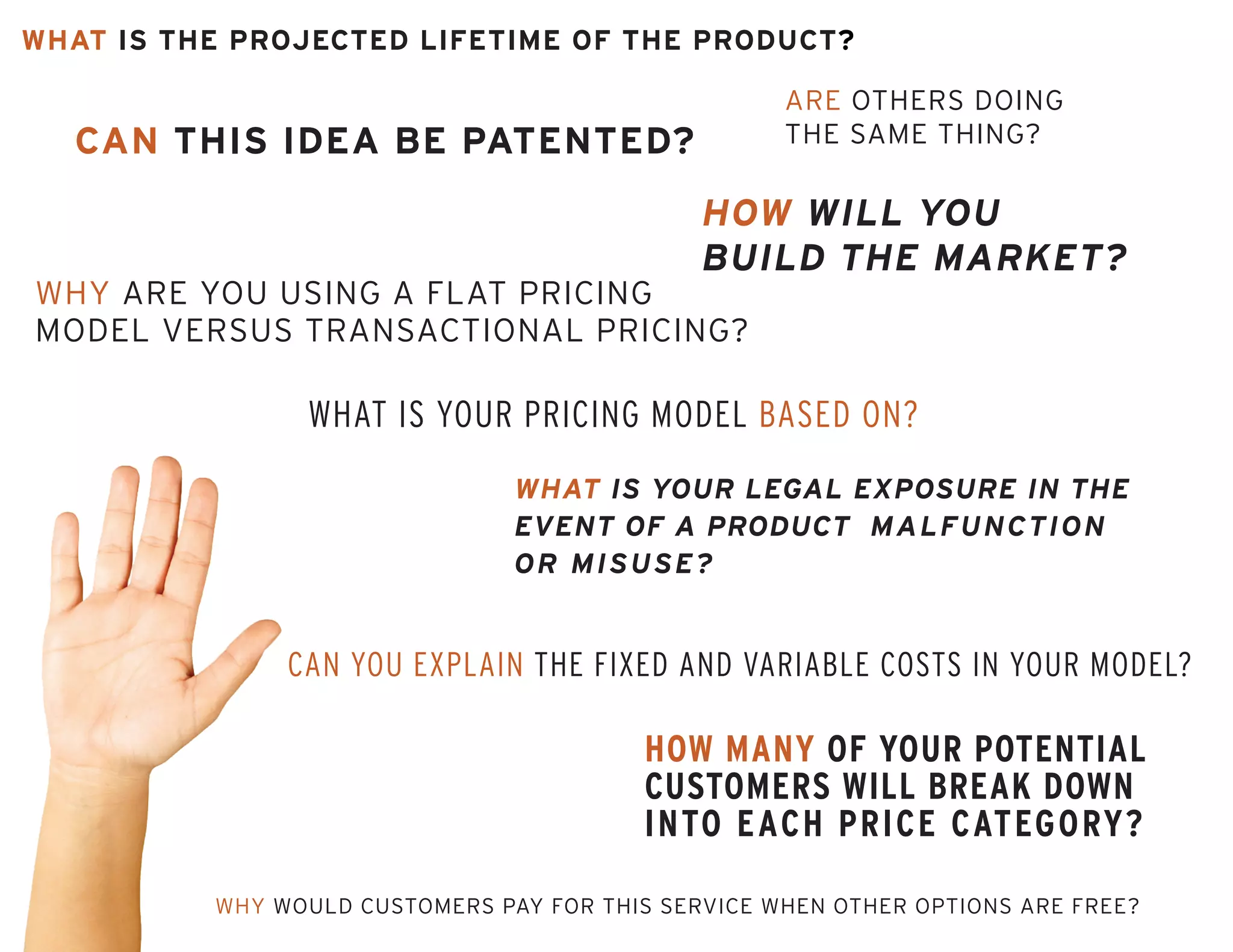

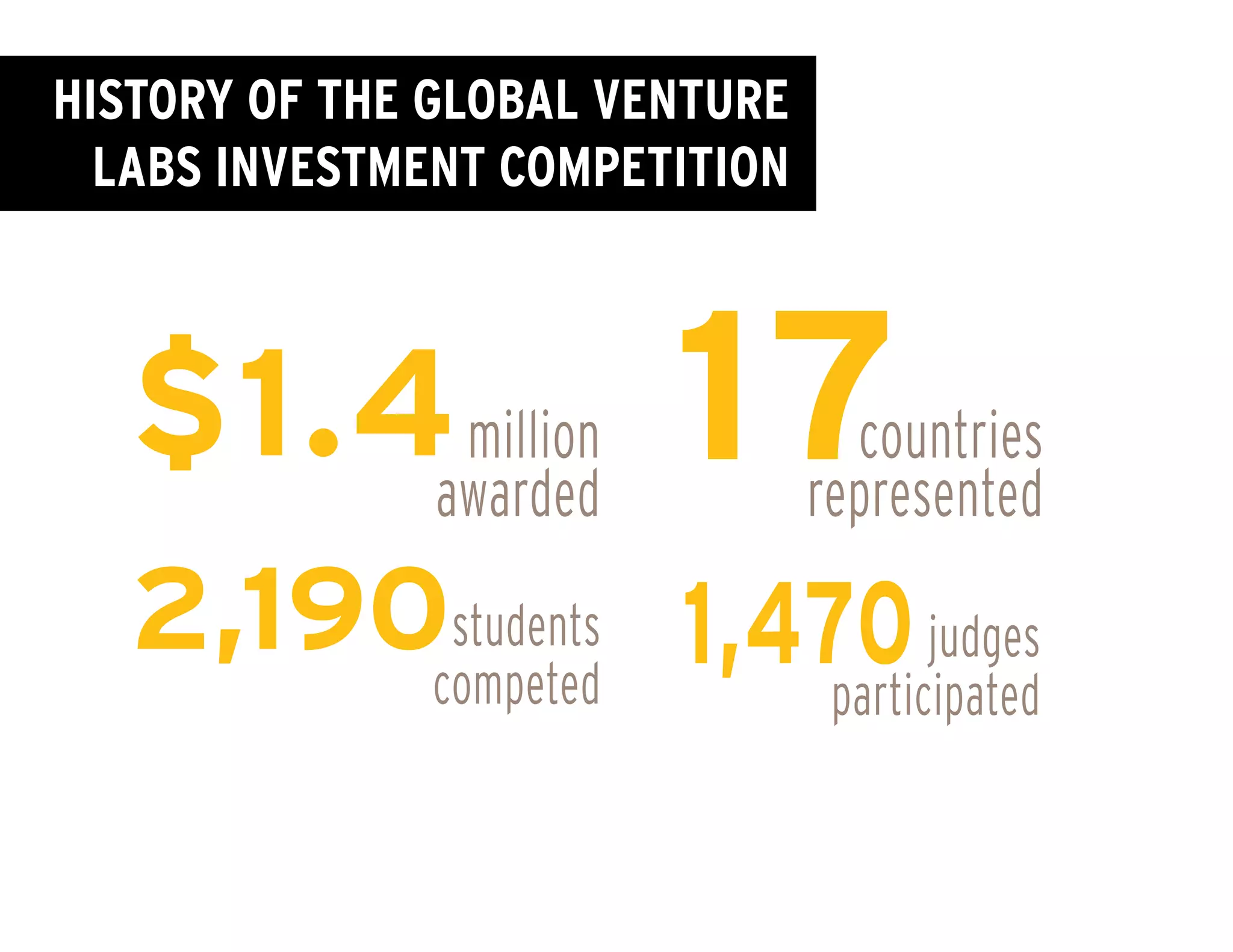

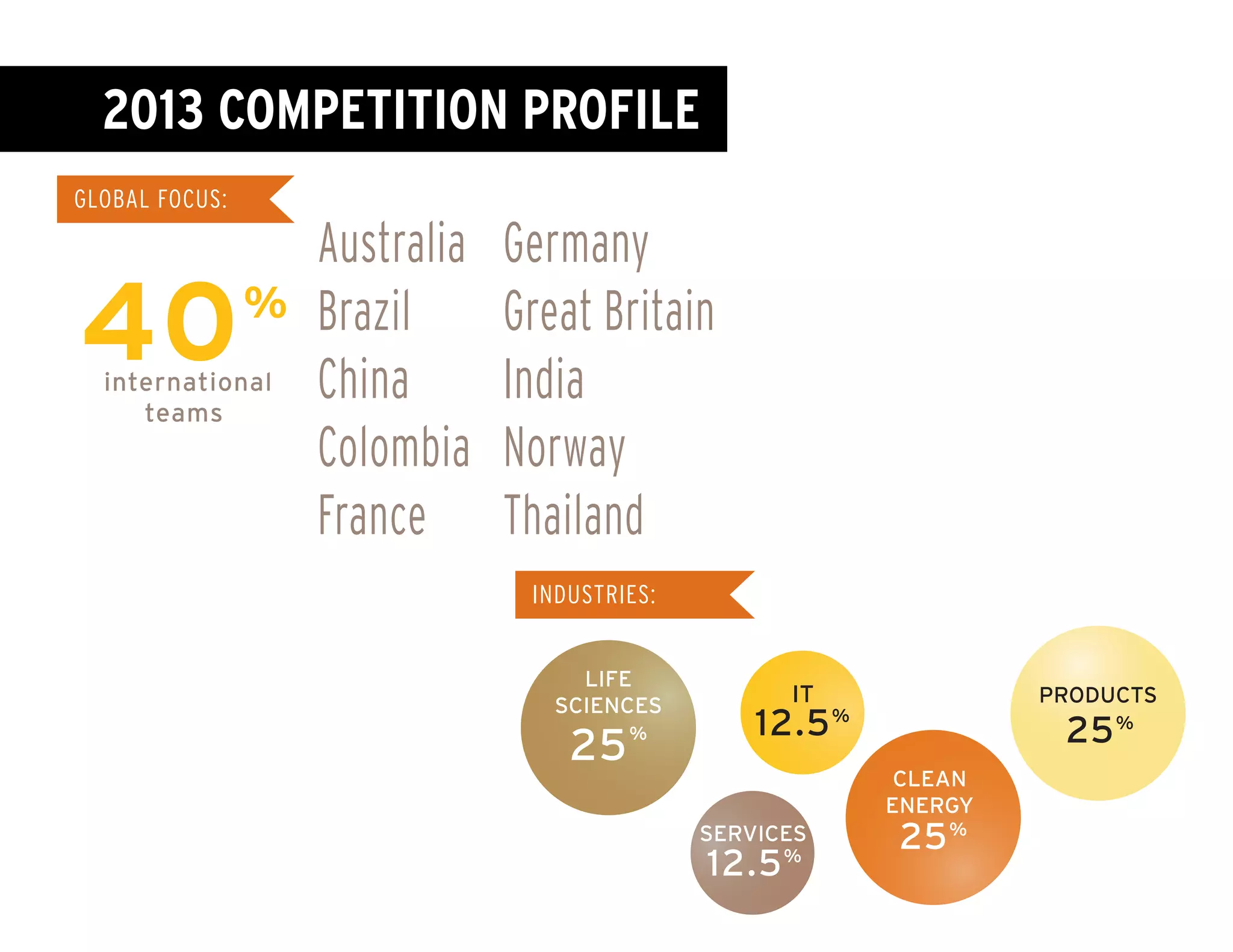

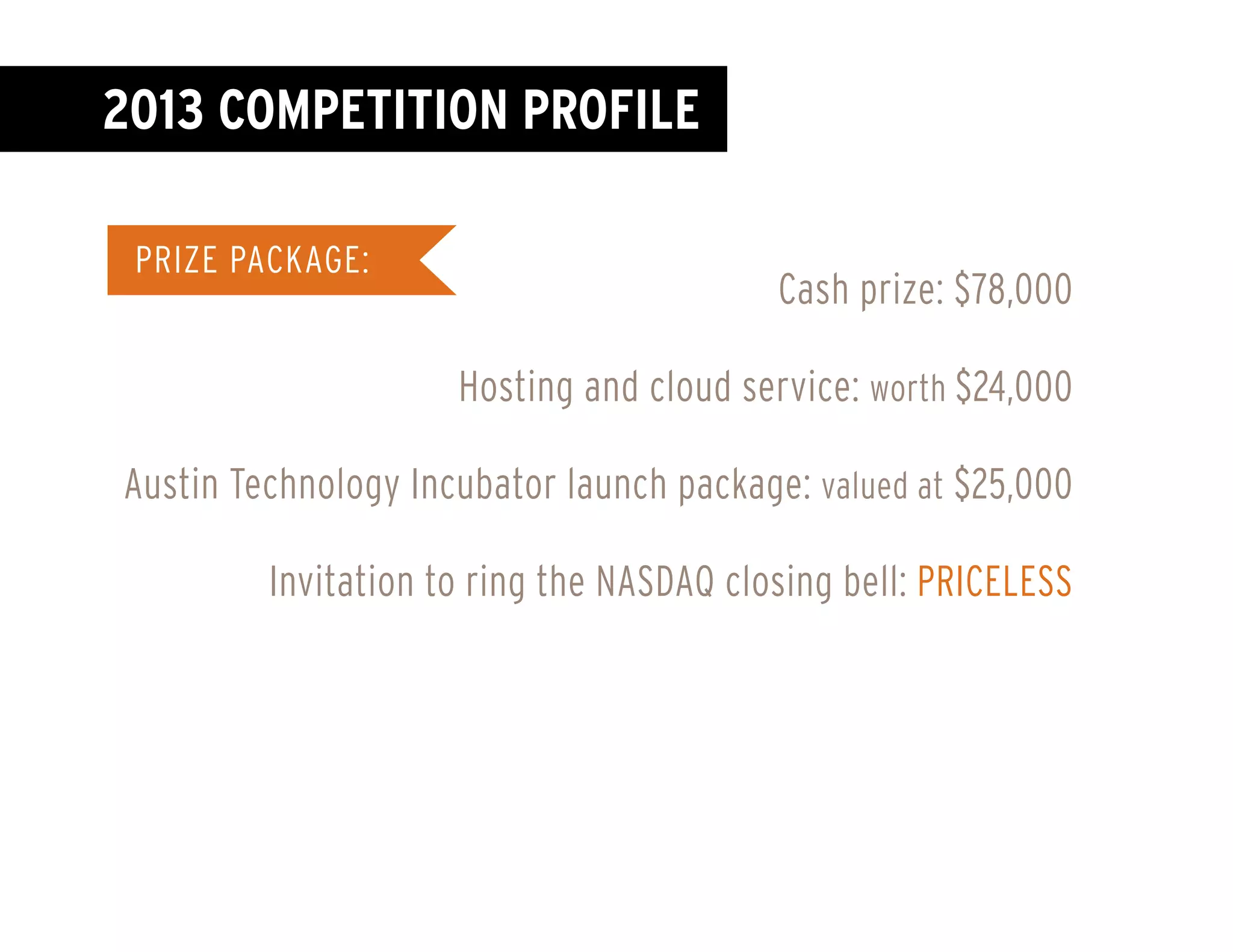

The document outlines 9 steps to become investor-ready for startups. It summarizes each step with a quote from industry experts, including finding passion, identifying market pain points, refining your target, building an amazing team, networking extensively, avoiding buzzwords, preparing for tough questions from investors, delivering an impressive pitch, and celebrating successes. It also provides an overview of the Global Venture Labs Investment Competition, including historical trends showing growing interest in clean energy, life sciences and IT startups over time. The competition offers a substantial cash and in-kind prize package to the winning team.