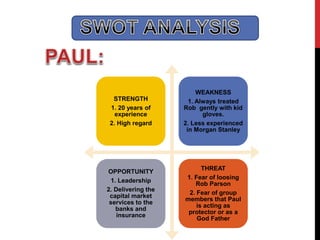

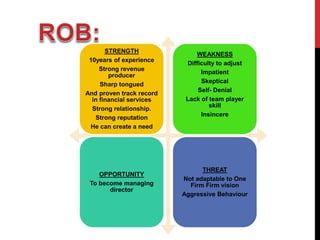

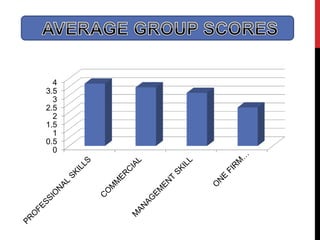

Morgan Stanley is a leading global financial services firm focused on investment banking, wealth management, and securities trading. The document discusses Morgan Stanley's CEO James Gorman and its vision to be the premier investment bank and employer. It also profiles two Morgan Stanley bankers, Paul Nasr and Rob Parson, including their strengths, weaknesses, opportunities, and threats. The 360 degree feedback program implemented by former CEO John Mack is mentioned, which provided comprehensive reviews of employee performance.