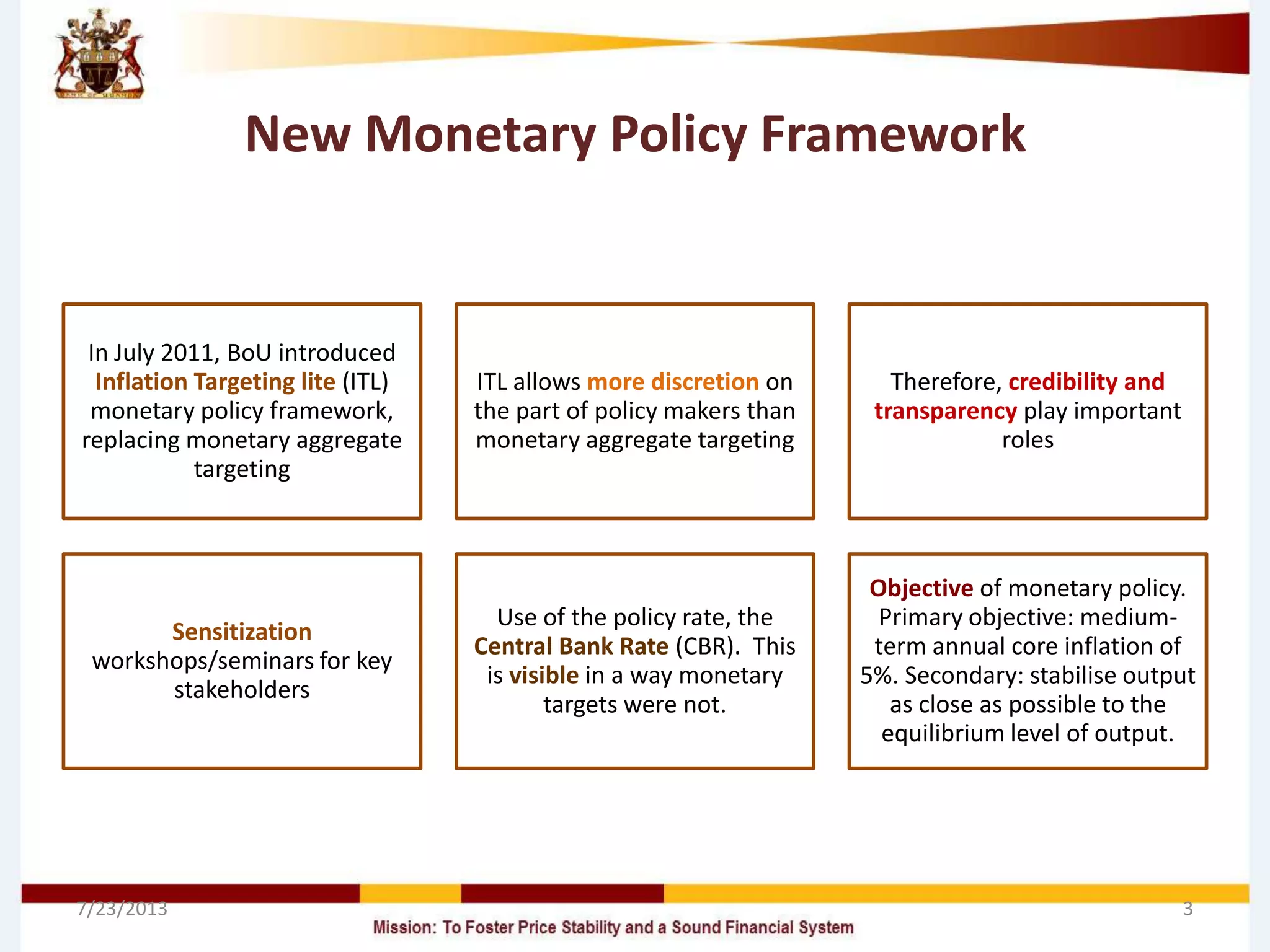

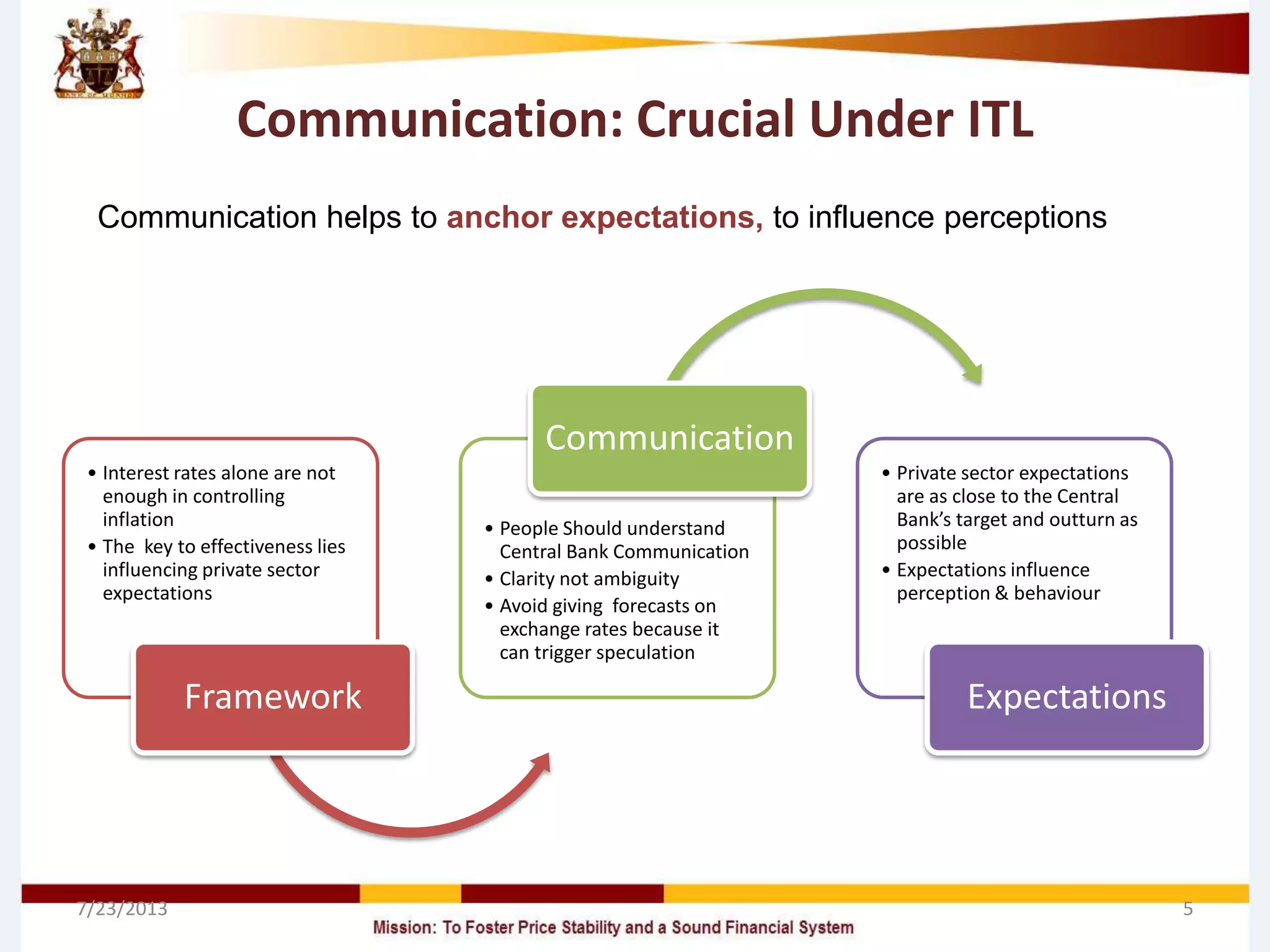

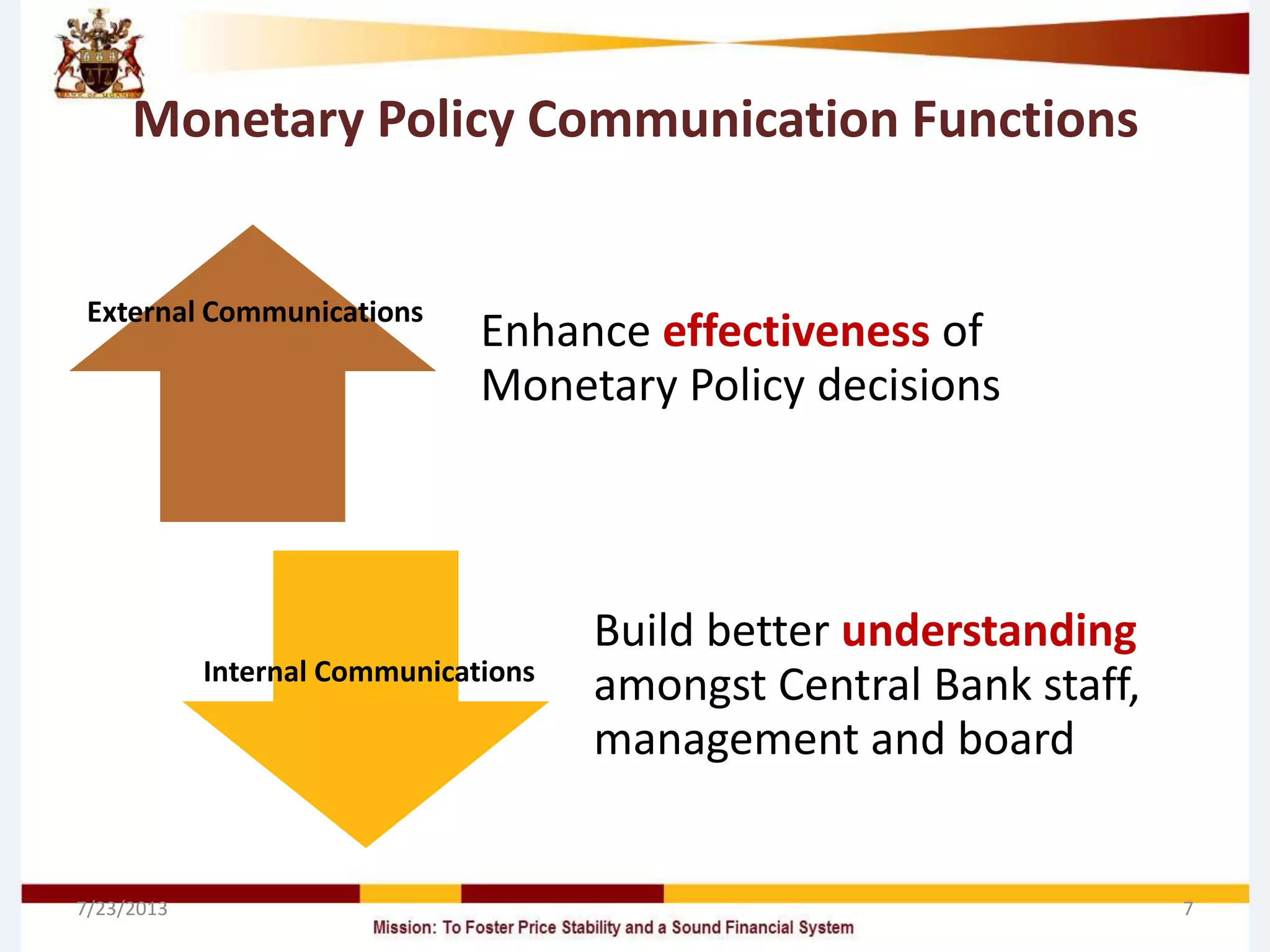

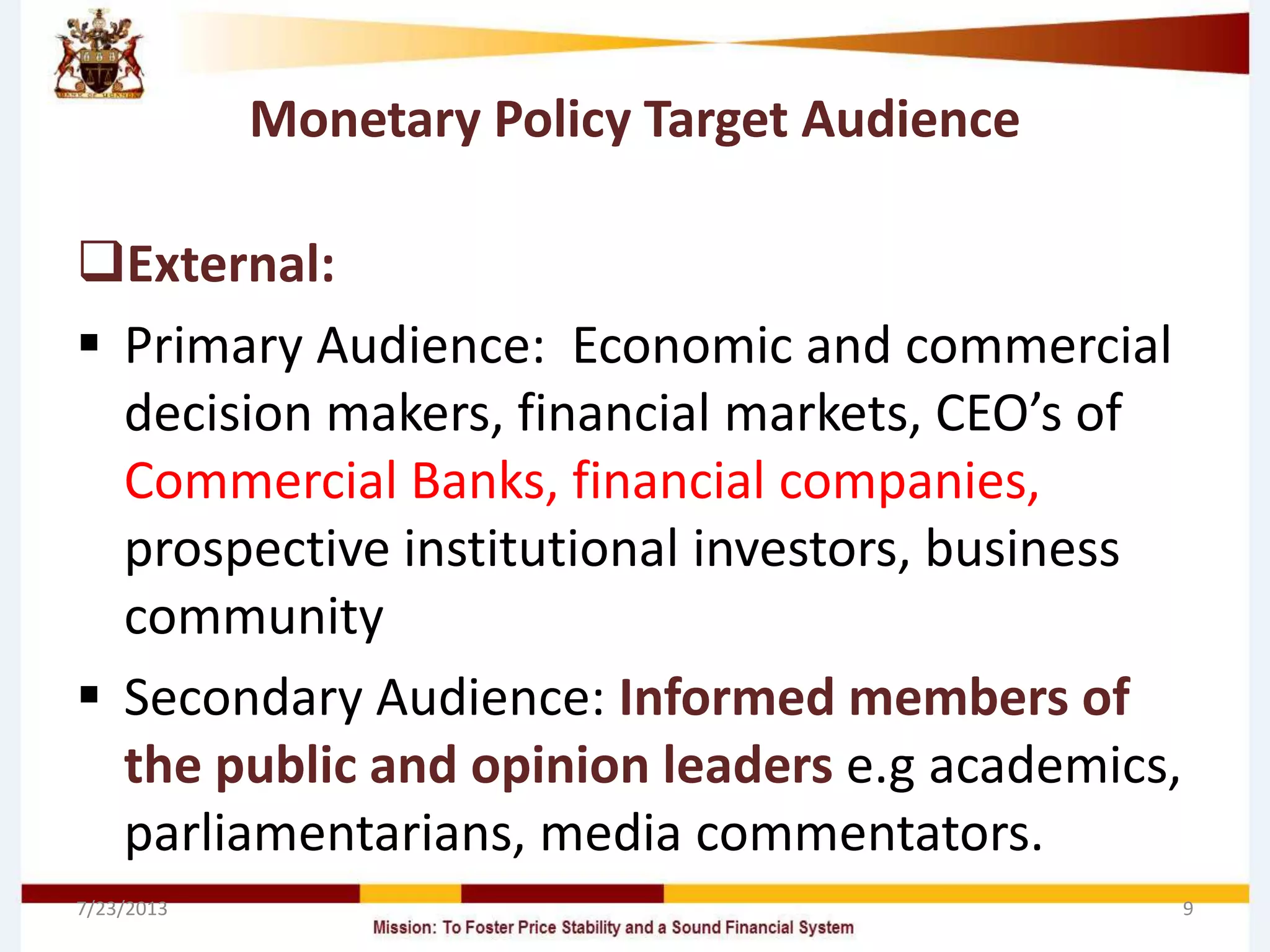

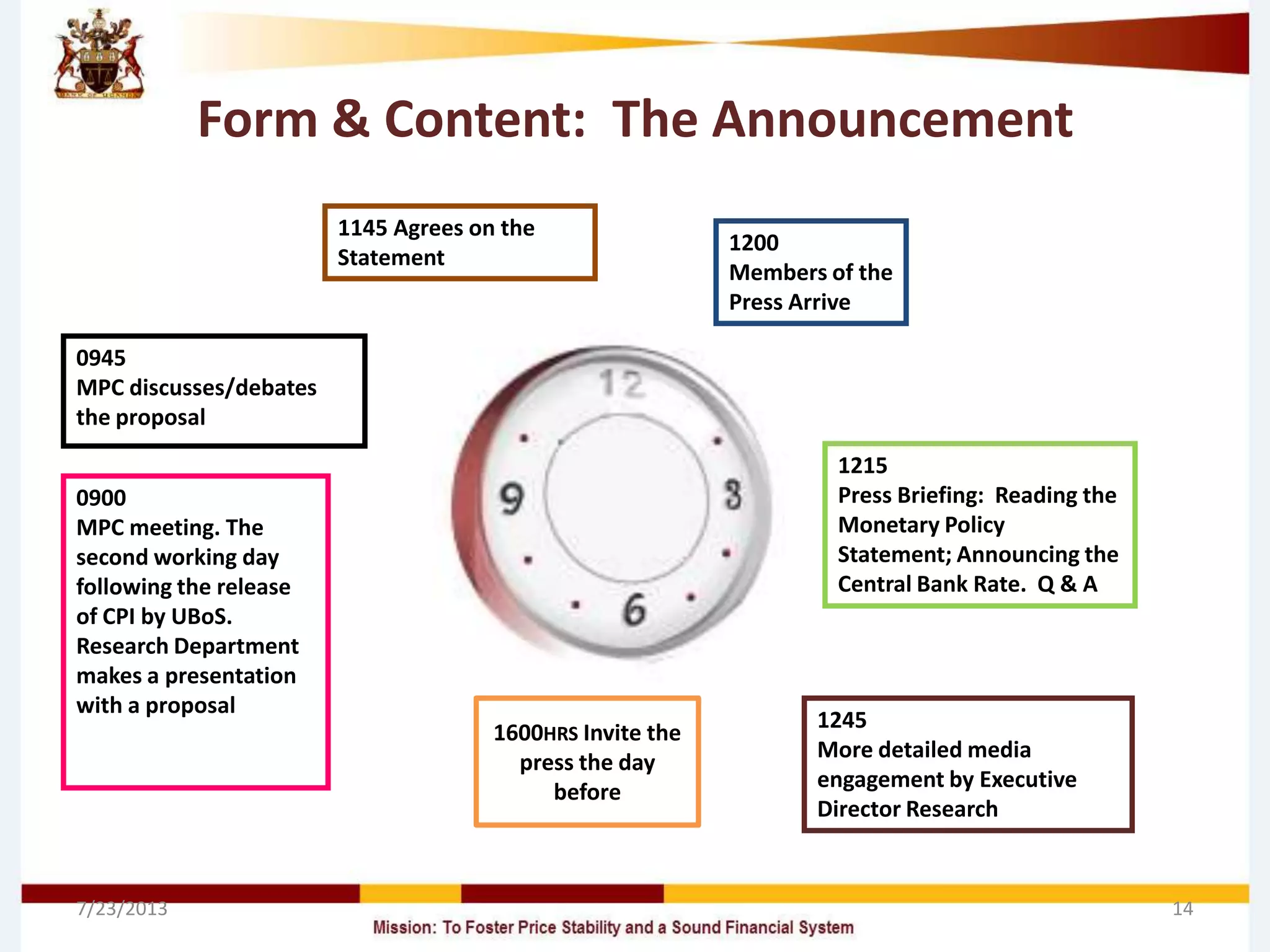

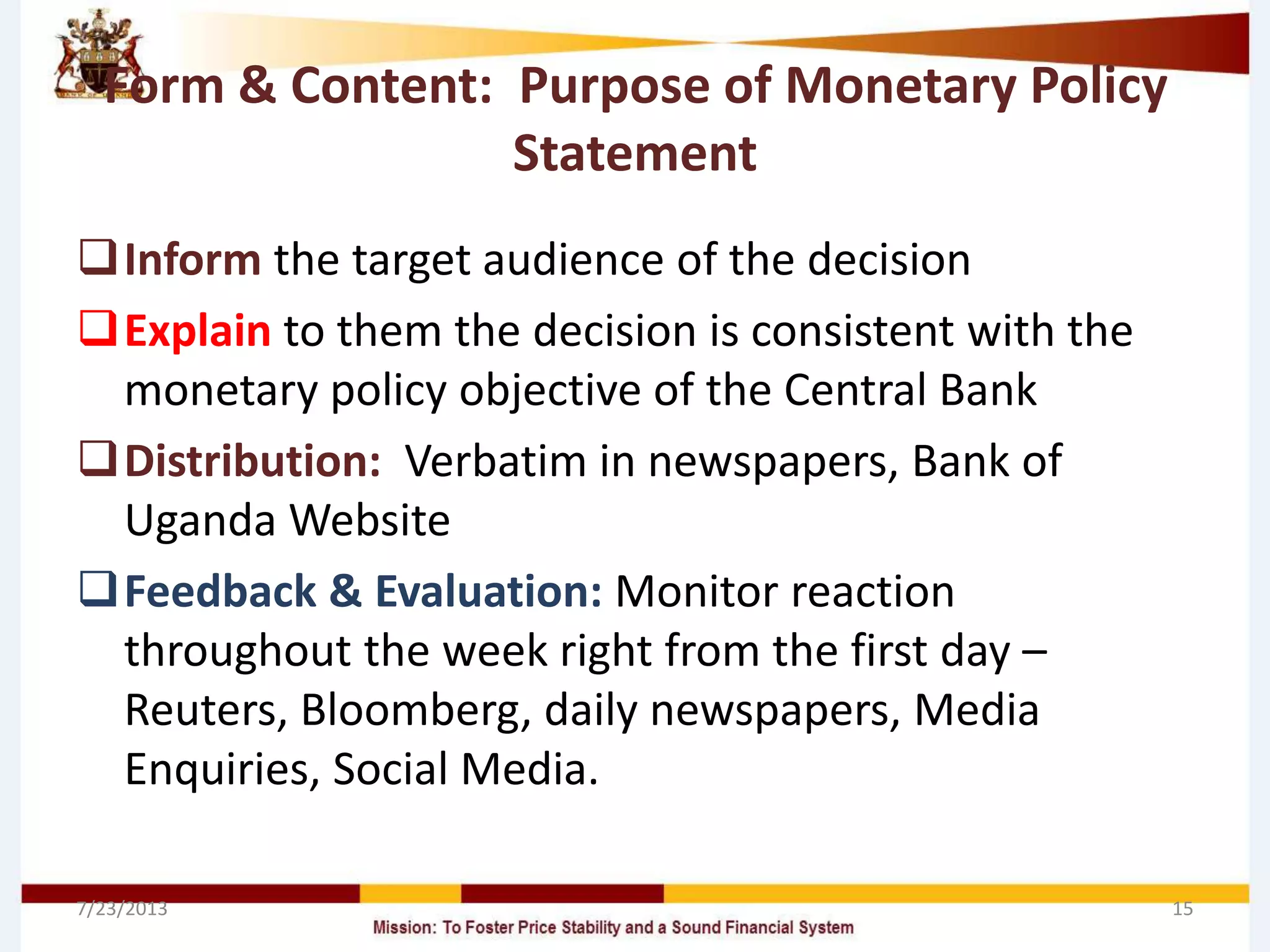

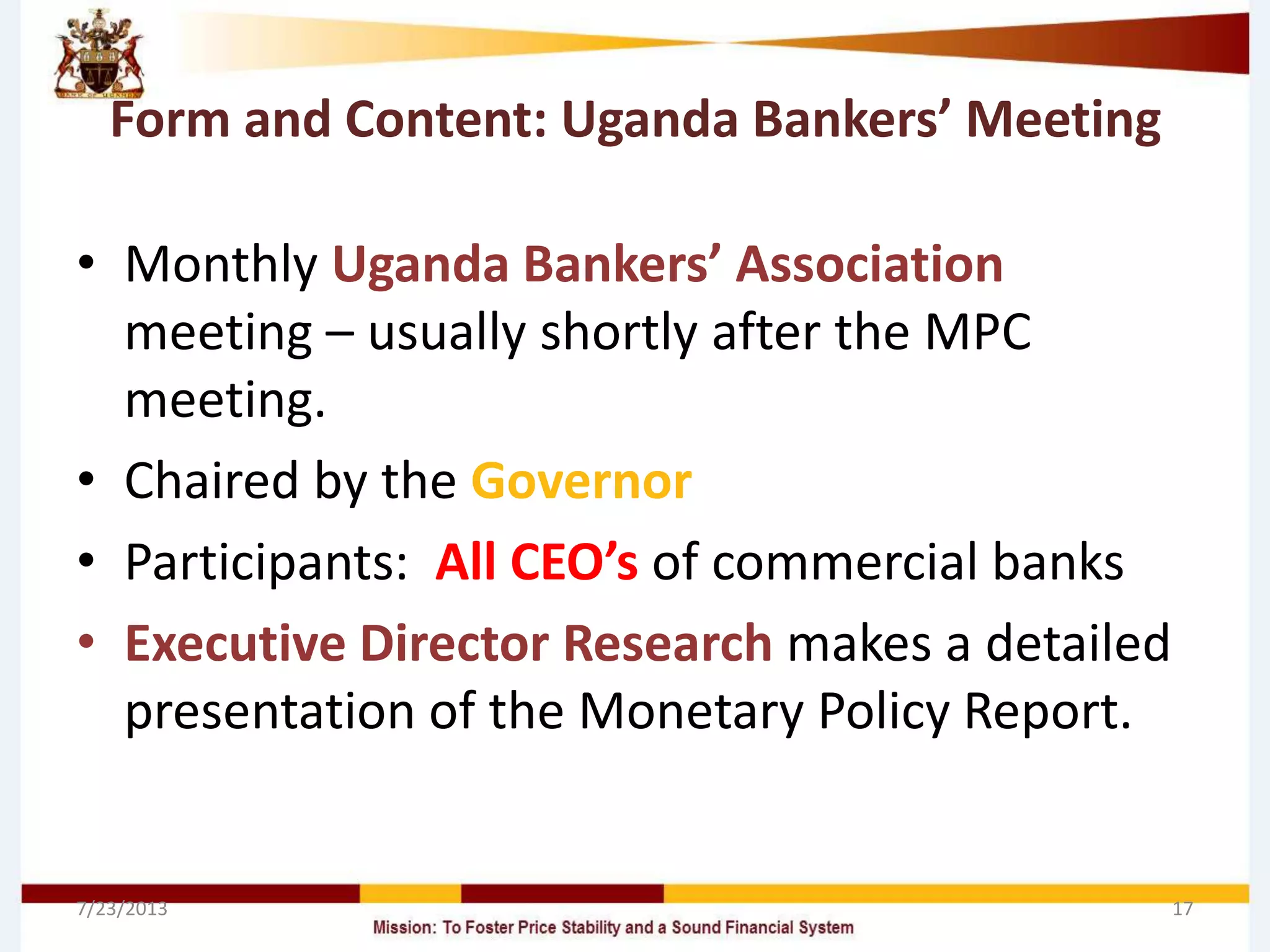

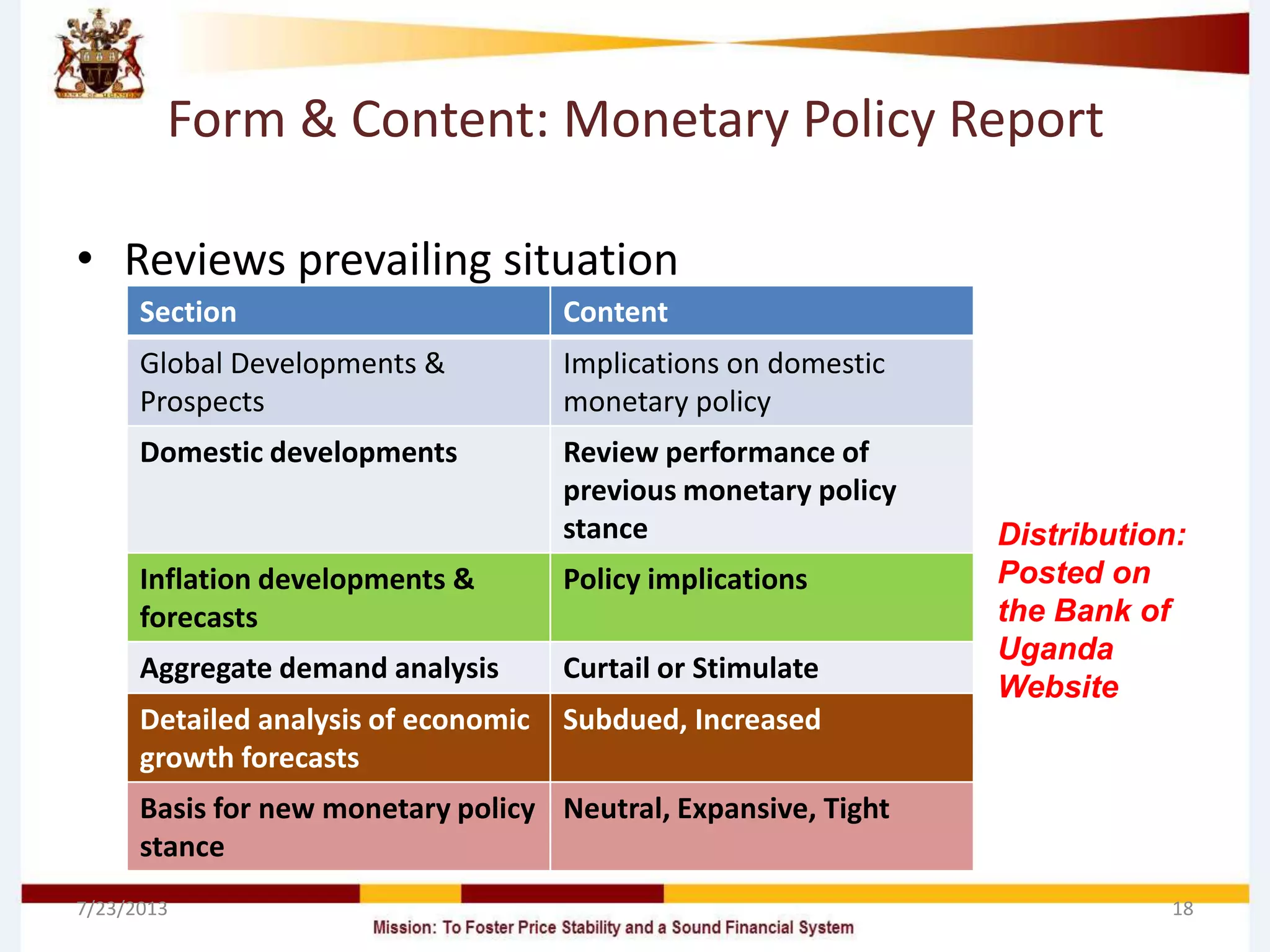

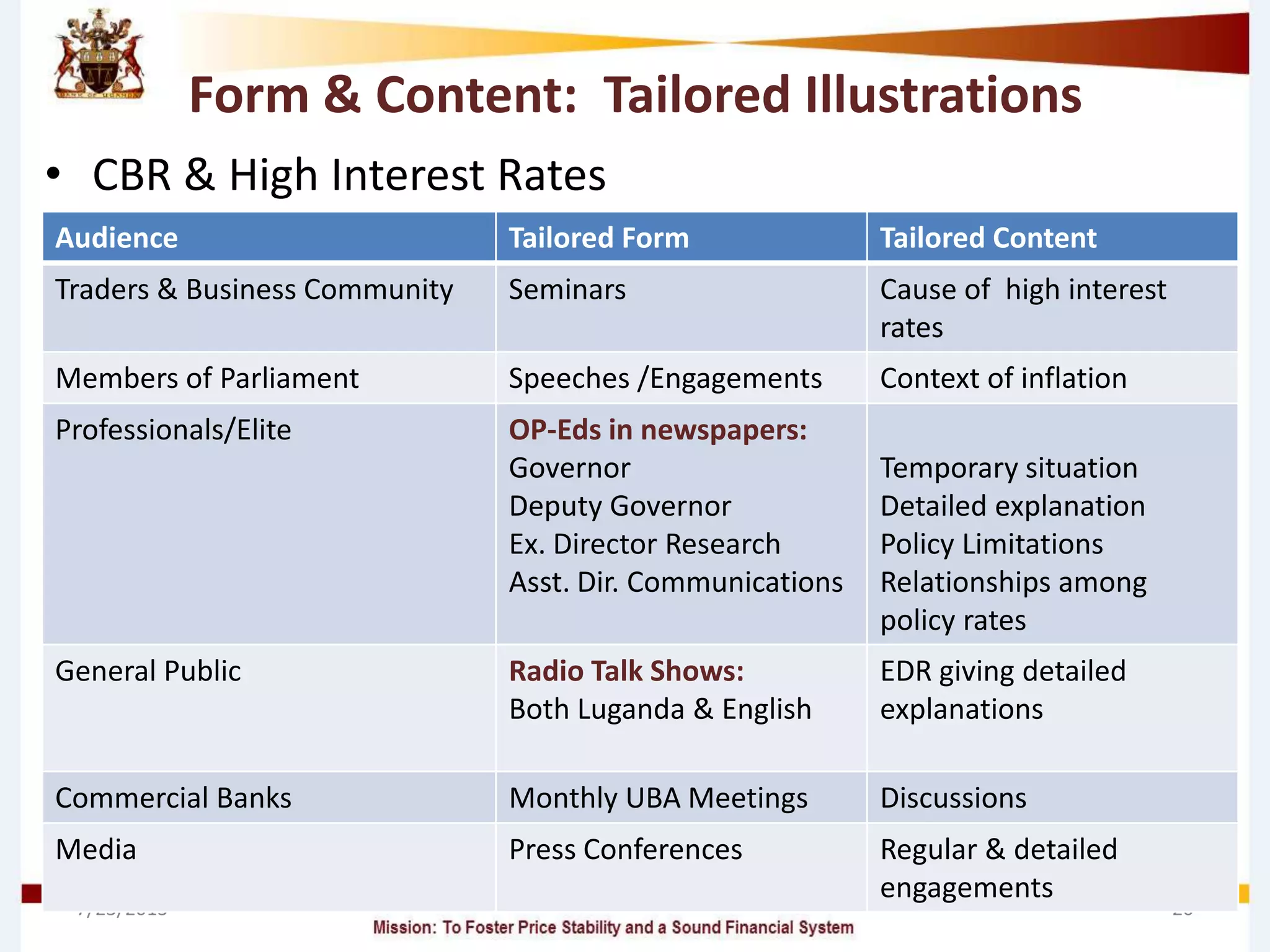

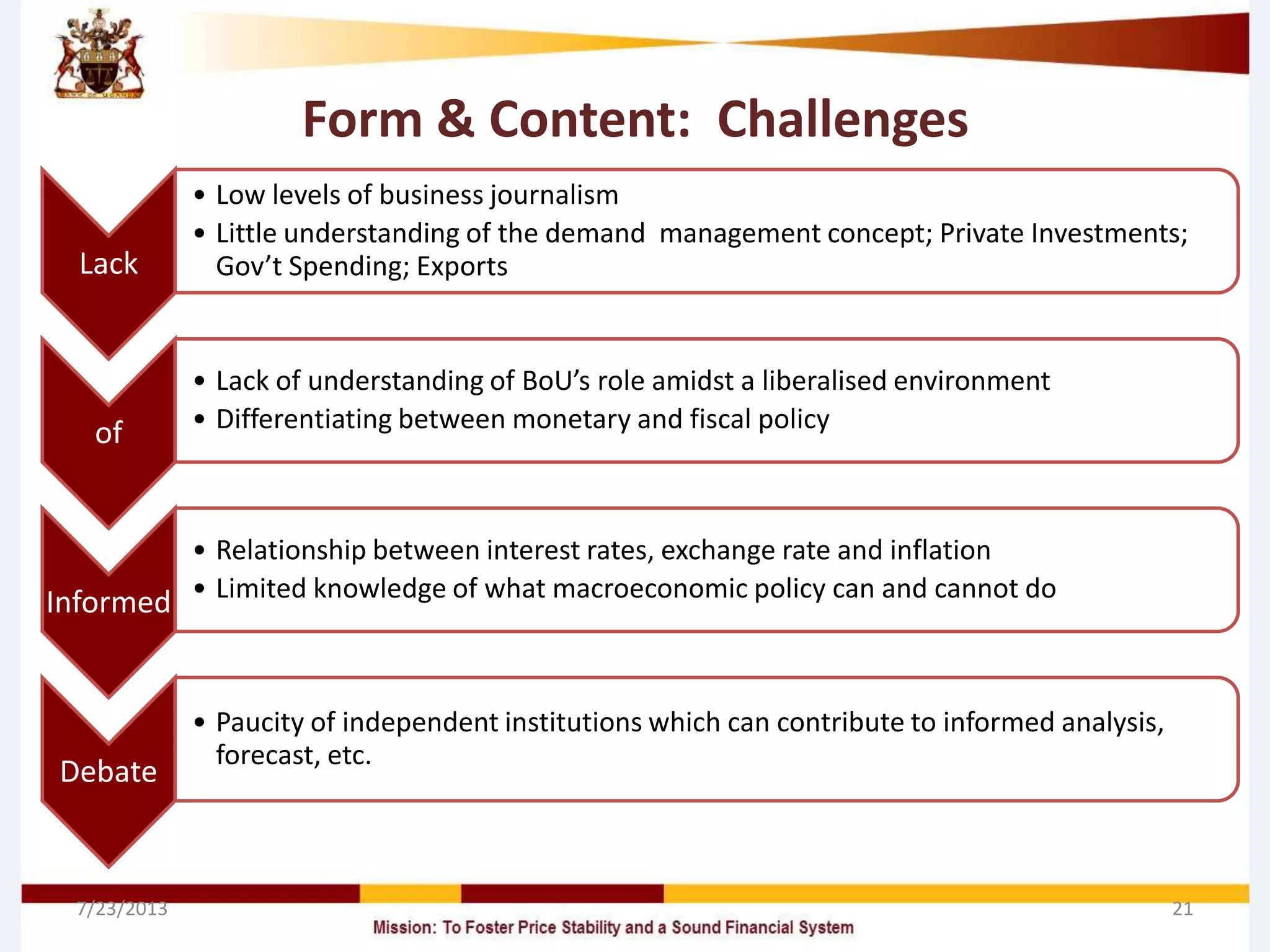

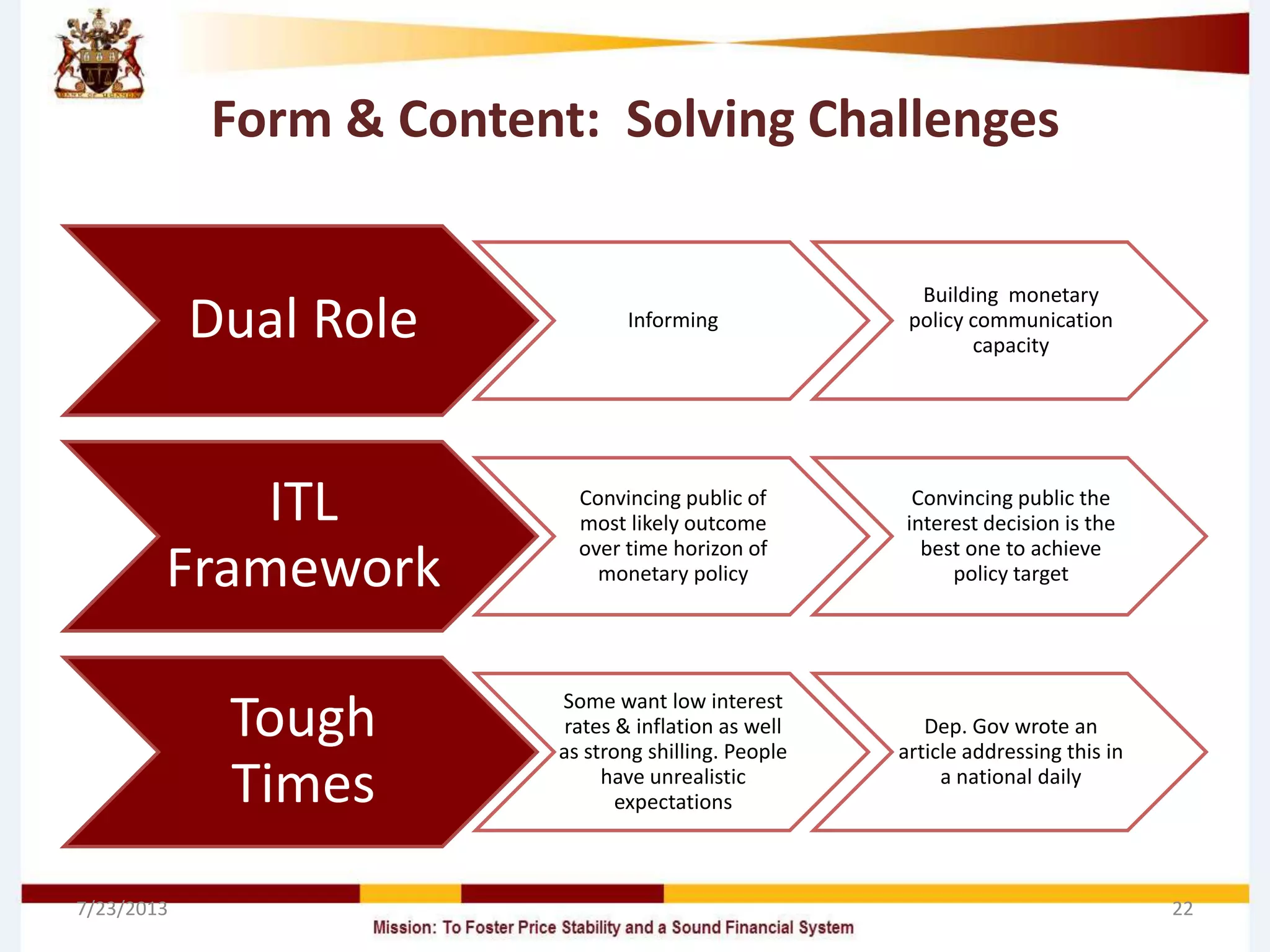

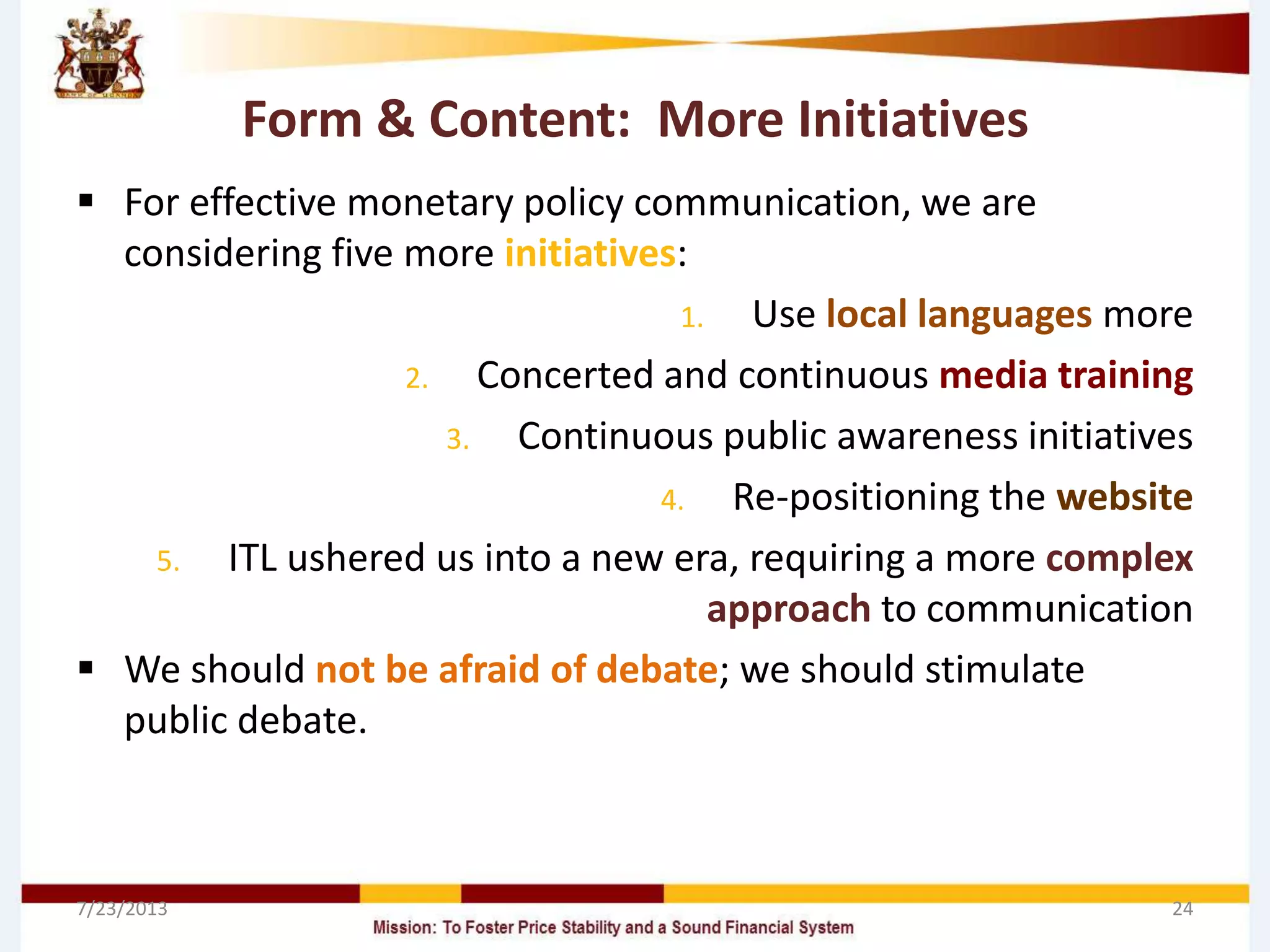

The document discusses the importance of communication in the newly adopted Inflation Targeting Lite (ITL) monetary policy framework by the Bank of Uganda, emphasizing the need to influence private sector expectations to ensure effective monetary policy. It outlines methods for both internal and external communication tailored to different audiences, including the media, commercial banks, and the public to enhance understanding and engagement. The presentation also presents challenges faced in achieving effective communication and suggests initiatives to improve public awareness and understanding of monetary policy.