The document summarizes a presentation given by Bob Metcalfe on startup ecosystems. Some key points:

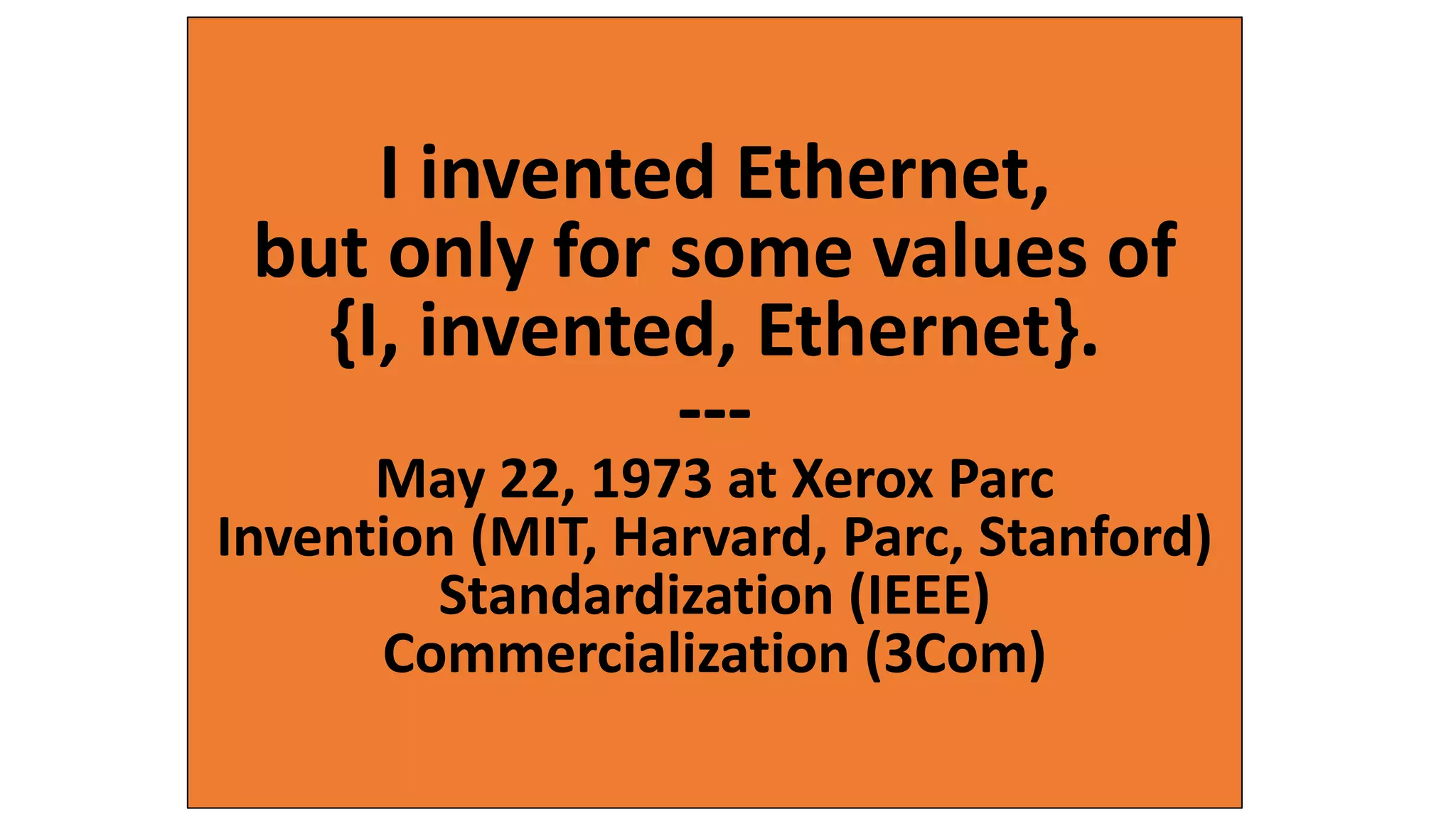

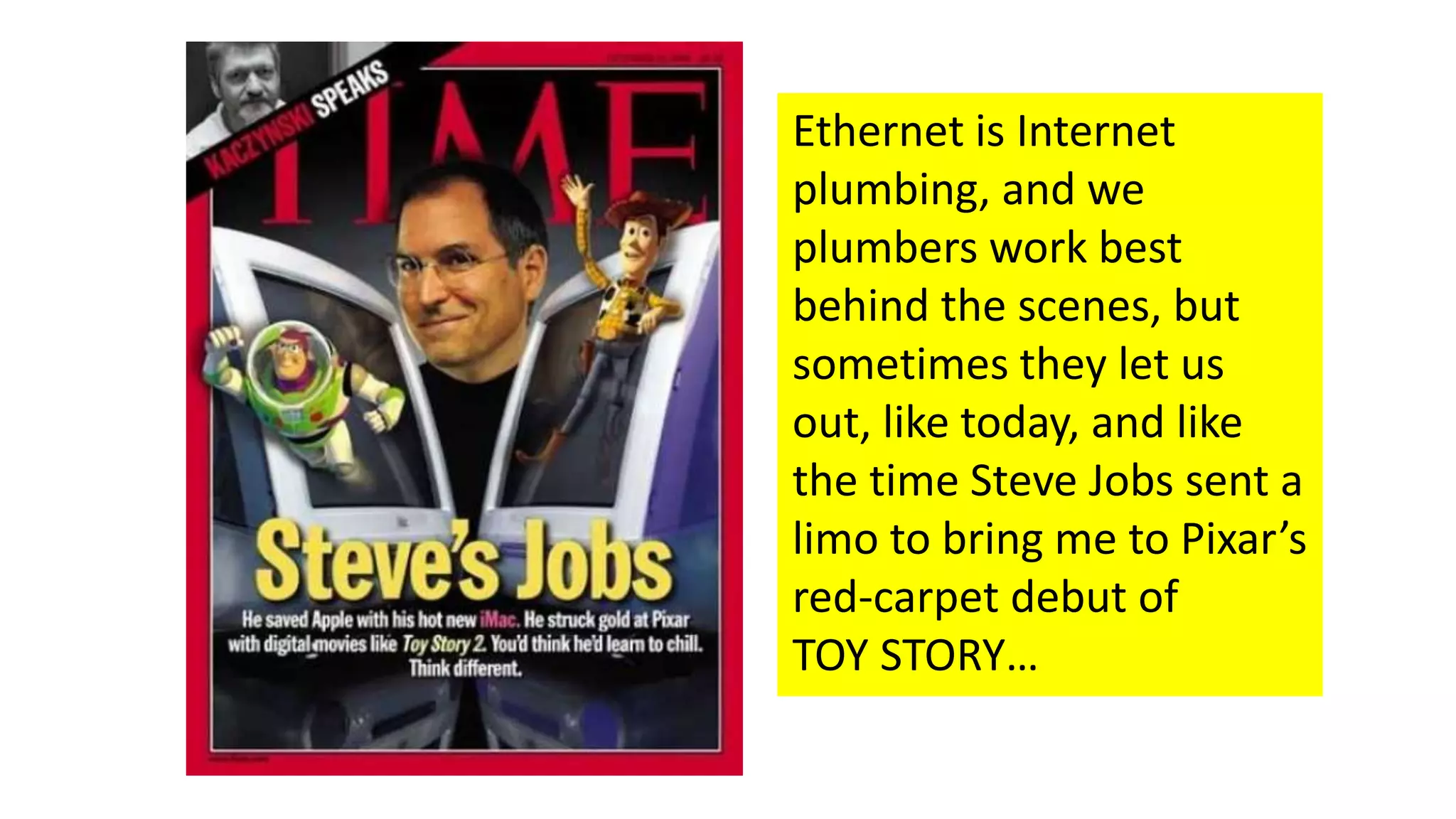

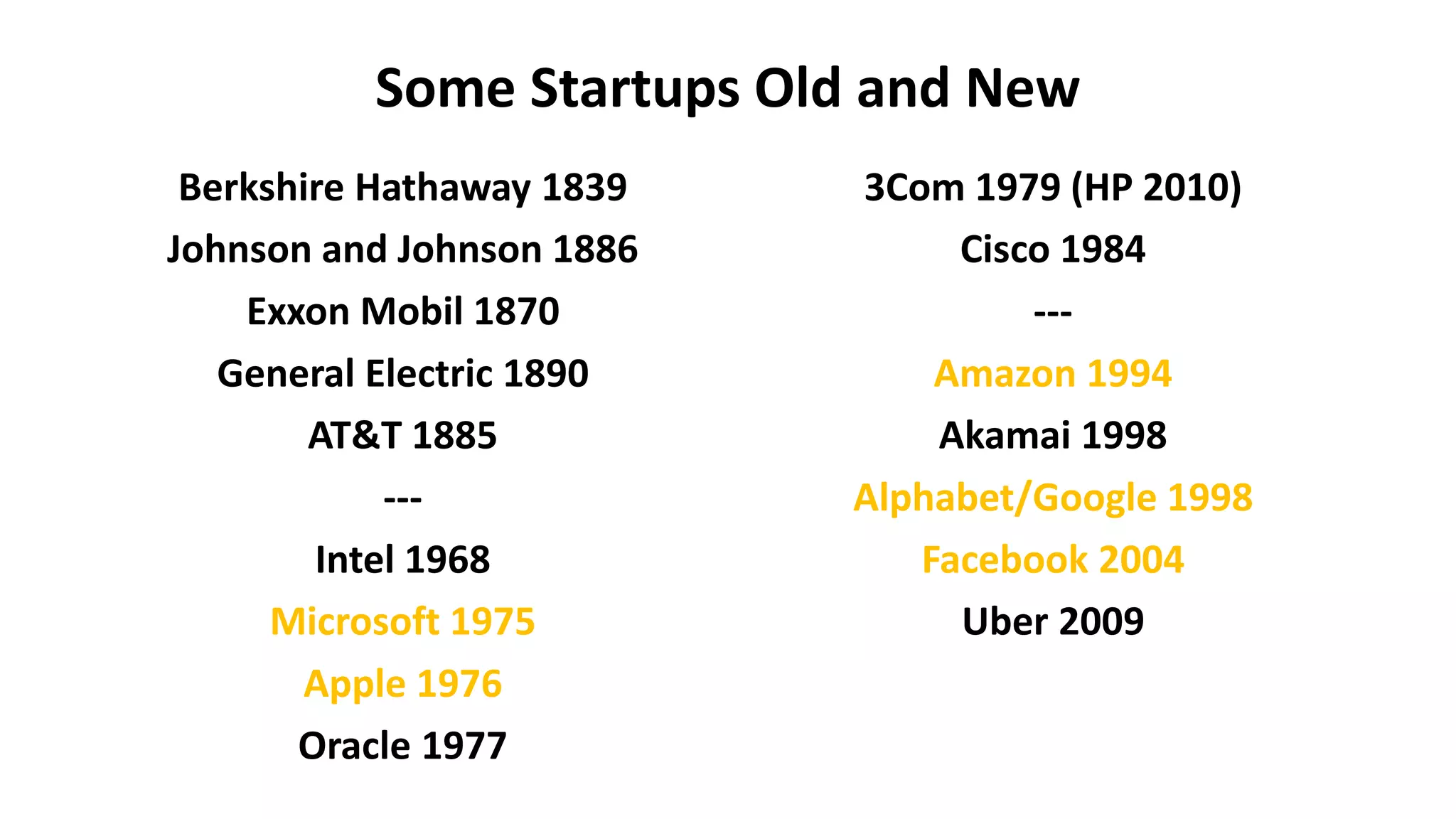

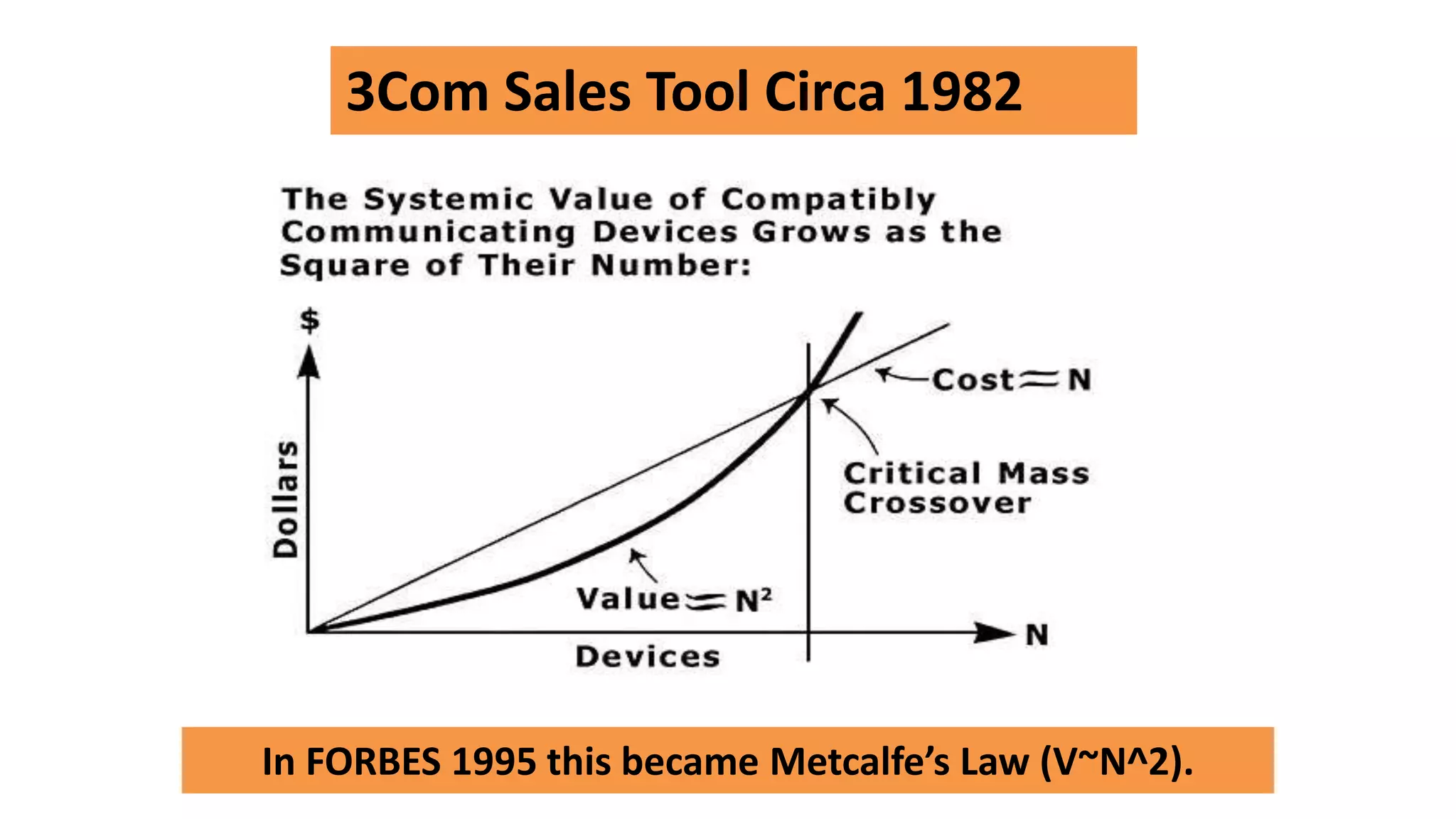

- Metcalfe discussed his role in inventing Ethernet and how innovations are commercialized.

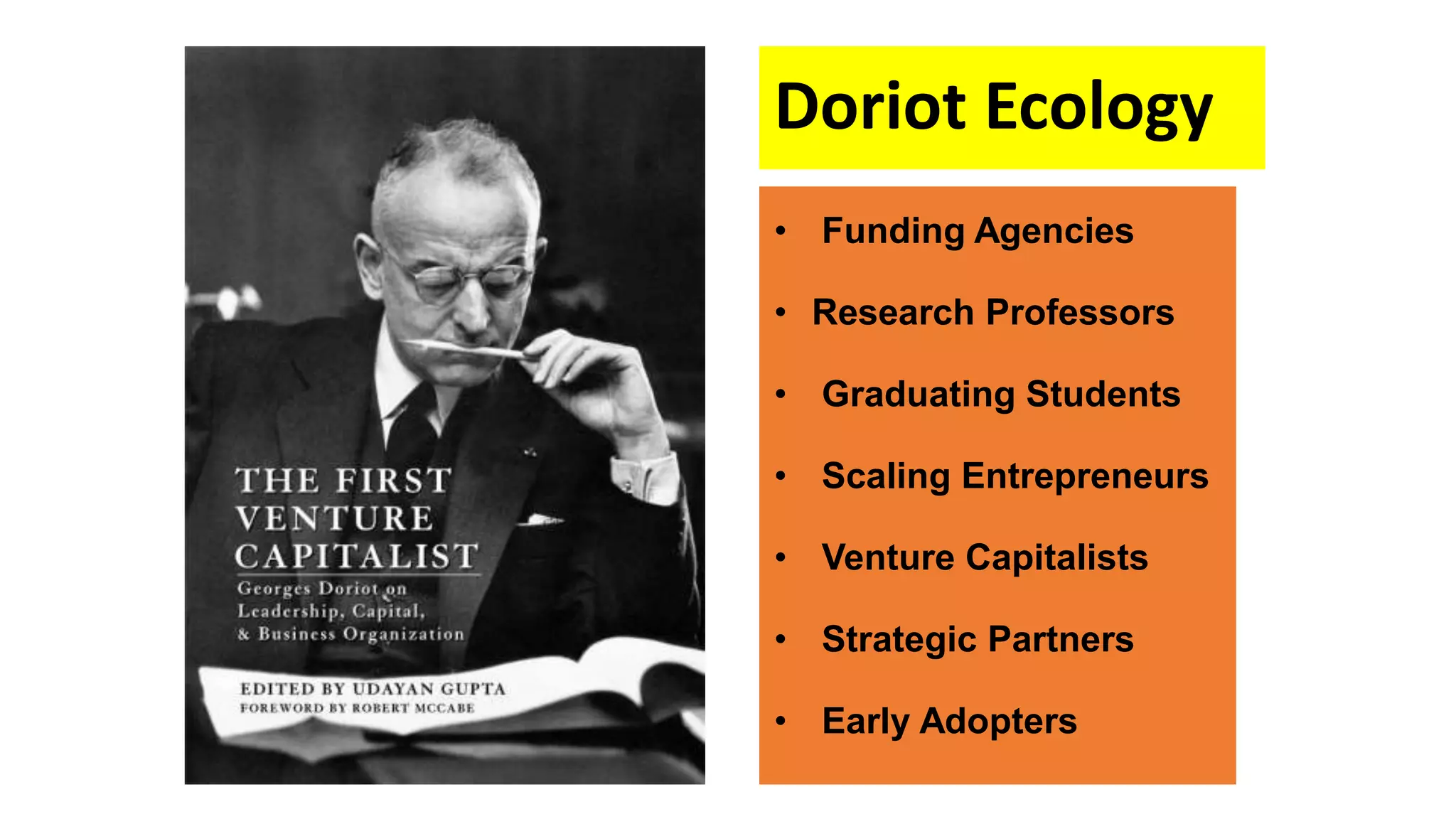

- He outlined the "Doriot ecology" of factors that support startup innovation, including funding agencies, researchers, entrepreneurs, investors, and customers.

- The concept of "Inoversities" was introduced, where universities focus more on innovation and allow professors to start companies based on their research.

- Many opportunities for startup innovation were listed, such as artificial intelligence, robotics, healthcare technologies, and the internet of things.