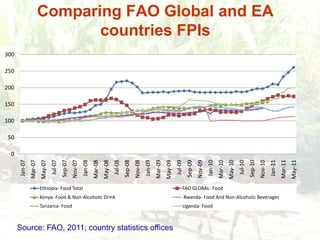

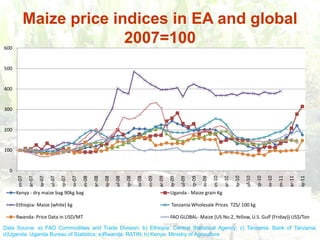

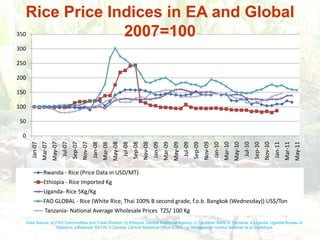

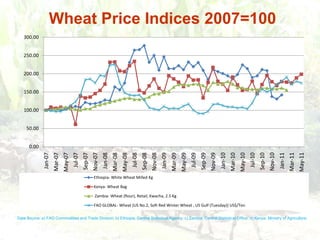

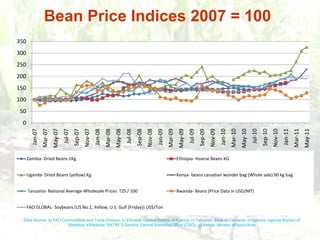

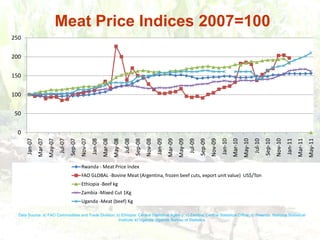

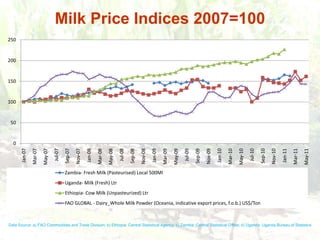

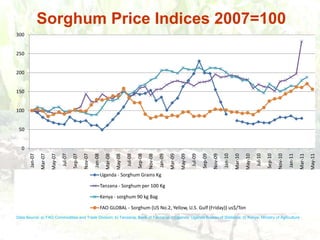

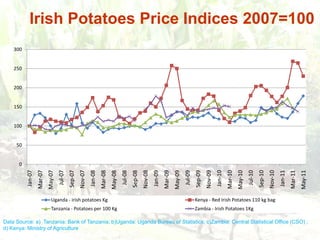

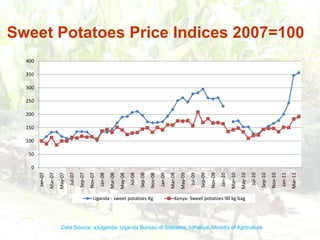

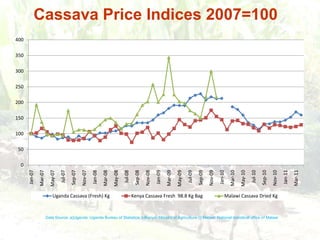

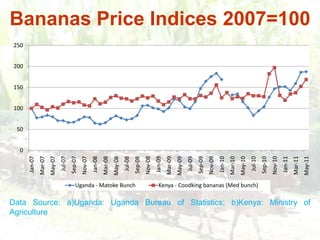

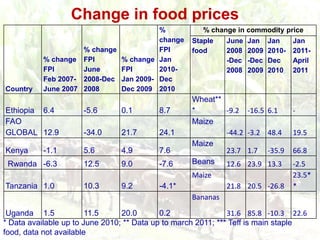

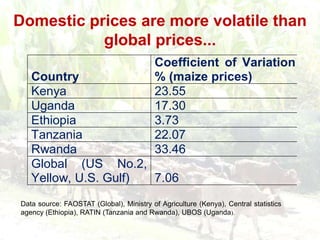

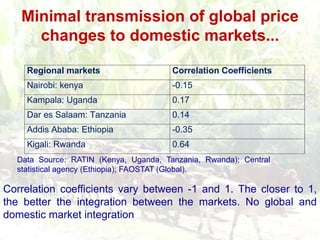

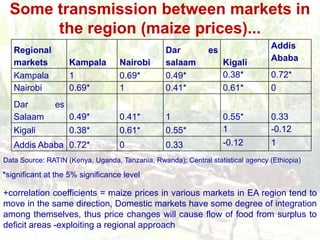

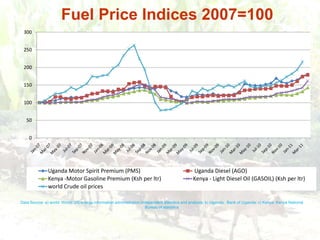

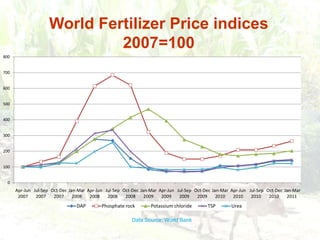

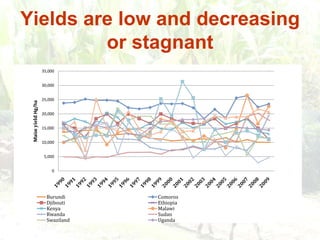

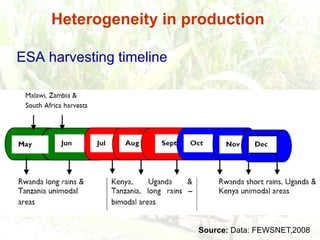

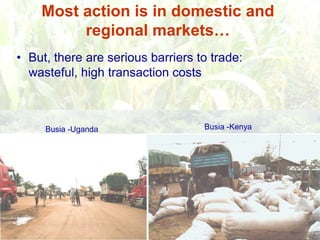

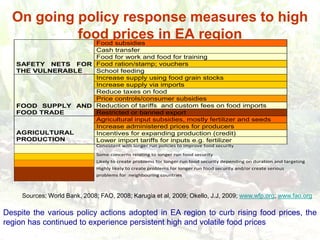

The document addresses the persistent high food prices in Eastern Africa and examines their causes, including low agricultural investments and market inefficiencies. It emphasizes the need for effective policy actions, such as targeted food subsidies and enhancing regional trade, to mitigate the impact on vulnerable populations. The analysis indicates a lack of global and domestic market integration, complicating the food crisis response.

![ConclusionsChanges in global food prices are not transmitted to domestic marketsRegional response offers opportunities to address the food price crisisFood price crisis offers opportunities for agricultural development through increased domestic production, regional trade and integration [Paul Romer: “A crisis is a terrible thing to waste”]](https://image.slidesharecdn.com/ofabkenya-june-2011-110704034052-phpapp02/85/Ofab-Kenya-June-2011-35-320.jpg)