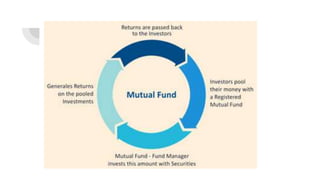

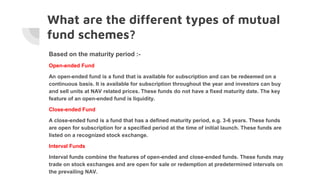

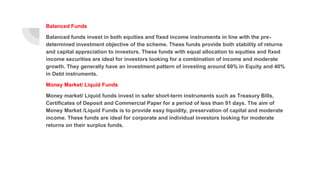

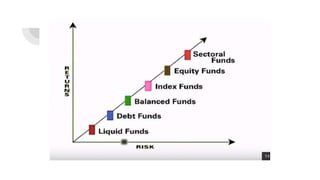

Mutual funds allow investors to pool their money and have it professionally managed across a variety of securities to achieve diversification and market returns. The Association of Mutual Funds in India regulates the industry and aims to develop ethical standards. Popular mutual fund investment options include systematic investment plans and different types of funds focused on objectives like income, growth, or balancing both. Investing in mutual funds provides benefits like professional management, diversification, liquidity, and lower costs compared to individual investing. However, there are also risks like potential loss of value and lack of control over the fund's portfolio. ULIPs combine life insurance and investment by allocating premiums to both.