More Related Content

Similar to Update October 2010

Similar to Update October 2010 (20)

More from Martin Leduc (20)

Update October 2010

- 1. GWLInvestment Management Ltd.GWLInvestment Management Ltd. October, 2010

Volume 3, Issue 10

ECONOMIC AND CAPITAL MARKETS MONTHLY UPDATE

THE ECONOMY

Canada

♦ Canadian retail sales fell 0.1% in July, a weaker-than-

expected result. The soft reading was accentuated by

the HST but the weakness in home-related sales had a

bigger impact.

♦ Consumer prices dipped 0.1% in August, dropping annual

inflation slightly to 1.7% from 1.8% in July. The results were

modestly lower than expected as a broad-based decline

in energy prices was the major factor behind the drop.

♦ The Canadian economy is expected to grow at a modest

2.0% annualized rate in the second half of 2010. Soft U.S.

demand and a strong loonie will increase the trade

deficit. Also, consumer confidence has slipped recently,

likely due to concerns about rising debts.

♦ On a positive note, industrial capacity utilization rose

slightly higher than projected to 76% in the second

quarter. Growth was broadly-based and included an

improvement in the battered manufacturing sector.

United States

♦ Inflation pressures remain subdued, with deflation is still

only a remote possibility. The U.S. consumer price index

rose 0.3% in August, largely due to a jump in gasoline

prices and partly because of slightly higher food costs.

♦ U.S. housing starts increased 10.5% in August to 598,000

units annualized, for surpassing expectations. This was the

highest since April of this year with starts 2.2% above a

year ago and 25% above April 2009’s record low of

477,000 units. However, housing starts and completions

are likely to fall for all of the third quarter.

♦ The U.S. economy is forecast to grow just under 2.0%

annualized in the second half of the year. Households

have made progress in deleveraging by raising their

savings from 2.0% before the recession to approximately

6.0%. Household debt as a ratio of disposable income has

fallen 12.0% since 2007, returning to 2005 levels.

International

♦ The recovery of world trade continues with 12-month

trade volume growth running at an impressive 20% plus. In

parallel with the trade rebound, industrial output has risen

significantly in emerging countries and is now 11.9% above

the pre-recession peak and more than offsets the drag

from industrial output in the advanced economies.

♦ The euro zone has maintained its cyclical momentum and

fears of a downturn have abated slightly. Real GDP

expanded at a 3.9% annualized rate in the second

quarter with German GDP up a remarkable 9.0%.

Manufacturing output has been rising strongly with gains

even in Spain and Portugal.

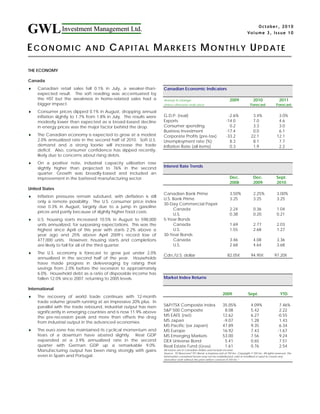

Canadian Economic Indicators

Annual % change 2009 2010 2011

Unless otherwise indicated Forecast Forecast

G.D.P. (real) -2.6% 3.4% 3.0%

Exports -14.0 7.0 4.6

Consumer spending 0.2 3.3 3.0

Business Investment -17.4 0.0 6.1

Corporate Profits (pre-tax) -33.2 22.1 12.1

Unemployment rate (%) 8.3 8.1 7.7

Inflation Rate (all items) 0.3 1.9 2.2

Interest Rate Trends

Dec. Dec. Sept.

2008 2009 2010

Canadian Bank Prime 3.50% 2.25% 3.00%

U.S. Bank Prime 3.25 3.25 3.25

30-Day Commercial Paper

Canada 2.24 0.36 1.04

U.S. 0.38 0.20 0.21

5-Year Bonds

Canada 1.69 2.77 2.03

U.S. 1.55 2.68 1.27

30-Year Bonds

Canada 3.46 4.08 3.36

U.S. 2.68 4.64 3.68

Cdn./U.S. dollar 82.05¢ 94.95¢ 97.20¢

Market Index Returns

2009 Sept. YTD

S&P/TSX Composite Index 35.05% 4.09% 7.46%

S&P 500 Composite 8.08 5.42 2.22

MS EAFE (net) 12.62 6.27 -0.55

MS Japan -9.07 1.28 1.43

MS Pacific (ex Japan) 47.89 9.35 6.34

MS Europe 16.92 7.43 -1.67

MS Emerging Markets 53.00 7.56 9.24

DEX Universe Bond 5.41 0.65 7.51

Real Estate Fund (Gross) 1.61 0.76 2.54

All returns are in Canadian dollars and include income.

Source: TD Newcrest/”PC-Bond, a business unit of TSX Inc. Copyright © TSX Inc. All rights reserved. The

information contained herein may not be redistributed, sold or modified or used to create any

derivative work without the prior written consent of TSX Inc.”

- 2. 2.7

2.8

2.9

3.0

3.1

3.2

3.3

3.4

3.5

3.6

Sep/09 Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sept/10

GWLInvestment Management Ltd.

EQUITY MARKETS

September saw a surprisingly robust rally for global equities with the

S&P/TSX Composite Index gaining 4.1% during the month to a new post-

credit crisis high. Mid and small cap stocks saw even stronger

performance with the Completion Index up 6.6% during the month. A

slightly better tone to recent economic data out of the US has eased

fears of a double-dip recession. As well, the Federal Reserve has given

every indication that it will undertake further quantitative easing should

the situation warrant it. Sectors that led the market higher during the

month included the Technology, Utilities and Financial sectors. Lagging

performance was posted by the Healthcare and Consumer Staples

groups. The S&P/TSX Composite has at last broken out of the trading

range it’s been locked in since last September. This is encouraging

action. Commodity markets have also re-accelerated, in part reflecting

currency trends and the strength of emerging markets. All of this

underscores our constructive outlook for Canadian equities. As the

macro headwinds facing the market continue to clear, we expect

equities to show better relative performance to other asset classes in the

years ahead.

The US equity market posted its best September since 1939 and rose by

8.8%. This performance was driven primarily by rising expectations of

additional quantitative easing by the Federal Reserve. The Technology,

Industrials and Consumer Discretionary sectors led the charge, rising by

11 – 12%, as investors rotated into highly cyclical stocks. Accordingly, the

defensive Utilities and Consumer Staples sectors were the worst

performers with returns of 2.6% and 5.4%, respectively. Financials,

typically viewed as a cyclical sector, stood out as a laggard by rising

only 6.0%. The relatively poor performance of Financials stemmed

primarily from ongoing concerns over potential regulation and its

implications for long-term profitability. Investors continue to be fearful of

missing out on any potential market rally, and yet at the same time are

showing signs of elevated risk aversion, causing pronounced swings in the

market. Economic data continues to be mixed, suggesting that recent

US growth may be at risk - job growth remains elusive and house prices

could see another down-leg as an additional wave of foreclosures are

expected to hit the market. The current lack of job growth is the greatest

impediment to further stock market gains.

FIXED INCOME MARKETS

The DEX Universe Bond Index recorded a gain of 0.65% in September

continuing a very strong period of gains from the end of April. The gains

for the month were the strongest in the long-term sector of the index

where yields fell 12 basis points in the month compared to a decline of

only 7 basis points in the mid-term sector and an increase of 12 basis

points in the short-term sector. Provincial bond returns were very strong in

the month, returning 1.23%, compared to 0.68% for the corporate bond

sector and 0.31% for the federal government sector. On September 8

the Bank of Canada raised its overnight lending rate by 0.25% to 1.00%.

Recent commentary from the Bank suggests tightening of monetary

policy is now on hold indefinitely while it monitors future economic

conditions in Canada, the U.S. and around the world. In the U.S. the

Federal Reserve indicated a second round of quantitative easing would

be implemented in the near future if economic growth did not begin to

show stronger signs of improvement, especially in the critical area of

employment growth. In this environment, interest rates in Canada should

remain near current levels for the balance of the year unless economic

growth in Canada and the U.S. surprises to the upside.

10750

11000

11250

11500

11750

12000

12250

12500

Sep/09 Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sept/10

ECONOMIC AND CAPITAL MARKETS MONTHLY UPDATE

October, 2010

GWLInvestment Management Ltd. Page 2

The views expressed in this commentary are those of GWL Investment Management Ltd. (“GWLIM”) as at the date of publication and are subject to change without notice. This commentary

is presented only as a general source of information and is not intended as a solicitation to buy or sell specific investments, nor is it intended to provide tax or legal advice. Prospective

investors should review the offering documents relating to any investment carefully before making an investment decision and should ask their representative for advice based on their

specific circumstances. GWLIM is a subsidiary of The Great-West Life Assurance Company. Great-West and GWLIM are members of the Power Financial Corporation group of companies.

© GWL Investment Management Ltd. 2010

S&P/TSX COMPOSITE INDEX

STANDARD & POOR’S 500 INDEX

1000

1050

1100

1150

1200

1250

Sep/09 Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sept/10

MS EAFE INDEX

1300

1350

1400

1450

1500

1550

1600

1650

Sep/09 Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sept/10

DEX UNIVERSE BOND INDEX*

* Formerly the SC Universe Bond Index