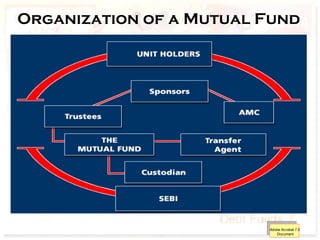

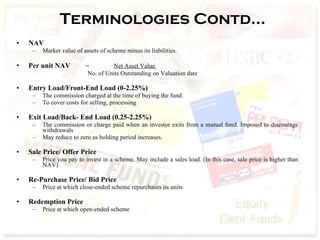

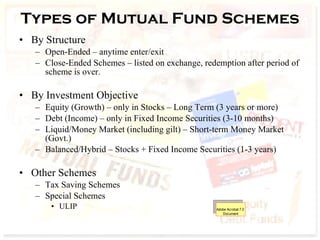

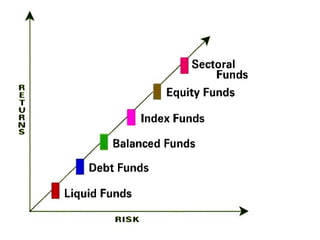

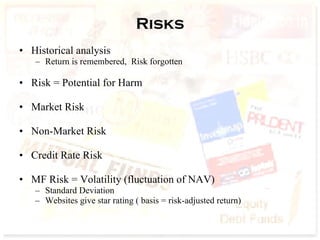

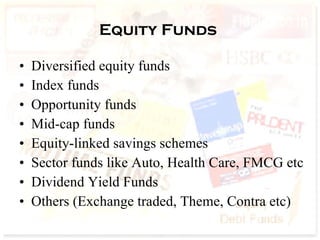

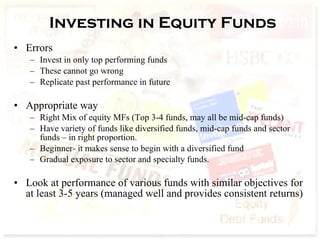

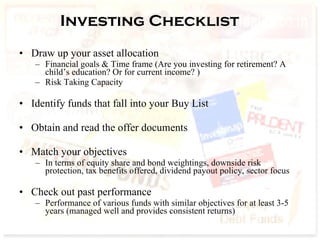

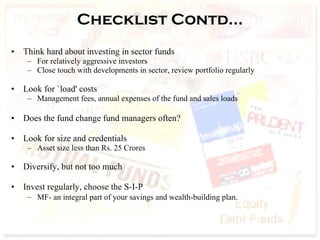

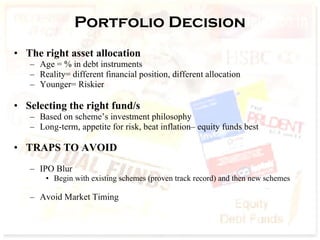

Mutual funds allow investors to pool their money together for investment purposes. The key advantages are professional management, diversification, flexibility, low costs, and transparency. Regulations in India are governed by SEBI and funds are organized as trusts. Terminology includes asset allocation, fund manager, NAV, entry/exit loads, and types of schemes such as equity, debt, balanced, tax saving, and other specialized funds. Investors must consider their goals, risk tolerance, fund performance and costs when selecting funds.