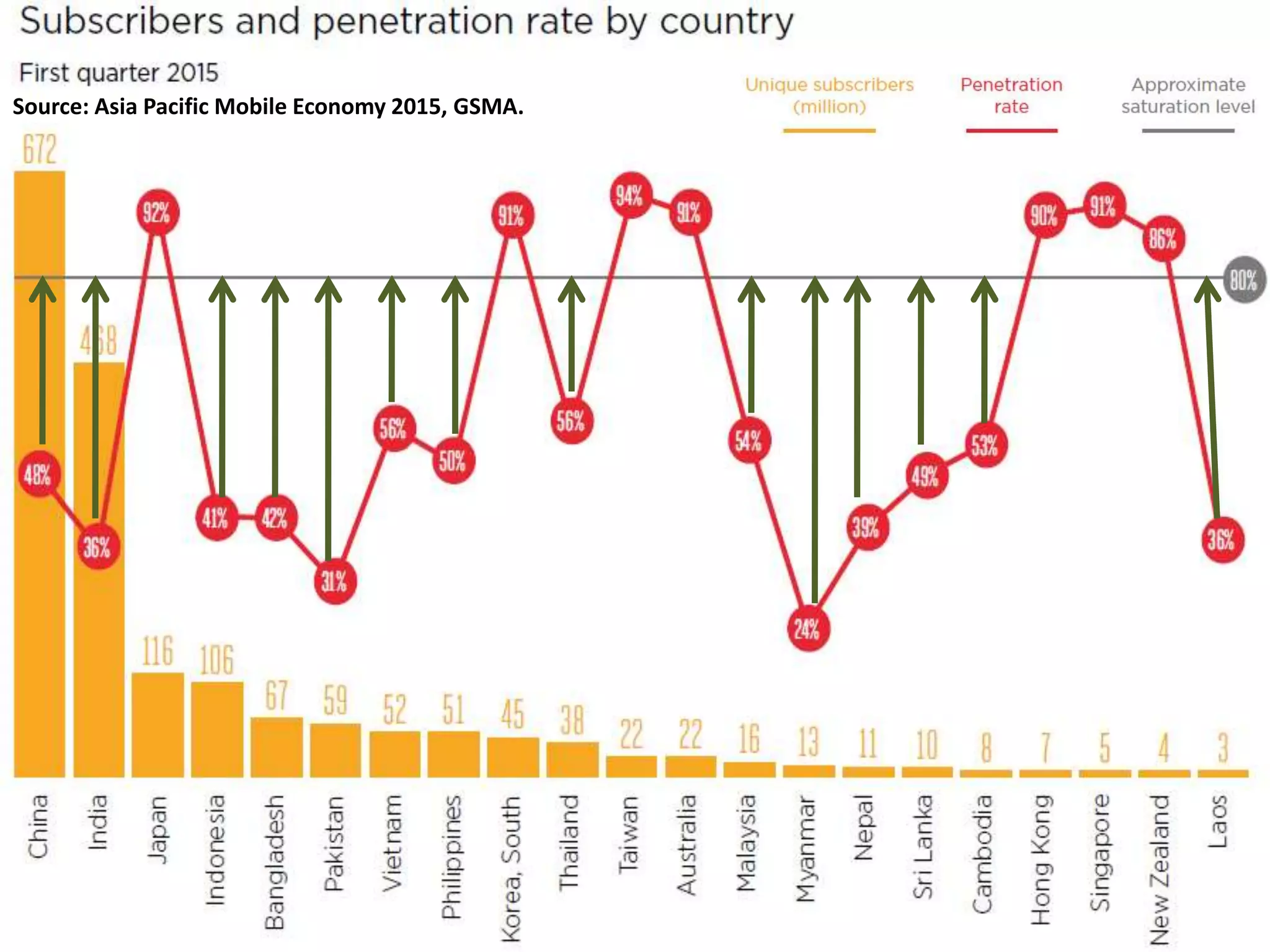

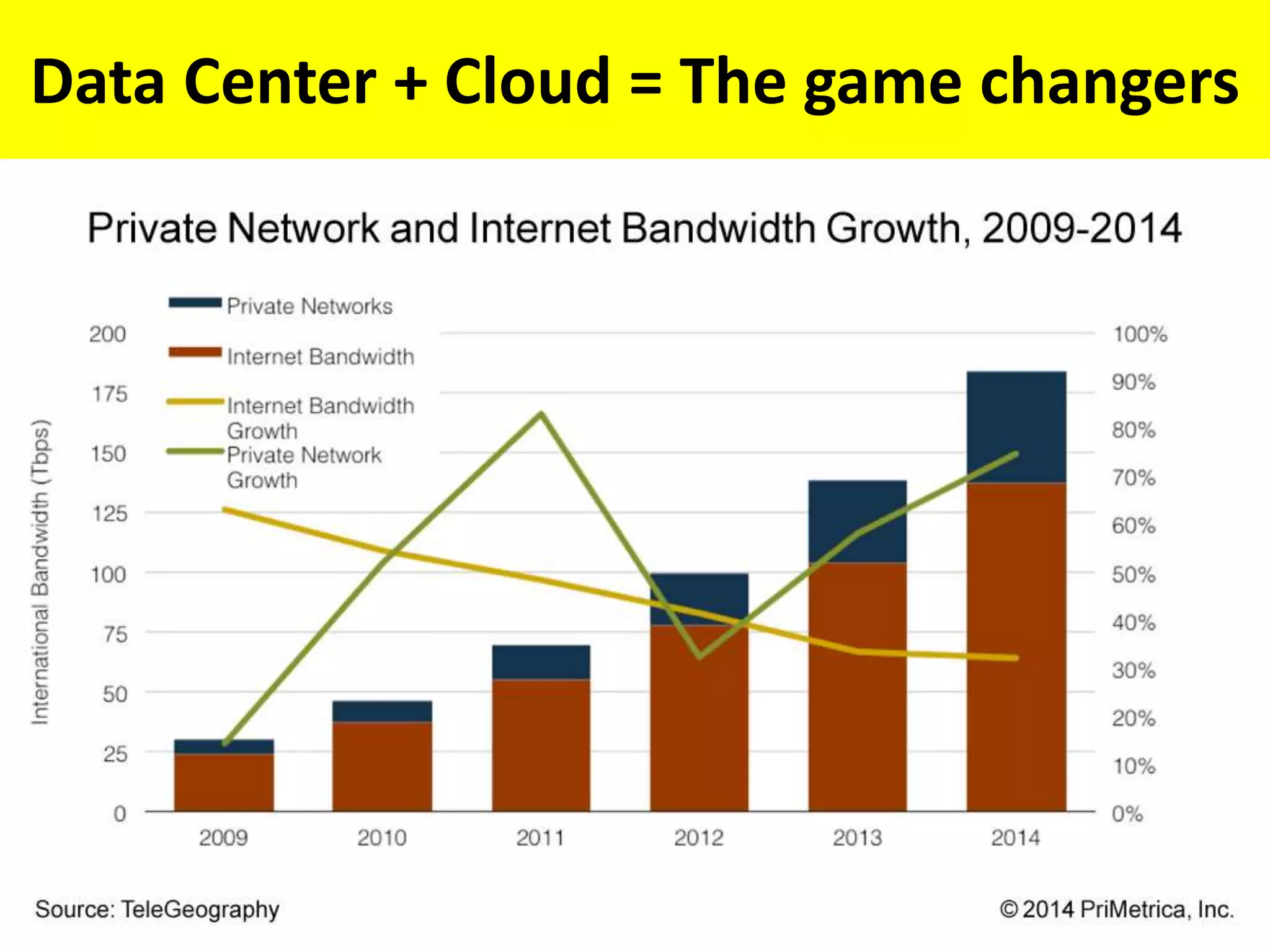

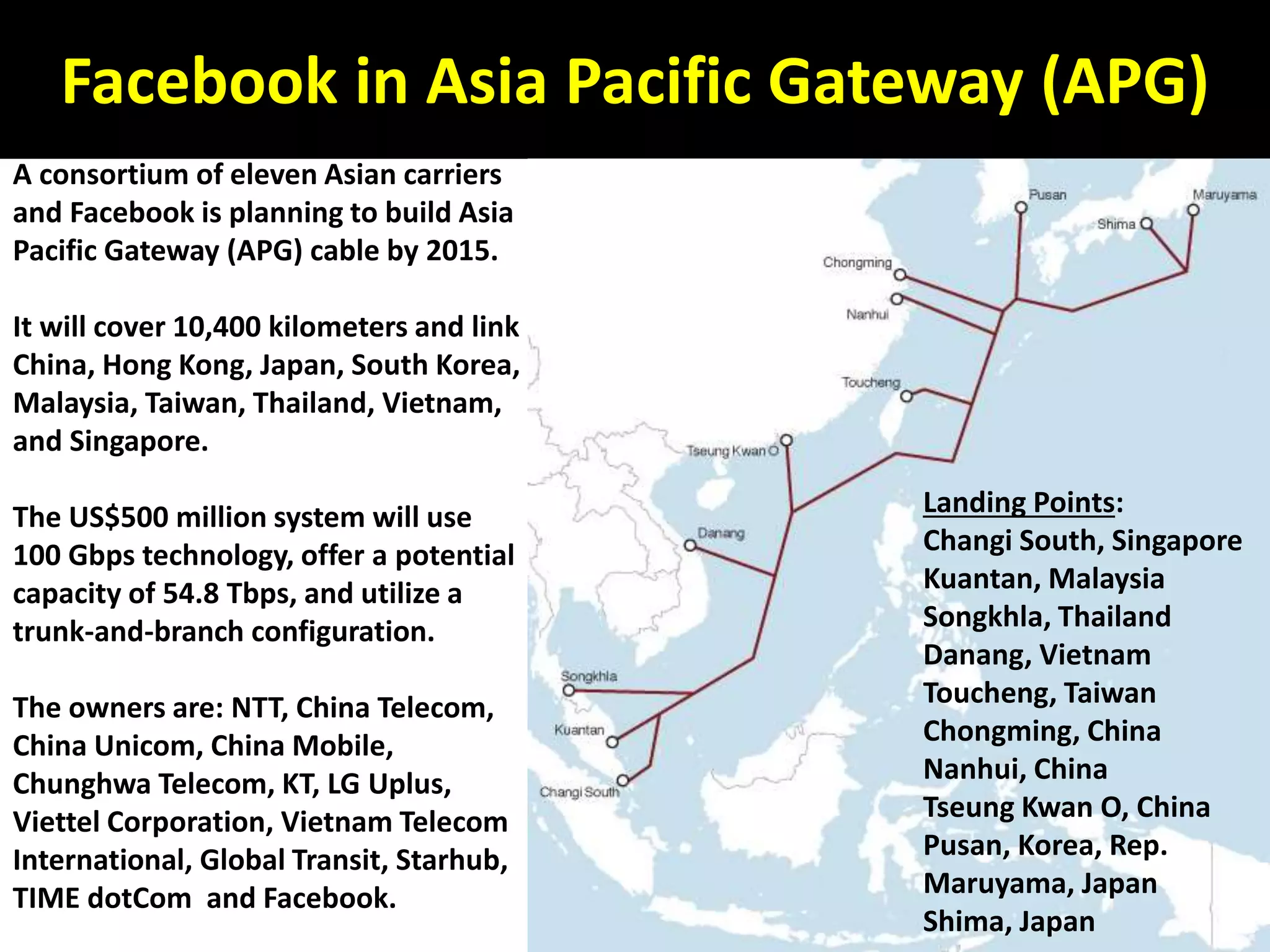

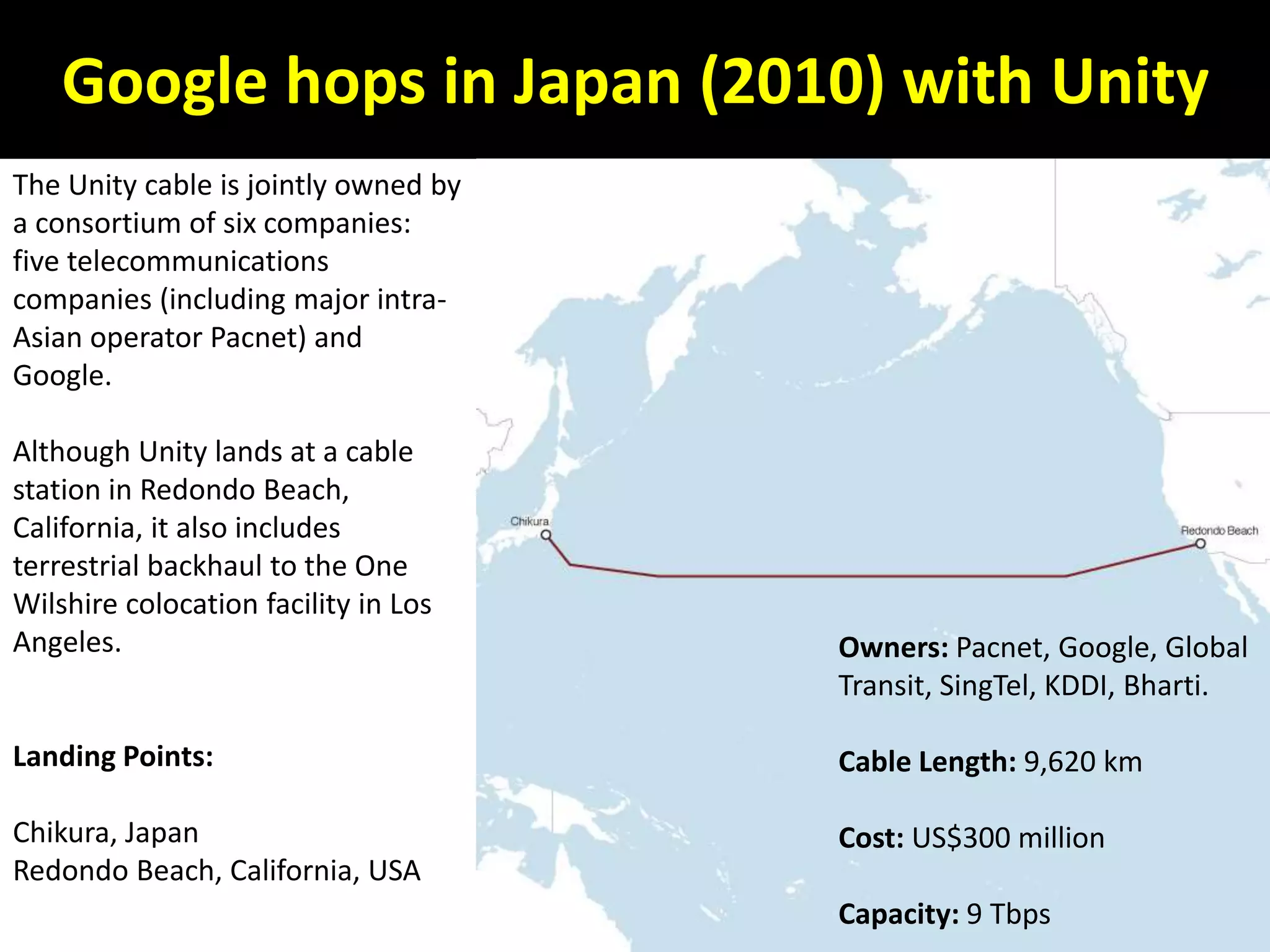

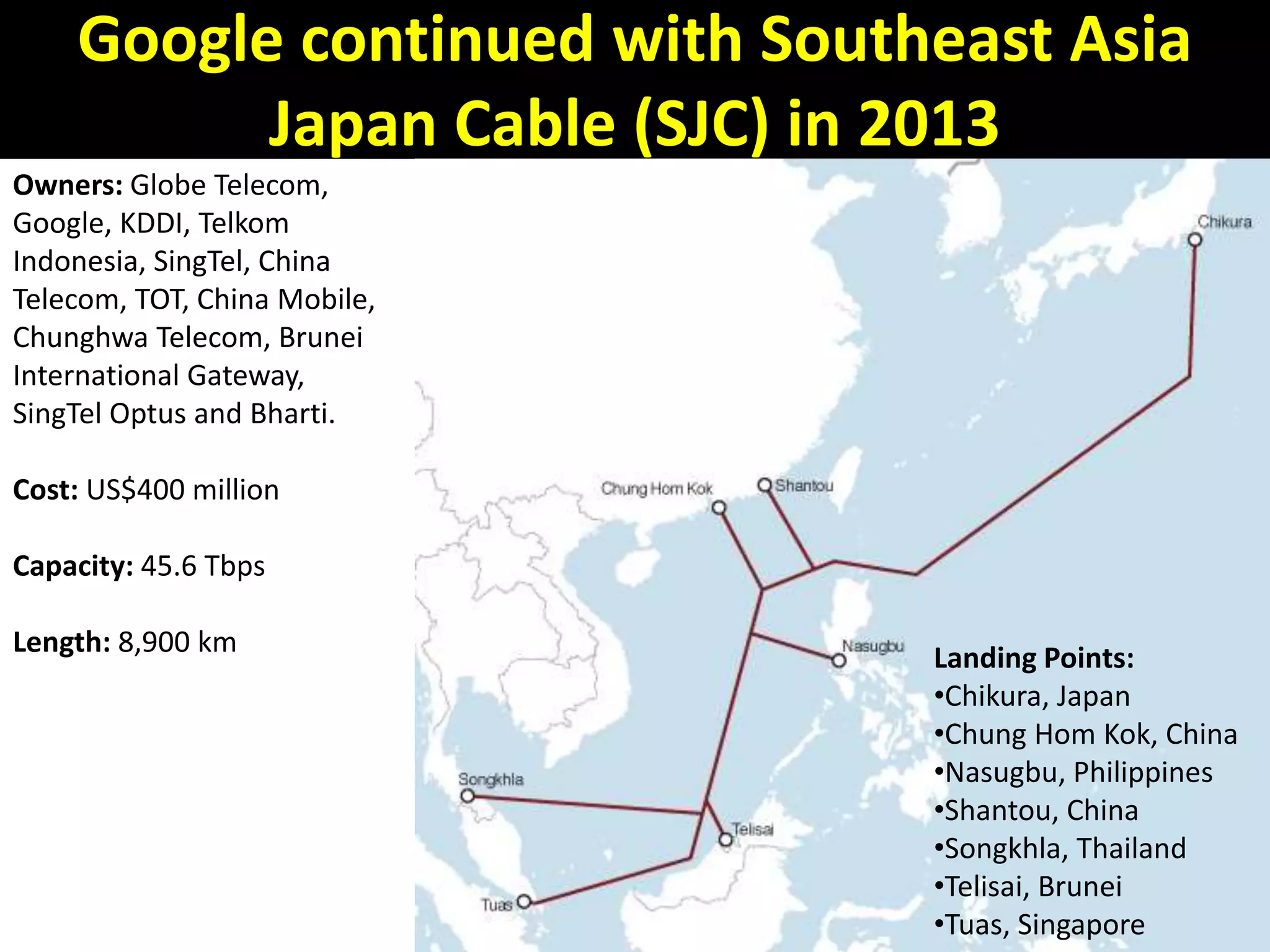

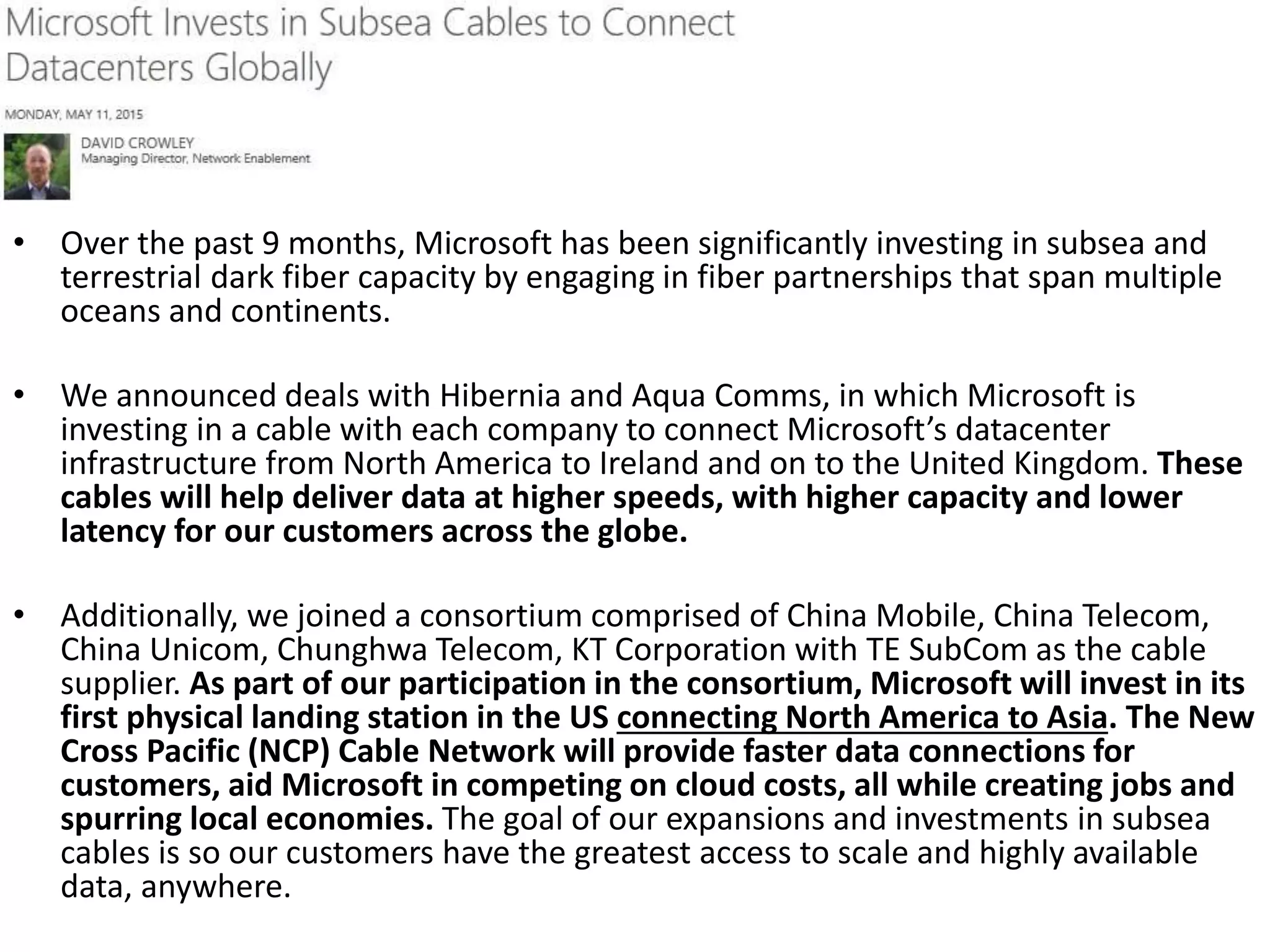

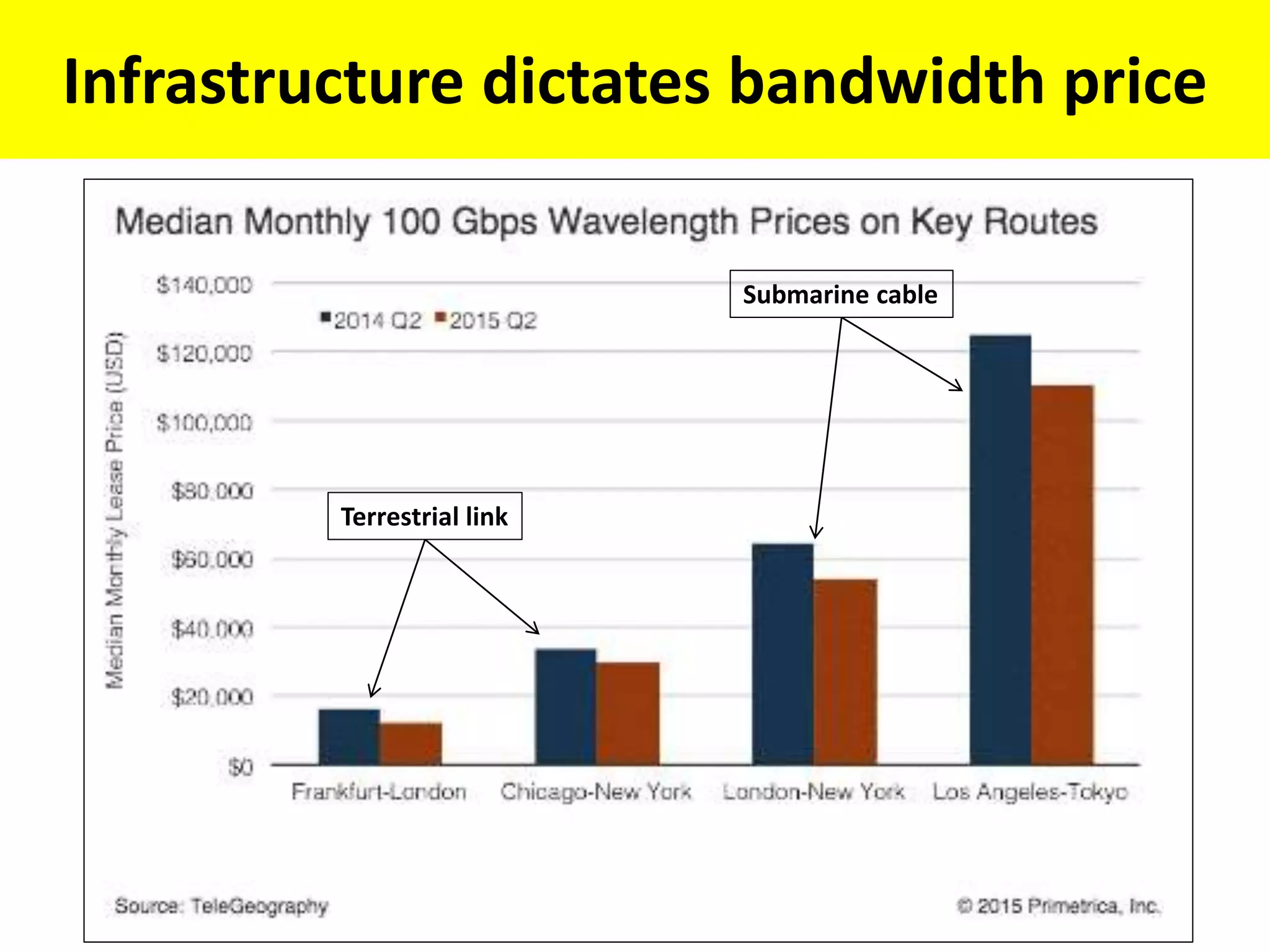

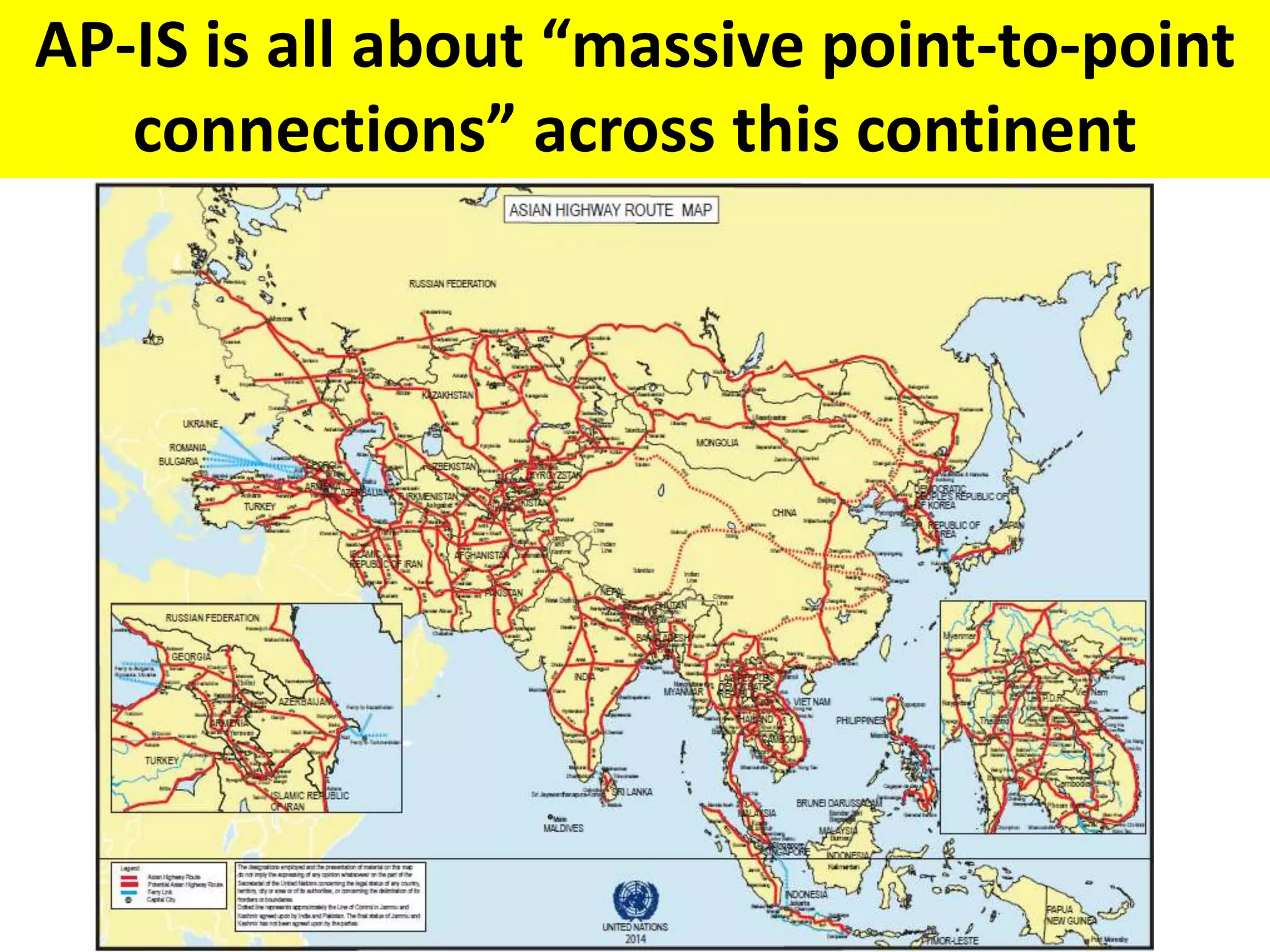

The document discusses the One Belt One Road initiative and related infrastructure developments, highlighting China's significant investments in transport projects, including rail and airport expansions. It also covers the rapid growth of mobile subscribers in Asia and the emergence of new subsea cable systems to enhance connectivity across various regions. Key players like Microsoft and Facebook are investing in technology to improve data transmission and cloud services globally.