This document discusses various aspects of managing technological innovation in business, including:

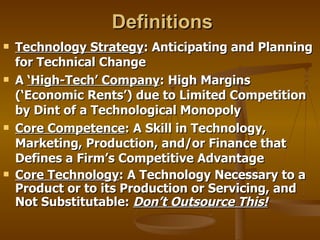

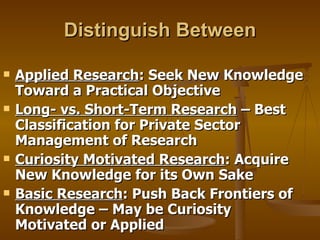

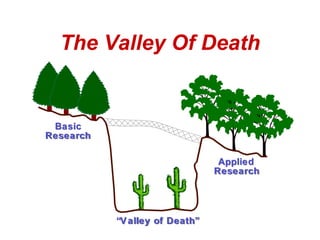

1. Definitions of key terms like technology strategy, core competence, applied vs. basic research, and the industrial R&D laboratory.

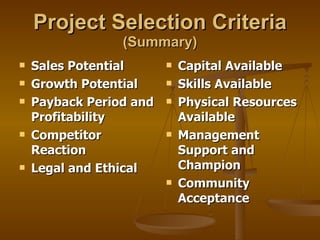

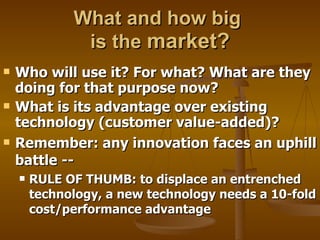

2. Factors to consider for project selection like market potential, payback period, and skills available.

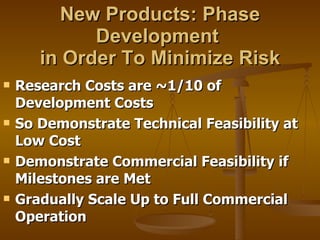

3. Phases of new product development like demonstrating technical and commercial feasibility before full commercial operation.

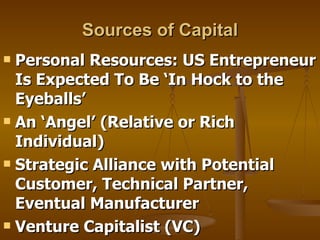

4. Growth patterns of start-up firms pursuing new technologies and challenges they may face.