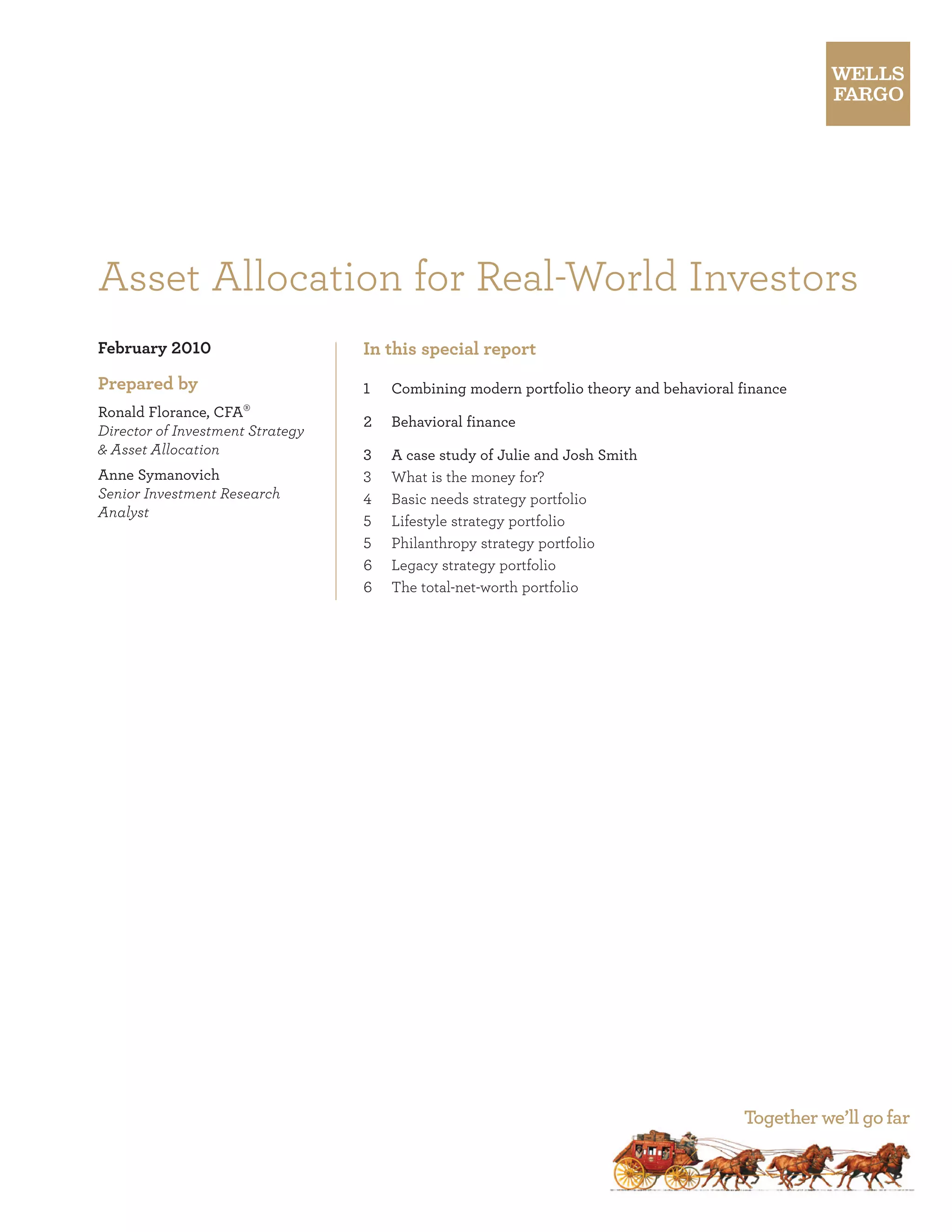

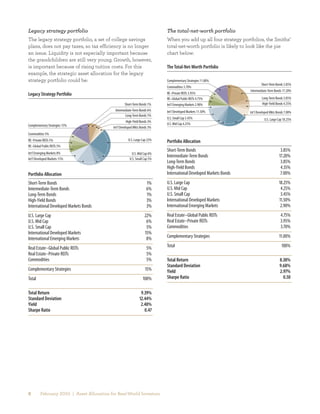

The document provides an overview of how to develop a comprehensive investment strategy using a behavioral finance approach to meet various financial goals over an individual's lifetime. It discusses combining modern portfolio theory with behavioral finance to account for multiple investment goals and risk tolerances. It then provides a case study of allocating assets for a couple across basic needs, lifestyle, philanthropy, and legacy portfolios based on their specific needs, goals, and risk profiles for each.