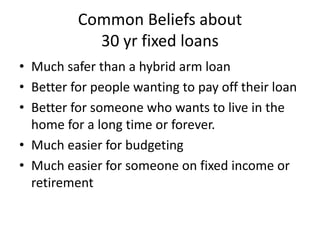

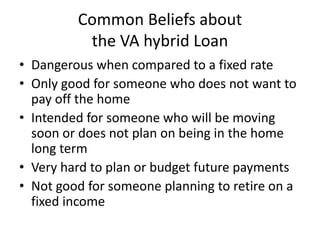

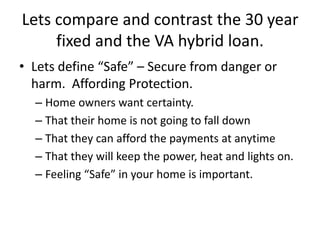

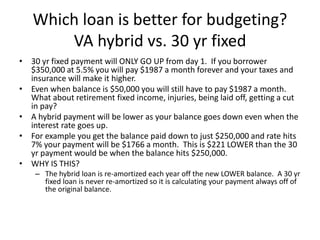

This document compares the safety and advantages of 30-year fixed rate mortgages versus VA hybrid loans. It argues that VA hybrid loans are actually safer for long-term homeownership because they have much lower initial payments, allowing homeowners to pay down their principal faster and save more for unexpected expenses. Even as interest rates rise on a hybrid loan over time, payments will remain lower than the fixed 30-year rate. This makes the hybrid safer for retirees or those on a fixed income, as payments are more predictable and affordable throughout ownership. The document aims to dispel myths that fixed rates are inherently safer, when hybrid loans can result in being debt free sooner with greater financial flexibility.