Monthly update november 2010

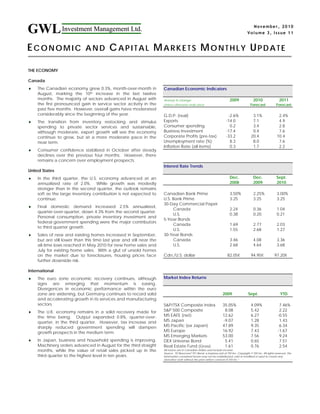

- 1. GWLInvestment Management Ltd.GWLInvestment Management Ltd. November, 2010 Volume 3, Issue 11 ECONOMIC AND CAPITAL MARKETS MONTHLY UPDATE THE ECONOMY Canada ♦ The Canadian economy grew 0.3%, month-over-month in August, marking the 10th increase in the last twelve months. The majority of sectors advanced in August with the first pronounced gain in service sector activity in the past five months. However, overall gains have moderated considerably since the beginning of the year. ♦ The transition from inventory restocking and stimulus spending to private sector services and sustainable, although moderate, export growth will see the economy continue to grow, but at a more moderate pace in the near term. ♦ Consumer confidence stabilized in October after steady declines over the previous four months. However, there remains a concern over employment prospects. United States ♦ In the third quarter, the U.S. economy advanced at an annualized rate of 2.0%. While growth was modestly stronger than in the second quarter, the outlook remains soft as the large inventory contribution is not expected to continue. ♦ Final domestic demand increased 2.5% annualized, quarter-over-quarter, down 4.3% from the second quarter. Personal consumption, private inventory investment and federal government spending were the major contributors to third quarter growth. ♦ Sales of new and existing homes increased in September, but are still lower than this time last year and still near the all-time lows reached in May 2010 for new home sales and July for existing home sales. With a glut of unsold homes on the market due to foreclosures, housing prices face further downside risk. International ♦ The euro zone economic recovery continues, although signs are emerging that momentum is easing. Divergences in economic performance within the euro zone are widening, but Germany continues to record solid and accelerating growth in its services and manufacturing sectors. ♦ The U.K. economy remains in a solid recovery made for the time being. Output expanded 0.8%, quarter-over- quarter, in the third quarter. However, tax increase and sharply reduced government spending will dampen growth prospects in the medium term. ♦ In Japan, business and household spending is improving. Machinery orders advanced in August for the third straight months, while the value of retail sales picked up in the third quarter to the highest level in ten years. Canadian Economic Indicators Annual % change 2009 2010 2011 Unless otherwise indicated Forecast Forecast G.D.P. (real) -2.6% 3.1% 2.4% Exports -14.0 7.1 4.9 Consumer spending 0.2 3.4 2.8 Business Investment -17.4 0.4 7.6 Corporate Profits (pre-tax) -33.2 20.4 10.4 Unemployment rate (%) 8.3 8.0 7.6 Inflation Rate (all items) 0.3 1.7 2.2 Interest Rate Trends Dec. Dec. Sept. 2008 2009 2010 Canadian Bank Prime 3.50% 2.25% 3.00% U.S. Bank Prime 3.25 3.25 3.25 30-Day Commercial Paper Canada 2.24 0.36 1.04 U.S. 0.38 0.20 0.21 5-Year Bonds Canada 1.69 2.77 2.03 U.S. 1.55 2.68 1.27 30-Year Bonds Canada 3.46 4.08 3.36 U.S. 2.68 4.64 3.68 Cdn./U.S. dollar 82.05¢ 94.95¢ 97.20¢ Market Index Returns 2009 Sept. YTD S&P/TSX Composite Index 35.05% 4.09% 7.46% S&P 500 Composite 8.08 5.42 2.22 MS EAFE (net) 12.62 6.27 -0.55 MS Japan -9.07 1.28 1.43 MS Pacific (ex Japan) 47.89 9.35 6.34 MS Europe 16.92 7.43 -1.67 MS Emerging Markets 53.00 7.56 9.24 DEX Universe Bond 5.41 0.65 7.51 Real Estate Fund (Gross) 1.61 0.76 2.54 All returns are in Canadian dollars and include income. Source: TD Newcrest/”PC-Bond, a business unit of TSX Inc. Copyright © TSX Inc. All rights reserved. The information contained herein may not be redistributed, sold or modified or used to create any derivative work without the prior written consent of TSX Inc.”

- 2. 2.7 2.8 2.9 3.0 3.1 3.2 3.3 3.4 3.5 3.6 Oct / 09 Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sept Oct /10 GWLInvestment Management Ltd. EQUITY MARKETS October brought further gains for Canadian equities with the S&P/TSX Composite Index gaining 2.7% during the month to close at 12,676, another post-credit crisis high. Mid and small cap stocks continued their outperforming trend with the S&P/TSX Smallcap Index up 5.9% for the period. The market continued to firm as economic data out of the US grew more encouraging as the month progressed. As well, an imminent announcement out of the Federal Reserve on further quantitative easing spurred global equity markets higher. Sectors that led the market higher during the month included the Technology, Healthcare and Consumer Staples sectors. Lagging performance was posted by the Utilities and Telecom groups. The S&P/TSX Composite continues to perform well reflecting Canada’s stronger economic outlook, significant exposure to robust commodity markets and compelling valuation relative to alternative asset classes. All of this underscores our constructive outlook for Canadian equities. The US equity market was strong again in October, returning 3.7%. This strength was driven primarily by robust earnings reports and rising expectations of additional quantitative easing by the Federal Reserve. The Technology, Consumer Discretionary and Materials sectors led the market, as investors continued to rotate into cyclical stocks. Accordingly, the defensive Utility and Telecom sectors were the worst performers. Financials, typically viewed as a cyclical sector, again stood out as a laggard. The relatively poor performance of Financials stemmed primarily from ongoing concerns over potential regulation and its implications for long-term profitability. Economic data continues to be mixed, suggesting that recent US growth may be at risk - job growth remains elusive and house prices could see another down-leg as an additional wave of foreclosures are expected to hit the market. The foreclosure moratorium currently in place at some major lenders will likely be short-lived, but it does create additional uncertainty in an already difficult environment. FIXED INCOME MARKETS The DEX Universe Bond Index recorded a gain of 0.22% in October, continuing a stretch of six straight months of positive returns. Year-to- date the Index has returned 7.75%. As in September, the provincial sector return of 0.45% easily outperformed the Government of Canada sector return of 0.05% and the corporate sector return of 0.30%. With respect to the yield curve, gains for the month were concentrated in the short term sector (0.25%) and the mid term sector (0.43%) while the long term sector experienced a negative return of 0.02%. Returns for the month were primarily driven by a very stable level of interest rates in October as the average yield for the Index fell from 2.80% to 2.79% in month. This stable interest rate environment reflects investors’ uncertainty regarding the impact on the future level of interest rates due to the expected introduction of Quantitative Easing II by the U.S. Federal Reserve in early November. We expect the Federal Reserve will not only maintain its commitment to keep its Federal Funds rate at “exceptionally low levels for an extended period” but will also commit to purchase up to $1.0 trillion of 2 to 10 year U.S. Treasury securities over the next 6-8 months. In this environment we anticipate interest rates in both Canada and the U.S. will remain in a trading range for the balance of 2010 unless economic growth surprises to the upside. 10750 11000 11250 11500 11750 12000 12250 12500 12750 Oct /09 Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sept Oct /10 ECONOMIC AND CAPITAL MARKETS MONTHLY UPDATE November, 2010 GWLInvestment Management Ltd. Page 2 The views expressed in this commentary are those of GWL Investment Management Ltd. (“GWLIM”) as at the date of publication and are subject to change without notice. This commentary is presented only as a general source of information and is not intended as a solicitation to buy or sell specific investments, nor is it intended to provide tax or legal advice. Prospective investors should review the offering documents relating to any investment carefully before making an investment decision and should ask their representative for advice based on their specific circumstances. GWLIM is a subsidiary of The Great-West Life Assurance Company. Great-West and GWLIM are members of the Power Financial Corporation group of companies. © GWL Investment Management Ltd. 2010 S&P/TSX COMPOSITE INDEX STANDARD & POOR’S 500 INDEX 1000 1050 1100 1150 1200 1250 Oct/ 09 Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sept Oct/ 10 MS EAFE INDEX 1300 1350 1400 1450 1500 1550 1600 1650 Oct /09 Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sept/ 1Oct / 10 DEX UNIVERSE BOND INDEX* * Formerly the SC Universe Bond Index