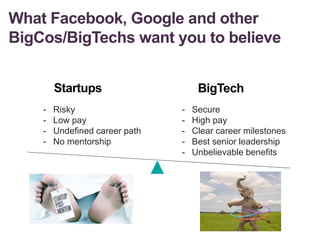

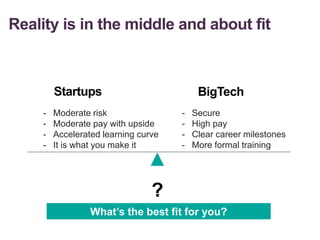

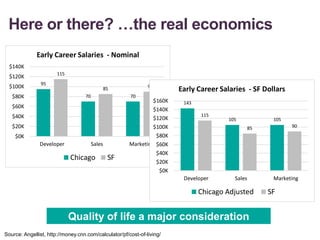

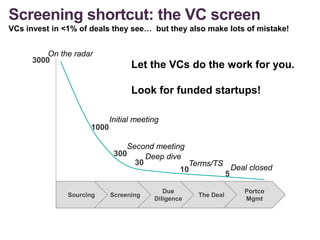

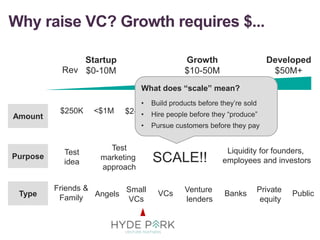

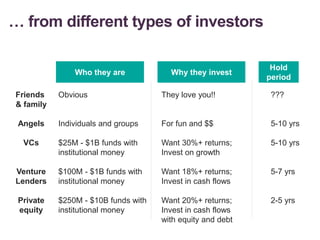

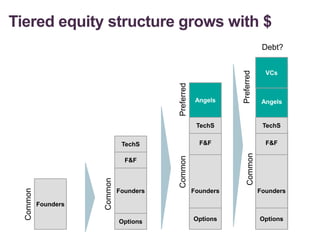

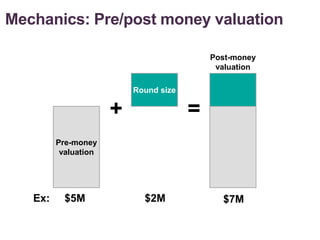

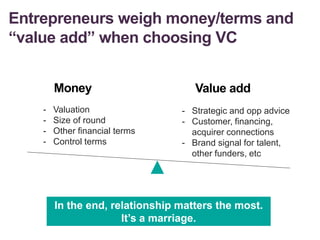

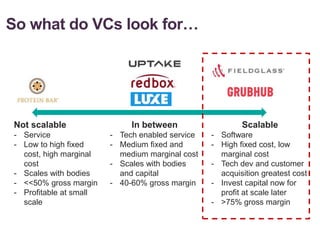

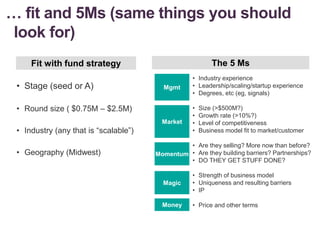

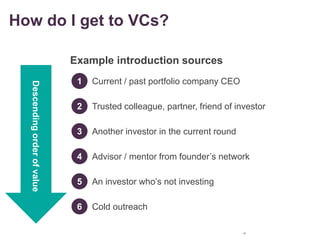

The document provides an overview of startups and venture capital, including trade-offs of working for startups compared to large tech companies, guidance on finding reliable startups, and the importance of cultural fit. It discusses various funding stages, sources of investment, and what venture capitalists look for in potential investments. Additionally, it emphasizes the importance of relationships between entrepreneurs and investors in the fundraising process.