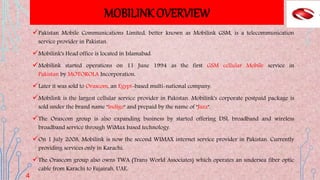

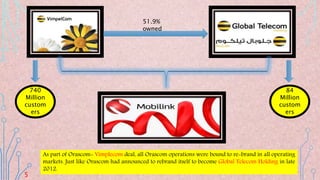

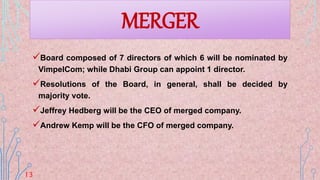

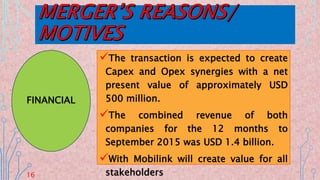

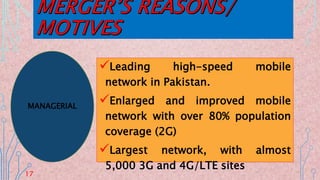

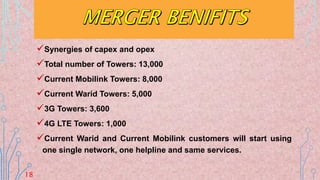

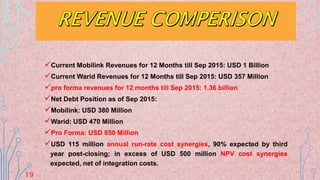

Mobilink and Warid will merge into a single company with Mobilink acquiring 100% of Warid. Dhabi Group will receive 15% stakes in Mobilink. The merger will create strategic, managerial, and financial benefits including cost synergies valued at $500 million. The combined company will have over 80% population coverage, nearly 5,000 3G/4G sites, and pro forma annual revenues of $1.36 billion.