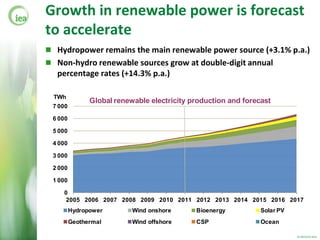

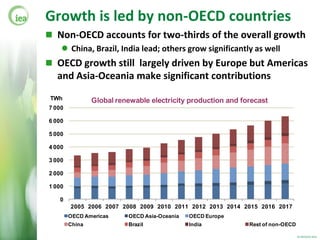

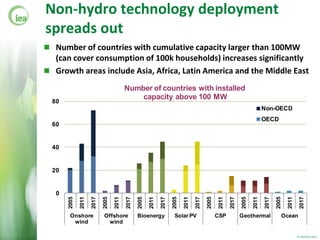

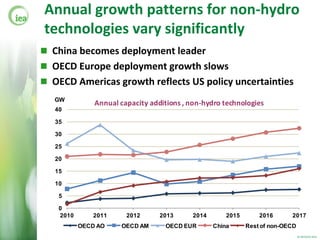

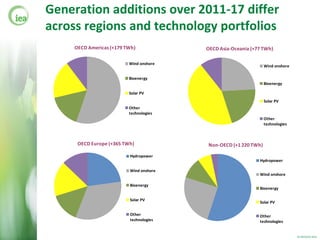

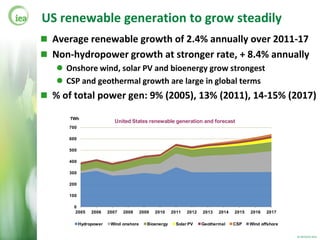

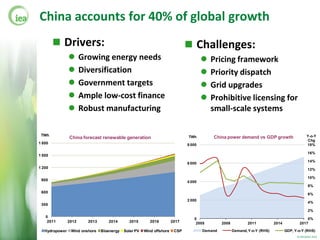

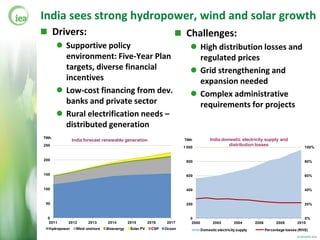

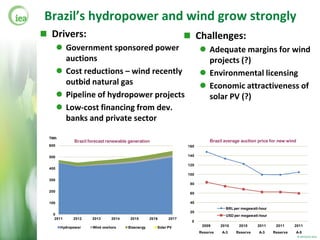

This document provides an overview and forecast of global renewable energy capacity and generation from 2011-2017. It finds that renewable power generation is projected to rise 40% over this period, led by strong growth in China, India, Brazil and other emerging markets. Renewable deployment is also expected to spread out geographically as the costs of some technologies become more competitive. Key renewable technologies like wind and solar PV are forecast to see double-digit annual growth rates, while total renewable capacity additions are expected to accelerate compared to the previous period.