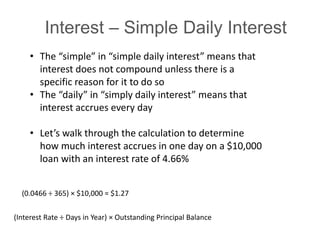

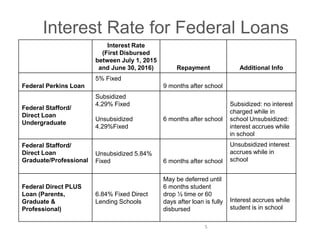

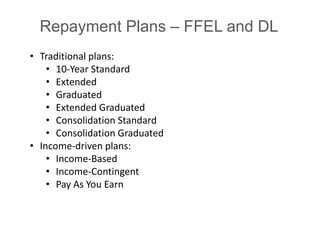

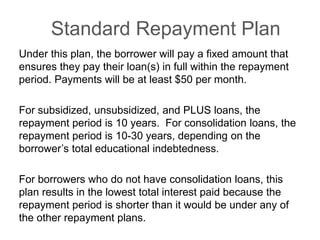

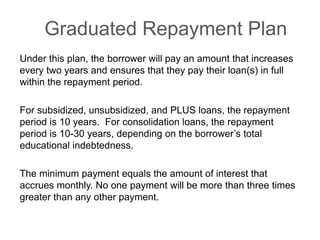

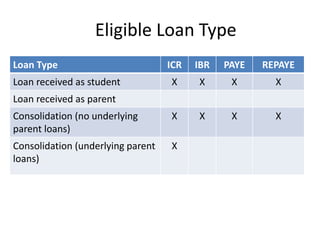

The document provides an overview of student loan basics, including types of federal loans with their respective interest rates and repayment plans. It details the calculation of simple daily interest, different loan repayment options, and eligibility criteria for various plans. Additionally, it emphasizes that private loans are not eligible for federal loan consolidation.