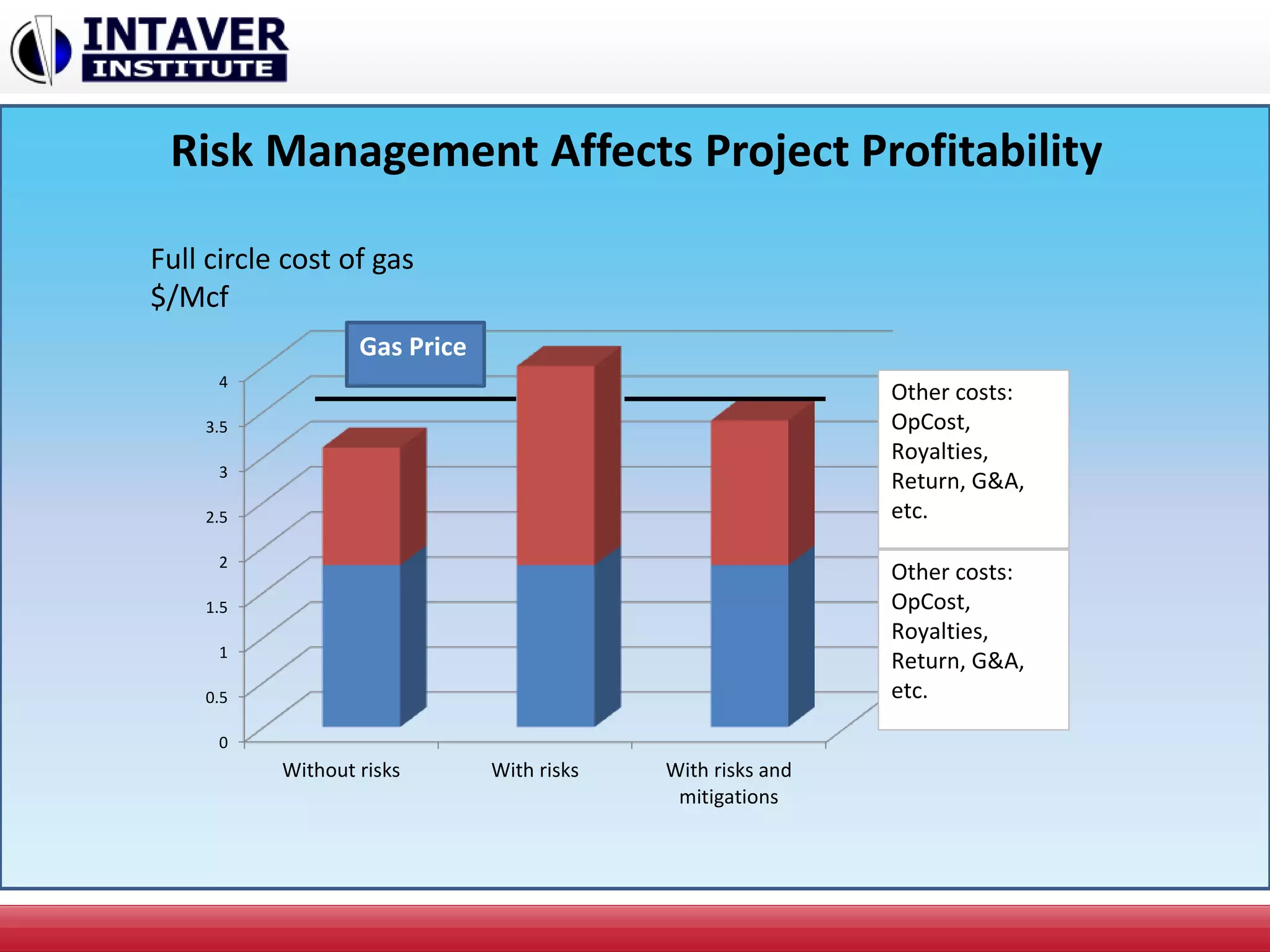

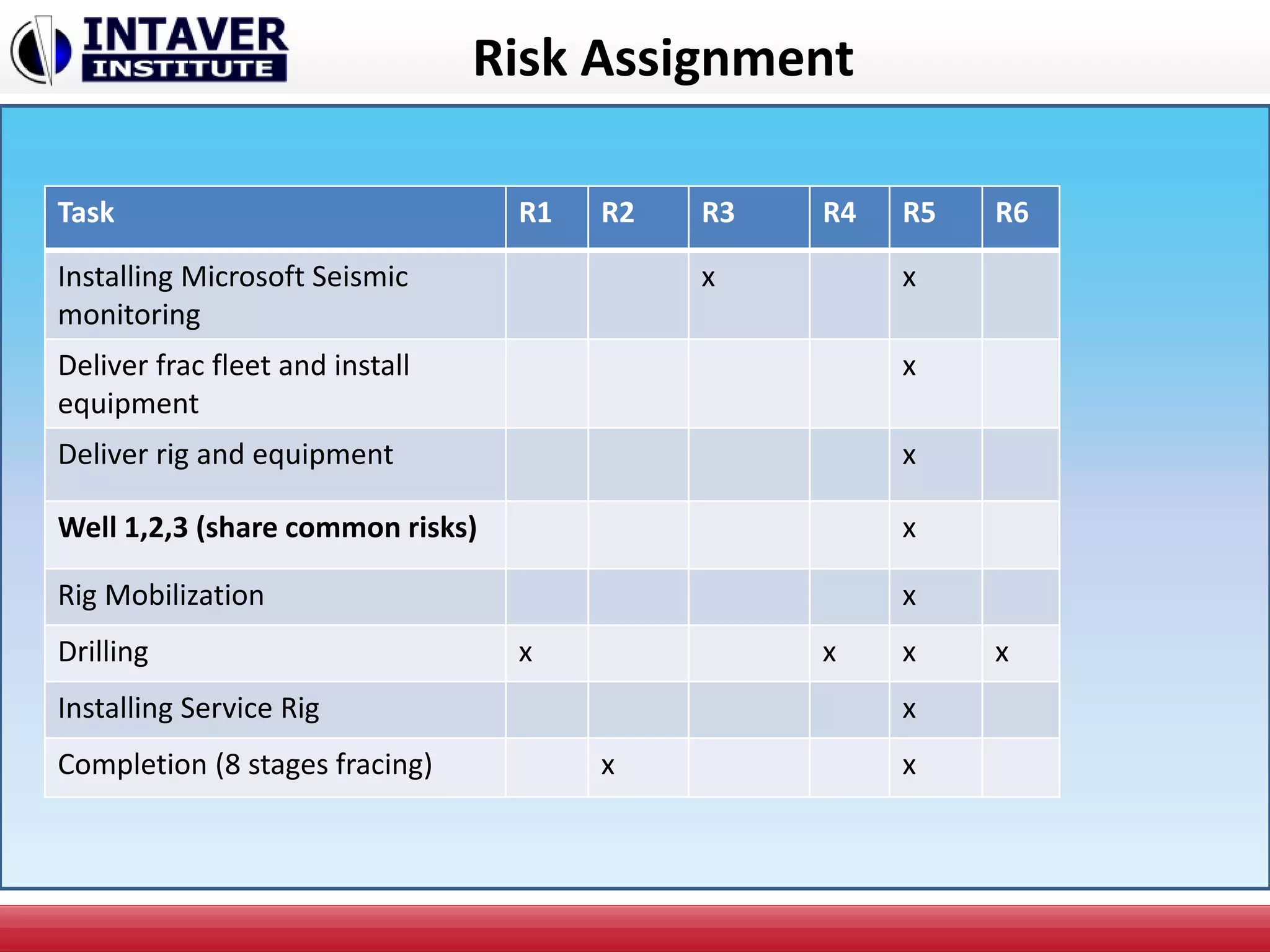

The document presents a webinar by Intaver Institute Inc. on risk management for oil and gas projects, detailing the development of their product 'RiskyProject' which includes various risk analysis tools. It emphasizes the importance of identifying and managing critical risks in project portfolio management and highlights the role of schedule risk in driving project costs. Key elements include project risk analysis methodologies, potential risks, and mitigation strategies to enhance project profitability.