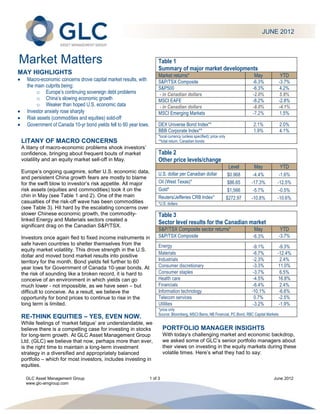

This document provides a summary of major market developments in May and year-to-date. It discusses macroeconomic concerns that drove declines in global stock markets and commodity prices in May. The S&P 500, MSCI EAFE, emerging markets and Canadian indexes all declined significantly in May. Bond yields fell to very low levels. The document also includes perspectives from GLC portfolio managers who argue that despite short-term volatility, there remains a compelling long-term case for investing in equities at this time.