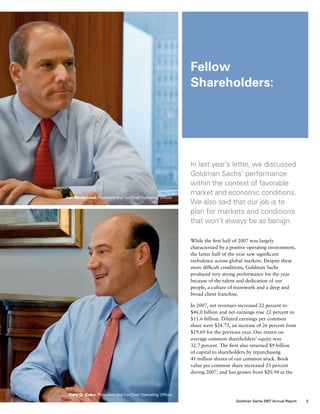

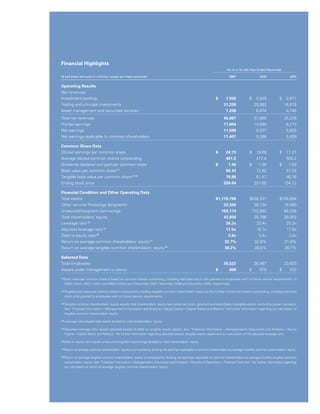

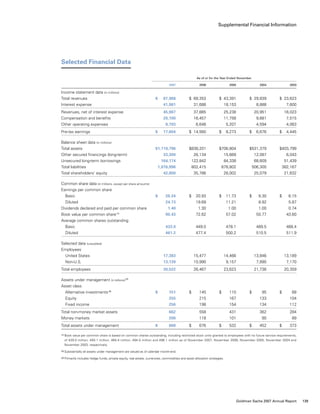

The document is Goldman Sachs' 2007 annual report. It discusses Goldman Sachs' strong financial performance in 2007 despite turbulence in the markets. Net revenues increased 22% to $46 billion and net earnings rose 22% to $11.6 billion. The report attributes Goldman Sachs' success to the talent and dedication of its people and a culture of teamwork. It also highlights Goldman Sachs' global client franchise and strategic focus on growth markets as drivers of its performance.