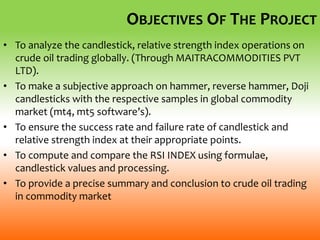

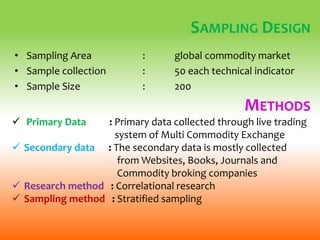

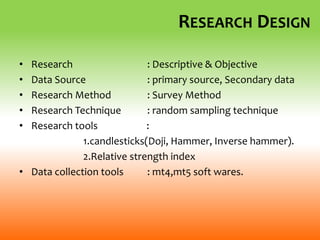

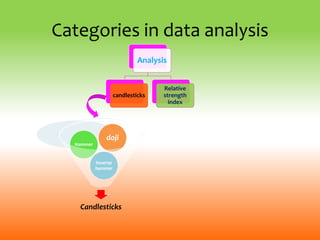

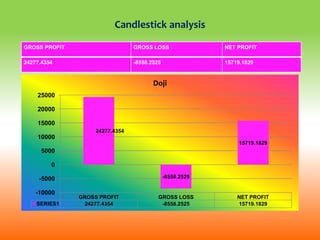

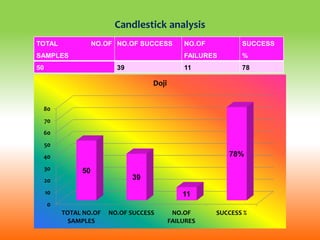

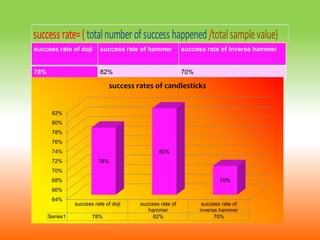

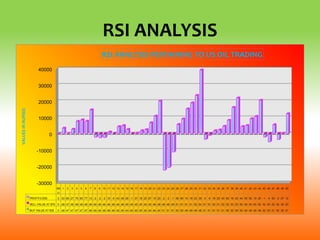

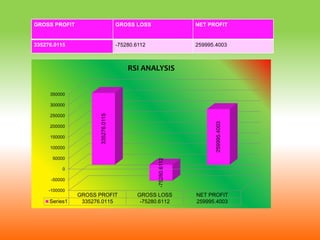

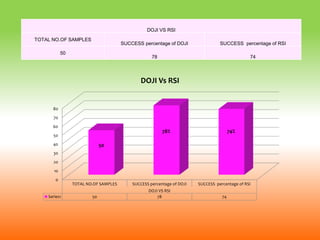

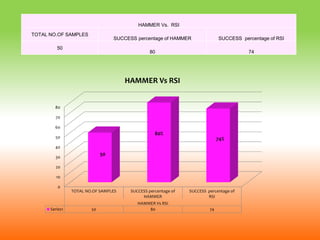

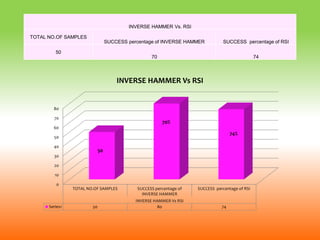

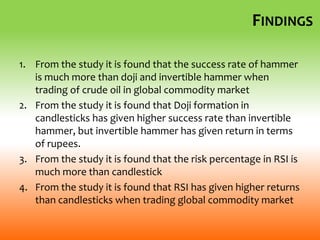

This document is a project report on comparing the success rates of two technical indicators - candlestick patterns and relative strength index (RSI) - for crude oil trading. The objectives are to analyze candlestick and RSI operations on crude oil globally through a commodities company, ensure the success and failure rates of candlestick and RSI at different points, and compare RSI calculations to candlestick values. The report provides an introduction to the commodity markets industry in India and outlines the limitations of the study.