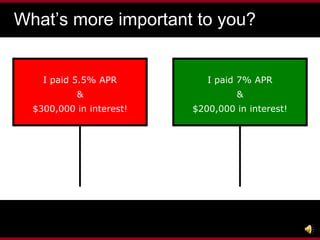

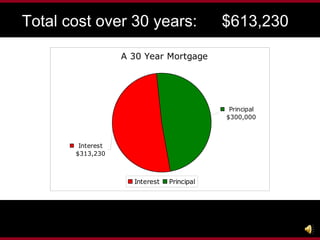

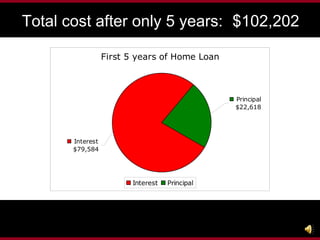

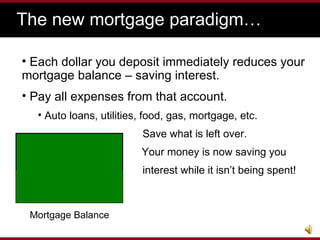

The document discusses strategies for paying off a mortgage faster, including bi-weekly payments and extra principal payments. It introduces a new paradigm where depositing money reduces the mortgage balance instantly, thereby saving interest. The goal is to eliminate the home loan in half the time or less and save thousands without changing spending habits.

![How does it work? Eliminate your home loan in half the time or less. Save thousands in interest. With no change to earning or spending. Find out today if you qualify – email us [email_address] Is it right for you? the best home loan available](https://image.slidesharecdn.com/mortgage-12675311608136-phpapp02/85/Mortgage-Analysis-10-320.jpg)