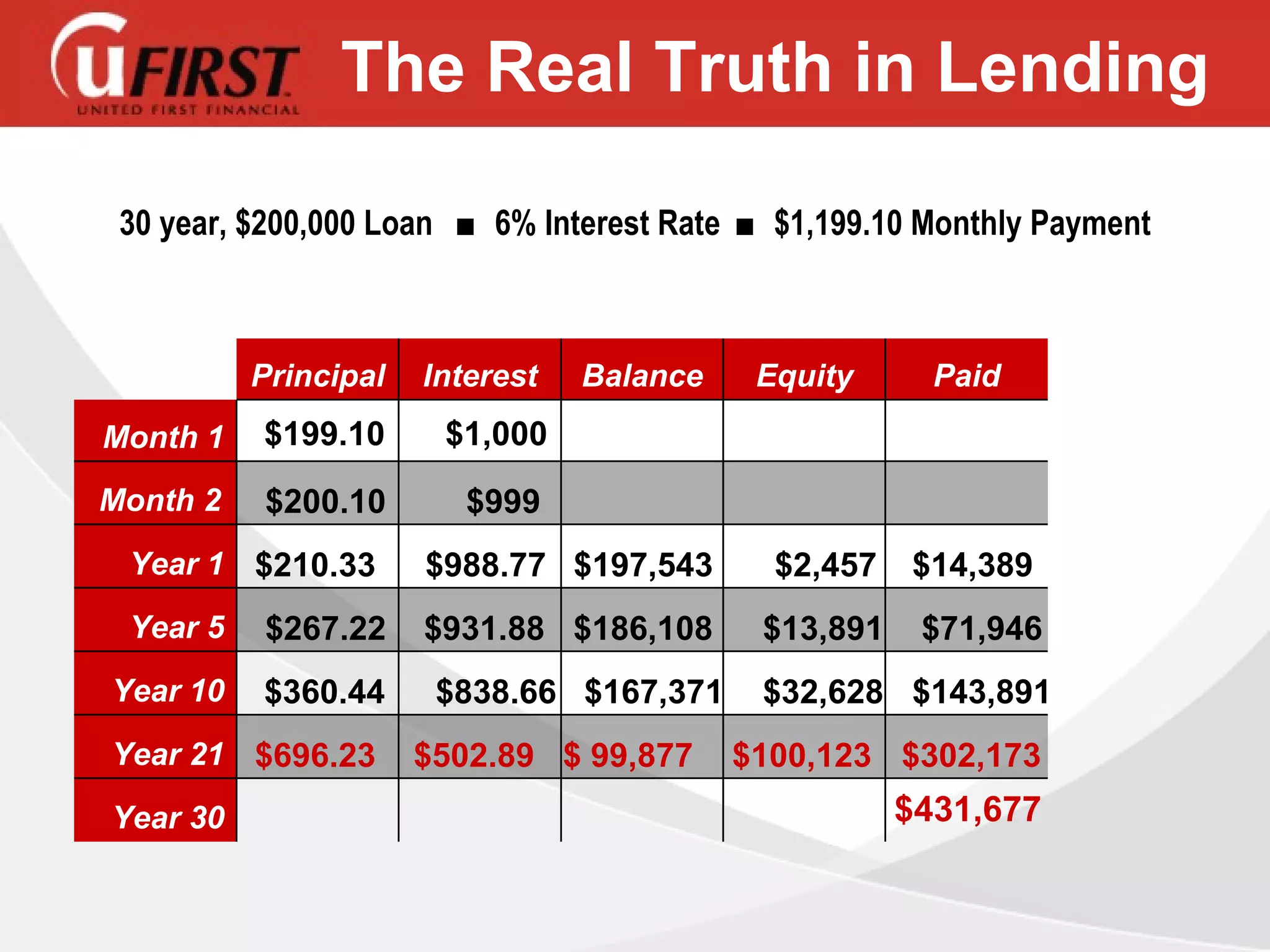

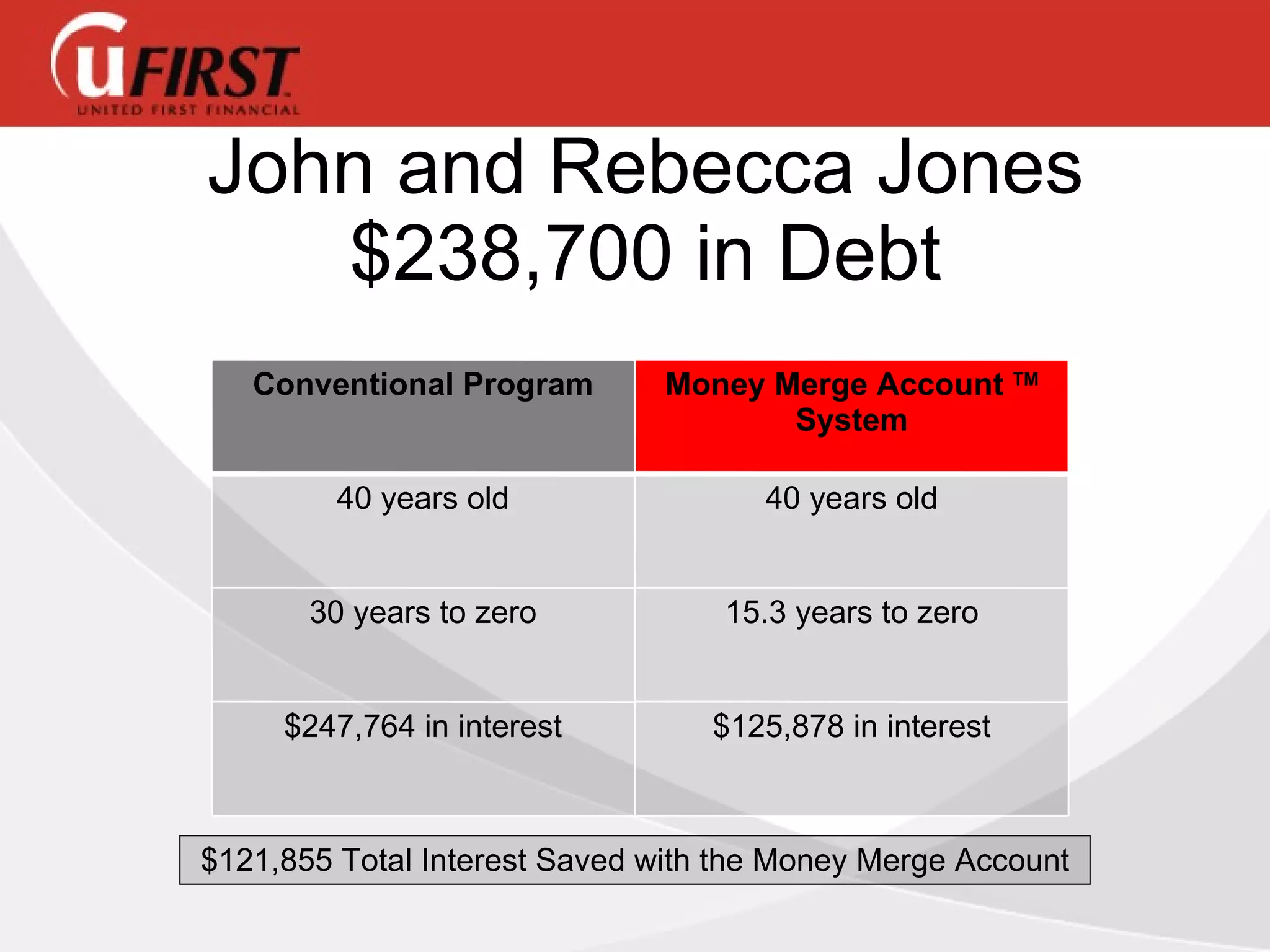

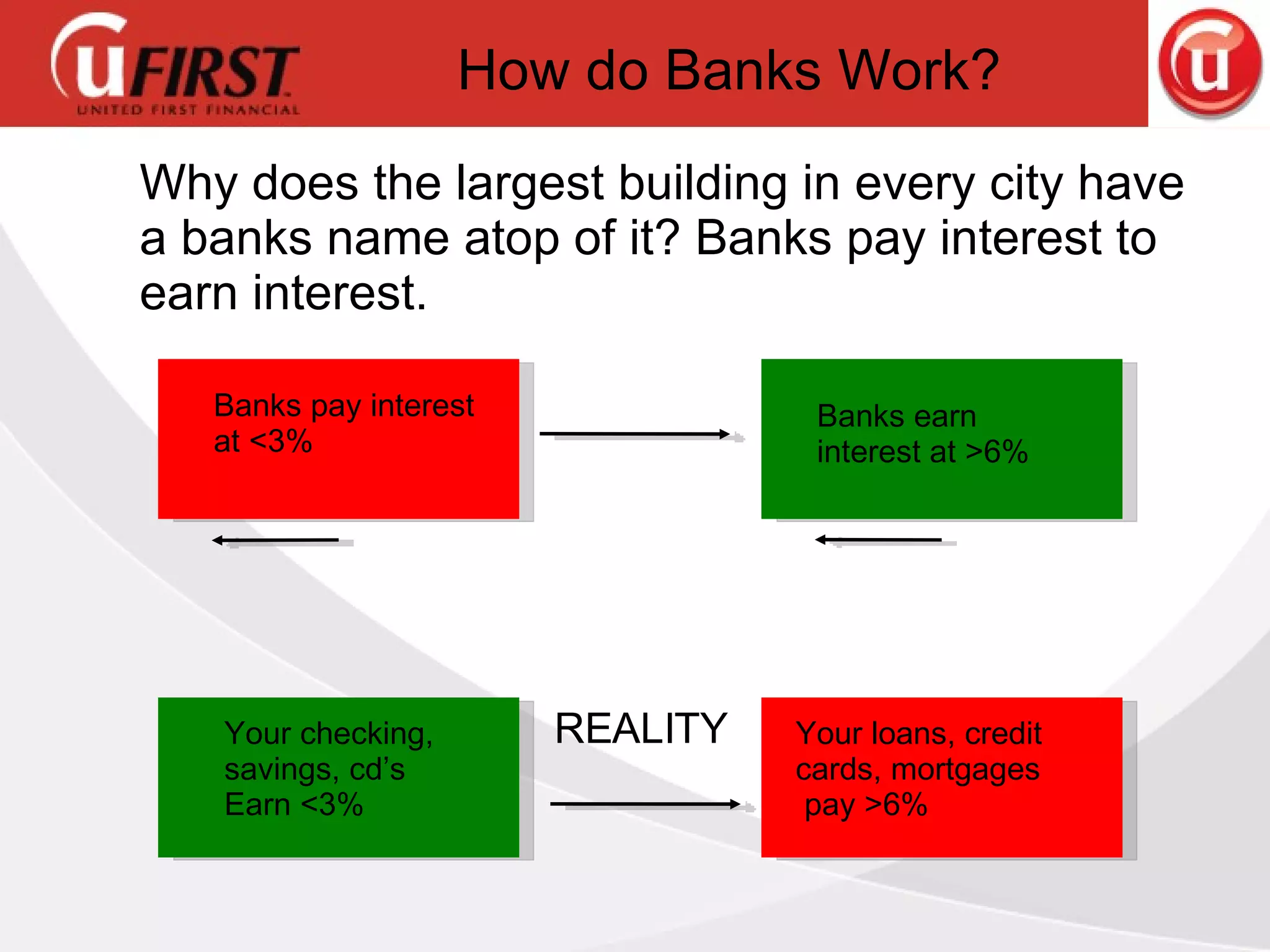

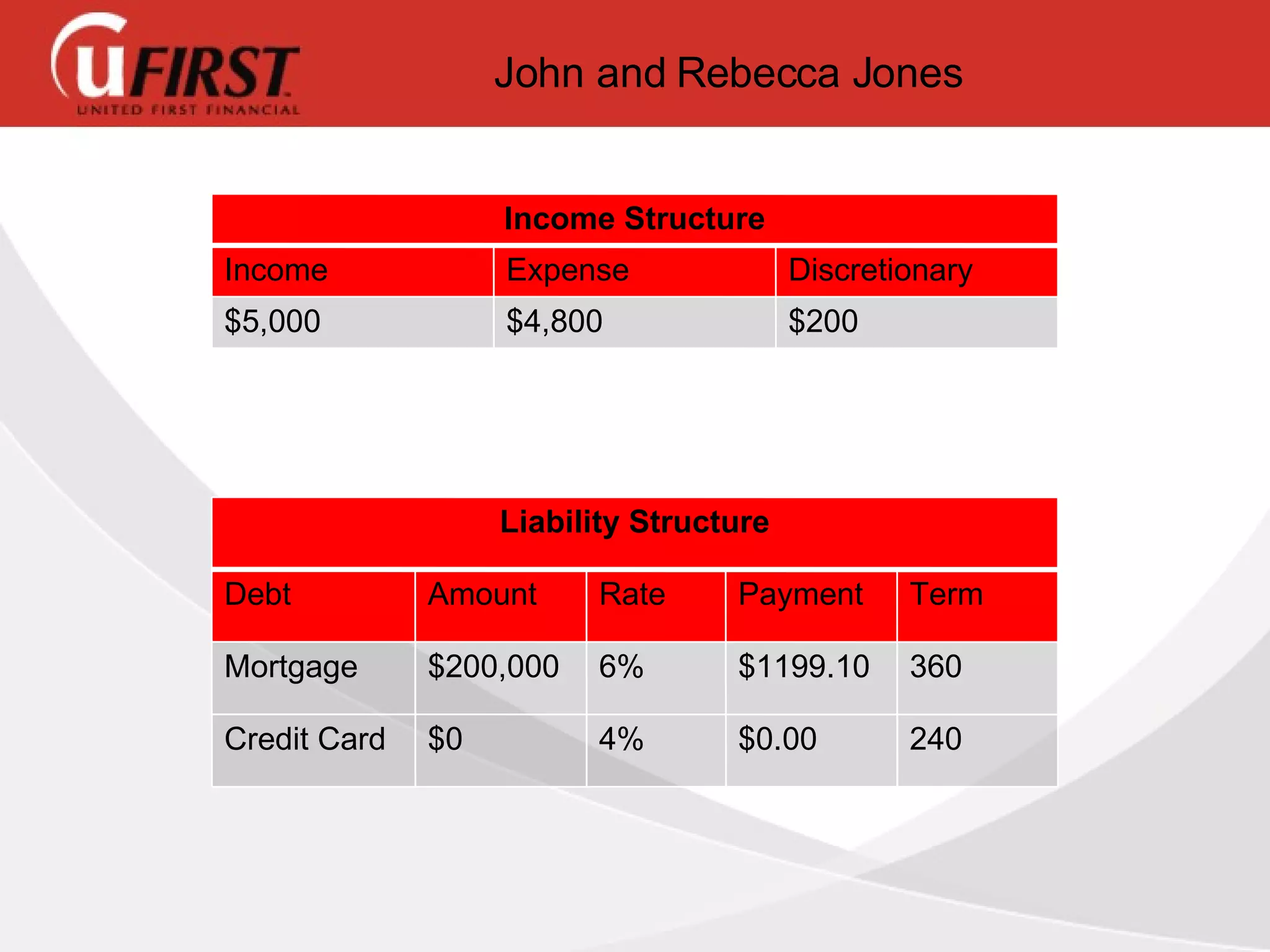

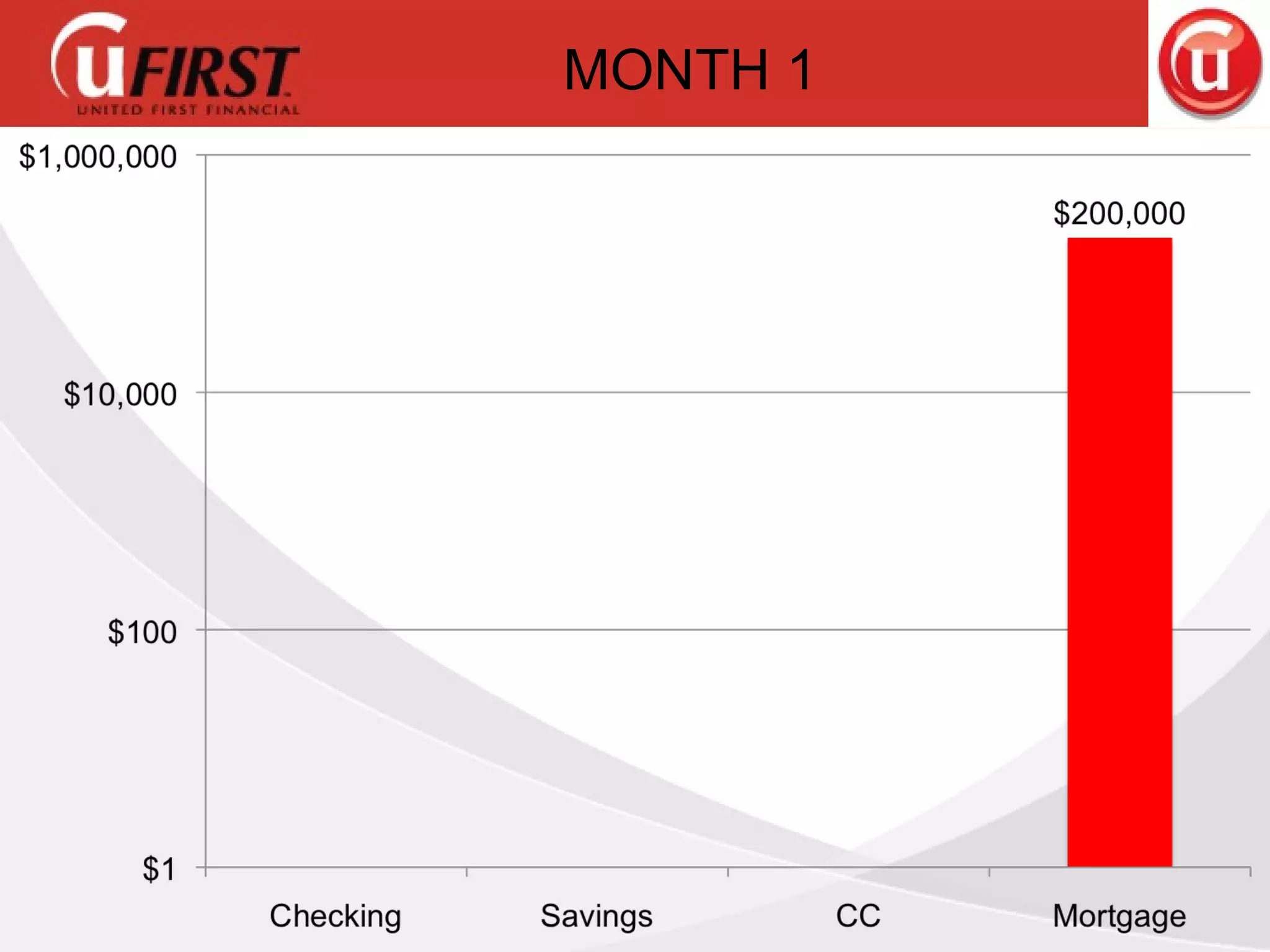

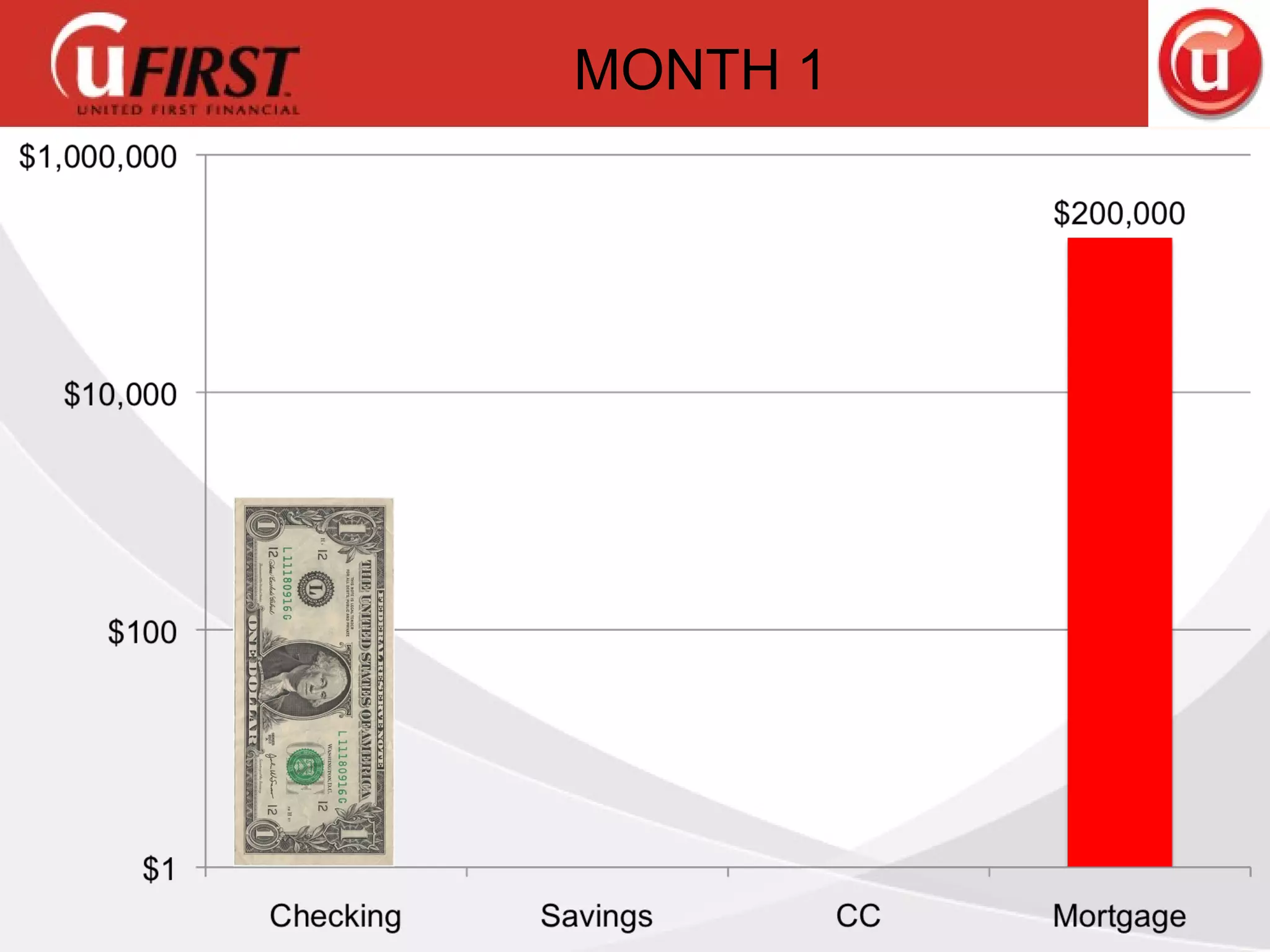

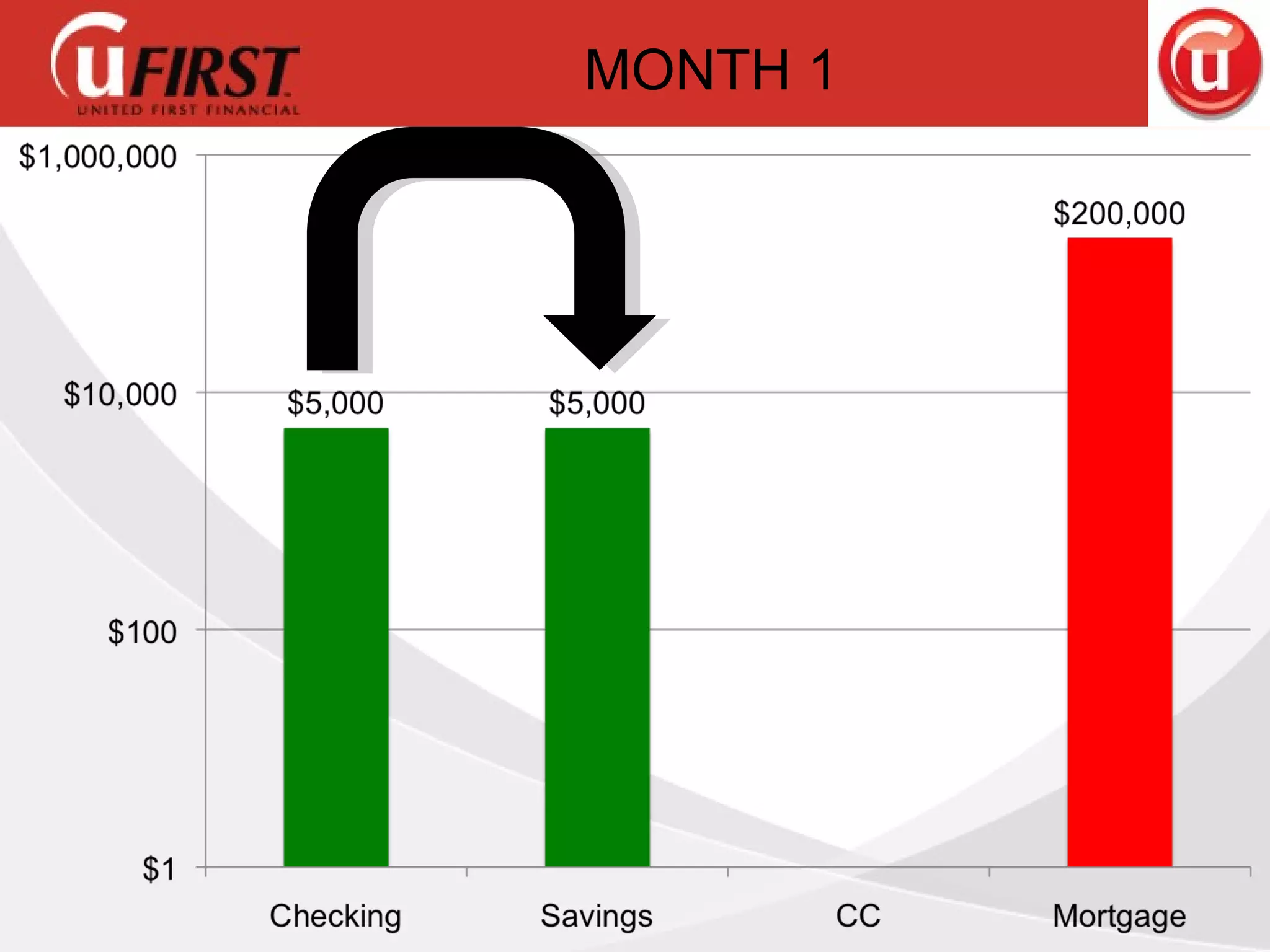

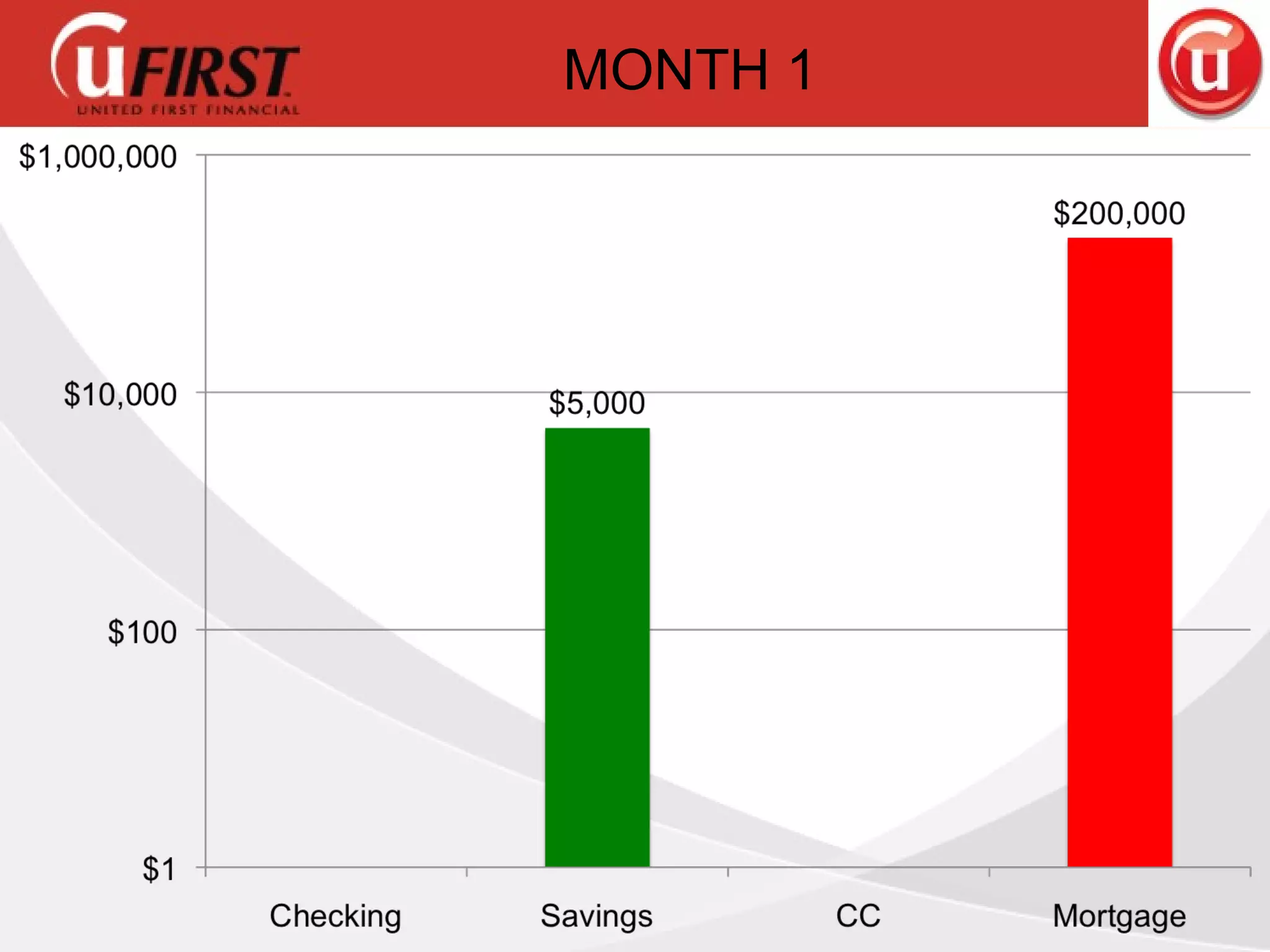

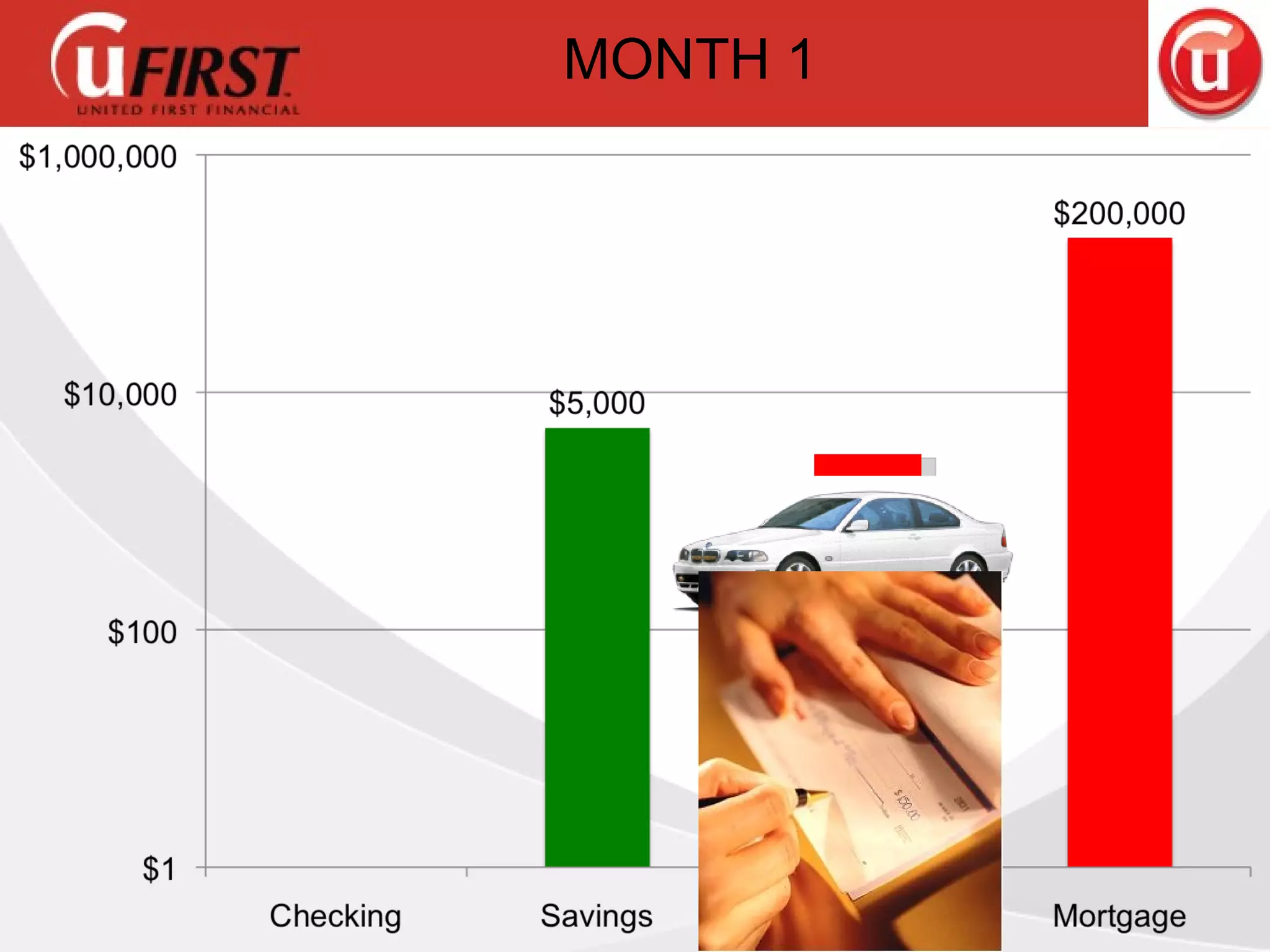

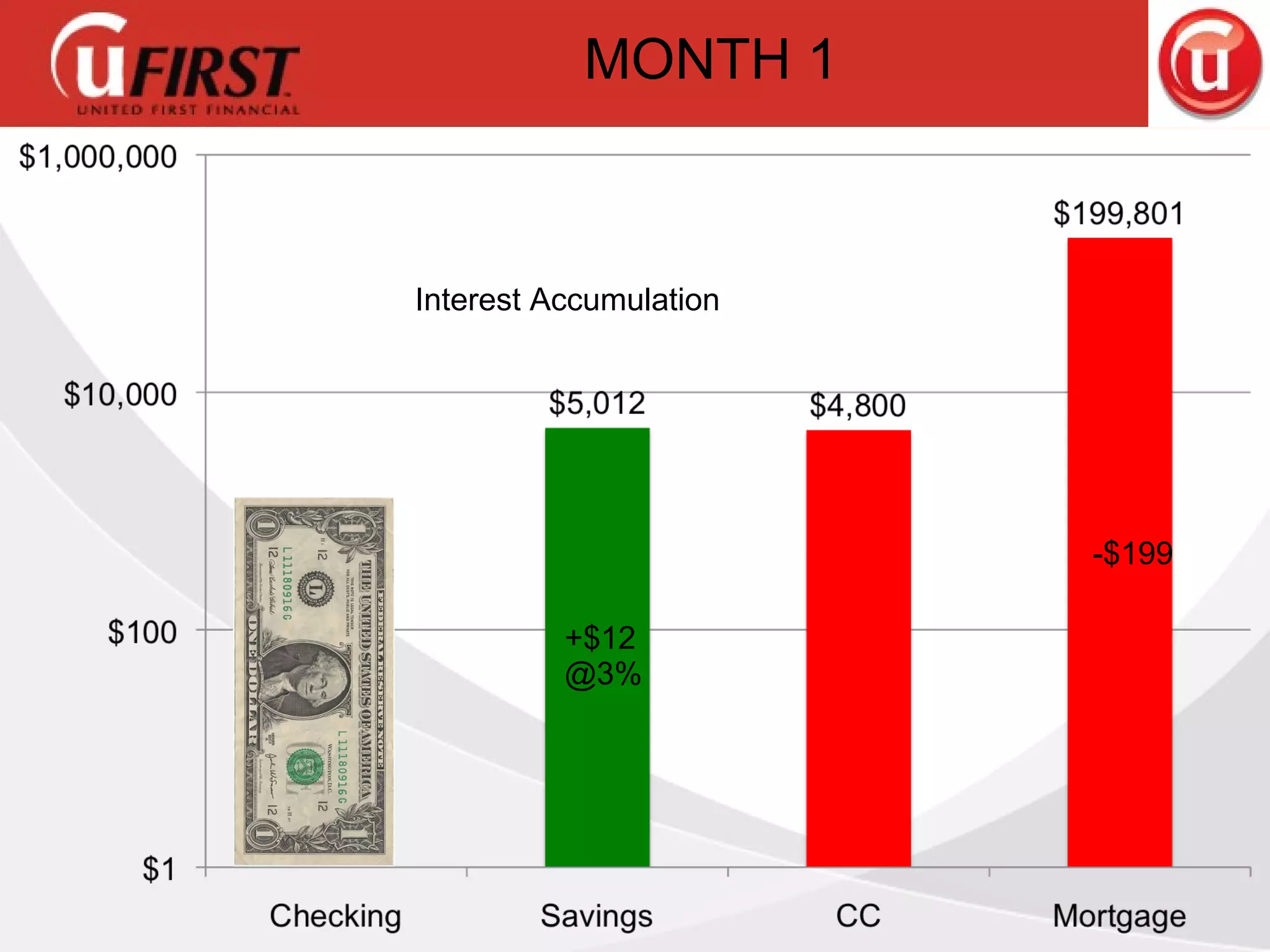

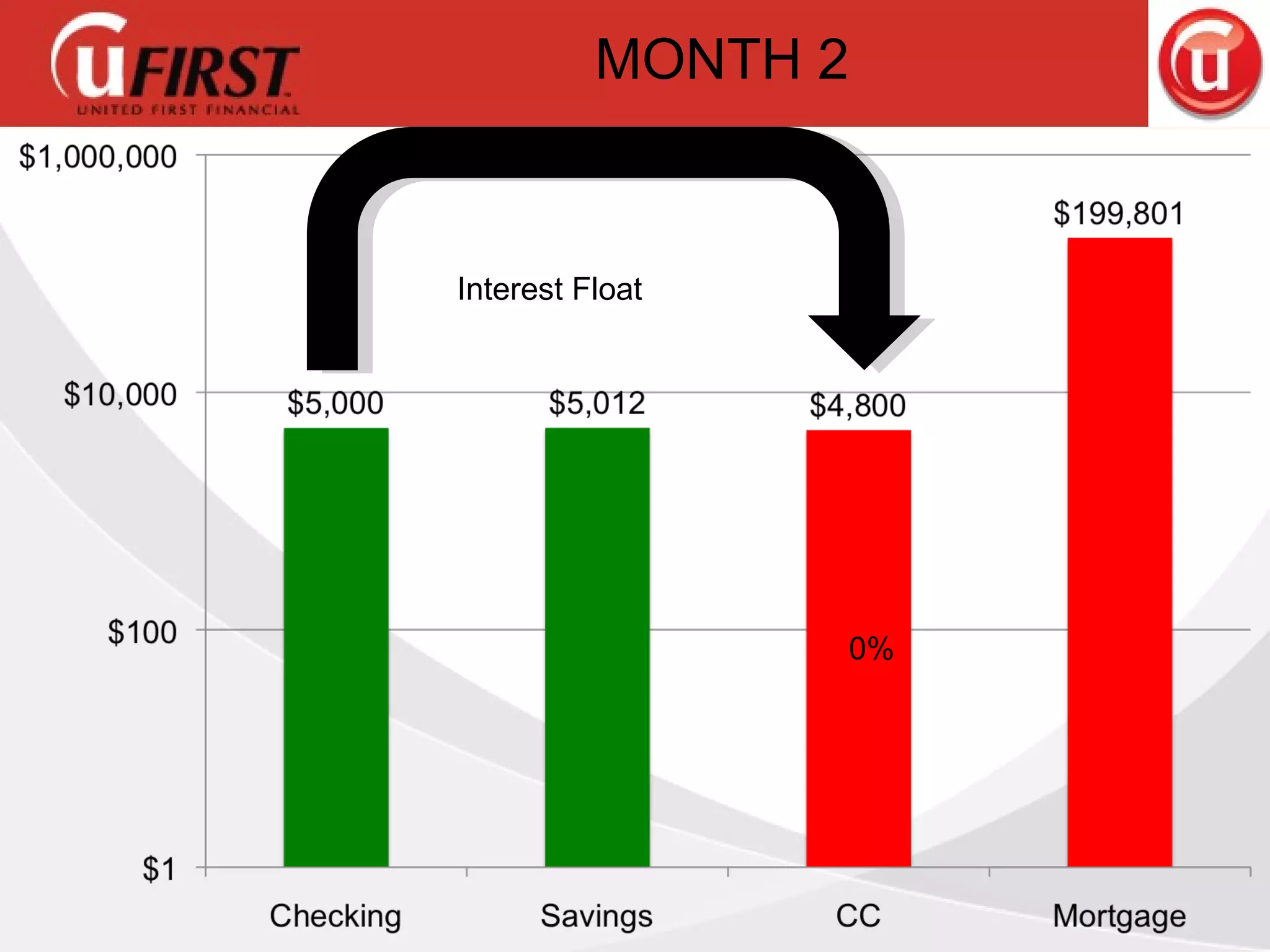

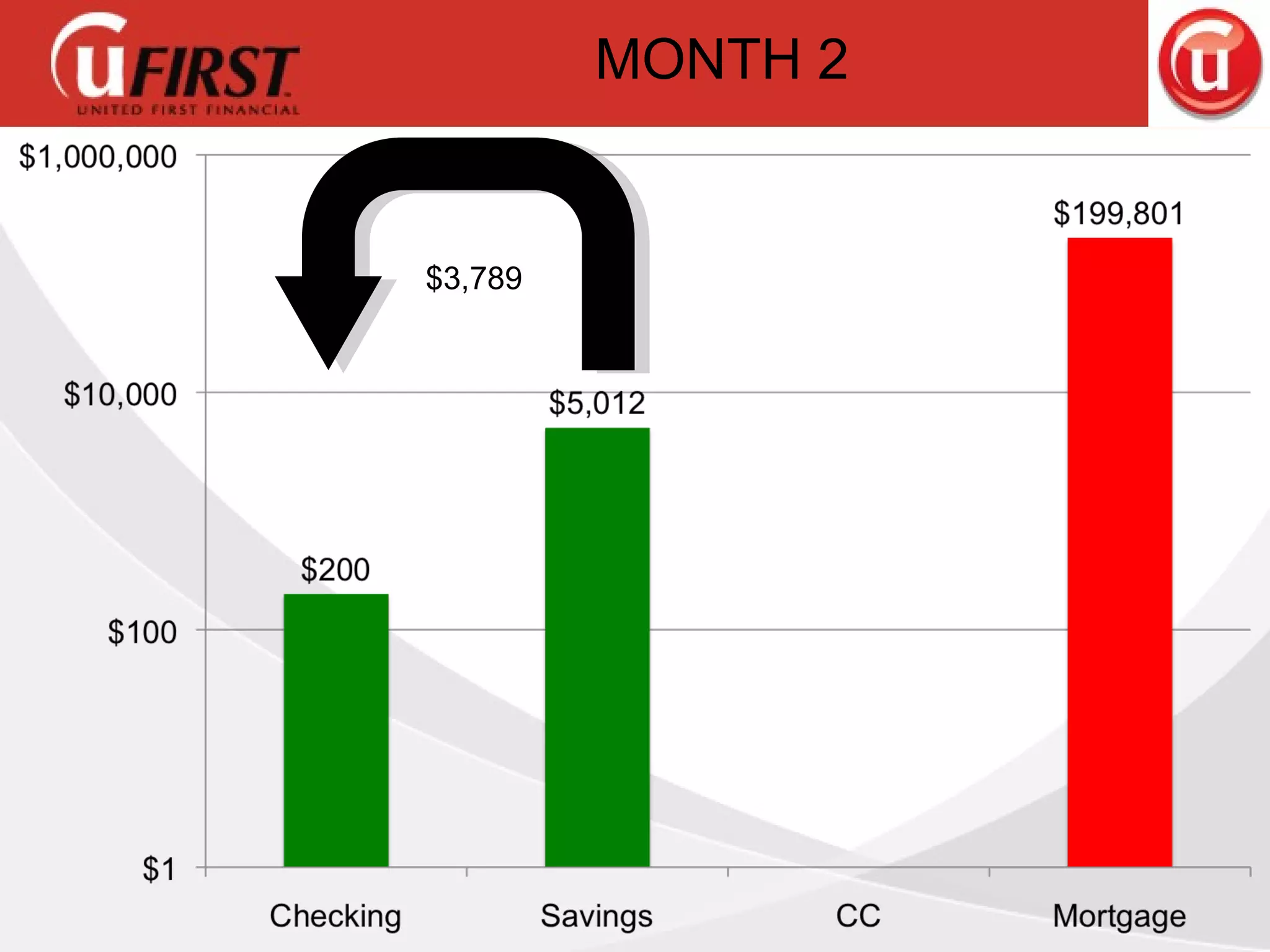

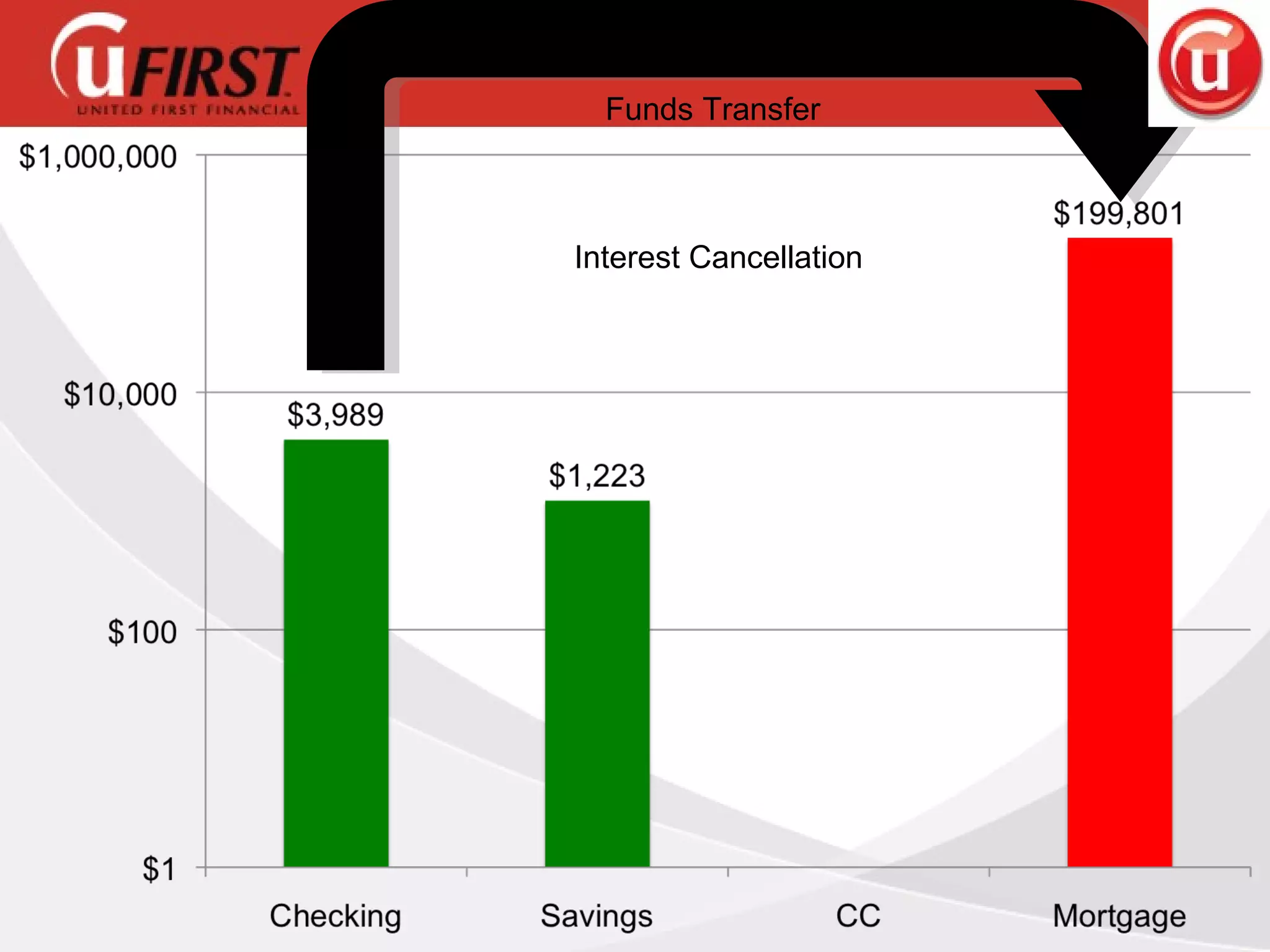

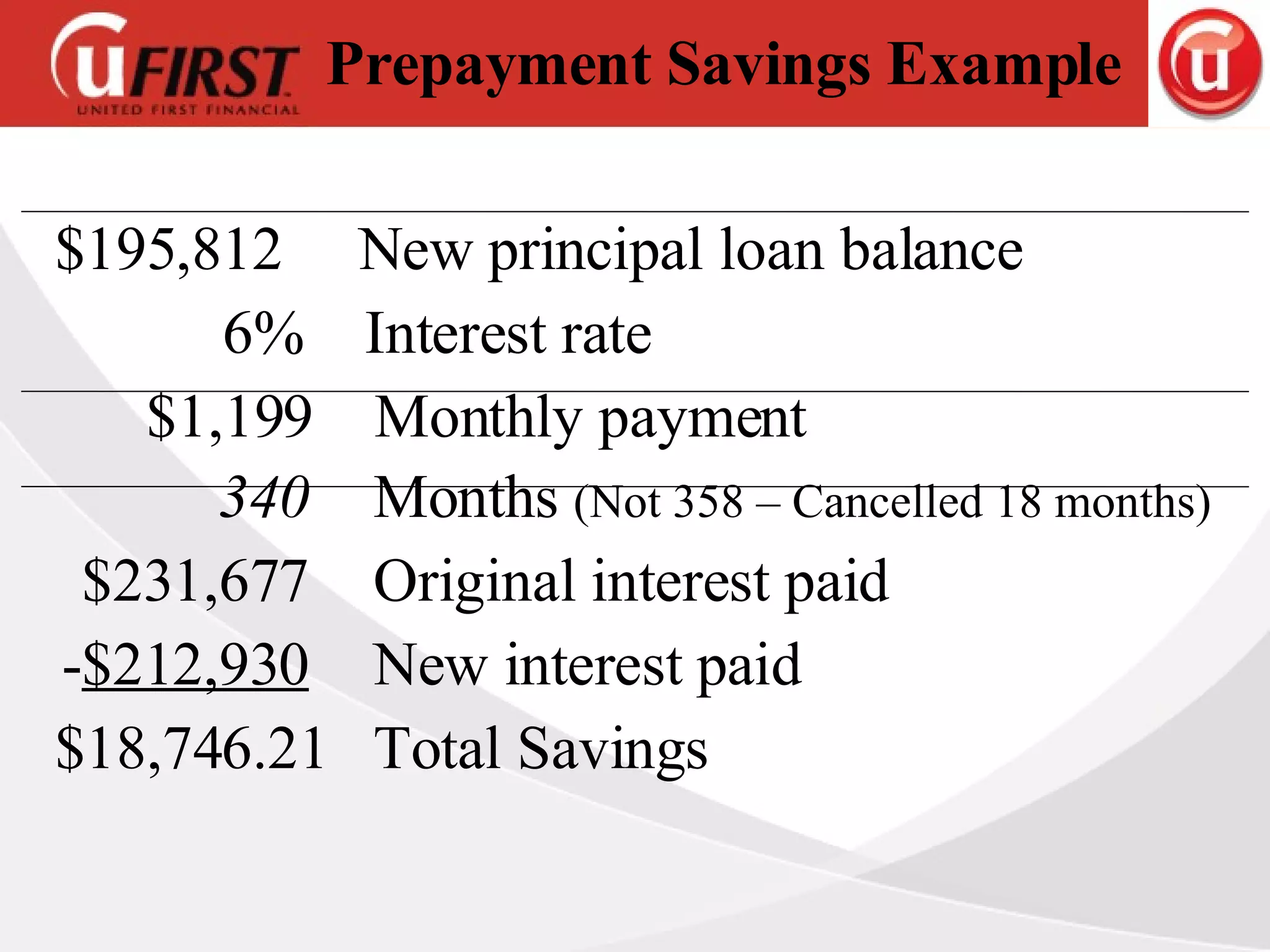

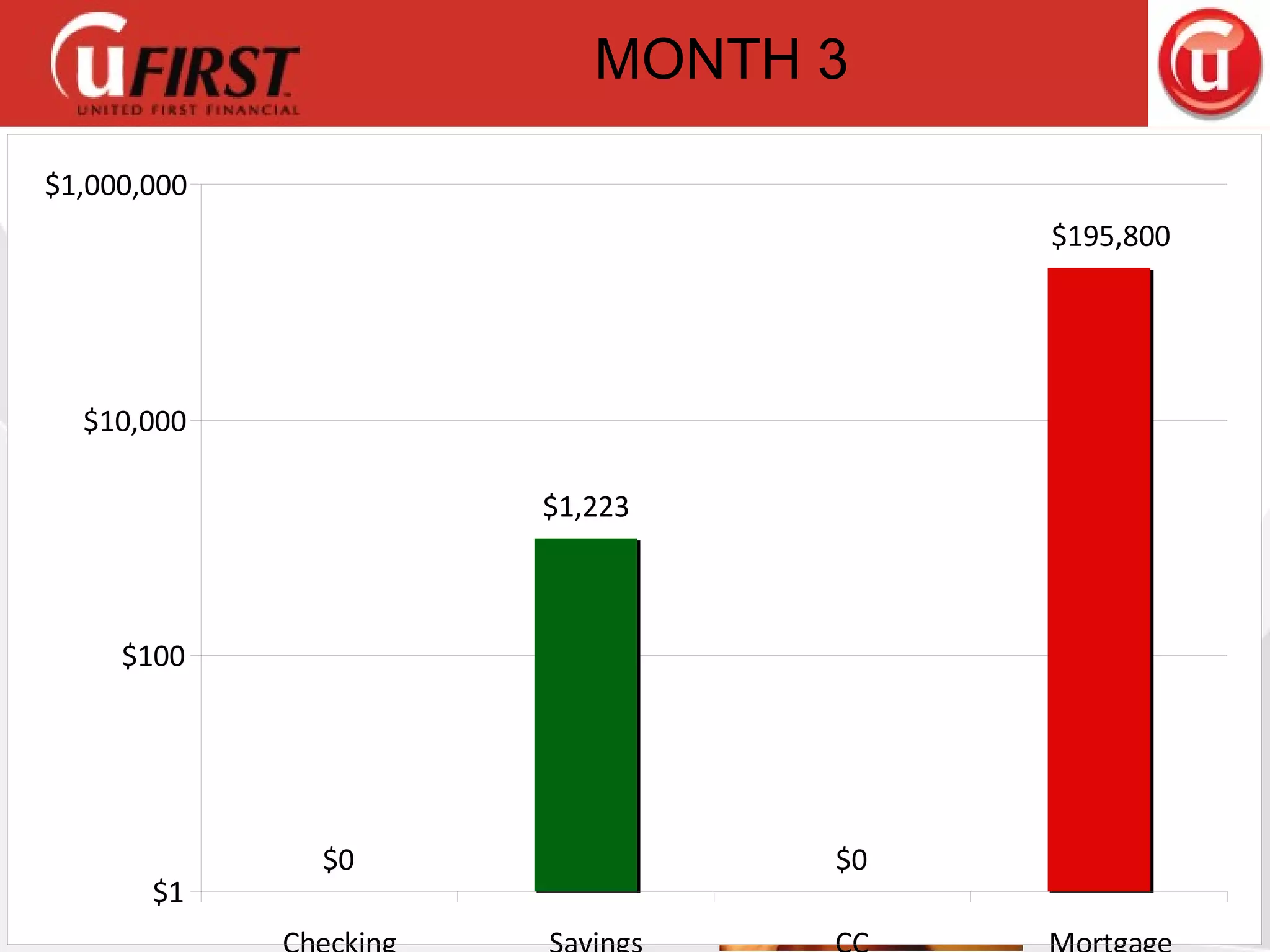

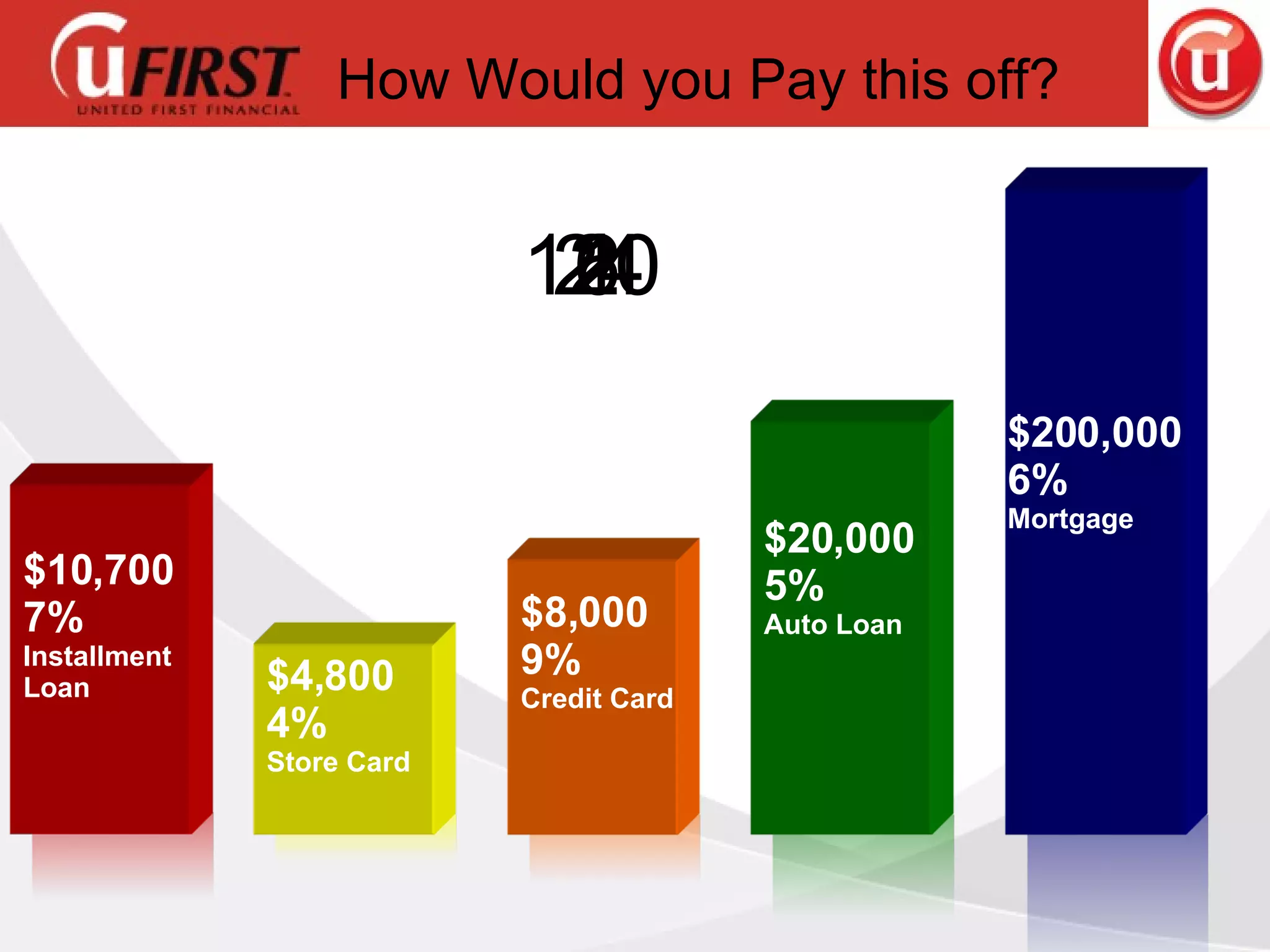

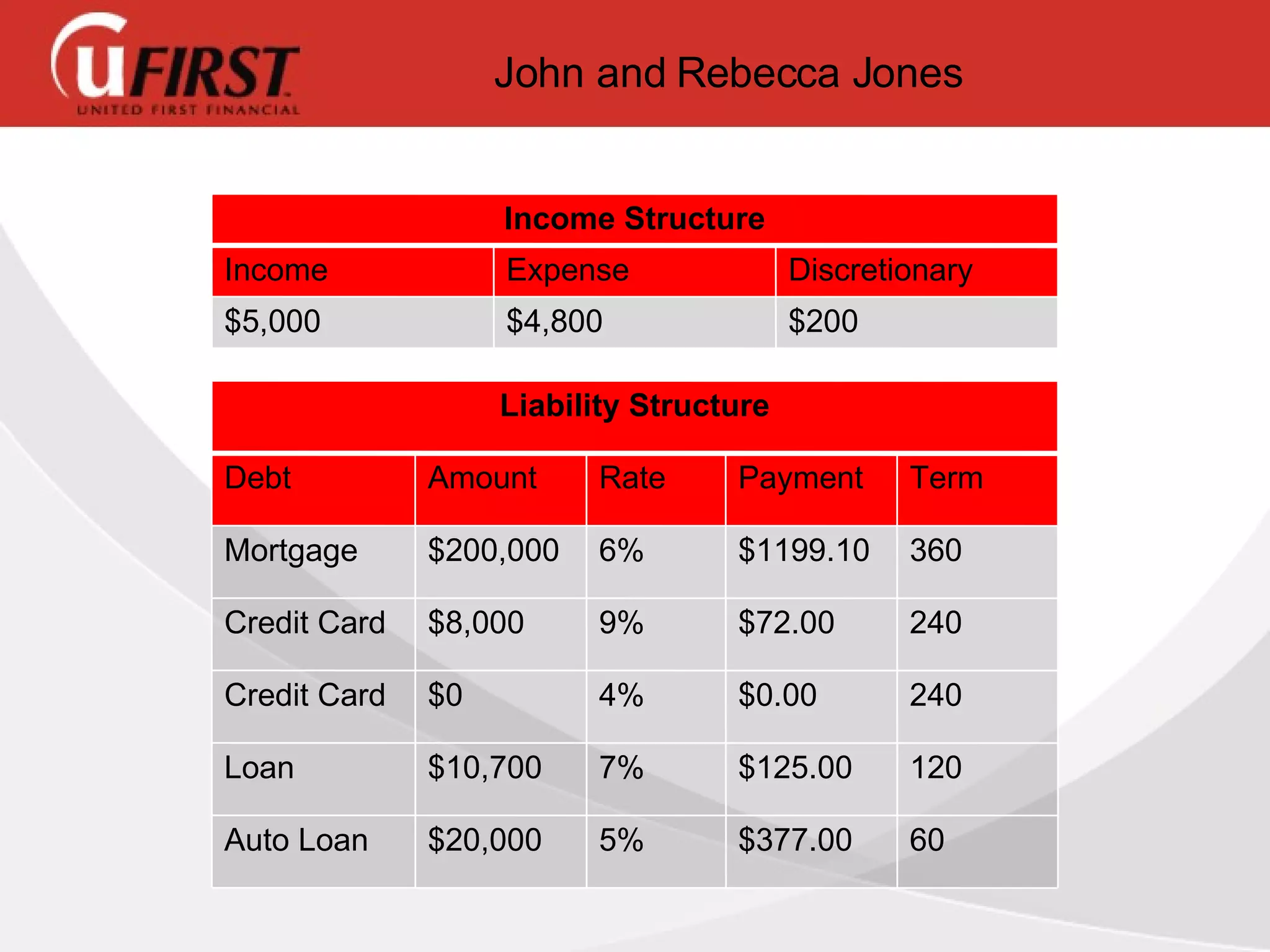

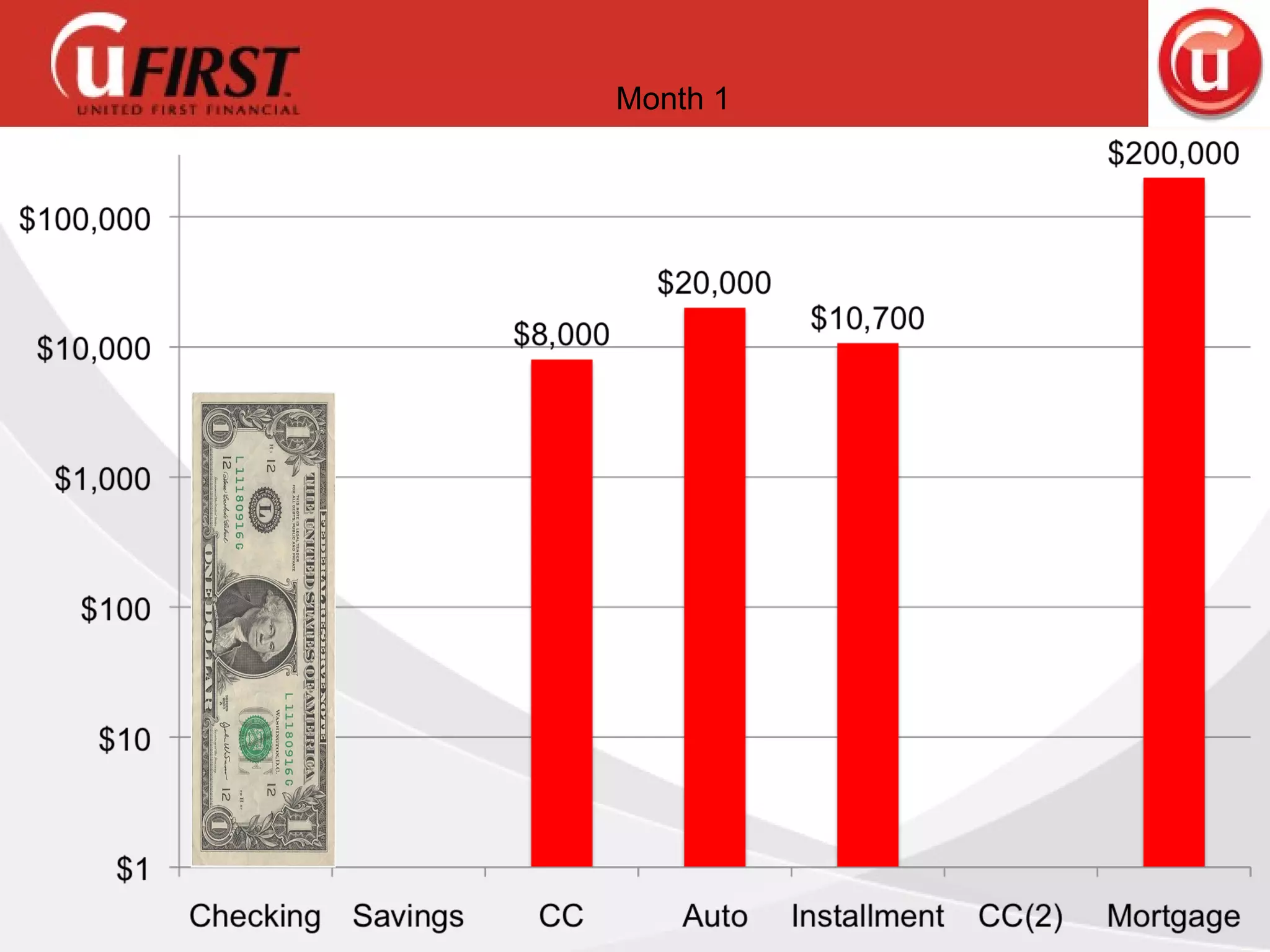

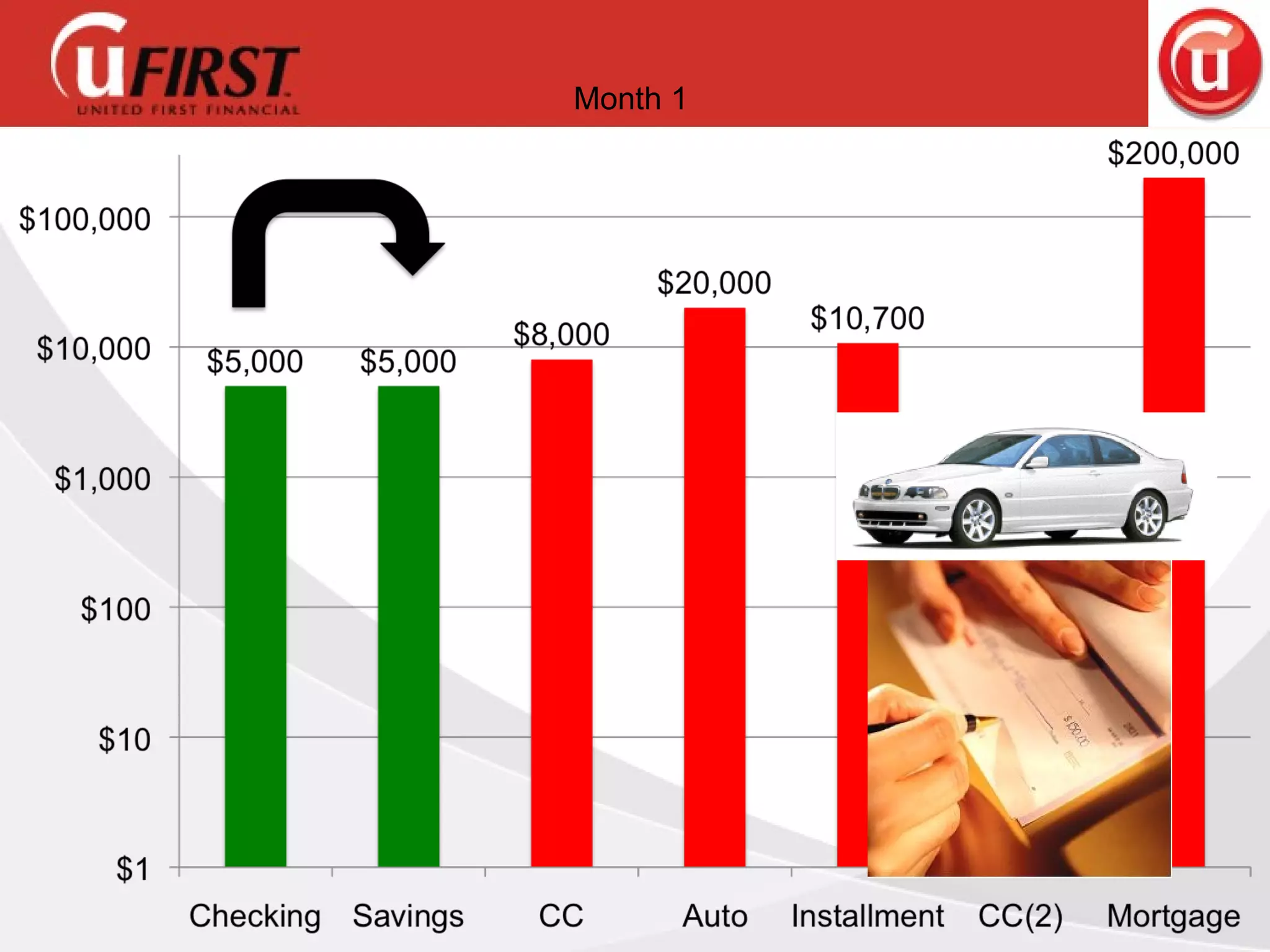

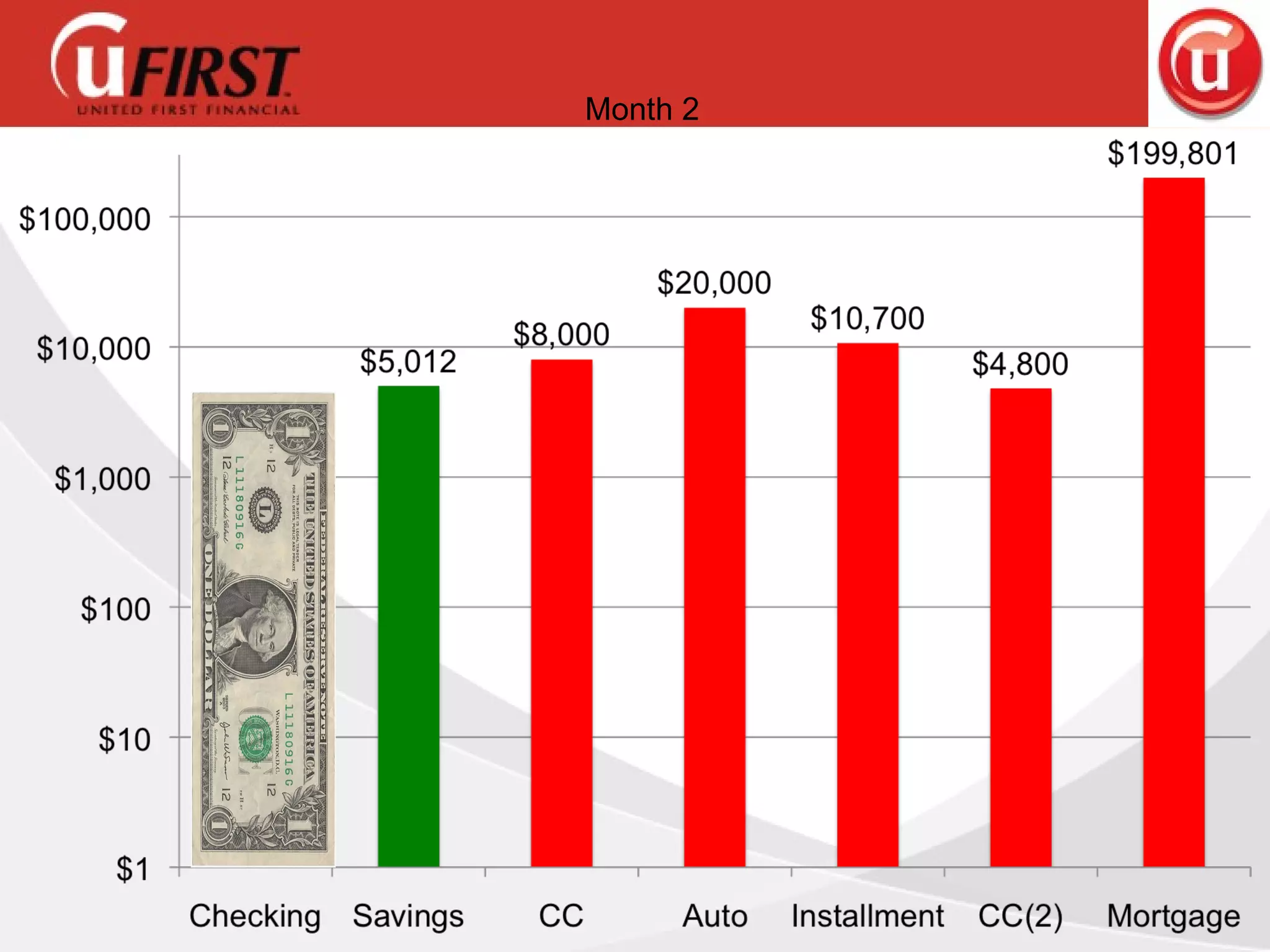

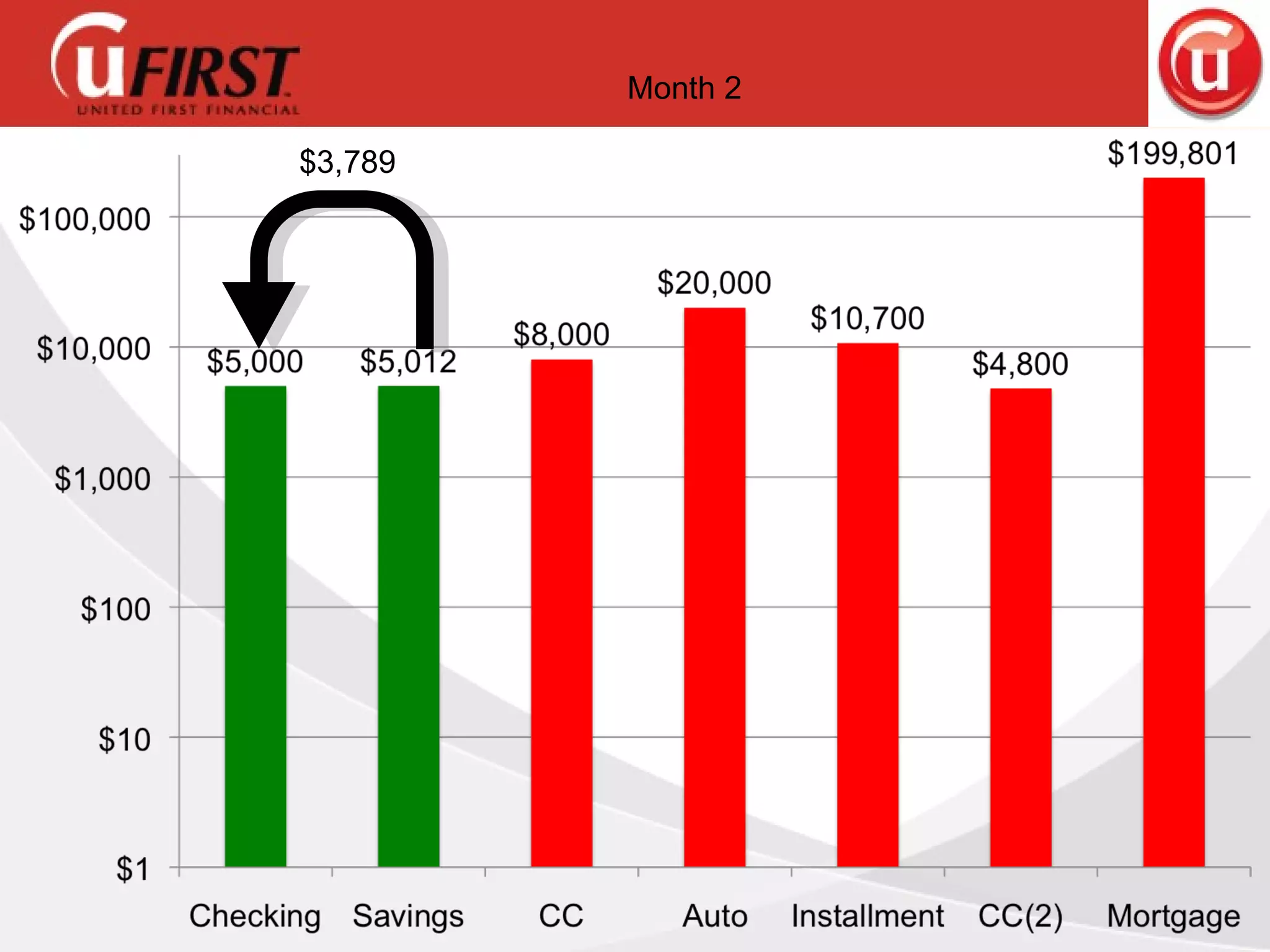

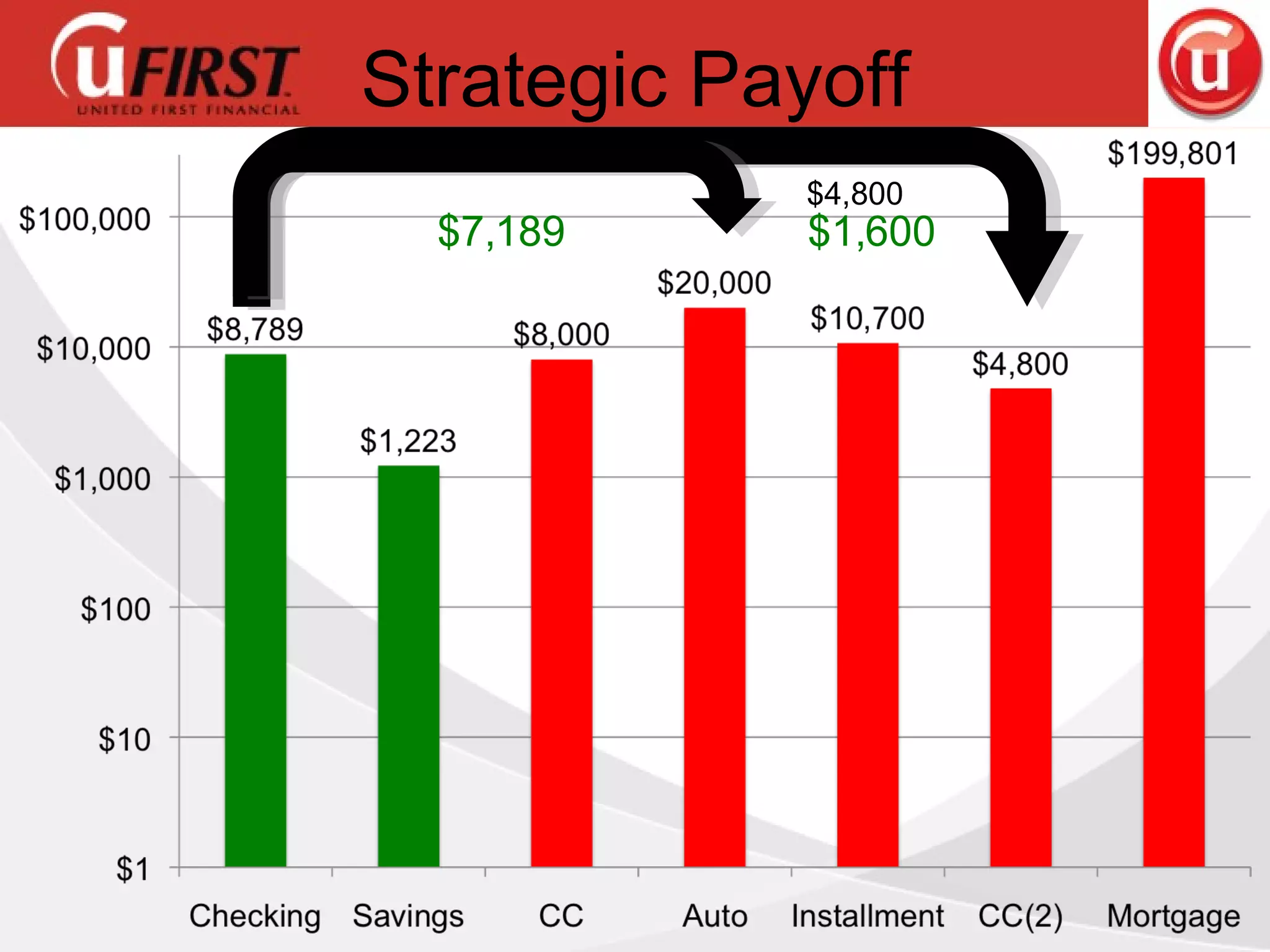

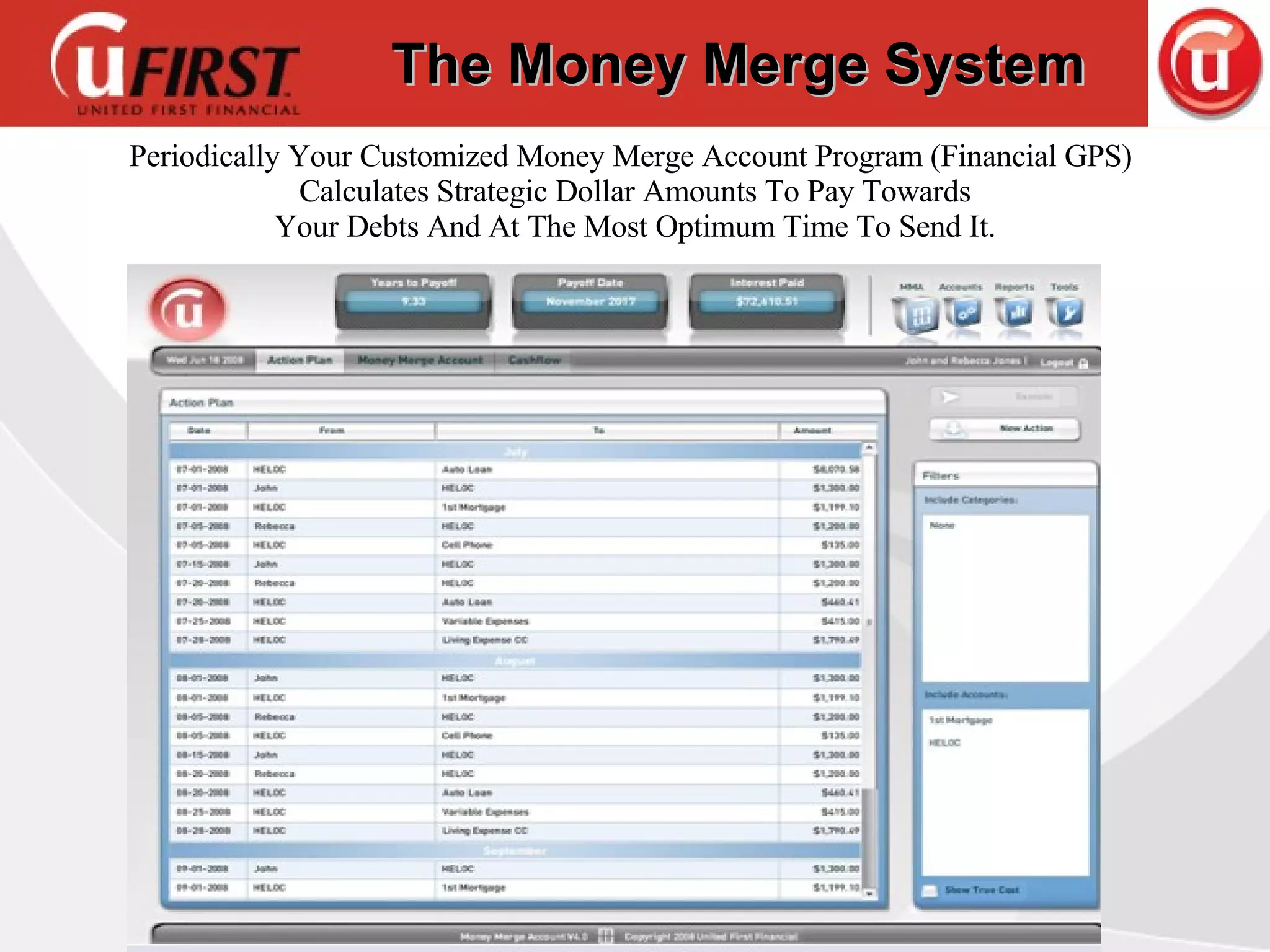

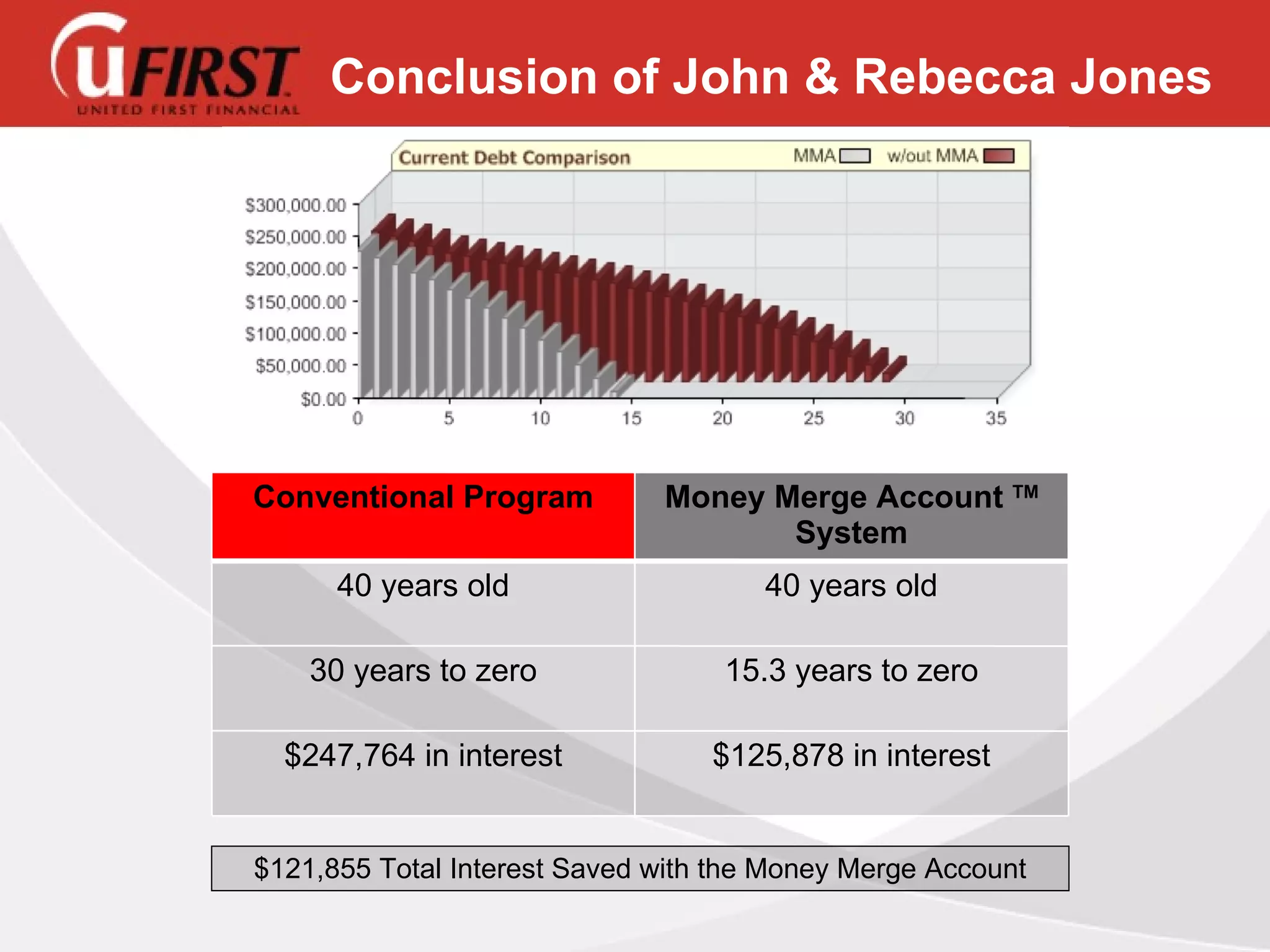

A significant portion of Americans experience financial stress, with 70% living paycheck to paycheck and a substantial percentage facing debt, such as credit card and mortgage obligations. The Money Merge Account system, developed to assist homeowners in paying off their debts efficiently, claims to provide methods that can lead to complete debt repayment much faster than conventional methods. By employing specific algorithms and strategic payments, users of the system reportedly save substantial amounts in interest while accelerating their path to financial freedom.