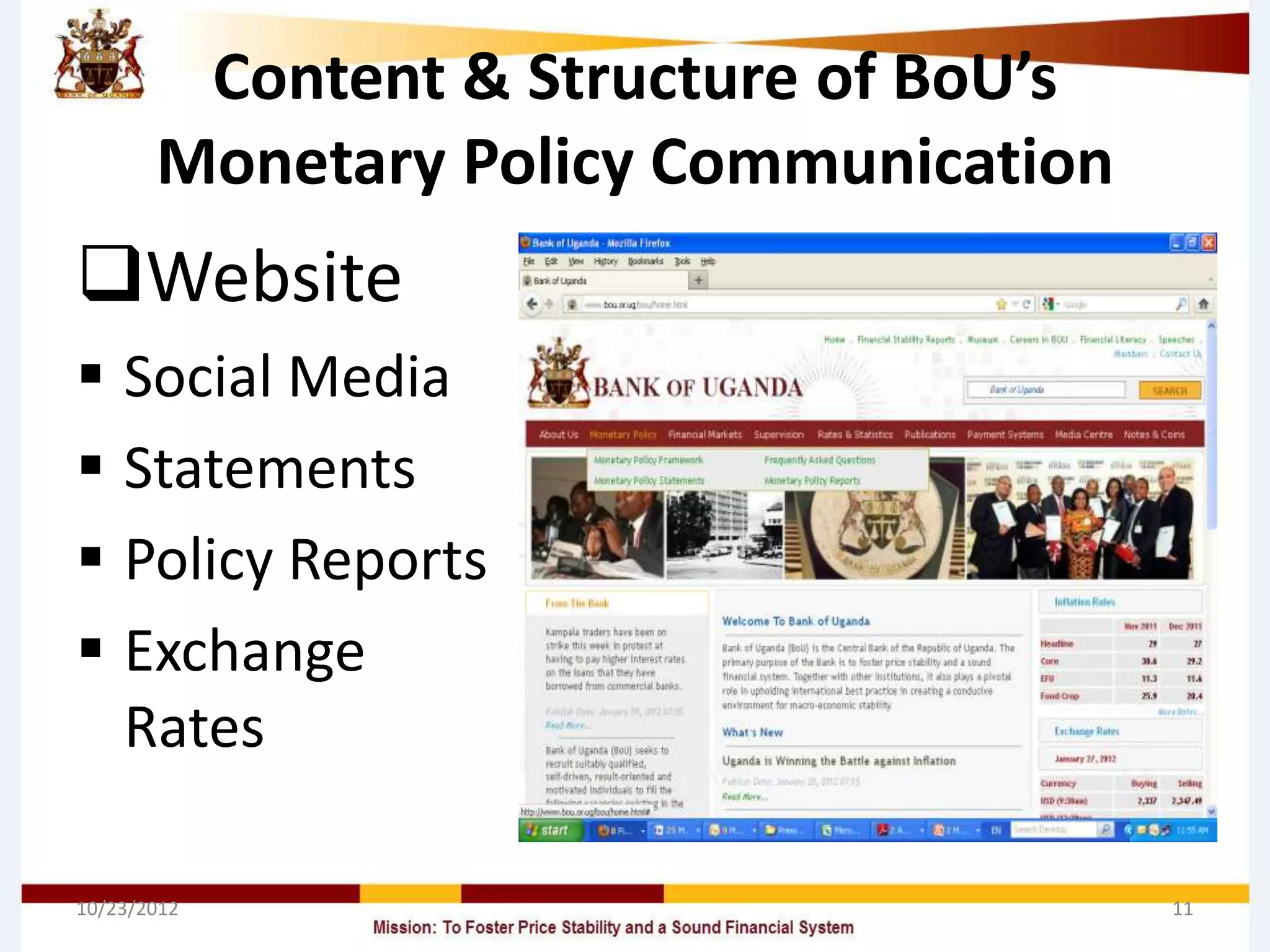

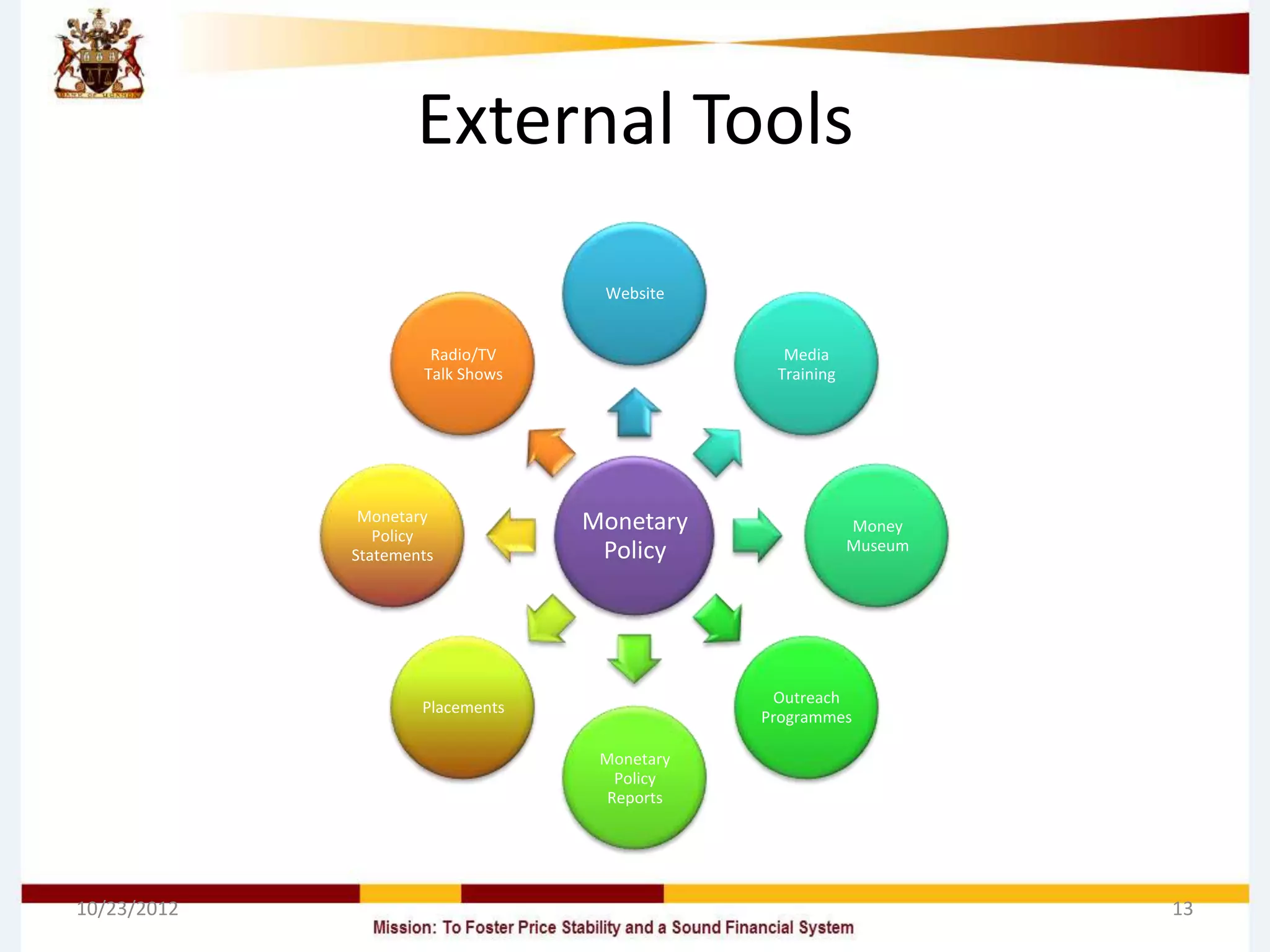

This document discusses the challenges of monetary policy communication at the Bank of Uganda. It provides background on Uganda's adoption of an inflation targeting lite monetary policy framework in 2011. It then outlines some of the key challenges in communicating monetary policy, including language barriers, low economic literacy, lack of informed debate, limited media capacity, and balancing informing the public with convincing them of policy decisions. It concludes by recommending increased use of local languages, ongoing media training, public awareness initiatives, improving the central bank website, and not being afraid of public debate.