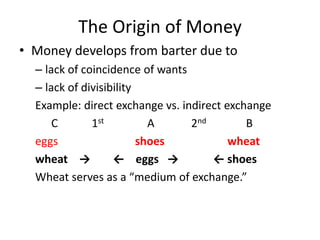

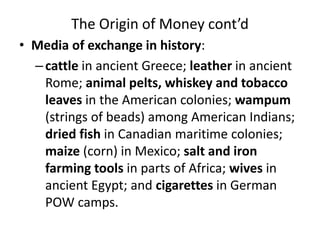

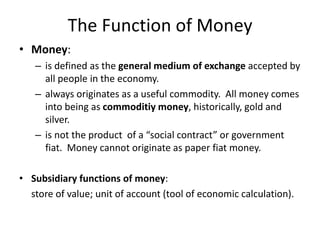

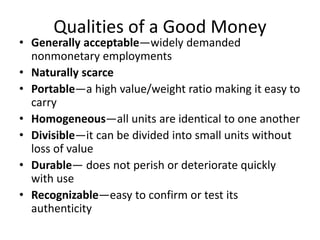

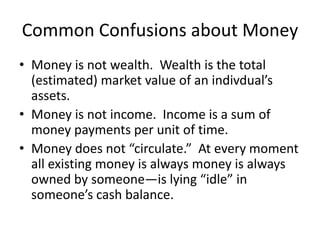

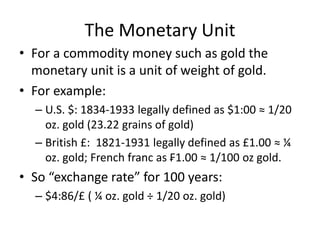

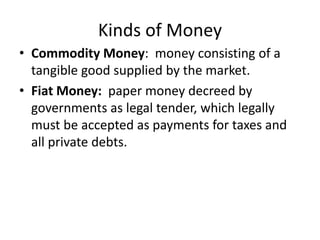

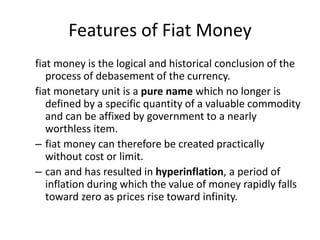

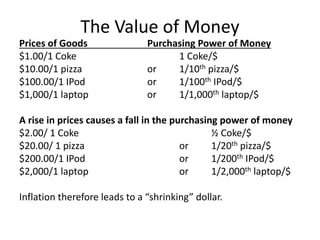

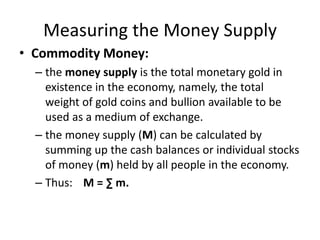

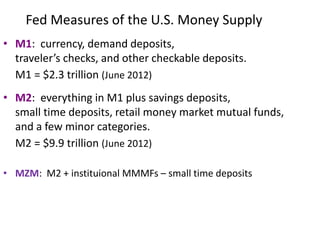

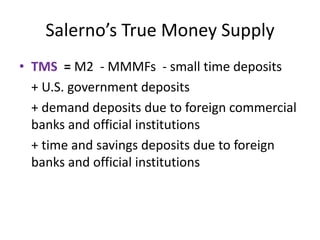

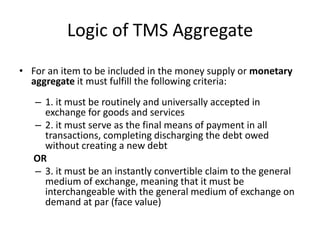

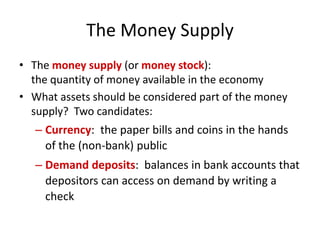

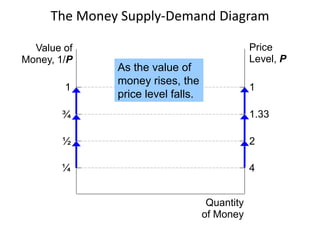

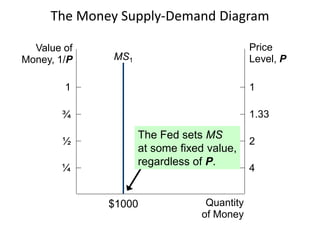

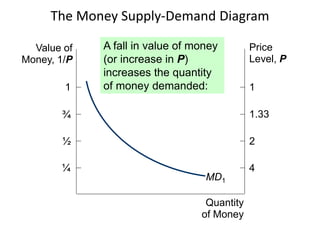

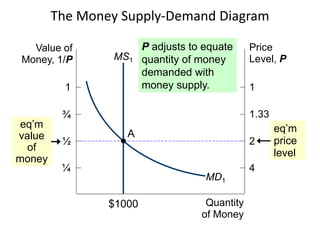

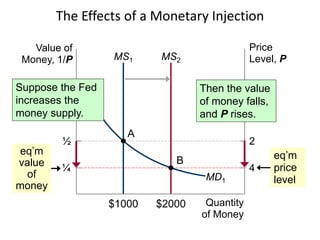

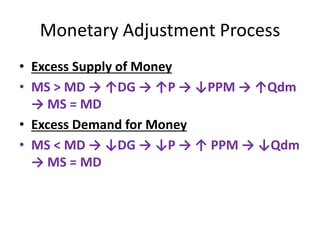

The document discusses the evolution and functions of money, emphasizing its origin from barter systems and the necessity for a medium of exchange. It outlines the characteristics of effective money, the distinction between commodity and fiat money, and the implications of monetary supply and demand on purchasing power and inflation. Additionally, it covers the processes involved in measuring money supply and the impact of monetary policy on price levels in an economy.