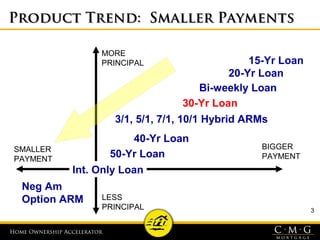

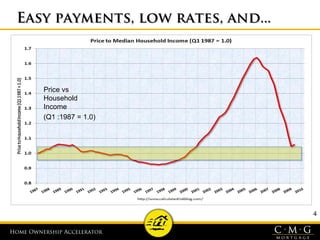

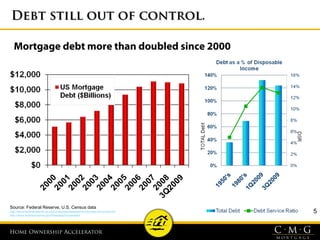

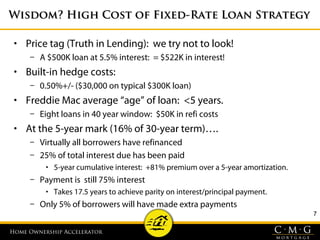

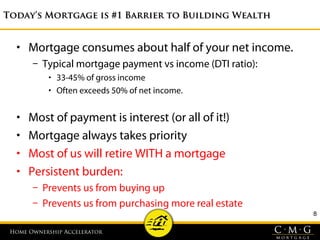

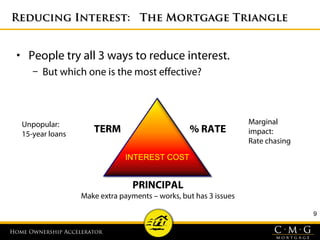

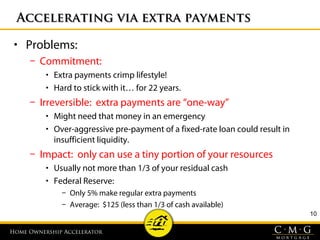

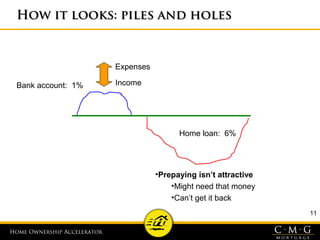

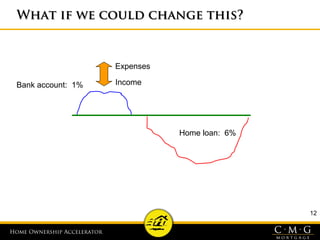

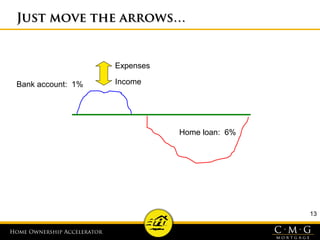

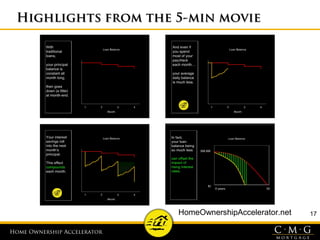

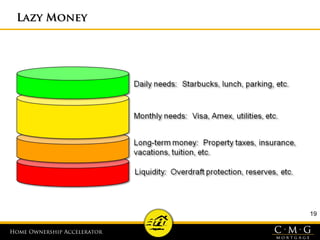

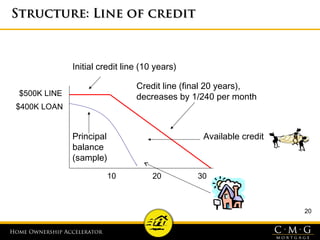

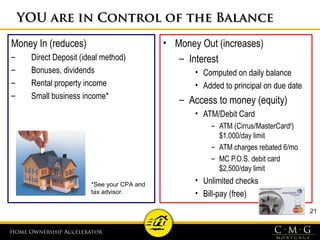

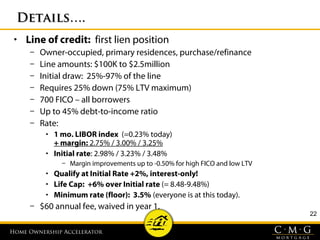

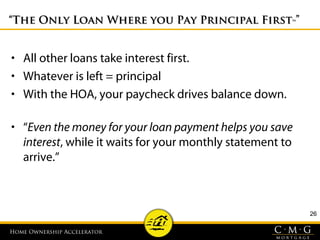

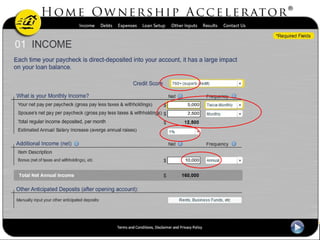

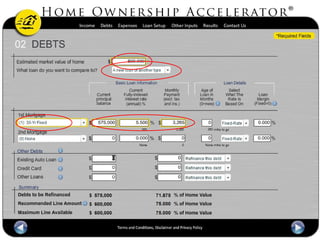

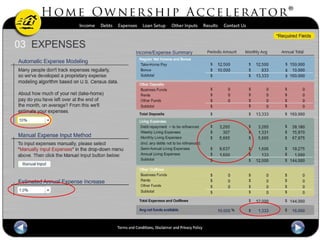

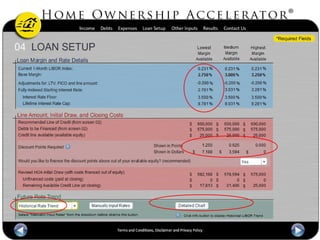

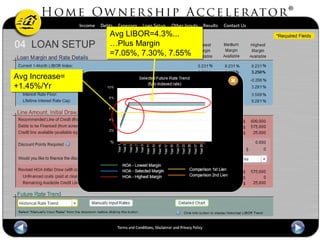

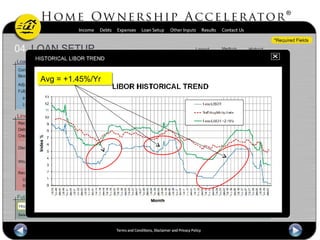

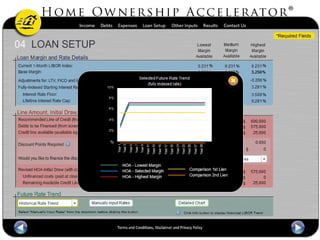

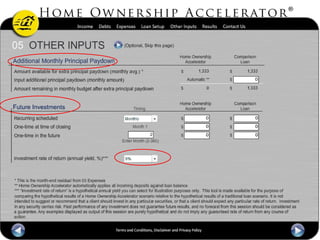

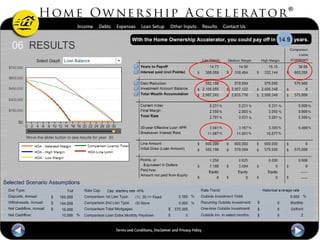

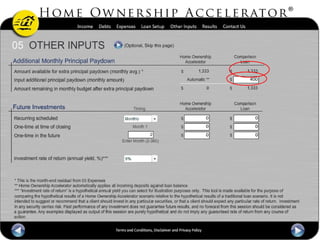

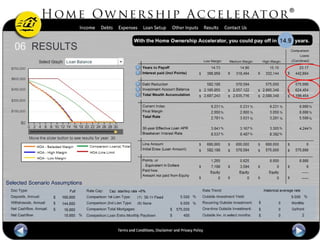

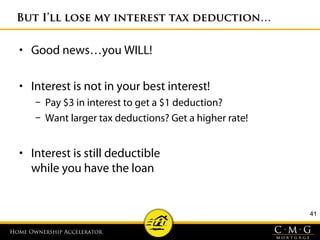

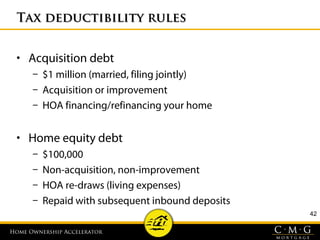

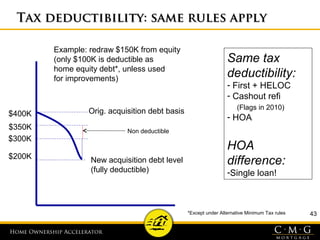

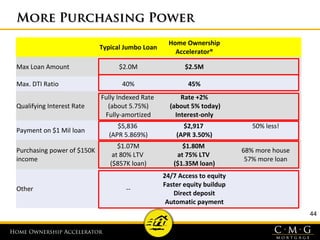

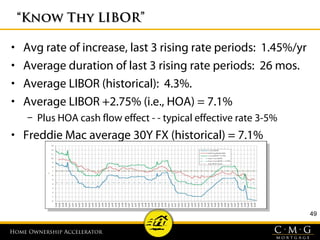

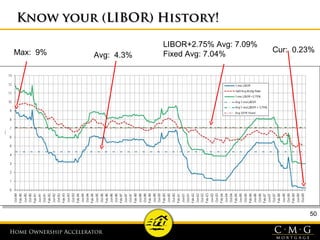

This document provides an overview and presentation on the CMG Home Ownership Accelerator program. It begins by noting how previous generations spent their working years paying off 30-year mortgages. It then discusses trends toward smaller mortgage payments and rising household debt levels. The presentation argues that the conventional wisdom of opting for a 30-year fixed rate mortgage may not be the best strategy, as it can result in paying a high amount of interest over the long run. It introduces the Home Ownership Accelerator program as an alternative that allows borrowers to pay down their principal faster by depositing income directly into a line of credit, saving on interest costs over time. Key details about the program are outlined, and objections to