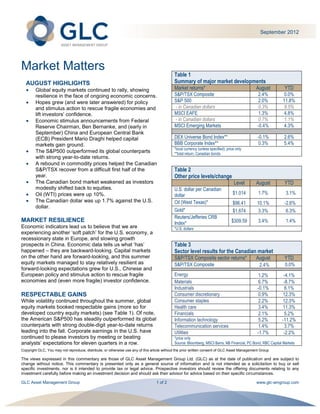

Global equity markets rallied in August despite ongoing economic concerns. Hopes grew for policy action to rescue fragile economies and boost confidence, with the US Federal Reserve and central banks in China and Europe announcing stimulus packages. As a result, major markets posted gains for the month, led by the US S&P 500 index with double-digit year-to-date returns. Commodity prices and the Canadian market rebounded from declines earlier in the year on signs of improved global growth prospects from the stimulus measures.