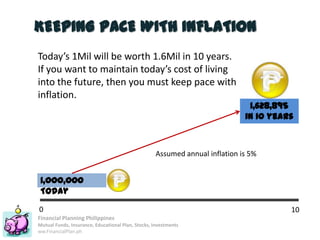

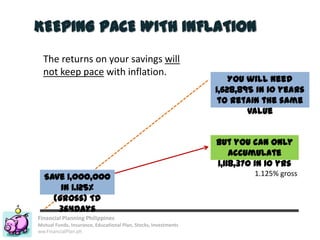

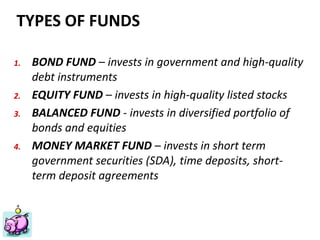

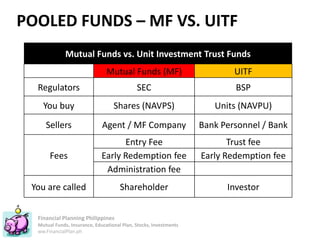

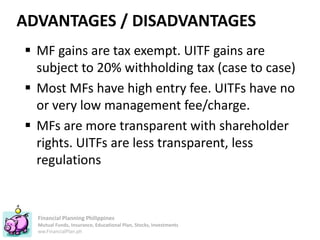

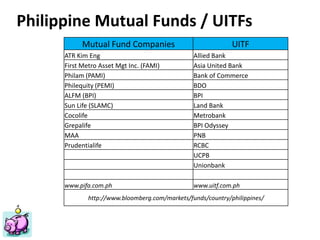

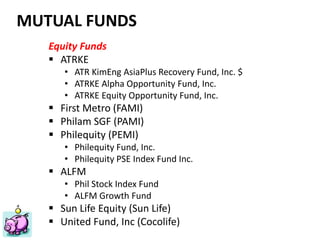

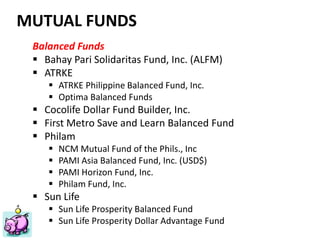

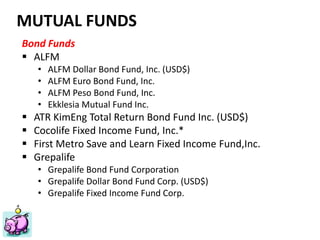

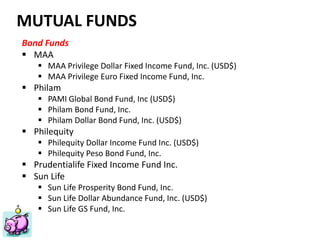

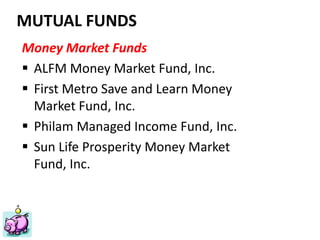

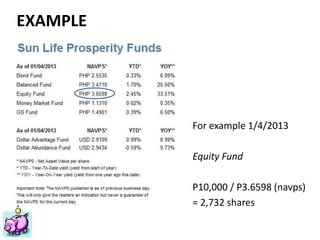

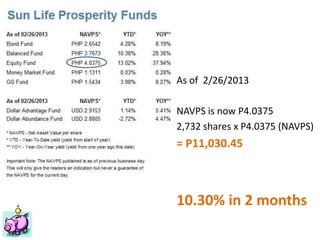

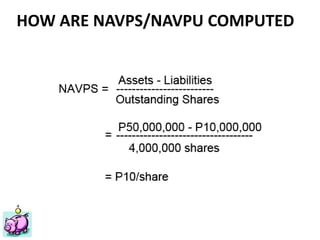

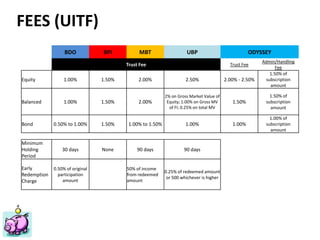

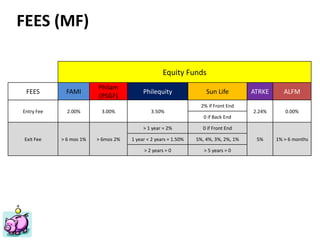

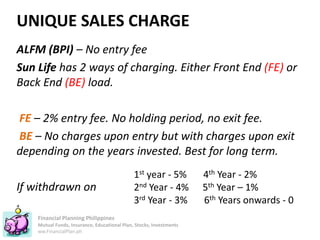

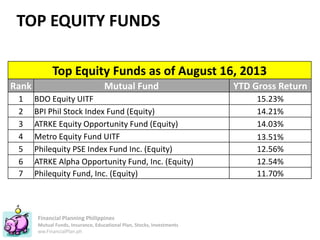

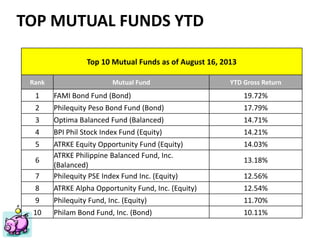

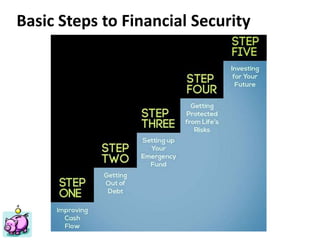

The document discusses investing in pooled funds like mutual funds and unit investment trust funds (UITFs) in the Philippines, outlining their advantages such as professional management, diversification, liquidity and potential for higher returns compared to traditional savings instruments. Key details covered include types of mutual funds and UITFs, how they are structured differently, common fees and charges involved, and examples of calculating investment returns.