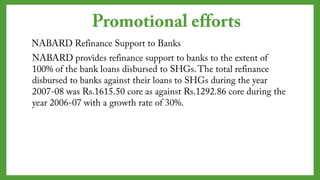

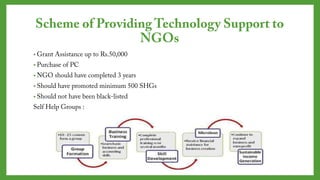

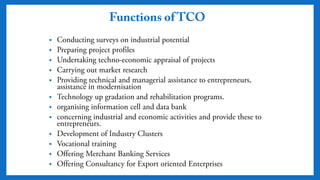

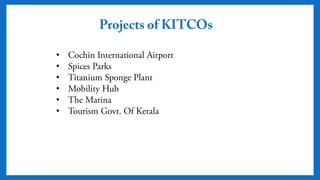

This document discusses National Bank for Agriculture and Rural Development (NABARD), its vision, mission, objectives, roles and functions. NABARD is the apex organization for agriculture and rural development in India. It provides refinancing support to banks for loans to self-help groups. It also promotes various innovative projects for rural development. The document also discusses Small Industries Development Bank of India (SIDBI), its vision, mission, objectives, products and services in promoting micro, small and medium enterprises in India. Finally, it discusses the role and functions of Technical Consultancy Organizations which provide technical support to entrepreneurs and industrial projects.