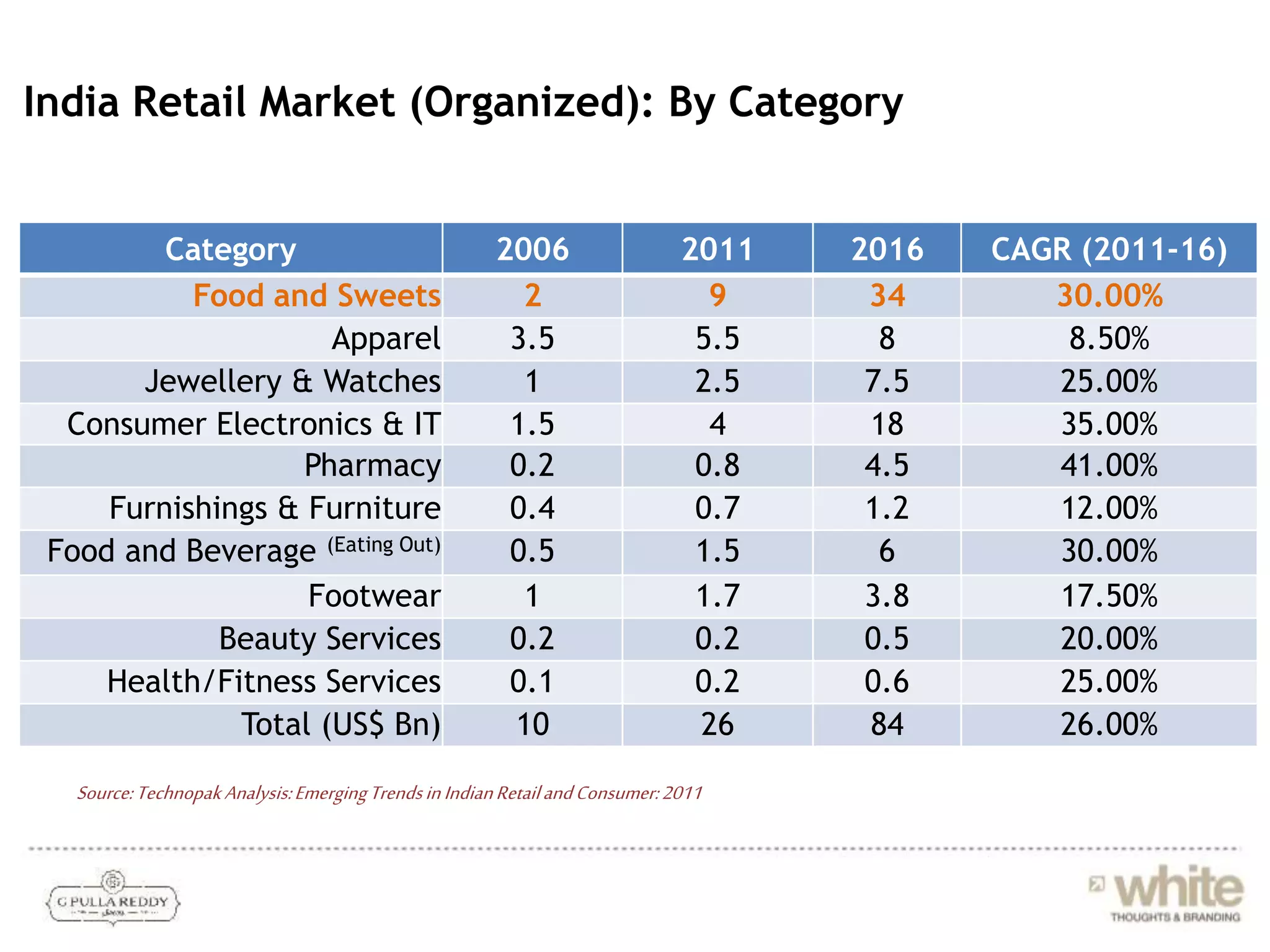

The document summarizes research on the Indian sweet industry and a survey of Pullareddy Sweets' competitors. Some key findings include:

- The Indian sweet market is valued at $664 million and growing at 10% annually. Hyderabad ranks 7th in India for sweet consumption.

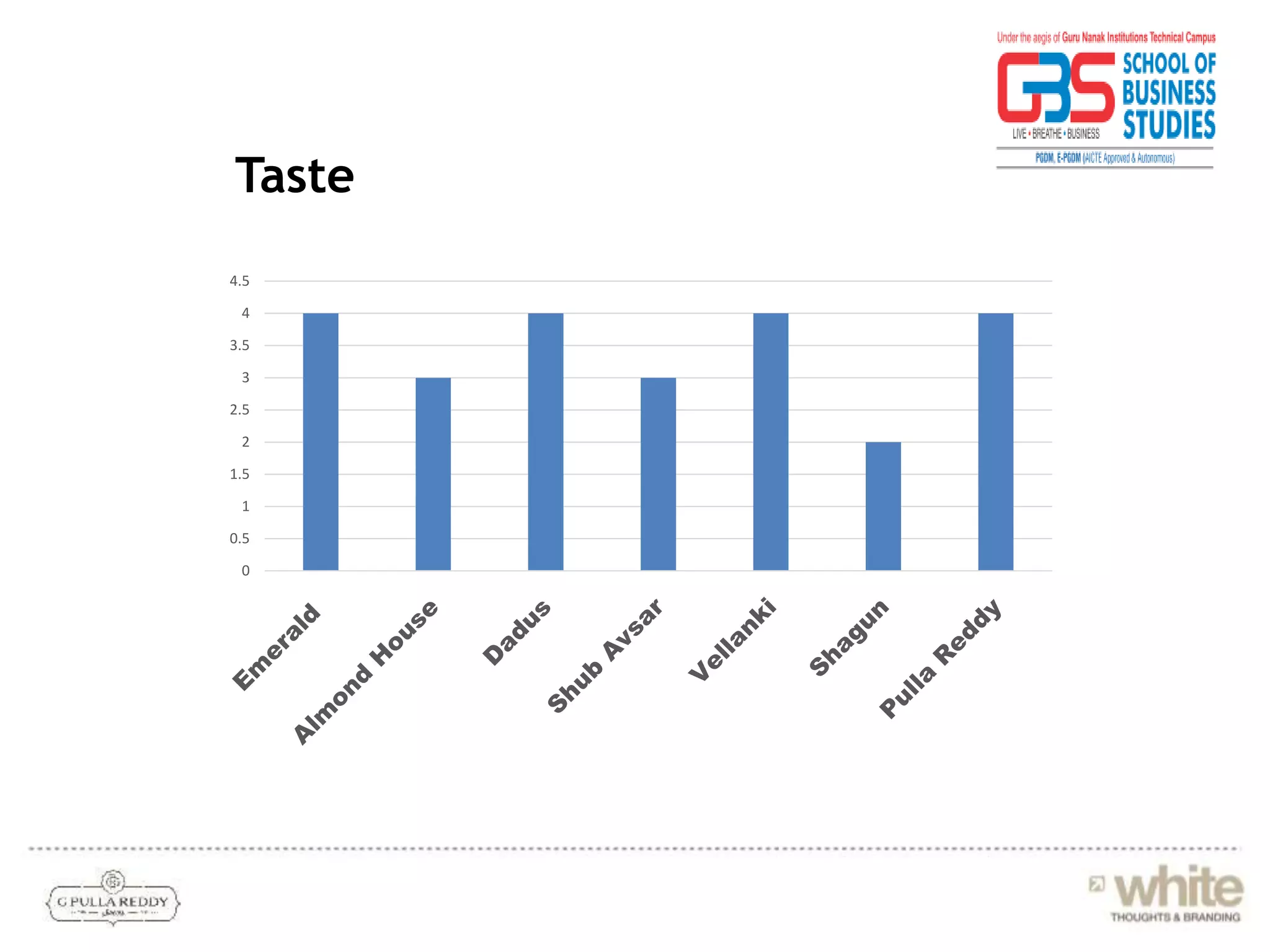

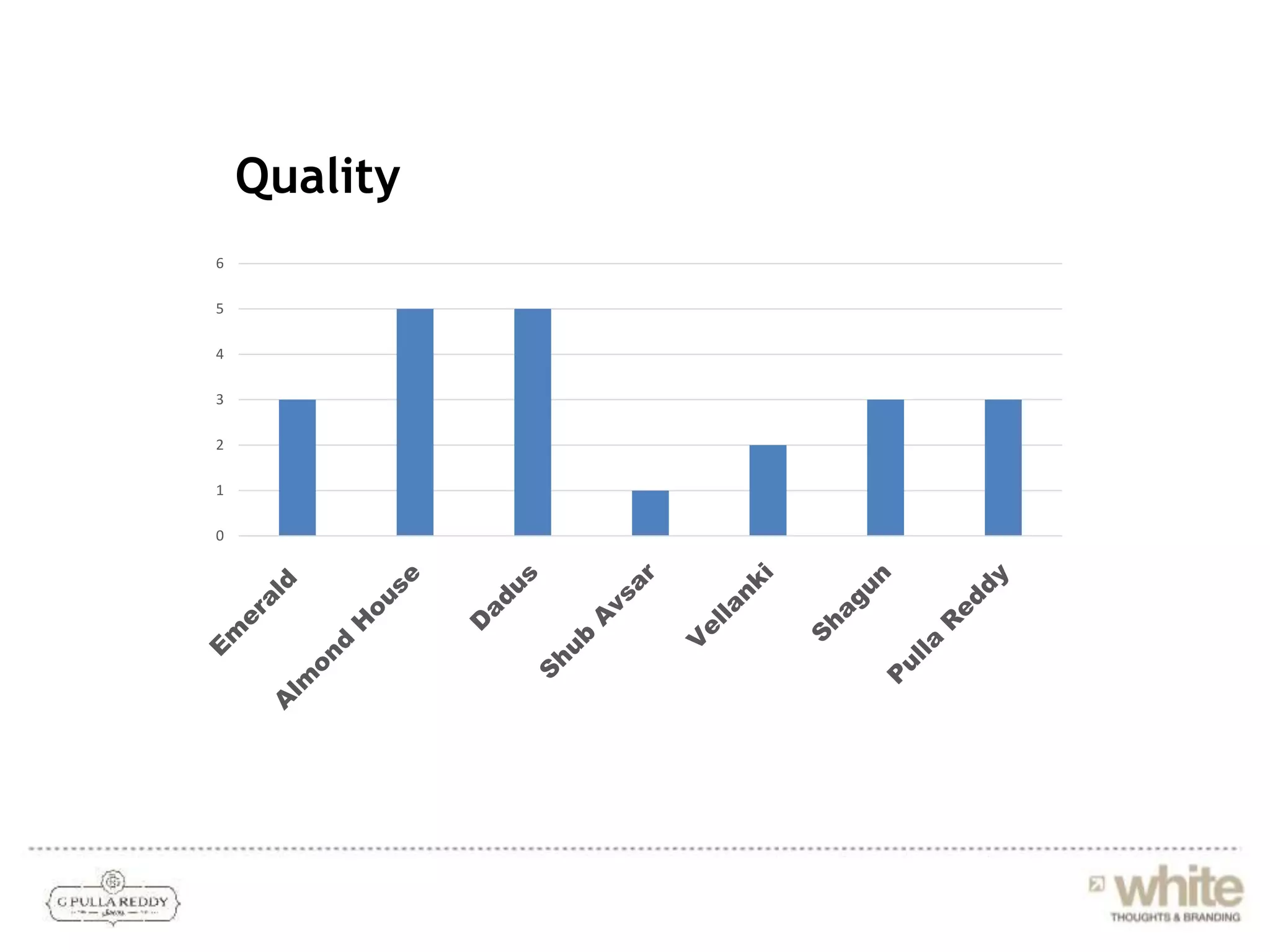

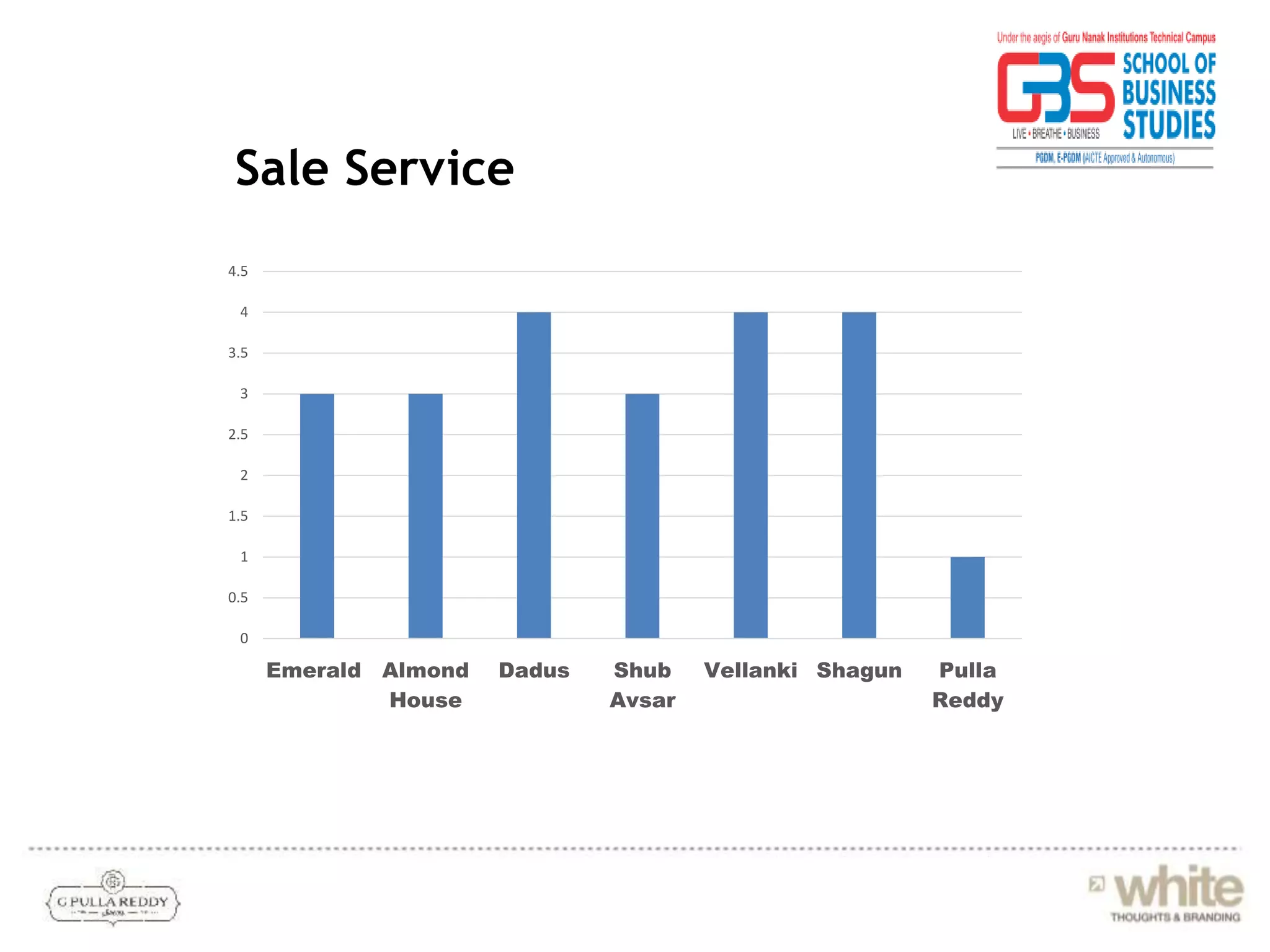

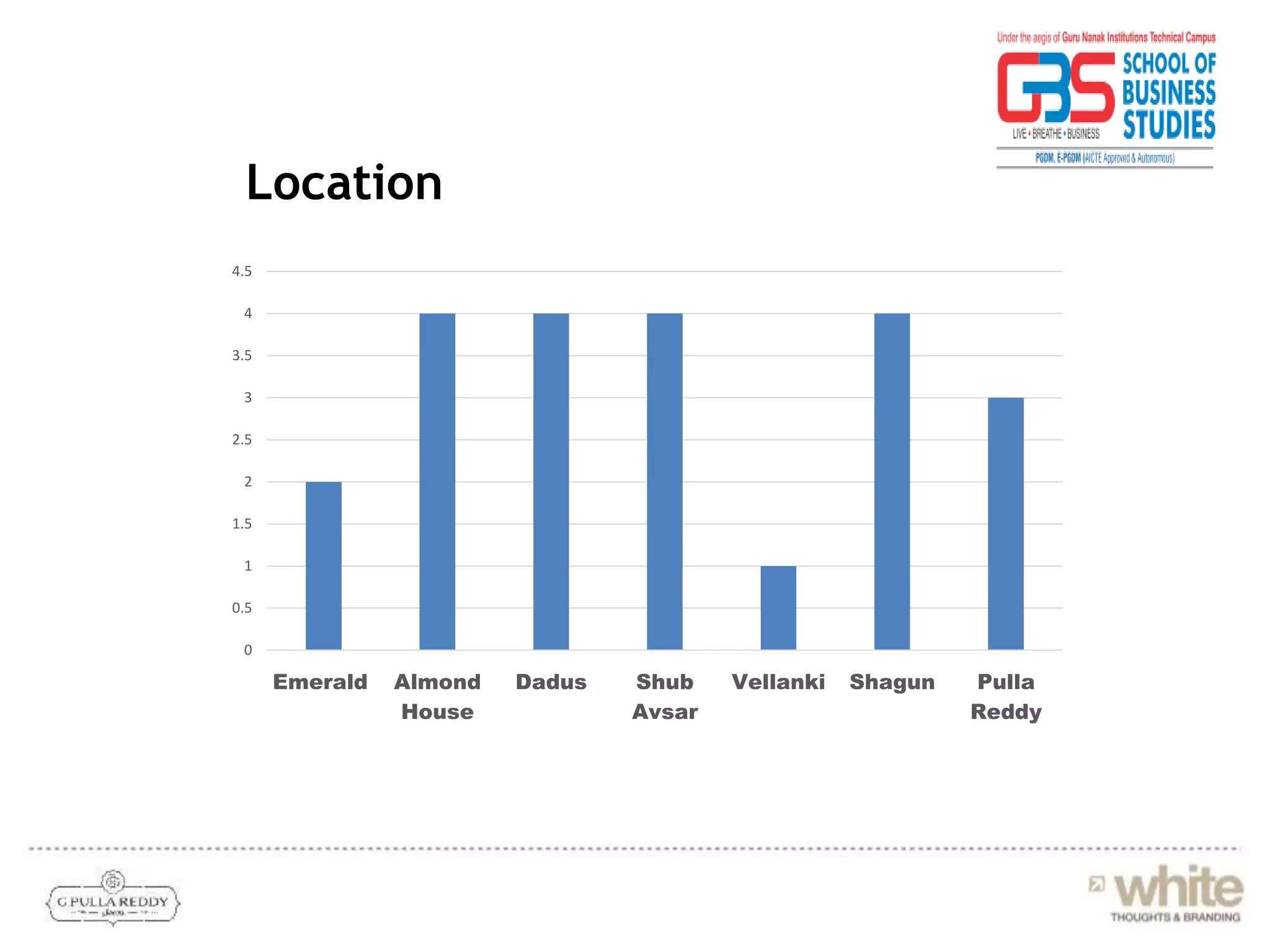

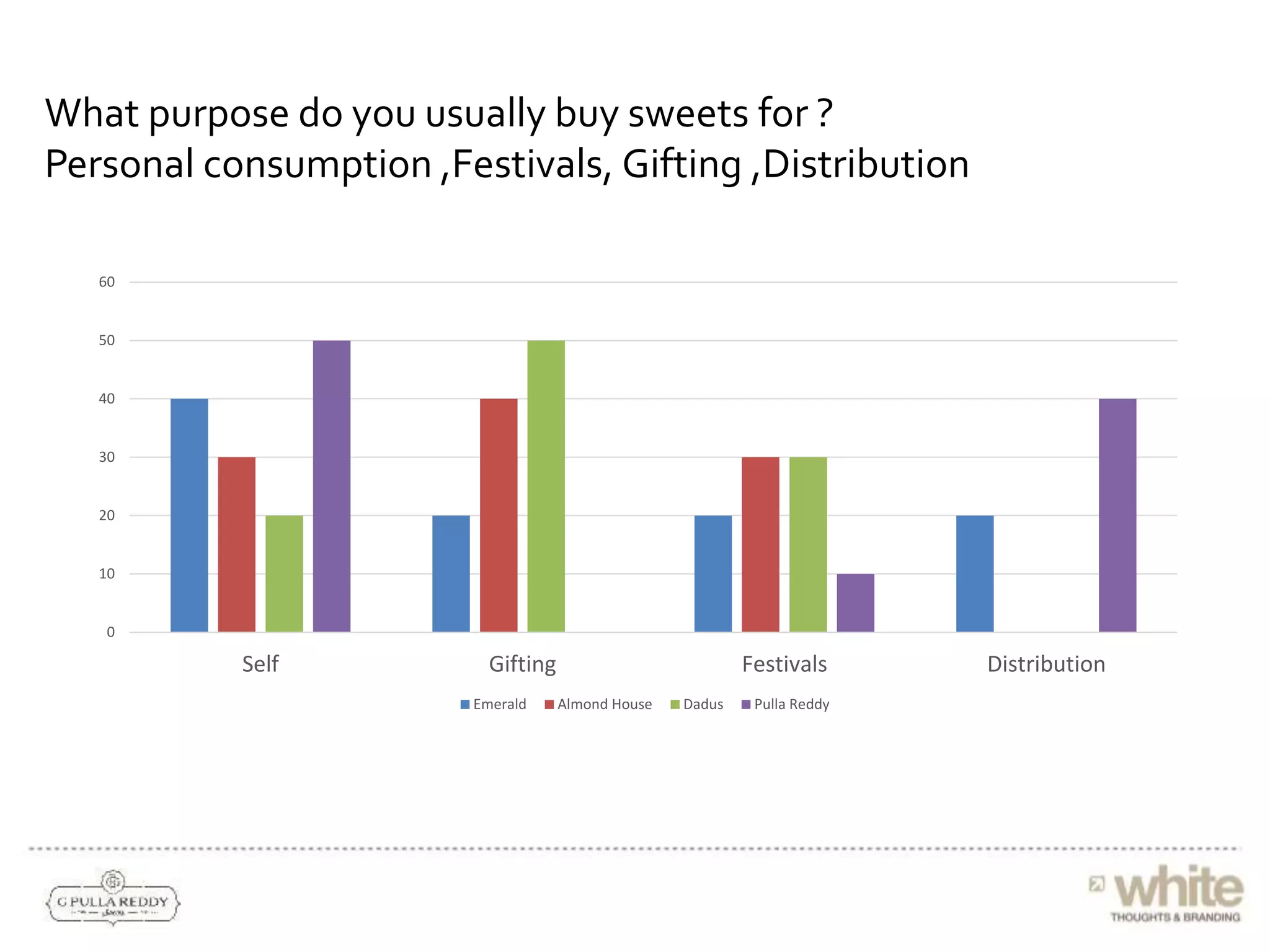

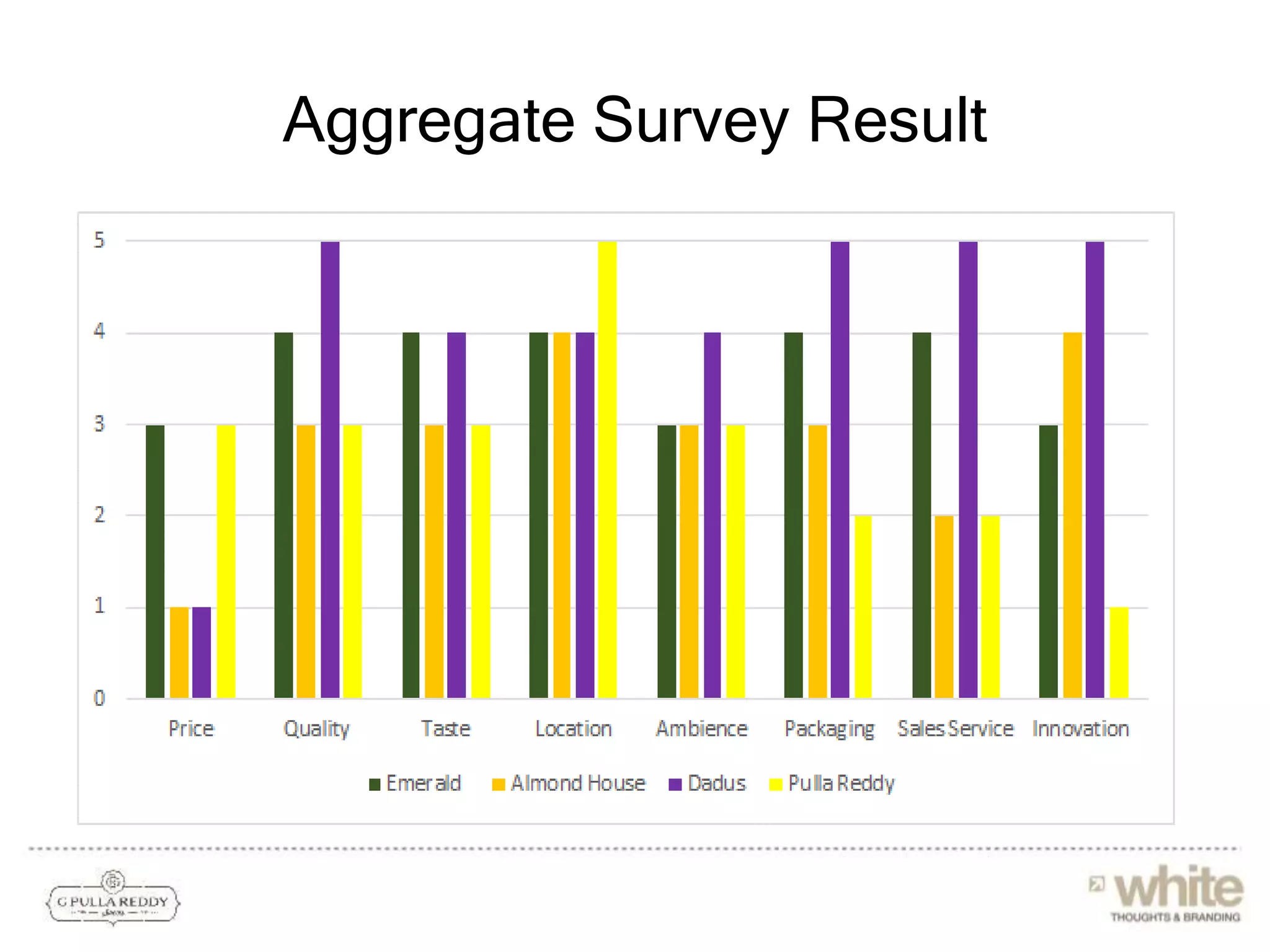

- The survey compared Pullareddy Sweets to competitors on price, taste, quality, service, and more. It found Pullareddy rated lowest on taste and was least recommended.

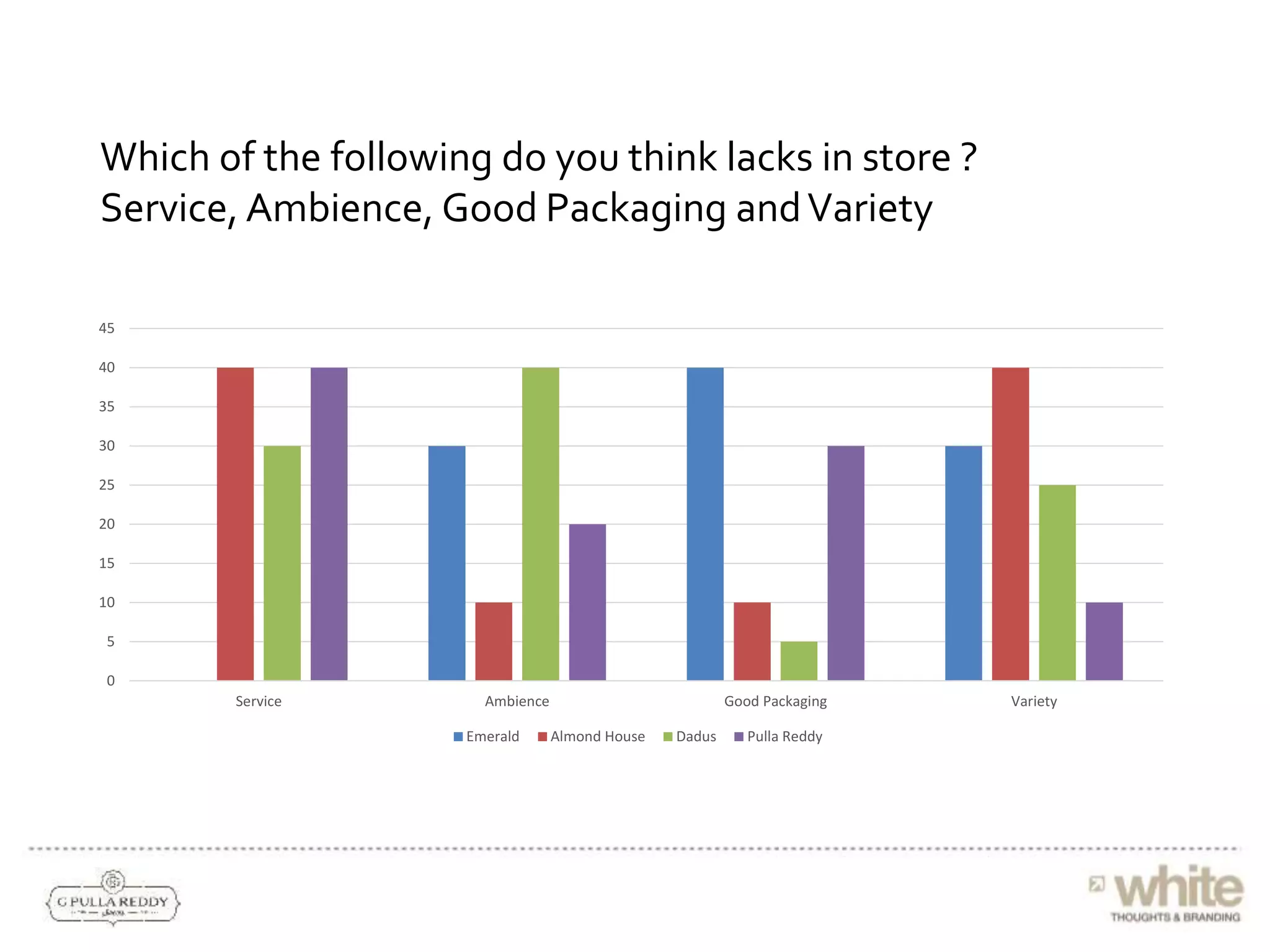

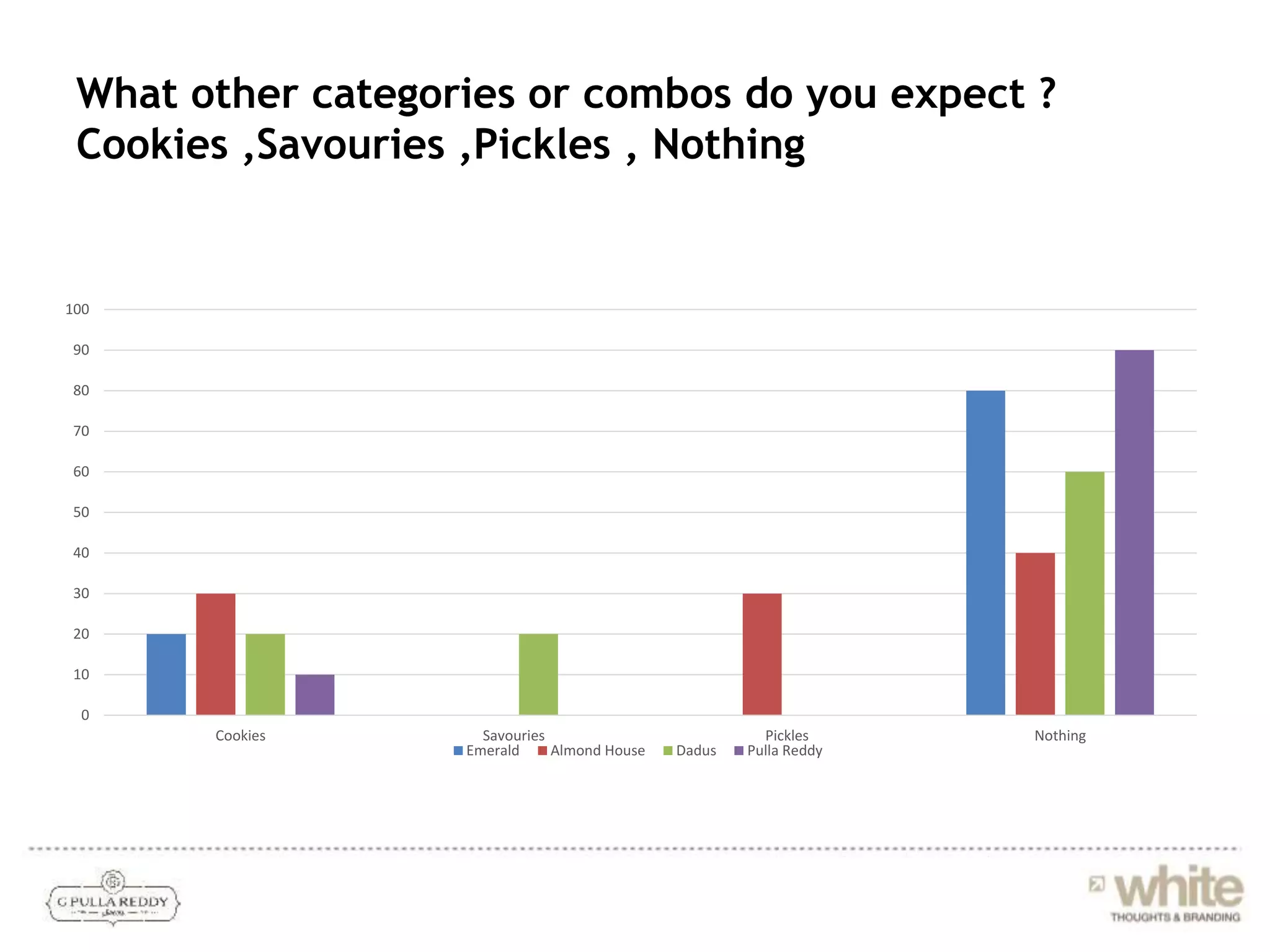

- Customers said competitors had better service, packaging, and variety. Younger generations were not a target, and products lacked North Indian appeal.

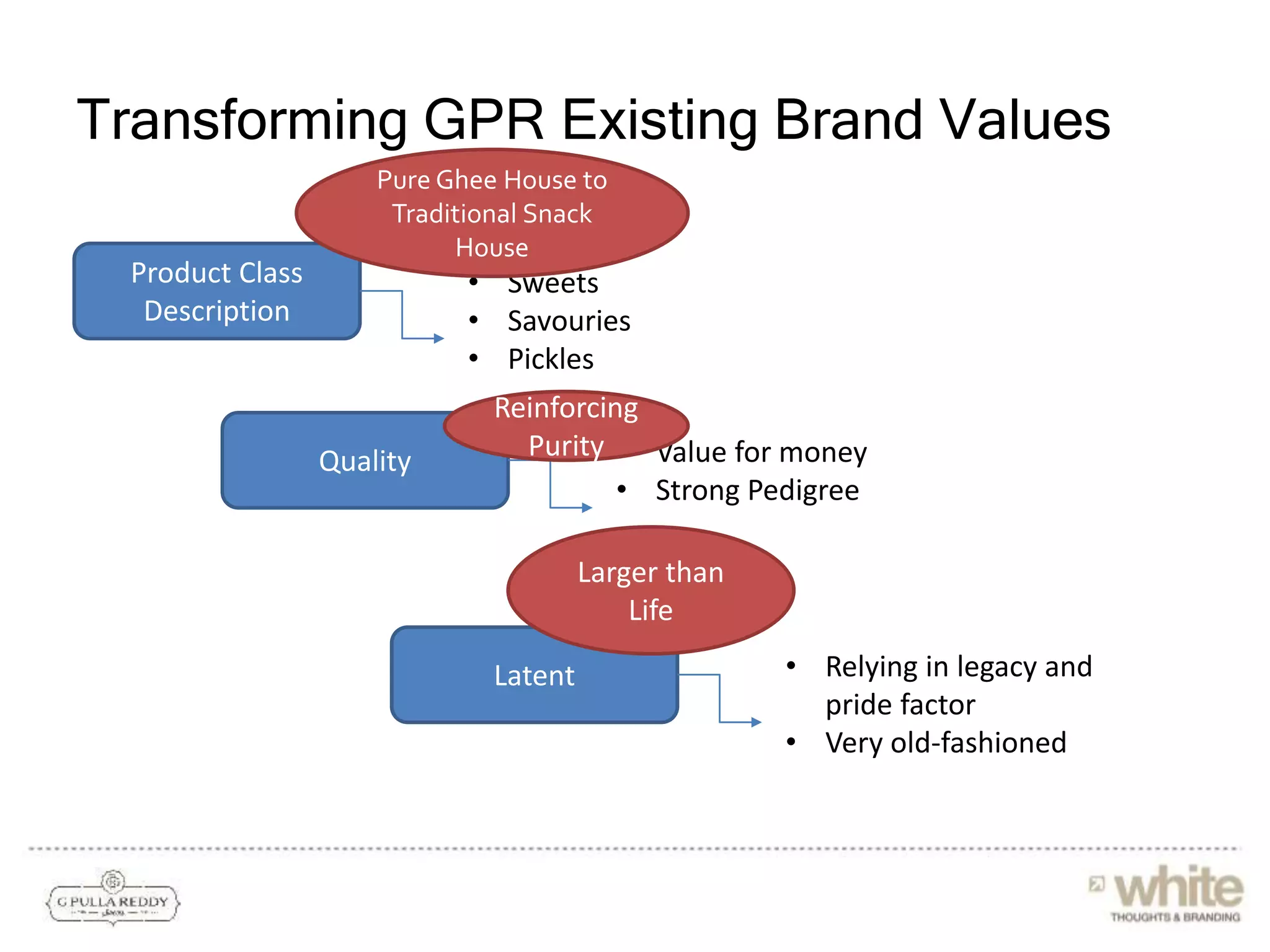

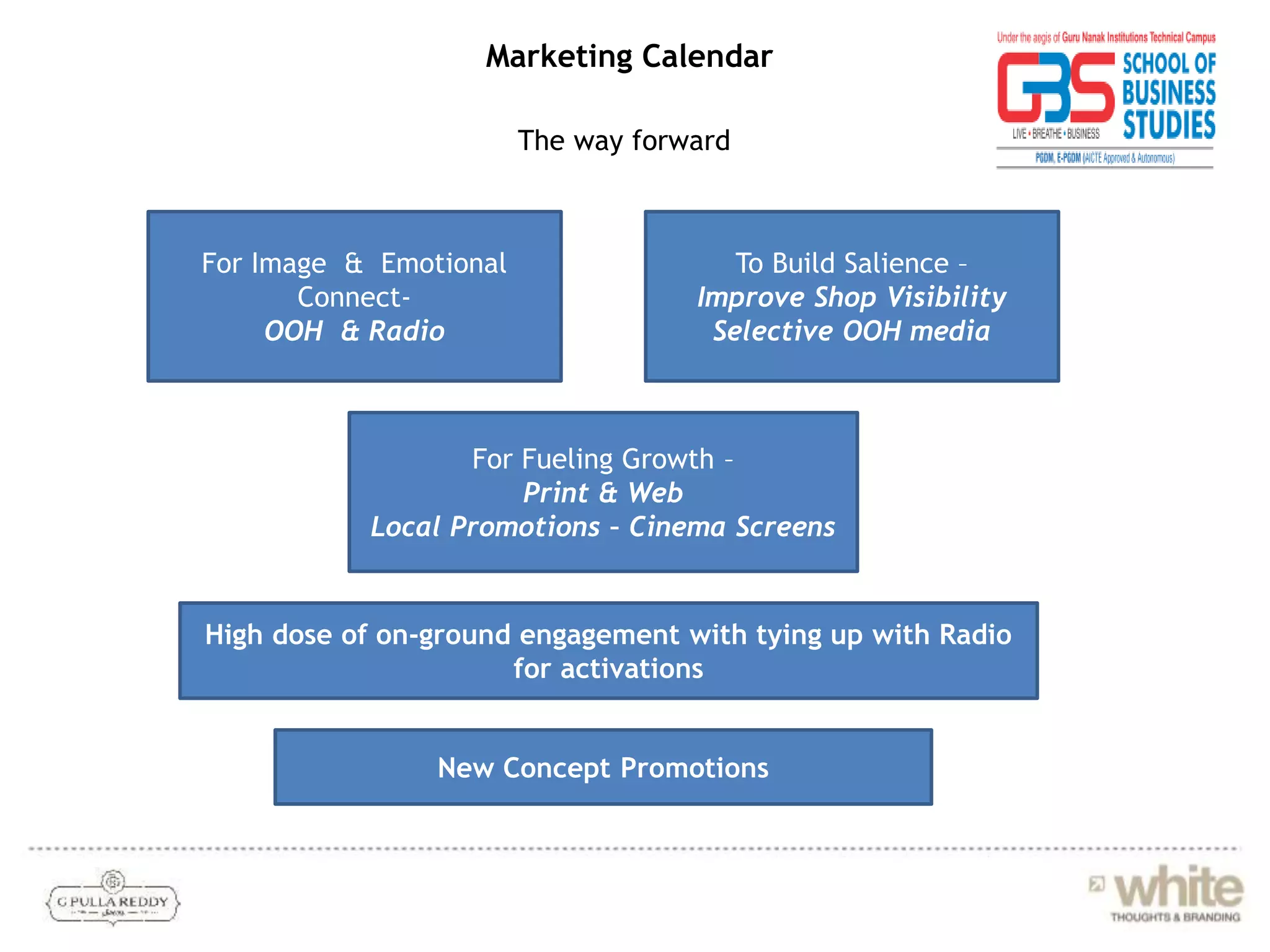

The report identifies problems and opportunities for Pullareddy Sweets to reinvent