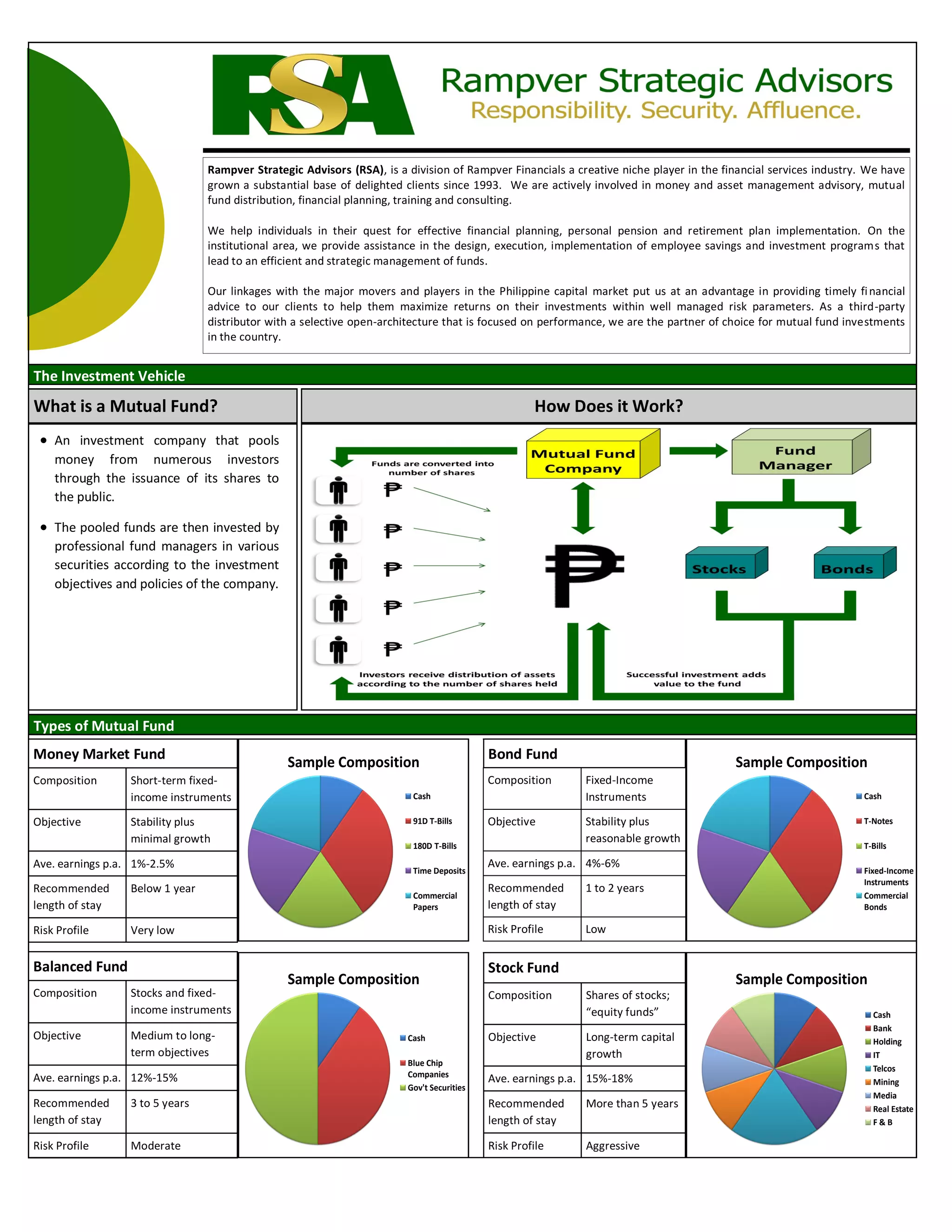

Rampver Strategic Advisors is a division of Rampver Financials that provides money and asset management, mutual fund distribution, financial planning, and consulting services. It helps both individuals and institutions with financial planning, retirement plans, and efficient management of investment programs. As a third-party mutual fund distributor with a focus on performance, Rampver is a partner of choice for mutual fund investments in the Philippines.