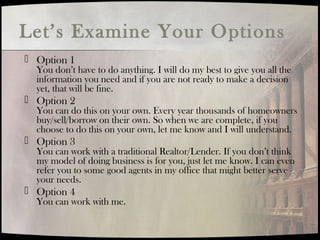

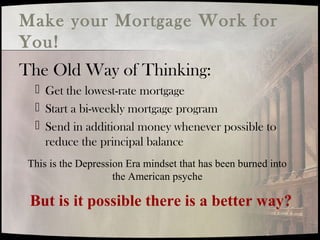

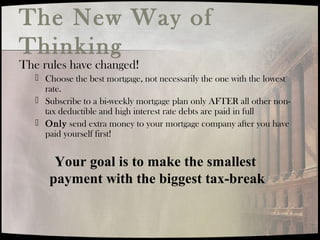

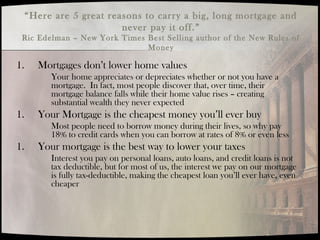

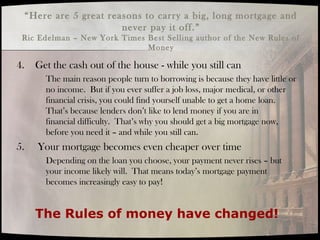

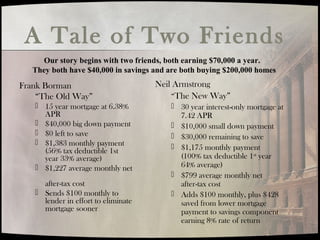

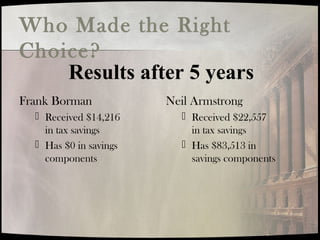

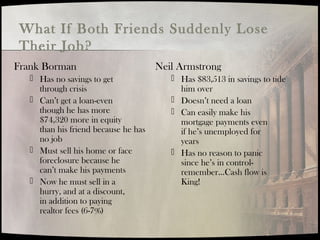

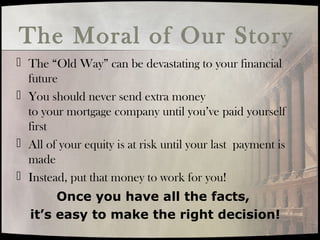

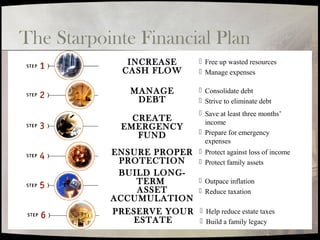

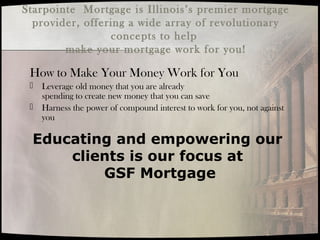

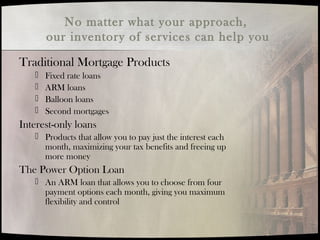

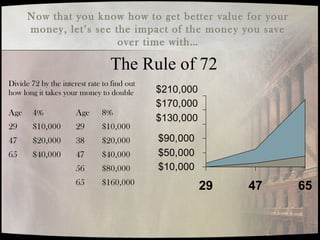

This document discusses options for homeowners to leverage their home equity. It presents 4 options: 1) do nothing; 2) handle it yourself; 3) work with a traditional realtor/lender; or 4) work with the author. It then discusses strategies for making one's mortgage work for them, including choosing the best mortgage type and using extra payments to build savings rather than pay down the mortgage early. Examples are given showing the benefits of this approach over the traditional method of paying off the mortgage quickly. The document promotes working with the author/company to utilize these strategies to better leverage one's home equity.